RESURRECTION OF THE BOMBAY TRANS-HARBOUR

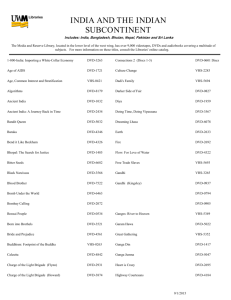

advertisement

RESURRECTION OF THE BOMBAY TRANS-HARBOUR

LINK PROJECT BY USING WHEATON'S MONOCENTRIC

MODELS OF URBAN LAND USE

by

Shubhada Bhave

Bachelor of Architecture

Sir J.J. College of Architecture

Bombay University, India

1984

SUBMITTED TO THE DEPARTMENT OF

ARCHITECTURE IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE DEGREES OF

MASTER OF SCIENCE IN ARCHITECTURE STUDIES

AND

MASTER OF CITY PLANNING

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

February 1987

Copyright (c) 1987 Shubhada Bhave

The Author hereby grants to M.I.T.

permission to reproduce and to distribute publicly copies

of this thesis document in whole or in part.

/

Signature of Author

A

, .,,

Department of Architecture

February 13, 1987

Certified by

Ranko Bon

Assistant Professor of Econo ics in Architecture, Thesis Supervisor

Accepted by

U

JiajBeH

Chairman, Departmental Committee for graduate students

Accepted by

MASS

CH

LOSNGY

Director,

FEB 2 5 1987

Philip Clay

Master of City Planning Program

RESURRECTION OF THE BOMBAY TRANS-HARBOUR

LINK PROJECT BY USING WHEATON'S MONOCENTRIC

MODELS OF URBAN LAND USE

by

Shubhada Bhave

Submitted to the Department of Architecture on February 13, 1987

in partial fulfillment of the requirements for the degrees of

Master of Science in Architecture Studies

and

Master of City Planning.

Abstract

BOMBAY TRANS-HARBOUR LINK PROJECT: A possible solution to Bombay's

seemingly unsurmountable social problems.

The primary idea behind this thesis is to present a new technique for the appraisal of large

scale urban transportation projects which are envisaged to have a major impact on the

surrounding physical and economic urban structure. The Bombay Trans-Harbour Link

(BTHL) Project, a 16 kilometers long road bridge proposed by the Indian Planning

Commission to connect the island city of Bombay and the surrounding mainland, was

considered to be an excellent case study for demonstrating the application of this technique.

This project would mean a major transportation investment for the Bombay Metropolitan

Region. The investment is justified because it is envisaged to act as a catalyst to draw

people from the island to the mainland. This would help reduce the existing acute

congestion in the city of Bombay by securing more land mass and bringing this newly

acquired land within convenient commuting time of the existing business district in the

main city.

Thus, the three essential features that the BTHL would perform are:

1. Open up new 'virgin' land for development and thus be an integral part of the

process of decentralizing Bombay.

2. Form the 'connecting link' between the mainland and Bombay city, thus

removing the only significant bottleneck to development, namely, the lack of

adequate communication between the island and the mainland.

3. Once built, the BTHL would open up vast unused areas on the mainland that

would in all probability attract other investments and improvements or

requirements necessary for development which, once the BTHL is

constructed, would be relatively easy to meet.

In this case, transportation infrastructure such as the BTHL becomes almost a

prerequisite, though by no means a guarantee, of economic development. The benefits

would be long-term ones, and in fact in the initial time period after the investment, traffic

growth could be much larger than the corresponding anticipated growth in income. In

these early stages, the ratio of capital to output could well be extremely high. Thus, in

view of the anticipated strategic role of the BTHL and the large investment required, a

careful appraisal of the costs and benefits of the project is particularly important. It is

equally important to set forth the investment criteria which would be used in deciding

whether or not to undertake the project.

The engineering feasibility of the project as well as its total cost has been established by

Messrs. Peter Fraenkel and Consultants. The Project is estimated to cost US $110.41

million in 1990 constant prices. This thesis emphasises the fact that the methods of

evaluation used to date for appraising the benefits of transport investments suffer from

the application of mistaken techniques and from inadequate analyses of economic

externalities and linkages.

The first part of the thesis partly includes a description of these methodologies and a

critique of each of them. The second half of the thesis is written from the viewpoint of a

consultant to the Indian Planning Commission under the auspices of Tata Economic

Consultancy Services, entrusted with the task of seeing whether an investment in the

BTHL today would be justified or not, and if so on what grounds. I have endeavoured to

present a different methdology for the appraisal of the BTHL Project.

