Business Accounting Ratio Analysis Assignment

advertisement

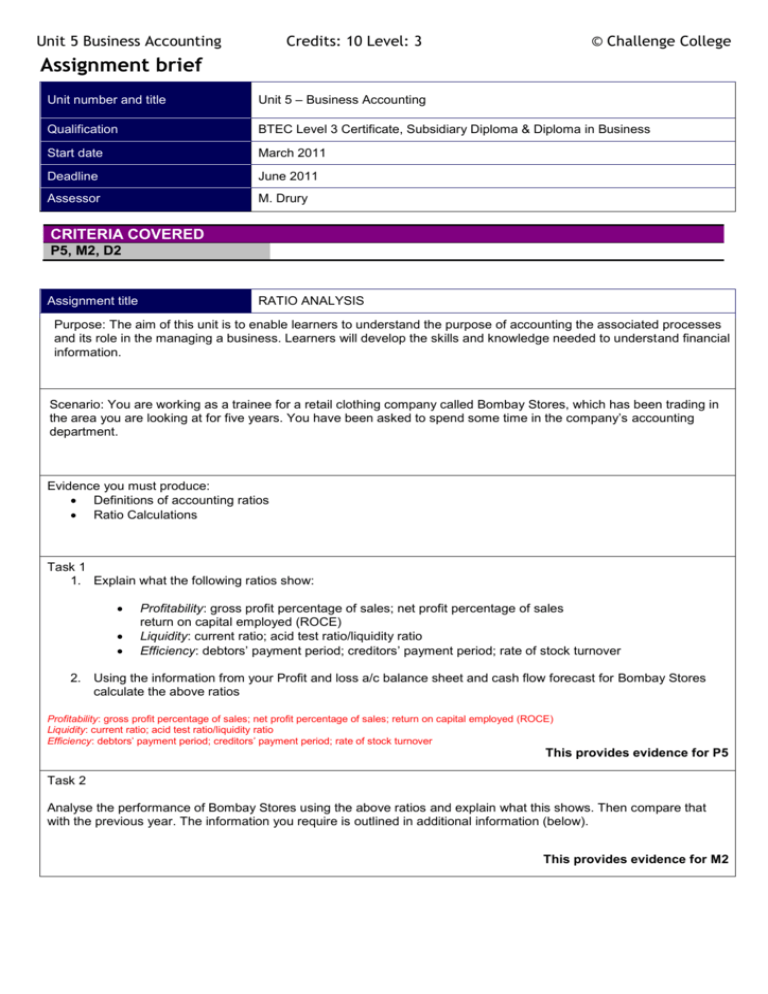

Unit 5 Business Accounting Credits: 10 Level: 3 © Challenge College Assignment brief Unit number and title Unit 5 – Business Accounting Qualification BTEC Level 3 Certificate, Subsidiary Diploma & Diploma in Business Start date March 2011 Deadline June 2011 Assessor M. Drury CRITERIA COVERED P5, M2, D2 Assignment title RATIO ANALYSIS Purpose: The aim of this unit is to enable learners to understand the purpose of accounting the associated processes and its role in the managing a business. Learners will develop the skills and knowledge needed to understand financial information. Scenario: You are working as a trainee for a retail clothing company called Bombay Stores, which has been trading in the area you are looking at for five years. You have been asked to spend some time in the company’s accounting department. Evidence you must produce: Definitions of accounting ratios Ratio Calculations Task 1 1. Explain what the following ratios show: Profitability: gross profit percentage of sales; net profit percentage of sales return on capital employed (ROCE) Liquidity: current ratio; acid test ratio/liquidity ratio Efficiency: debtors’ payment period; creditors’ payment period; rate of stock turnover 2. Using the information from your Profit and loss a/c balance sheet and cash flow forecast for Bombay Stores calculate the above ratios Profitability: gross profit percentage of sales; net profit percentage of sales; return on capital employed (ROCE) Liquidity: current ratio; acid test ratio/liquidity ratio Efficiency: debtors’ payment period; creditors’ payment period; rate of stock turnover This provides evidence for P5 Task 2 Analyse the performance of Bombay Stores using the above ratios and explain what this shows. Then compare that with the previous year. The information you require is outlined in additional information (below). This provides evidence for M2 Unit 5 Business Accounting Credits: 10 Level: 3 © Challenge College Task 3 Evaluate the financial performance and position of Bombay Stores using ratio analysis. You will be required to present this in the form of a board meeting that has come about to discuss Bombay Stores position after the credit crunch. This is your final task that will take place on July 7th 2011. This provides evidence for D2 Sources of information: Bevan J, Dransfield R, Coupland-Smith H, Goymer J and Richards C – BTEC Level 3 National Business Student Book 1 (Pearson, 2009) ISBN 9781846906343 Bevan J, Goymer J, Richards C and Richards N – BTEC Level 3 National Business Student Book 2 (Pearson, 2009) ISBN 9781846906350 Coupland-Smith H and Mencattelli C – BTEC Level 3 National Business Teaching Resource Pack (Pearson, 2009) ISBN 9781846906367 www.bbc.co.uk/business BBC Business website www.bbc.co.uk/news BBC News website www.becta.org.uk British Educational Communications and Technology Agency www.bized.ac.uk Business education website including learning materials and quizzes www.careers-in-business.com Information on a variety of business careers www.carol.co.uk Online company annual reports www.direct.gov.uk Gateway to public services This brief has been verified as being fit for purpose Assessor Signature Date Internal verifier Signature Date P5 perform ratio analysis to measure the profitability, liquidity and efficiency of a given organisation. [CT] M2 analyse the performance of a business using suitable ratios. D2 evaluate the financial performance and position of a business using ratio analysis. Additional Information for Ratio analysis: Profitability Ratio figures Gross Profit percentage Bombay Stores 31 March 2010 25 March 2009 £'000 £'000 Sales 140150 80200 Gross Profit 107850 62500 Unit 5 Business Accounting Credits: 10 Level: 3 © Challenge College Net Profit Percentage Bombay Stores 31 Mar 2010 25 Mar 2009 £000 Sales Net Profit £000 140150 80200 89800 58300 ROCE Bombay Stores 31 March 2010 25 March 2009 £'000 £'000 Net Profit 89800 58300 Capital (shareholders) 50000 50000 Liquidity Ratio figures Current Ratio Bombay Stores 31 March 2010 25 March 2009 £'000 Current Assets Current Liabilities £'000 12900 10600 1800 1200 Acid Test Bombay Stores 31 Mar 2010 25 Mar 2009 £000 Current Assets £000 12900 10600 Current Liabilities 1800 1200 Stock 3800 2510 Unit 5 Business Accounting Credits: 10 Level: 3 © Challenge College Efficiency Ratio figures Stock Turnover Analysis Bombay Stores 31 March 2010 25 March 2009 Consolidated Profit and Loss Account £'000 Cost of sales Stock £'000 32300 26400 3800 2700 Debtors Payment Period Bombay Stores 31 Mar 2010 25 Mar 2009 £000 Turnover Debtors due within one year £000 140150 80200 2400 1600 Creditor Payment Period Bombay Stores 31 March 2010 25 March 2009 £'000 Cost of sales Creditors: Amounts falling due within one year £'000 32000 26400 1800 1150