The Economic Power of Cities: London in a Global Context

advertisement

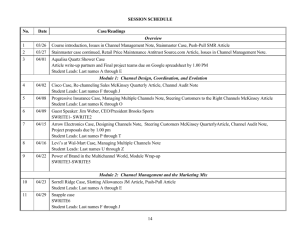

Sustaining and Enhancing London’s Leadership Position Venkie Shantaram Partner McKINSEY GLOBAL INSTITUTE Presentation to the LSE March 2012 CONFIDENTIAL AND PROPRIETARY Any use of this material without specific permission of McKinsey & Company is strictly prohibited The McKinsey Global Institute (MGI) – An overview Overview ▪ Founded in 1990 as McKinsey’s business MGI mission and aspirations ▪ Help leaders in the commercial, public, and economics research arm ▪ MGI research combines the disciplines of economics and management ▪ Micro-to-macro methodology examines microeconomic industry trends to better understand the broad macroeconomic forces affecting business strategy and public policy ▪ Research is funded by the partners of McKinsey independent from any business, government, or other institution MGI location and social sectors develop a deeper understanding of the evolution of the global economy ▪ Provide a fact-base that contributes to decision-making on critical management and policy decisions ▪ Focus on long-term fundamental research and maintain very high standards of peer review and intellectual rigor in its work McKinsey & Company | 1 MGI’s core research areas McKinsey Global Institute Productivity and growth Urbanization Global capital markets The future of work Technology and innovation Resources McKinsey & Company | 2 MGI’s report ‘Urban World’ highlighted the importance of 600 cities in driving future global growth Today ▪ ▪ ▪ ▪ 1.5 billion people live in the top 600 cities – 22 percent of global population $30 trillion of GDP in 2007 – more than half of global GDP 485 million households, with average per capita GDP of $20,000 $21 trillion of GDP in 2007 generated by the top 100 cities Tomorrow ▪ ▪ ▪ ▪ 2.0 billion people will live in these 600 cities in 2025 – 25 percent of the global population $64 trillion of GDP in 2025, nearly 60 percent of global GDP 735 million households will live in these cities, with average per capita GDP of $32,000 235 million households in developing world cities will have income above $20,000 per annum 1 The 600 are the top cities by contribution to global GDP growth from 2007 to 2025. SOURCE: Urban world: Mapping the economic power of cities, McKinsey Global Institute; McKinsey Global Institute Cityscope 1.0 McKinsey & Company | 3 Successful cities will be the key to future economic growth in the UK 78% share of English GDP growth from urban areas in last 10 years 73% share of English population living in urban areas 26% local government share of public sector expenditure 81% of central government targets are on local spending SOURCE: ONS, DEFRA, CLG Local Government Financial Statistics England 2010, Barker Review, McKinsey & Company | 4 Key messages London is one of the world’s great cities – An economic and cultural powerhouse It has the potential to remain so, and generate significant economic growth over the next 20 years However, there are potential threats to London’s pre-eminence A clear strategy for London would increase the chances of it achieving its full potential McKinsey & Company | 5 London is the third largest city in the world by GDP Grey italic text Developing regions Normal text Developed regions1 2007 city rankings GDP2 Total population Children3 Total households Households with annual income over $20,0004 1 2 Tokyo Tokyo Mexico City Tokyo Tokyo New York Mumbai Mumbai Osaka Osaka 3 London Mexico City Karachi New York New York 4 Paris Sao Paulo Kolkata Shanghai London 5 Los Angeles Osaka Tokyo London Rhein-Ruhr 6 Osaka New York Sao Paulo Beijing Paris 7 Chicago Shanghai Dhaka Sao Paulo Los Angeles 8 Rhein-Ruhr Nagoya Kolkata Beijing Delhi New York Rhein-Ruhr Chongqing Moscow Chicago Randstad Milan Washington, D.C. Houston