A Level PA Exam (2009) Paper 1 Review

advertisement

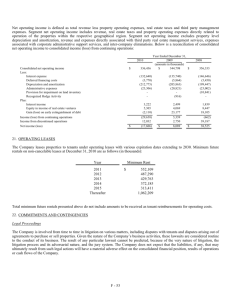

Candidates’ Performance in the 2009 Examination – Paper 1 Mr. WAN Shiu-kee Overall Performance Satisfactory Possess broad understanding of the topics Able to give appropriate answers based on the scenarios given 2 Overall Performance Should read the questions carefully Should present their answers in a logical and systematic manner Abbreviations are not acceptable Proper heading / title should be provided for each account / statement Journal narratives should not be omitted Should show workings in their answers 3 Overall Performance Questions Popularity Performance 1 Satisfactorily answered 2 Good 3 96.0% Well answered 4 35.7% Poor 5 68.3% Well answered 4 Question 1 – Consolidated financial statements Satisfactorily answered Well prepared for a question on consolidated financial statements 5 Question 1 – Consolidated financial statements a) Poor Not able to explain the accounting definition of goodwill in the context of consolidation Wrongly focused on elaborating the difference between purchased goodwill and inherent goodwill Did not understand the meaning of “attributing factors” 6 Question 1 – Consolidated financial statements b) Well answered Computation of goodwill should include holding company’s share of ordinary share capital, share premium, pre-acquisition profits and fair value adjustments on office premises Did not net off the pre-acquisition dividend from the cost of investment 7 Question 1 – Consolidated financial statements c) Not familiar with the adjustments relating to intra-group transactions Mistakenly treated the mark-up as gross profit margin overstatement of cost of goods sold and understatement of gross profit Could not identify the adjustments to be made to depreciation expenses depreciation on profit of the transferred machinery should be excluded, additional depreciation should be computed basing on the fair value adjustment of the office premises 8 Question 1 – Consolidated financial statements Failed to exclude intra-group management fees from administrative expenses No difficulty in calculating goodwill arising from consolidation, but not familiar with the treatment of impairment loss on goodwill Profit attributable to the equity holders of the parent and minority interest were to be shown separately 9 Question 1 – Consolidated financial statements Amounts of unrealised profit adjustment arising from upstream sale of machinery and additional depreciation on revaluation of office premises were to be apportioned to minority interest 10 Question 1 – Consolidated financial statements Should present the consolidated balance sheet in vertical form and classify various items under the appropriate headings Did not adjust the net book value of PPE with the amounts of unrealised profits on machinery, fair value adjustments on office premises and the related depreciation 11 Question 1 – Consolidated financial statements Cash in transit should be shown neither as a separate item nor as a reduction of bank overdraft Failed to deduct 2 years’ additional depreciation on fair value adjustment from retained profits Ignored the depreciation adjustment on the transferred machinery from retained profits 12 Question 2 – Partnership accounts Good Quite familiar with the preparation of various accounts for a partnership 13 Question 2 – Partnership accounts a) Confused the treatments of debit notes and credit notes Rule of the lower of cost or net realisable value (LCN rule) should be applied to the valuation of closing inventories Not aware that insurance expenses had been included in selling and administrative expenses Wrongly calculated the allowance for doubtful debts basing on “confirmations received from trade debtors” Returned cheques should be added to the balance of trade debtors 14 Question 2 – Partnership accounts b) Remember that no goodwill account was to be maintained in the books GW should be written off through partners’ capital accounts No difficulty in recording the drawings of the partners but the full amount of the partners’ salaries had been credited to the capital accounts Share of profits should be calculated after taking away the partners’ salaries from the net profit before appropriation 15 Question 2 – Partnership accounts c) Should transfer the book values of various assets to the realisation account failed to show the net amount of trade debtors and forgot to include the prepaid portion of the insurance expenses Could not record the correct payment to trade creditors in the bank account Ignored the share of realisation profits in recording the final settlement to the partners 16 Question 2 – Partnership accounts d) No difficulty in preparing the required journal entries Mistakenly recorded the assets in the books of A&B Ltd at book values 17 Question 3 – Cash flow statement Well answered Demonstrated an acceptable level of understanding in preparing a cash flow statement 18 Question 3 – Cash flow statement a) Not able to calculate the correct amounts of the depreciation of machinery and equipment as well as profit before taxation Not aware that short-term investment was listed at fair value wrongly computed the profit on sale of investment Had difficulties in calculating the valuation surplus on short-term investments for adjustment to net cash flows from operating activities 19 Question 3 – Cash flow statement Should classify interest paid as an operating activity and dividend income as an investing activity Wrongly disclosed increase in fixed deposit as a cash flow from investing activities Should not divide the proceeds from issuance of ordinary shares into par value and share premium and disclosed separately 20 Question 3 – Cash flow statement Did not notice the repayment in 2008 and the re-classification of bank loan at the end of 2007 and 2008 Fixed deposit with a maturity of 6months was not to be treated as cash equivalents 21 Question 3 – Cash flow statement b) Fair Could not manage to explain 2 advantages of a cash flow statement to investors focused on stating the uses and classifications of a cash flow statement 22 Question 4 – Ratios and Errors Poor Could not apply conceptual understanding in solving various accounting problems Did not posses sufficient knowledge of some specific issues related to lease, provisions and intangible assets, etc 23 Question 4 – Ratios and Errors a) Could not calculate the return on equity and return on capital employed correctly wrongly used average profit figure instead of averages for equity and capital employed Failed to include issued debenture in calculating opening figure for equity Did not adjust debenture interest to net profit in computing return on capital employed 24 Question 4 – Ratios and Errors b) Gave comments only on the gearing ratio without giving proper reference to their answers in (a) Failed to explain the implications of return on equity and return on capital employed to the shareholders of a highly geared company 25 Question 4 – Ratios and Errors c) Did not understand how to apply the concept of “substance over form” in the question tended to list the criteria of a lease as their answers 26 Question 4 – Ratios and Errors d) Not aware that the books had been closed recorded omissions and corrections directly to various expenses instead of profit and loss account Had difficulty in calculating the amounts of lease creditors and finance charge for the year Not able to prepare the necessary journal entries to recorded the lease 27 Question 4 – Ratios and Errors Should not record the construction cost of the fire exits as a liability Failed to apply the matching principle to deal with the nonrefundable rental premium and the accrued rent at the end of year 2008 28 Question 5 – Non-profit making organisation Well-answered Could identify the items to be shown in the income and expenditure account and balance sheet 29 Question 5 – Non-profit making organisation a) Did not know how to work out the cost of goods sold from sales to star plan members mistakenly treated the margin as the mark-up in arriving at total amount of cost of goods sold Did not account for stock loss when calculating operating expenses 30 Question 5 – Non-profit making organisation b) Had difficulty in calculating income from subscription fees forgot to allocate the star plan members’ subscription fees over a period of 3 years Failed to apply the realisation principle in calculating revenue from wine tasting courses Did not include the deposits for the function room as an expense in computing profit from annual dinner 31 Question 5 – Non-profit making organisation c) Could not manage to split deferred subscription fees into current and non-current portions and show them correctly in the balance sheet Deferred course fees for January and February 2009 should be disclosed as a current liability 32 Thank you !