This new approach is based upon the application of monocentric models of urban land

use to theories of metropolitan spatial development, a technique developed in its most

recent form by Professor William C. Wheaton of the departments of Economics and

Urban Studies and Planning, M.I.T. By using both static and dynamic monocentric

models, this approach helps envisage and compare two alternative urban scenarios of the

future, one without the project and one with it. The urban structure is analysed in terms

of city spread outward from the Central Businesss District, the rent gradient along the

cross-section of the city, and the density structure at all points in the city. This

information concerns the potential utility derived per person in either scenario, which in

turn becomes the primary criterion for an investment decision.

Thesis Supervisor: Ranko Bon

Title: Assistant Professor of Economics in Architecture

Acknowledgements

I wish to extend my most sincere thanks to the following gentlemen who assisted and

guided me towards preparing this document.

Professor Ranko Bon (Department of Architecture, M.I.T.), for acting as my advisor from

the faculty of architecture.

Professor William C. Wheaton (Departments of Economics and Urban Studies, M.I.T), for

giving a lot of his time to develop a modelling technique for use in this specific context and

for subsequently advising me through this semester.

Professor Alan Strout (Department of Urban Studies, M.I.T.), for giving valuable feedback

and correcting me on the essential points of benefit-cost analysis.

I furthermore wish to thank Professor Ralph Gakenheimer (Departments of Civil

Engineering and Urban Studies, M.I.T.) for acting as one of the readers of this thesis and

Professor Julian Beinart (Department of Architecture, M.I.T.), for guiding me through the

course of the thesis preparation seminar and helping me formulate my thoughts.

In addition, I wish to thank the American Institute of Architects for the research grant

scholarship which provided me the opportunity of spending an extended period of time in

Bombay in connection with both planning and operating agencies in order to gather

sufficient data for the preparation of this document.

I must further add that this thesis could never have been submitted in its present printed

format without the diligent editing and computer expertise of Jean Marie Diaz.

It goes without saying that none of these individuals or organizations necessarily endorses

the views presented herein.

And lastly let me dedicate this thesis to my parents who made it possible for me to come to

M.I.T. and ever put my wishes before theirs. It was their unwavering confidence in me and

the constant support of my husband Brett, that helped me put so much effort into my work.

Table of Contents

Abstract

Acknowledgements

1. BOMBAY CITY: HISTORY OF DEVELOPMENT

1.1 NEED FOR EXPANSION ON THE MAINLAND

1.2 HISTORY OF PLANNING STRATEGIES THAT HAVE INFLUENCED

THE DEVELOPMENT TO DATE

1.2.1 INDUSTRIAL LOCATION

1.2.2 OFFICE AND COMMERCIAL ESTABLISHMENT LOCATION

1.2.3 LOCATION OF WHOLESALE MARKETS

1.2.4 ADDITIONAL PORTS

1.2.5 HOUSING

1.2.6 TRANSPORTATION

2

3

6

10

17

23

24

25

27

27

30

2. BTHL: THE SOUTHERN LINK BETWEEN THE ISLAND AND THE

MAINLAND

2.1 WHY IS BTHL DESIRABLE FROM THE PLANNER'S POINT OF VIEW?

2.1.1 ENVISAGED DEVELOPMENT SCENARIO-

35

3. A LOOK AT THE FINANCIAL AND ECONOMIC ANALYSIS OF THE

BTHL DONE BY TATA ECONOMIC CONSULTANCY SERVICES.