Dallas Philadelphia Belgian central metro San Francisco Boston Moscow Sao Paulo Madrid Mexico City Atlanta Miami Rhein-Main Delhi Chongqing Kinshasa Manila Lagos Buenos Aires Cairo Chongqing Los Angeles Istanbul Paris Mumbai Mexico City Los Angeles Moscow Seoul Buenos Aires Delhi Kolkata Rio de Janeiro Chicago Nagoya Milan Tianjin Istanbul Randstad Nagoya Mexico City Seoul Milan Randstad Istanbul Fukuoka Philadelphia Taipei Sao Paulo Hong Kong Miami Dallas Washington, D.C. Madrid Belgian central metro Rank 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 London Dhaka Buenos Aires Los Angeles Karachi Paris Manila Rio de Janeiro Rhein-Ruhr Istanbul Cairo Moscow Seoul Bangkok London Osaka Lahore Rio de Janeiro Paris Baghdad Jakarta Lima 1 Developed regions comprise the United States and Canada, Western Europe, Australasia, Japan, and South Korea 2 GDP 2007 in predicted real exchange rate 3 Population below age 15 4 Households with annual incomes greater than $20,000 in purchasing power parity (PPP) terms 5 Mexico City Metropolitan Region NOTE: For metropolitan regions, we use the first name of the region: e.g., New York for New York-Newark SOURCE: McKinsey Global Institute Cityscope 1.3 McKinsey & Company | 6 … and the largest in Europe Grey italic text Eastern Europe Normal text Western Europe 2007 city rankings GDP Total population Share of retirees1 Children Households with annual income over $70,000 1 London London Trieste London London 2 Paris Paris Genoa Paris Paris 3 Rhein-Ruhr Rhein-Ruhr Chemnitz Rhein-Ruhr Rhein-Ruhr 4 Randstad Milan Ravenna Randstad Milan 5 Milan Randstad Livorno Milan Randstad 6 Belgian central metro Madrid Parma Madrid Madrid 7 Madrid Rhein-Main Munich Barcelona (ESP) Rome Vienna Hamburg Stuttgart Lille Athens Stockholm Birmingham Oresund Oslo Dublin Rhein-Neckar Berlin Noord Venice Barcelona (ESP) Belgian central metro Upper Silesian metro Lille Rhein-Main Athens Rome Naples Berlin Vienna Munich Warsaw Stuttgart Hamburg Birmingham Budapest Lisbon Rhein-Neckar Venice Salamanca Florence Perugia Lubeck Nice Turin Leipzig Rostock Oviedo Hannover Toulon Dresden Braunschweig Modena Burgos Limoges Bremen Kassel Corunna Lille Belgian central metro Barcelona (ESP) Naples Upper Silesian metro Rhein-Main Birmingham Rome Athens Vienna Munich Stuttgart Manchester Budapest Warsaw Hamburg Lisbon Noord Liverpool Barcelona (ESP) Rhein-Main Athens Munich Rome Lille Vienna Stuttgart Birmingham Belgian central metro Rhein-Neckar Luxembourg Venice Gelderland Manchester Hamburg Noord Stockholm West Yorkshire Rank 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 1 Share of population aged 65 and above. 2 Households with annual incomes greater than €70,000 in PPP terms. SOURCE: McKinsey Global Institute Cityscope 1.3 McKinsey & Company | 7 The 3 largest economies in Europe have different profiles – UK is unusually dependent on London Small cities & Rural areas Middleweights Top city Number of cities Share of GDP % Share of population % 24 40 37 Per capita GDP gap to country Indexed, country = 100 79 82 94 96 86 30 49 43 43 112 46 31 49 33 44 138 157 106 33 29 15 United France Kingdom Germany 24 18 United France Kingdom 14 Germany United France Kingdom 33 SOURCE: McKinsey Global Institute Cityscope 1.2 26 Germany 29 McKinsey & Company | 8 In terms of growth, while London outpaced the UK comfortably, Paris and Rhein-Ruhr were unable to outpace middleweights Share of country GDP growth 2000-07 by city type % United Kingdom France 2.5 22 Middleweights 1.6 2.3 Middleweights (examples): Birmingham Manchester 2.2 33 1.7 Middleweights (examples): Lyon Lille 40 46 2.0 Middleweights (examples): Munich Stuttgart Paris 3.0 29 1.9 Rhein-Ruhr 14 SOURCE: McKinsey Global Institute Cityscope 1.2 1.7 1.5 London 39 Megacities Germany 1.8 38 39 Small cities & Rural areas CAGR, 2000-07, % 1.5 