Fact or Fiction: Hear from Experts in the Field on the Tax Subjects

advertisement

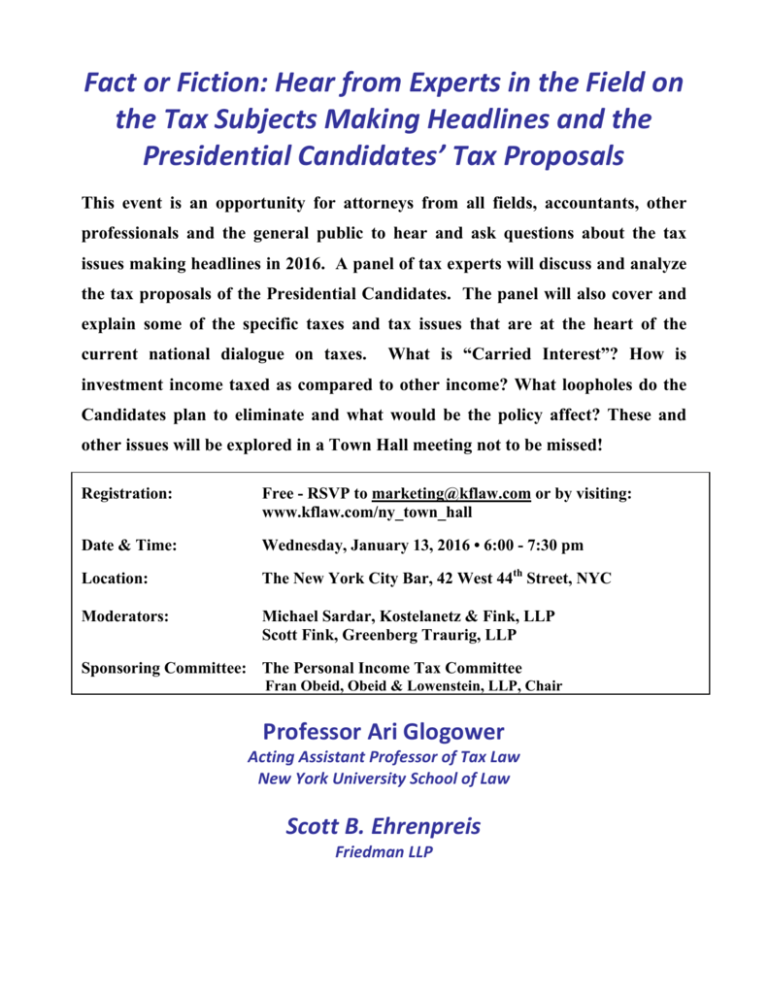

Fact or Fiction: Hear from Experts in the Field on the Tax Subjects Making Headlines and the Presidential Candidates’ Tax Proposals This event is an opportunity for attorneys from all fields, accountants, other professionals and the general public to hear and ask questions about the tax issues making headlines in 2016. A panel of tax experts will discuss and analyze the tax proposals of the Presidential Candidates. The panel will also cover and explain some of the specific taxes and tax issues that are at the heart of the current national dialogue on taxes. What is “Carried Interest”? How is investment income taxed as compared to other income? What loopholes do the Candidates plan to eliminate and what would be the policy affect? These and other issues will be explored in a Town Hall meeting not to be missed! Registration: Free - RSVP to marketing@kflaw.com or by visiting: www.kflaw.com/ny_town_hall Date & Time: Wednesday, January 13, 2016 • 6:00 - 7:30 pm Location: The New York City Bar, 42 West 44th Street, NYC Moderators: Michael Sardar, Kostelanetz & Fink, LLP Scott Fink, Greenberg Traurig, LLP Sponsoring Committee: The Personal Income Tax Committee Fran Obeid, Obeid & Lowenstein, LLP, Chair Professor Ari Glogower Acting Assistant Professor of Tax Law New York University School of Law Scott B. Ehrenpreis Friedman LLP

![no 8 Form rules 17 and 290] [See](http://s2.studylib.net/store/data/016947017_1-bdf803ab4180721310e3ec4259dca46e-300x300.png)