3.1 ECONOMIC APPRAISAL OF THE BTHL PROJECT AS DONE BY TECS

3.1.1 IDENTIFICATION OF BENEFITS OF TRANSPORT PROJECTS

3.1.1.1 Reduced Operating Expenses In Areas Now Served By A New

Facility

3.1.1.2 Stimulus To Economic Development Now Served By The New

Facility

3.1.1.3 Savings In Time For Passengers And Freight

3.1.1.4 Reductions In Accidents And Damage

3.1.1.5 Increased Convenience And Comfort

3.1.2 BENEFITS SPECIFIC TO THE BTHL PROJECT

3.1.3 IDENTIFICATION OF BENEFITS

3.1.3.1 Savings In Vehicle Operating Expenses

3.1.3.2 Value Added In Industry

3.1.3.3 Savings In Time

3.1.4 QUANTIFICATION OF BENEFITS

3.1.5 METHODOLOGY OF QUANTIFICATION

3.2 A CRITIQUE OF THE ECONOMIC APPRAISAL DESCRIBED IN PART

45

47

47

48

48

49

49

50

51

53

53

55

3.2.1 Principles Of Social Benefit-Cost Analysis

3.3 A NOTE ON THE FINANCIAL APPRAISAL OF THE BTHL PROJECT

3.3.0.1 Rental Levies

3.3.0.2 Sales Tax Proceeds

3.3.0.3 Toll Receipts

3.3.0.4 Regarding Rental Levies

3.3.0.5 Regarding Sales Tax Proceeds

3.3.0.6 Regarding Toll Receipts

55

61

61

61

62

62

62

62

39

40

46

46

46

47

3.4 A CRITIQUE OF THE FINANCIAL APPRAISAL DESCRIBED IN PART

63

3.4.1 The Methodology In General

3.4.2 Specific Drawbacks With The Identification And Quantification Of

Financial Benefits In The Case Of The BTHL

3.4.2.1 Toll Receipts

3.4.2.2 Sales Tax Levies

3.4.2.3 Rental Levies

63

63

NEW TECHNIQUE FOR THE APPRAISAL OF TRANSPORT

PROJECTS: APPLICATION OF WHEATON'S MONOCENTRIC

MODELS OF URBAN LAND USE

4.1 Introduction

4.2 A BRIEF OVERVIEW OF DIFFERENT OPINIONS REGARDING THE

APPRAISAL OF TRANSPORTATION INVESTMENTS

4.3 DEVELOPING THE WHEATON MODEL

4.3.0.1 URBAN LAND SUPPLY

4.3.0.2 RURAL LAND SUPPLY

4.3.0.3 RESULTANT OUTPUT OF THE MODEL

4.4 MONOCENTRIC MODELS OF URBAN LAND USE: APPLICATION TO

BOMBAY'S TRANSPORTATION PLANNING

4.4.1 Introduction

4.5 MONOCENTRIC CITY MODELS AS APPLIED TO THE PROBELM OF

TRANSPORTATION INVESTMENTS

4.6 CONCLUSIONS REGARDING CHAPTER 4, SECTION 4.3

4.6.0.1 COMMENTS

4.7 THEORIZED IMPACT OF THE PROJECT IN RESTRUCTURING

URBAN GROWTH IN AND AROUND BOMBAY BASED ON LAND

RENT PATTERNS

67

5. INPUT DATA AND METHODOLOGY FOR SIMULATION

5.1 DISCUSSION ON THE OUTPUT OF THE 'BOMBAY' AND THE

'BOMBAY2' MODELS

5.2 COMPARING THE RESPECTIVE WITH AND WITHOUT PROJECT

SCENARIOS OF THE TWO MODELS

5.2.1 URBAN BOUNDARY

5.2.2 POPULATION DISTRIBUTION AND LOT SIZES

5.2.3 POPULATION DISTRIBUTION AND DENSITIES.

5.2.4 Rental Incomes

5.2.5 UTILITY LEVEL PER INDIVIDUAL

5.3 SUMMARY OF THE SIMULATIONS PERFORMED

5.4 CONCLUSIONS REGARDING CHAPTER 5

5.4.1 APPLICATIONS OF THE 'BOMBAY' AND THE 'BOMBAY2'

MODELS

96

109

4. A

COMMENTS

6. CONCLUDING

REGARDING THIS STUDY

Appendix A.

A.1 Table 2

A.2 Table 3

A.3 Table 4

AND

OVERALL

OBSERVATIONS

63

64

65

67

68

72

74

75

78

81

81

83

86

92

93

115

115

115

117

117

118

120

122

134

140

145

146

147

148

A.4 Table

A.5 Table

A.6 Table

A.7 Table

Appendix B.

B.1 Table

B.2 Table

B.3 Table

B.4 Table

B.5 Table

B.6 Table

B.7 Table

5

6

7

8

149

150

151

152

2

3

4

5

6

7

8

153

154

155

156

157

158

159

160

Appendix C.

C.1 Table 2

C.2 Table 3

C.3 Table 4

C.4 Table 5

C.5 Table 6

References and Notes

161

162

163

164

165

166

167

Appendix D.

D.0.1 CONNECTED AGENCIES

D.O.2 OTHER ABBREVIATIONS

170

171

172

Chapter 1

BOMBAY CITY: HISTORY OF DEVELOPMENT

Large metropolitan cities the world over eventually tend to be suffocated by the

various serious civic problems which arise due to overpopulation and the resulting intensive

congestion. Bombay city in India is no exception. If at all, the situation there is worse than

in most other cities and is deteriorating day by day.

The island city of Bombay, which is commonly regarded as the commercial capital of

India, cannot continue to develop for long in its present form. The land mass within the

municipal confines of the Bombay Metropolitan Region is around 600 sq.kms., of which

438 sq.kms. -is part of Greater Bombay. Because of the peculiar physical configuration of

the city, this land mass is distributed in the form of a narrow north-south crescent. The

population in the region has already surpassed nine million and is still rising rapidly. The

average density works out to be 1106 persons per hectare. Though this number is high in

itself, it does not tell the whole story because the population is extremely unevenly

distributed over the different wards. In fact, the upper extreme of density is 2000+ persons

per hectare.

The commercial/business activities are concentrated in a small tip in the south of the

city, such that around 62% of the total employment is concentrated in 4% of the land mass

of the island. At the same time, residential areas have spread to the north. The transport

system is thus under an extremely heavy strain as it is required to carry more than eight

million commuters every day in an almost unidirectional flow, the majority of the working

population travelling to the CBD in the morning and back north in the evening.