McKinsey & Company | 9 Key messages London is one of the world’s great cities – An economic and cultural powerhouse It has the potential to remain so, and generate significant economic growth over the next 20 years However, there are potential threats to London’s pre-eminence A clear strategy for London would increase the chances of it achieving its full potential McKinsey & Company | 10 Top 25 hot spots in 2025 from MGI Cityscope Grey italic text Developing regions Normal text Developed regions1 2025 city rankings GDP2 GDP growth 2007-25 Total population Children3 Total households Households with annual income over $20,0004 1 2 Tokyo Shanghai Tokyo Kinshasa Tokyo Tokyo New York Beijing Mumbai Karachi Shanghai Osaka 3 London Shenzhen Shanghai Lagos Beijing New York 4 Guangzhou Tianjin Chongqing Los Angeles New York Beijing Delhi Calcutta Mexico City5 São Paulo Mumbai Dhaka Calcutta Mexico City5 Delhi Chongqing Osaka New York Mumbai London 5 6 7 8 Los Angeles Shanghai Paris Beijing Osaka London Beijing Shanghai Paris Rhein-Ruhr 9 10 11 12 Rhein-Ruhr Chicago São Paulo Shenzhen São Paulo Wuhan Moscow Shenyang Dhaka Chongqing New York Karachi Manila Tokyo New York Los Angeles São Paulo Delhi Paris Lagos Los Angeles São Paulo Moscow Mexico City5 13 Moscow London Osaka São Paulo Rhein-Ruhr Seoul 14 Houston Hangzhou London Cairo Mexico City5 Nagoya 15 16 Dallas Guangzhou Chengdu Singapore Lagos Manila Lahore Buenos Aires Calcutta Tianjin Chicago Milan 17 18 19 20 21 22 23 24 25 Washington, D.C. Dallas Kinshasa London Shenzhen Mumbai Tianjin Randstad Mexico City5 Seoul Nagoya Singapore Hong Kong Atlanta Nanjing Tokyo Foshan Bangkok Istanbul Paris Houston Seoul Los Angeles Shenzhen Buenos Aires Cairo Istanbul Paris Tianjin Bangkok Baghdad Kabul Luanda Istanbul Khartoum Paris Nairobi Dar es Salaam Hangzhou Chengdu Los Angeles Moscow Wuhan Dhaka Buenos Aires Seoul Istanbul Hong Kong Dallas Randstad Bangkok Shenzhen Taipei Houston Rank 1 Developed regions comprise the United States and Canada, Western Europe, Australasia, Japan, and South Korea. 2 GDP 2007 to 2025 in predicted real exchange rate. 3 Population below age 15. 4 Households with annual incomes greater than $20,000 in purchasing power parity (PPP) terms. 5 Mexico City Metropolitan Region. NOTE: For metropolitan regions, we use the first name of the region: e.g., New York for New York-Newark. SOURCE: McKinsey Global Institute Cityscope 1.3 McKinsey & Company | 11 London is expected to both grow substantially in absolute size and increase it’s GDP/Capita above the European median … Small middleweights (<2 mn inhabitants) Mid-sized middleweights (2-5 mn inhabitants Large middleweights (5-10 mn inhabitants) Megacities (>10 mn inhabitants) Bubble size indicative of GDP/Cap, 2007 GDP/Capita growth 2007-25 USD ‘000 40 Oslo 30 Munich 20 Rhein-Ruhr Randstad London 10 Paris Median=9.5 Milan Madrid Barcelona 0 -10 100 1,000 10,000 100,000 1,000,000 GDP growth 2007-25 USD million NOTE 1: Only European Cities shown NOTE 2: All figures relate to real exchange rate calculations SOURCE: McKinsey Global Institute Cityscope 1.3 McKinsey & Company | 12 … the growth rate figures are in the mid tier of even the largest cities due to London’s high initial size GDP 2007 USD billion Warsaw GDP growth rate, 2007-25 Percent CAGR 112 Budapest 5.2% 66 Upper Silesian metro 3.9% 52 3.7% Munich 115 Hamburg 87 Rhein-Neckar 59 Rhein-Ruhr 215 Stuttgart 68 Rhein-Main 96 Berlin Vienna 233 Manchester 25 Stuttgart 2.4% Rhein-Ruhr 2.2% Rhein-Main 2.1% Rhein-Neckar 2.0% Munich 1.8% Randstad 1.7% Vienna 1.6% Lille 1.6% Belgian central metro 1.5% 300 Paris 2.5% Berlin 91 London Budapest Hamburg 128 Belgian central metro Upper Silesian metro 1.9% 65 Randstad Warsaw 2.0% 47 GDP/Cap growth rate, 2007-25 Percent CAGR GDP/Cap 2007 USD ‘000 5.1% 23 4.0% 12 3.5% 23 2.2% 49 2.2% 43 2.0% 53 1.9% 