Problem set 2 - Answers to Problem set 1

advertisement

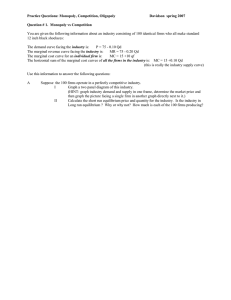

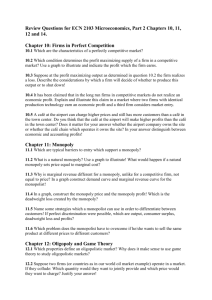

Peking University Guanghua School of Management Industrial Organization, Spring 2013 L. Shi Problem Set 2 Out on March 4th, due on Monday, March 11, 2013 Question 1: Perfect Competition, Monopoly, Elasticity of Demand Suppose the market demand curve is Q(p)=10-p. The cost function is given by C(q)=2q. (a) What are the perfect competition price and output and what is the total welfare? (b) What are the monopoly price and output and what is the dead weight loss due to monopoly? What is the price elasticity of demand ( ) at the monopoly price? (c) Answer question (b) when the market demand curve changes to Q(p)=10-0.5*p. (d) How does the dead weight loss change with | |? (For the following two questions, please check out note on cartel at the course webpage) (e) Suppose there are two firms, what are the choice of q and price if they form a cartel? (f) At the cartel equilibrium, do they have incentives to deviate from the equilibrium? Question 2: Dominant Firm and Competitive Fringe Industry demand, P=100-Q; Cost for dominant firm, C ( q) 32q q2 , Cost for each of the 8 smaller firms, C ( q) 70q 2q 2 (a) What are the monopoly quantity, price, and profit? (b) Solve for the equilibrium of Dominant Firm and Competitive Fringe i. What is the choice of output for each of the 8 smaller firms, given that the dominant firm chose qd . ii. Realizing the choice of the smaller firms, what is the optimal choice of qd for the dominant firm? (c) Compare the equilibrium quantities, price, and profits in the monopoly case and the equilibrium of dominant firm and competitive fringe. Is the smaller firm still earning profit? If there is free entry of smaller firms, would smaller firms enter? Question 3: Cartel Market demand: P=100-Q, Q= q1 q2 Cost for firm1, C1 ( q1 ) q12 , Cost for firm 2, C2 ( q2 ) 2q22 Find the optimal cartel strategy, i.e., the output levels that should be produced if the two firms to maximize joint profits. Also compute the cartel price and profit. Question 4: In Bandiera et al. (2005), why can the authors claim that the effect is not due to pro-social preference, but due to collusion under relative performance evaluation?