This has created intense demand for central residential locations. Housing is getting

increasingly inadequate as construction is stalled due to the acute pressure on land, which

has caused an increase in the land price. The result is that more than half of the population

today does not have a roof over its head and slums on footpaths and shanty colonies are on

the increase.

Because of its peculiar physical configuration, the city can expand only in the

northern direction. The land mass in the city has already been excessively utilised and there

is very little scope for further horizontal expansion of the built area. Since most of the

business and industrial activities are concentrated in the southern region, any northward

expansion of the residential area leads to increasing commuting time between the residence

and the place of work and discourages people from moving there. The inevitable result is

acute congestion in the city, intense pollution and noise. All these have been far above the

internationally recommended safe limits for some years now.

Over the years, the city has grown in a most unplanned and haphazard manner. Its

population has been continuously rising, and is now over nine million, not including the

suburbs. Housing conditions are appalling, with peak densities now reaching over 2000

persons per hactare. Industrial and commercial establishments have mushroomed wherever

they could find space. Traffic and communication are extremely poor. Most of the civic

infrastructure are in need of major repair. The net result is extremely poor living conditions

for the majority of residents in Bombay.

The population of Greater Bombay increased from 4.17 million in 1961 to 5.9 million

in 1971 and further to 8.24 million in 1981. The land mass toward the center was used up

fairly quickly and today offers no scope for further expansion, unless redevelopment and

conversion of present land use takes place. However, if the densities have to be prevented

from rising beyond their already high level, then a substantial amount of additional capital

outlay would be required in residential conversion or new construction. The only other

alternative is for residential densities to be allowed to increase to unreasonably high levels.

The population of South Bombay has been stable at around 1.5 million over the last

FI&U6FE 101

r'P A

B AC*

(P.56DNTlAL 9eF 51 T1e5 -tAVF

200 PeOsons /+AA 19

P70W TOWJN IFfSomAY.

decade, since residential densities had already reached saturation limits. On the other hand,

population in the suburbs and extended suburbs has increased considerably, rising from 1.4

million to 4.96 million in one decade, as a result of a lot of open land being available for

expansion. Now all land at reasonable commuting distance from the CBD has been eaten

away and travelling from the extended suburbs is comparable to long distance travel.

The overall population growth rate in the BMR in the past two decades was around

2

3.6% p.a. while the national growth rate was only 2.2% p.a. This phenomenal population

increase has caused an increase in the population densities at all locations in the city, but

especially steeply as one approaches the CBD at the southern tip. The central density was

1388 persons/ha in 1961, which increased to 1917 persons/ha in 1971 and is around 2000+

persons/ha today.

This acute demand for central space has caused a substantial increase in the price of

land, in addition to which the housing conditions have grown steadily worse.

As the

statistical records of the National Building Organization show, today 75% of the population

lives in one room units, 15% in two room units and only 10% in larger dwellings. The land

rent varies from as high as Rupees 1.25 per square foot near the CBD, to Rupees 0.25 to

2

0.50 in the extended suburbs. This deterioration of the housing condition is evidenced by

an almost secular decline in the rate of building completion certificates issued since 1975.

In 1981, Greater Bombay contained 1.59 million dwelling units with slums

accounting for over 30% of these.

The growing population figure in the Bombay

Metropolitan Region (BMR) was attributable to the ever increasing employment

opportunities as compared to elsewhere. The total employment over the past two decades

increased from 1.68 million to 2.86 million.

Moreover, most of this employment is concentrated in the extreme southern tip of

Bombay. The land mass of this southern tip is only 35 square kms. in contrast with the 369

square kms. of the suburbs. This means that about 61% of the offfice and industrial jobs

are in an area of 16 square kms. which is only 4% of the total land mass.

This extreme concentration of jobs in the city's southern tip, together with the

peculiar north-south configuration of the city, has created substantial transportation

problems. Since this southern tip is accessible only from one direction, this employment

concentration has placed a tremendous strain on the city's bus and train services causing

quite a few hardships to the millions of daily commuters.

9-

In addition to the congestion caused by the lopsided employment distribution, the

heavy port activity which Bombay supports on its eastern stretch, further impedes the northsouth flow of traffic.

The overall effect is that the peak hour traffic from north to south even reaches 4500

Passenger Car Units (PCU) per hour. Apart from this traffic congestion, the overall

metropolitan congestion and overcrowding has exerted severe strain on the other civic

amenities, like water supply and sanitation. These problems combined with the housing

shortage, the lack of adequate open space even for parks and playgrounds, has resulted in

very poor living conditions for the residents as well as a host of other social problems.