46 1.8% 62 1.7% 51 1.6% 35 1.3% 54 1.2% 51 1.2% 34 1.0% 53 Paris 64 0.9% 1.2% London 64 0.9% Lille 37 1.2% Manchester 42 0.7% Barcelona (ESP) 42 1.1% Birmingham 42 0.6% 1.0% Lisbon 0.9% Athens 0.9% Venice Birmingham 27 Madrid Lisbon 44 14 Milan Venice 43 12 0.6% Naples 0.6% Rome Rome 17 0.5% Milan Athens 12 0.5% Barcelona (ESP) Naples 4 0.2% Madrid 0.5% 30 0.2% 33 42 0.2% 0.2% 22 46 47 38 42 0.2% 0.2% 0.1% 0.1% NOTE 1: Only European Megacities, large- and midsized middleweights shown NOTE 2: All figures relate to real exchange rate calculations SOURCE: McKinsey Global Institute Cityscope 1.3 McKinsey & Company | 13 Key messages London is one of the world’s great cities – An economic and cultural powerhouse It has the potential to remain so, and generate significant economic growth over the next 20 years However, there are potential threats to London’s pre-eminence A clear strategy for London would increase the chances of it achieving its full potential McKinsey & Company | 14 Potential threats to London’s pre-eminence Reduced open-ness to skilled immigrants and international students Loss of competitiveness in global financial services due to ‘super-equivalent’ regulation Restrictions on London’s physical expansion Reduced attractiveness as a HQ location due to poor infrastructure, uncompetitive tax regimes and restrictions on skilled immigration Under-investment in London’s cultural and artistic heritage – a major driver of quality of life and essential to under-pin its attractiveness to global talent Under-investment in primary, secondary and tertiary education in London McKinsey & Company | 15 Despite the crisis, London remains the leading international financial centre 2006 Financial services contribute 3-6X more to the overall balance of payments in the UK than they do in other countries EUR billions 2007 2008 51 40 30 9 11 13 9 11 12 3 4 3 3 5 5 2 3 3 0 4 0 -1 UK Luxembourg Switzerland Financial services net exports EUR billions Ireland US Germany Banks Securities dealers Fund Managers Baltic Exchange Insurance Other financial services 50,557 41,849 40,426 29,893 24,914 26,692 24,283 22,195 15,784 19,307 15,881 Japan 01 02 03 04 1 Compounded Annual Growth Rate 05 06 -1 -1 France -5 Hong Kong -5 -6 Mexico Spread earnings FISIM Contribution of Banks to financial services net exports EUR billions 2 08 -5 -6 China Fee income Other exports CAGR1 % 00-05 05-09 00-05 05-09 9 15 16 14 16 14 24 8 28 16 18 19 31,049 25,336 24,431 18,265 07 -5 CAGR1 % -10 52 -7 -11 20 38 4 12 6 3 12 -15 6,841 6,958 1999 2000 -1 5 2009 1999 2000 13,148 14,929 12,150 8,754 9,559 01 02 03 04 05 06 07 08 2009 2 FISIM stands for Financial Intermediation Services Indirectly Measured SOURCE: ONS Balance of Payments – Pink Book, IMF, The CityUK research McKinsey & Company | 16 Multiple factors drive London’s competitive success Stable legal framework Culture of innovation Magnet for global talent Strong arts and culture Historically predictable tax regime Low crime rate People and culture Cost of living Benign corporate tax rates Open migration Overall context English speaking Noninvasive approach of tax authorities Openness to foreign ownership Deep local talent pool Distinctive professiona l services Primary international transport hub Leading, but unsupportive financial media System and services Robust technology infrastructure/ future capacity Favourable personal tax rates Commercially minded employment laws Regulatory system and reputation Must visit road-show destination Proximity to eurozone Extensive transport network Cutting edge sophisticated complex client needs Global centre for research Welcome to foreigners Customer cluster Time zone bridging US and Asia Strong ties to US Global client base London retains top position in the Global Financial Center Index for 2010 Source: Clusters and the New Economics of