mille r thomso n llp what is appealable?

advertisement

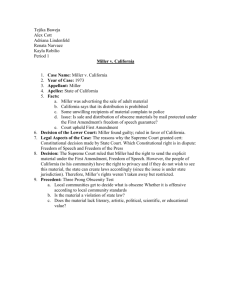

INCOME TAX ASSESSMENTS OBJECTIONS AND APPEALS Robert B. Hayhoe (416.595.8174) CGA Ontario Public Practitioners’ Convention Saturday, September 23, 2000 MILLER THOMSON LLP REPRESENTATION Audit Objection Tax Court Hiring Lawyers MILLER THOMSON LLP TAX TREAMENT OF REPRESENTATION EXPENSES ITA s.60(o) makes objection and appeal expenses deductible ITA s.56(1)(l) includes legal costs awarded by court in income MILLER THOMSON LLP WHAT IS APPEALABLE? Assessments and determinations Nil assessments not appealable Loss Determinations Interest and Penalties MILLER THOMSON LLP THE NOTICE OF OBJECTION - Time Limit For individuals and testamentary trusts, the later of: 90 days from mailing of notice of assessment one year from balance due date For all other taxpayers: 90 days from mailing of notice of assessment Discretionary permission to late-file MILLER THOMSON LLP THE NOTICE OF OBJECTION - Form Of Notice And Service T400A form suggested Registered mail not required but suggested Must be signed by individual taxpayer or authorized representative MILLER THOMSON LLP THE NOTICE OF OBJECTION - Statement Of Facts And Reasons Substance of the Objection Should set out enough facts and analysis to support the allowance of the objection note potential application of 163.2 penalties MILLER THOMSON LLP THE NOTICE OF OBJECTION - The Minister’s Response Chief of Appeals appeals officer assigned Letters and Meetings limit client contact Tight deadlines on taxpayers No deadlines on CCRA 90 day appeal to Tax Court of Canada MILLER THOMSON LLP THE NOTICE OF OBJECTION - Late Filed Notices of Objection Discretionary application to CCRA Conditions for late filing: within the time limit, the taxpayer either intended to appeal or could not act just and equitable application as soon as possible (no later than one year after ordinary deadline) Refusal can be appealed to TCC MILLER THOMSON LLP TCC PROCEDURES Informal Procedure General Procedure MILLER THOMSON LLP GENERAL PROCEDURE Larger cases Only lawyers may represent taxpayers Right of appeal to FCA Higher costs awards MILLER THOMSON LLP TCC INFORMAL PROCEDURE - When it Applies Appeals may be brought as Informal if any of the following applies: federal tax and penalties are less than $12,000 loss of less than $24,000 interest only tax over $12,000 or loss over $24,000 is waived Crown may apply to move a case up to general procedure MILLER THOMSON LLP TCC INFORMAL PROCEDURE - Representation Unrepresented individuals Individuals represented by agents Individuals represented by lawyers Corporations represented by lawyers MILLER THOMSON LLP TCC ONUS OF PROOF Taxpayer must prove that assessment is wrong Complicated rules on how to meet onus For Informal Procedure appeals: just prove the case! Minister bears the onus to justify penalties or late assessment MILLER THOMSON LLP POWERS OF THE TCC Confirm assessment Vacate assessment Vary assessment No power to increase assessment MILLER THOMSON LLP INSTITUTING A TCC APPEAL File Notice of Appeal with TCC must be received within 90 days of confirmation set out facts and reasons for appeal MILLER THOMSON LLP LATE FILED TCC APPEALS May be permitted by application to TCC Conditions for late filing: within the time limit, the taxpayer either intended to appeal or could not act just and equitable application as soon as possible (no later than one year after ordinary deadline) reasonable grounds for the appeal MILLER THOMSON LLP THE CROWN’S TCC REPLY Sets out the government position in the appeal Basis for settlement discussions MILLER THOMSON LLP TCC EXPERT WITNESSES An individual with special expertise who can express an opinion to help the court complicated rules on how to deal with experts – hire a lawyer MILLER THOMSON LLP SETTLING TCC APPEALS Majority of TCC appeals settle Settlement must be based on facts and law Crown is not permitted to settle on a “sawoff” basis usually possible to agree on facts to support settlement MILLER THOMSON LLP TCC DISCOVERY There is no examination for discovery in the Informal Procedure Request all CCRA documents pursuant to “Appeals Renewal Initiative” audit notes and report appeals notes and report MILLER THOMSON LLP TCC INFORMAL PROCEDURE HEARING Set by Court or at request of parties Formerly a backlog - now very fast MILLER THOMSON LLP TCC PRESENTATION ORDER Ordinary case: opening statements taxpayer’s evidence Crown evidence taxpayer argument Crown argument taxpayer reply May be reversed if only issue is penalties MILLER THOMSON LLP TCC INFORMAL PROCEDURE - Judgment and Appeal Usually judgment within 90 days No appeal right Right to Federal Court of Appeal judicial review only designed to correct serious and obvious errors MILLER THOMSON LLP TCC INFORMAL PROCEDURE COSTS CCRA success results in no costs award Taxpayer success may result in disbursements and legal fees Court will not award fees charged by agent MILLER THOMSON LLP INCOME TAX ASSESSMENTS OBJECTIONS AND APPEALS Robert B. Hayhoe (416.595.8174) CGA Ontario Public Practitioners’ Convention Saturday, September 23, 2000 MILLER THOMSON LLP