These conditions will continue to deteriorate unless lasting measures such as expansion of

the land area are taken quickly.

1.1 NEED FOR EXPANSION ON THE MAINLAND

By the year 2001, CIDCO surveys estimate the population of Greater Bombay to

grow from the present 8.3 million to 13 million. By that time all the land in the island city

which is economically amenable to housing development will have been used up, and the

only way to accommodate the natural increase in population and the continuing

immigration will be to expand beyond the present limits of Greater Bombay into the rest of

the BMR. The Development Plan has estimated that to satisfy the requirements of

residential land within Greater Bombay for the projected population of 2001, it would be

necessary to channel the city's development into zones hitherto earmarked as 'NoDevelopment' zones, despite the fact that these largely consist of vacant and barren tracts of

land along railway corridors located some distance from existing populated areas and

marshy and hilly areas. Extending infrastructure to these areas is likely to be relatively

expensive.

Net residential densities in Bombay are extremely high as Census Data and other

1

surveys about Greater Bombay reveal:

I,

Fv~6(It 1.02

TYICAL, PoWiN joWN Lt'o(44y

ZXN4A& A CI171lI 65 ON

3;VLO)N~iS A6 ZOM151,NVP

R4L L5itv, PPN I1N&

;UAL-t$S Cj(OLA'

-

PAVW$ M15

PfU

04O~

Lw

WN6M&

WWW~

61iAWC$

IN Wt~b FACbK6,MVN

Fl64W

TYP16ALI. NIPPLE eZA--q +fOV.4(N6

(N-F-O~4AY

I1O05

-

FI6UAE 106

.

7Dt

JSL AND CITY

MAINLAND

'N

/

R.-.KALvAN COMPLEX

II

N42

:4

9

t3

-40

36

- - 38

e-37

51

..

/

--

34

B.

|--. --

-

E

0

53

UNK)

IN

- 57-

~BOMBAY MET ROPOLIT AN

REGION 3TUDY AREA

-ZONES

AND SEM- TORS

-a.

--- TAeSLG

E50MMY tA~T50POUTAN 5661ON POPULATIoNAN4C7 &MPWYb'~NT S5TiuAT&S

6REAT3

PERCEN7AGR

BOMBAY NEW

88.6%

BOMBAY

~

VASAI

KALYAN

2X63

OF POPULAT(ON

9-35%

5*.-205-3

o

%

-E5PLOYM-N6226-

Ye RATIO OF

31.IY yo625

gmptOy/P0p..

bOM1AY METROPOLUTAN REGION STUD/ AE/\

SECTOR #

TOTAL POPULATION

7.OF TOTAL

%

ZONES AND 6ECTOliS

RESTICTED AREA

l377 300

18-33

290S, 300

(2.)

31-.74

E90 EoHA

32

-15

16

2,837,000

31-686%

290

7-A

66 HA

11

1'38 HA

30

A

3

13

14

(2- 9

cD

35

1

6:621,O00

18

19

E

~

(0-7 V)

1,6,46.00

Co-16

20

5f

E5

F

HA

7)

1-73

9- HA

0-76X

q1-2. HA

3.86x

2-6

m)

69,60o

(o.oizr

37

m~

5.5

3,582o

HA

(0.35 m)

56

p

57

rp

39

40

41

6_

2

4,4-f2,00

(0-4 7r)

E6-65 HA

1

FjcOV86 W0

1 DiSANC

0-10OKM5

TW.P

5O. M9A 1

927-9

-LEE-6ND

__

110-20K5+22

230MS

OVER

CITY

88-6

30 11.9

MINLAND

D15TAt4CF 5AVING5 AFFG#RPUD

bOMEbAY tMAThOPOL1TAM

RU~461O,(CAfE +4MILE5

1"

Island city

Suburbs

Greater Bombay

(average): 1542 persons/ha.

(peak): 2000+ persons/ha.

(average): 931 persons/ha.

(average): 1106 persons/ha.

These densities compare unfavourably with foreign metropolitan cities and indeed

with all other metropolitan Indian cities. As compared to this, net residential density in the

1

only developed node, Vashi on the mainland, is much lower:

Net residential density

Gross residential density

: 670 persons/ha.

: 325 persons/ha.

When seen in isolation the density of Vashi reflects a pleasingly low figure. But it

also means that the Vashi node has not made any significant dent in the present situation in

Bombay and that accelerated development elsewhere on the mainland is essential in order

to encourage the benefits of agglomeration with the island city.

If there is no acceleration in the growth rate on the mainland, the overall density

would decline to 297 persons/ha as the impact of open lands and non-residential areas in

New Bombay is felt. Thus if New Bombay does not develop rapidly enough, residential

densities in Greater Bombay, already very high, will come under further pressure.