Competition (Michael Porter) McKinsey & Company | 17 However, the outlook is worrying on several factors Competitiveness increasing Competitiveness flat Stable legal framework Culture of innovation Magnet for global talent Strong arts and culture Competitiveness decreasing Historically predictable tax regime Low crime rate People and culture Cost of living Benign corporate tax rates Open migration Overall context English speaking Non-invasive approach of tax authorities Openness to foreign ownership Deep local talent pool Distinctive professiona l services Primary international transport hub Leading, but unsupportive financial media System and services Robust technology infrastructure/ future capacity Favourable personal tax rates Commercially minded employment laws Regulatory system and reputation Must visit road-show destination Proximity to eurozone Extensive transport network Cutting edge sophisticated complex client needs Global centre for research Welcome to foreigners Customer cluster Time zone bridging US and Asia Strong ties to US Global client base London retains top position in the Global Financial Center Index for 2010 Source: Clusters and the New Economics of Competition (Michael Porter) McKinsey & Company | 18 Key messages London is one of the world’s great cities – An economic and cultural powerhouse It has the potential to remain so, and generate significant economic growth over the next 20 years However, there are potential threats to London’s pre-eminence A clear strategy for London would increase the chances of it achieving its full potential McKinsey & Company | 19 5 levers provide a common architecture to identify opportunities for economic growth Concentrations of industries, functions, and occupations 4 Physical and virtual infrastructure Enablers 5 Public and civic institutions Talent production, attraction, retention, and matching to jobs 1 Economic sectors/ clusters 2 Human capital 3 Innovation and entrepreneurship Linkages and movement of goods, people, and information ▪ Government efficiency ▪ ▪ and efficacy Business environment Tax value proposition ▪ Innovation performance ▪ Entrepreneurial ecosystem Source: Team economic development plans; Brookings Metropolitan Policy Program, Chicago Plan for Growth McKinsey & Company | 20 Priorities for London’s economic development ▪ ▪ ▪ ▪ ▪ Remaining open to skilled immigration ▪ Building on London’s great universities – Preserving London’s role as the leading international financial centre Expanding leadership in professional and business services Maintaining leadership in creative industries Building on early success in High Tech and bio science ▪ ▪ as knowledge factories and magnet for international talent Expanding affordable housing Providing more rented accommodation for young citizens 1 4 Physical and virtual infrastructure 2 Economic sectors and clusters Human capital Continued leadershi p 3 5 Public and civic institutions ▪ ▪ ▪ ▪ Allowing London to expand – rethink ‘green belt’ policy Building more airport capacity Investing in public transport infrastructure Eliminating road bottlenecks through road-pricing and usage taxes Innovation and entrepreneurship ▪ ▪ Openness to global talent Priorities – Creative industries – Tourism – Bioscience – High tech – Prof & Business Services – Financial services ▪ ▪ ▪ Stronger decision rights for London, as part of de-centralisation of power in the UK to cities Investment in arts and culture, and public spaces Equitable distribution of planning gains to encourage development and reduce local taxes McKinsey & Company | 21 Sustaining and Enhancing London’s Leadership Position Venkie Shantaram Partner McKINSEY GLOBAL INSTITUTE Presentation to the LSE March 2012 CONFIDENTIAL AND PROPRIETARY Any use of this material without specific permission of McKinsey & Company is strictly prohibited