View Presentation

advertisement

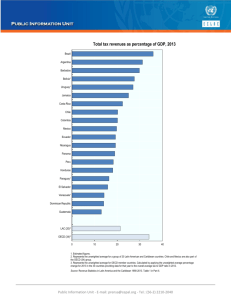

Some Reflections on the Job Scene Danny Leipziger Professor of Int’l Business, George Washington University NYU Jobs Conference, Sept. 25-26, 2011 S Basic Themes S What do we learn from the Latin American experience? And from Chile in particular? S What is there in the advanced countries’ experience that should raise cautionary flags for middle income countries in Latin America and beyond? S How do we connect the dots on the Great Recession and the longer run in terms of jobs and economic growth? Latin Lessons S Maintenance of fiscal space, a new development for many countries in the region, has served them well S Jobs, even if lower paying, provide an entry point into the formal or quasi-formal sector and are the only way to deal with persistent income inequality S Some hybrid between the US labor model that was associated with rapid job creation and the Euro-model that protects more in the downturn is probably best course S Poor educational outcomes and weak innovation systems separate the region from the best performers in East Asia Latin American Concerns S All Latin Am. countries are well below average in the OECD PISA scores, with Chile ranked the highest at #43, despite expenditure levels that are not markedly low S Most countries participating in PISA are in the 5th or 6th decile of respondents. Same is true for science & mathematics rankings S Regional labor productivity 1990-2005 was 1.5% on average, well below advance countries and far behind East Asia’s 4 percent S Youth unemployment is three-times the overall average Issues Most Relevant to Chile S Chile’s U-rate rose 2% in 2009 but reverted close to its 2008 level by 2010; still U-rate for the age cohort 24-29 tended to average 12% over the past decade S Female labor force participation rates lag those in Brazil, Argentina and Uruguay ( Growth Commission Special Report) and part-time employment impediments are a problem and this may worsen the income distribution S Income distribution is stubbornly unequal as seen in Gini coefficients above .5 despite low absolute poverty rates S The innovation system, including links between business and government, has been difficult to remedy despite efforts Some OECD Lessons S OECD Jobs Strategy speaks of innovation and technology diffusion policies to accompany education and training S Most countries now embrace knowledge-based industries S The externalities from major university centers is apparent S Governments have a fundamental role to play in coordination, management of science, functioning of financial and labor markets, and increasingly in providing signals if not a clear vision S Once jobs are lost, they are not likely to be regained Long Run Implications of Factors Affecting Labor Market S Education has longest term effect in terms of skills enhancement and adaptability of the labor force S Innovation policy has a strong effect via TFP S Infrastructure investments influence efficiency and labor productivity S Those with better education, innovation record and infrastructure, ceteris paribus, survived the crisis better—Australia, Canada, Finland (OECD) S During prolonged recessions, hh expenditures on education slip (WB evidence for Eastern Europe) and firm R&D expenditures on innovation fall (OECD evidence) with long-term effects on potential growth rates. Infrastructure evidence uncertain. Existing trends that the Great Recession exacerbated S In the US, poor distribution of income, got worse, and real wage declines of blue collar workers was extended to others S Incidence of shorter work weeks (Kurzarbeit), more reliance on part-time employment, that reduced real incomes S Evidence is not yet clear on whether gender disparities were exacerbated, depending on countries and sectors S Youth unemployment rose, especially in Europe—it doubled in Spain between 2008 and 2010 for aged 24-29 cohort! Short-Medium term factors affecting the Long-Run S Collapse of venture capital markets, already not robust in some countries, and directly linked to innovative investment S Prolonged unemployment spells that restrict labor market re- entry—high percentage of long spells S Delayed entry by the young limits long-term earnings and asset accumulation. S Asset collapses reduce confidence and the efficacy of fiscal stimulus and the usefulness of monetary easing Some Modest Final Thoughts S Australia and Korea had among the largest stimulus packages ( % of GDP); among the best rated innovation systems (OECD), and had among the lowest upticks in additional unemployment during the crisis S The crisis is an outlier in Obstfeld and Gourinchas and we should therefore expect the labor market to also react badly S The Reinhart & Rogoff analysis tells us that this time is not so different historically, but for some it certainly has been, and the political economy of joblessness will be profound S The economic and social costs of joblessness in countries with limited safety nets are such that globalization may take a hard and irreversible hit