Thus, the most important benefit from the BTHL will be the vast areas on the

mainland to be opened for housing development. In spite of this fact, these areas have not

yet been developed, despite the enormous pressure on the supply of housing in Bombay.

This has principally been because of the lack of quick communication and easy access to

the city, and especially to the CBD.

With Greater Bombay reaching the saturation limit for population density and New

Bombay not developing fast enough because of the absence of any east-west link, the only

other location for expansion is northward. However this northward expansion has already

created problems of its own. One such problem is that the commuting time to the heart of

the island city keeps increasing as expansion goes further north. The total commuting time

by train is approaching two hours from the northern-most point of Greater Bombay to the

CBD at the southern tip. Furthermore, Traffic congestion and peak load on the transport

network have increased with the augmentation of the north to south commuter movement.

Today, the principal means of mass transport, the rail network, is used to its capacity, with

the five suburban rail corridors carrying over four million passengers daily to and from the

southern end of the city. In addition, even the public transport buses carry around four

million passengers daily. A not inconceivable scenario for future Bombay would then be as

follows:

Existing zoning restrictions may be relaxed as the pressure on land increases in order

to allow part of the 'No-Development Zone' to come under housing. This expansion can

however be very limited in extent, since much of this zone consists of land that would be

relatively difficult and expensive to develop. What is more likely to happen, therefore, is

that net residential densities in Greater Bombay will rise still further and conditions of

living will worsen beyond the present level. After that the most visible manifestation of

such a 'disaster scenario' will be aggravation of the housing crisis, which even today has

reached alarming proportions.

The severly bad housing condition today is partially attributable to the culmination of

several factors such as the scarcity of land, rapid increase in population, the dilapidated

state of much of the formal housing stock, poor housebuilding performance, misplaced

3

government regulations such as wrongly applied rent control measures, and other factors.

1.2 HISTORY OF PLANNING STRATEGIES THAT HAVE INFLUENCED THE

DEVELOPMENT TO DATE

The following section describes some of the most critical problems caused by the

historically unplanned growth of Bombay. This is not to say that urban planning efforts

were never attempted. In fact, several steps were taken from time to time in that direction.

4,5

These have been briefly chronicled below.

F16vulu 1.0

PO0WNIOUJNf 130Mj4Y TOWAPL9 111' L6FT:

-

rTVC

10 PA/-K )5 &D.N6 1f1U ROADL

rff6L~(N6l~F/61aN6e51ioN IN 1,1a-f'O/&6~ONLJc.

NqAFXJ-r.

ON&Y

ptr,j4?

WtloaS AWI MAM5T AT JUNC11ON OF I M~AINl W~A06: ?&vpnN&

Thwfic.

6ffTW.Pl

r

r-16A IT I. to

MAY IN6 6PF,76

j N (tH5

T 6U VC-Hla&5 LVIJ il 1OILY

WONveU73 Ttf~u 16 19.AFFI6 6066-6110N

e5AN 5'MOFC (tfC- &OAp

-NO

iAf5ONCP 4-0 M PA6F6A

tF~ffPAY.

_ 1 HE~ 6b%0Tp tAA'N6 OF

-

IN

IV16 F0W80ID

rPAN5sPO6i 5066

FN16P) A~ND tr-AWt 1 i~lS &Ul1t(N

MA5 UMANPORT ; 57IF~

- -4Lq OL LuJR9Qi 9 9 N V NOIWkNQ7 5714 L 5%lVU-q

cgtkL 4/- W')JS -JJO 20IdOd 9tVO79 910 MGV7 Ayg~~

rqNp)QeO

HI .57Wi

WPL (;.9114-7dQ4 M91; U2nW LY 5;1

5'WO JO W2 NOIL2O'dL9NQ2

a

.m - -U

.

QN

IEEIE

I

6P!5;N AM&EA6 A0LANF n fbI~Pl5V60fFNT ON ItO, MAW~4~

F16URU 1-15

-JOT(AIV UN,XYCl78P V106&IN b*p

Modak-Meyer Master Plan for Bombay city drawn up.

Maharashtra Housing Board established to construct houses for

different income levels under various social housing schemes. Nearly

70% of their construction is in Greater Bombay.

Bombay Town Planning Act enacted.

Barve committee suggested the expansion of the southern tip by

reclamation of land and the development of alternative growth centres

in the northern tip.

Messrs. Wilbur Smith and Associates prepared several road network

plans for improving communications.

Maharashtra Regional and Town Planning Act came into force.

Development Plan of Greater Bombay prepared and approved by the

State Government

Bombay Metropolitan Region Planning Board set up.

Bombay Building Repairs and Construction Board established as part

of the Urban Renewal Scheme.

Bombay Repairs Cess established to generate necessary finance for

undertaking repairs of old and dilapidated buildings so that conversion

of land use and reconstruction could take place and new capital outlays

could be utilized to rebuild at desired densities. Maharashtra Slum

Improvement Board established because around this time the rapid

industrialisation of Bombay led to an influx of migrants into the city in

search of employment and this led to the inevitable growth of slum

dwellings.

1948

1954

1957

1962

1967

1969

However, none of these plans achieved any notable success and certainly did not lend

hope for long range and permanent benefits to all the residents of the city. It was then that

the 20-year development plan was prepared by the BMR Planning Board in 1969, the latter

being the first to recommend the following:

" Development of New Bombay on the mainland across the Thane Creek;

" Need for controlling commercial growth in South Bombay;

* Creating another sub-centre, towards the north, in a hitherto monocentric city

in order to reduce aggregate commuting; and

e

Control on the establishment of new industries.

Following the preparation of the Development Plan in 1975, the BMRDA was set up

for coordinating and controlling the various existing activities and local bodies for the

growth and development of the BMR. Its main function was to plan for the region as a

whole, the orderly development of housing and commercial and industrial activities in

4

Greater Bombay and the mainland.

The northern part of the island city did not offer much land for long term

agglomeration benefits with the Central Business District to materialize.

However, the

construction of the BTHL and the subsequent opening up of a vast area on the mainland

would give scope for most of the above recommendations to be put into effect. In fact,

BMIRDA amd CIDCO have both done a lot of footwork in investing towards this goal of

decentralizing Bombay so much so that the connecting link to the mainland is now perhaps

the only significant bottleneck to the development of New Bombay.

A brief look at the planning manouvers undertaken by CIDCO and BMRDA with a

5,6

view to decentralizing Bombay, reveals that they were in six principal directions:

1.2.1 INDUSTRIAL LOCATION

Ever since 1969, severe restrictions have been placed on industrial activity in any part

of Greater Bombay, increasing in intensity towards the south. Following this, the State

Government's Regional Plan of 1974 made major changes in the industrial location policy,

such as restricting and rationalising certain zoning policies. Dispersal and decentralisation

were looked upon as major policies with respect to industrial location, for the achieving of

which larger incentives (such as augmenting infrastructural facilities) were to be provided.

New industrial undertakings were allowed only in New Bombay or in the extended suburbs

to the north.

However, these policies based upon developing growth centres by the provision of a

combination of incentives were not very successful.

Growth tended to concentrate in

already developed areas of the BMR. It can thus be concluded that, unless a wholesale

shifting of industries is made possible and sufficient agglomeration benefits offered, the

chances of success towards decongesting the island city would not substantially improve.

1.2.2 OFFICE AND COMMERCIAL ESTABLISHMENT LOCATION

BMRDA made a conscious effort to have a polycentric pattern of job distribution

instead of a monocentric one. In particular, it was contemplated that South Bombay should

not have any further development unless it was with the objective of deliberately promoting

growth elsewhere. With this in view, district centres and suburbs were encouraged to cater

to business establishments. It was hoped that New Bombay would become a growth centre

with a diversified base. To achieve this in the fastest possible way, BMRDA suggested the

shifting of government and semi-government offices to the North and to New Bombay,

hoping that the linkages of these establishments would be strong enough to encourage and

promote further shifting. It was further hoped that the new port suggested for Nhava on the

mainland may help attract much more activity in the future.

It was found, however, that the development of the port at Nhava by itself was not

enough to persuade the private sector to relocate. Even the relatively low cost of land at

Nhava in contrast to that in the CBD in Bombay was not a sufficient incentive for offices to

shift there. A brief investigation of the causes reveals that all the locations suggested as new

growth centres, have been in remote suburbs. More often than not, these suggested

locations have not been able to develop the needed cluster of economic activities which

could provide sufficient agglomeration benefits to office establishments. Increasingly,

studies showed that the benefits of agglomeration available in the central city outweighed

the savings in private costs involved in locating the office elsewhere. As it stands today, the

Nhava- Sheva port cannot develop the necessary critical mass to ensure self-sustained

growth. This is because the Thane-Creek Bridge has not provided a substantial reduction in

commuting time to the CBD though it provides an east-west link to the main city from the

mainland. It also did not help direct any of the congestion away from the north- south

direction.

However, it is hoped that once a southern link is built and areas on the mainland are

brought much closer to the CBD in terms of commuting time, agglomeration benefits will

soon be evidenced, and effective decentralization can be achieved.

EFFI75 70 AT115A6

OI6r&. Shd INDUSIR165

TO Nf&W oolAy.

1.2.3 LOCATION OF WHOLESALE MARKETS

This activity causes the maximum amount of population congestion and subsequent

traffic obstruction. Most of the wholesale vegetable markets are the open air kind and use a

large amount of human labour which occupies an enormous quantity of space. A substantial

amount of the traffic obstruction is due to truck traffic which carries products from

elsewhere in the country to these markets, most of which are well within the city. Similar

conditions exist for non-agricultural produce markets.

The Regional Plan of the BMR envisages the shifting of agricultural and nonagricultural produce markets to New Bombay. At present all the wholesale agricultural

produce markets are located in and around the South Island City. Unfortunately this already

congested region does not possess the physical characteristics to contain a wholesale

market. The result is that these wholesale markets are mixed with retail activities and

densely populated tenements. The acute shortage of business and warehousing space has

led to a steep increase in the cost of space, a large scale conversion from residential to

commercial land use, acute lack of parking space, and ever increasing traffic congestion.

CIDCO has thus undertaken the phased development of wholesale markets in New Bombay

in addition to allocating undeveloped plots to desirous traders.

It was estimated through past surveys that wholesale markets together generated a

very large number of person trips per day. The impact of the proposed shifting of markets

can be gauged from the pattern of outward flow of commodities from the existing markets.

Surveys showed that only about 25% of the outward flow was within the island city and

30% was accounted for by the suburbs. Thus, only around half of the total inflow of

commodities is for consumption within Greater Bombay. This implies that almost half of

the total inflow of commodities need not enter the city at all. The commodities are entering

at present only because of the inward central location of the wholesale markets. Thus

shifting of the wholesale markets is likely to have a significant positive impact on traffic

congestion in the city.

To start with, the BTHL would play a similar role as mentioned in the earlier two

cases. Because of the geographical constraints, all trucks entering Bombay from outside

have to pass through New Bombay. Since only about half of these goods are for

consumption within the city of Bombay, around half of the trucks need not enter the city at

all but could terminate in New Bombay. The only trucks that would need access to the city

are intra-city distribution trucks, catering to the consumption demand within the city itself.

Thus New Bombay could handle all inter-city heavy truck traffic, and only smaller intracity distribution trucks would be added to the Bombay traffic instead of the present load of

heavy long-distance vehicles. Access to the South Island City would be via a newly

constructed southern link and to the North Island City via the TCB.

1.2.4 ADDITIONAL PORTS

All the strategies mentioned above would remove the congestion on the Eastern

corridor only to an extent, the reason being that the main sources of congestion on this

easten stretch of the city are the ports and the port-related activities. The only far reaching

solution would be to augment port capacity elsewhere. Thus the government has decided to

construct an additional port at Nhava- Sheva, as mentioned earlier. This new port would

handle all the overseas trade, and only the internal trade would then need to be handled by

Bombay port. Even now, as part of the overall plan for New Bombay, an entire region

around the port has been identified for development to contain infrastructure required for

the port, areas for port-based industries, housing and commercial activities and various

social infrastructure.

As already mentioned, however, just the development of the port at Nhava would not

be enough for the private sector to relocate.

As it stands today the Nhava port cannot

develop the necessary critical mass to ensure self-sustained growth. It is only following the

development of a sufficient cluster of economic activities by virtue of the link, that

sufficient employment can be generated and impetus can be provided to the development of

New Bombay.

1.2.5 HOUSING

The census data of 1981 estimated the need for 60,000 new housing units in the BMR

per year. As against this, the maximum building capability achieved to date has been

25,000 units per year. The following schemes are in operation or at least in the proposal

stage to help alleviate housing shortage in the BMR:9

VT6tA Ha TAitU oN PAVfMt1T OF NAJO,6 HIiiMuAY

6ON0108160610FOV IffU WIW&6AI& MWOT Ift OUNIOUN~ J-36M1AY

28

F(6URE M7

PJG'IIL. MAfi3JF75

OR PA~eMEr'NT6 OF

-ALff UADY 6LOWO&P

t LA TF5.

The World Bank inititated and assisted a "Bombay Urban Development

Program". This included two programs:

e The Slum Upgrading Program, where slum areas mostly in Greater

Bombay are proposed to be upgraded by measures such as provision of

tenure, improved infrastructure, home improvement loans, etc.

e The Low Income Sites and Services Program, which would develop

serviced residential, commercial and small industrial plots within a range

of existing residential, commercial and industrial activity.

MIHADA and CIDCO are following the World Bank example and are

developing a number of sites in various extended suburbs.

"Habitat India" organised a slum resettlement scheme, which envisaged

allocating land to cooperative housing societies to be formed by slum

dwellers and surrendering to the Government the land presently occupied

by them.

As evidenced by the steadily deteriorating condition of Bombay, however, none of

these schemes have achieved any significant success, the main reason being that all these

schemes tried to achieve the impossible task of accommodating the ever-growing

population of Bombay within the narrow confines of the island city itself. Since the space

available is very restricted, horizontal expansion could only be very limited. Vertical

expansion would still not solve the problem of the over-burdened infrastructure. The overall

effect is that residences and workplaces remained as separate as before. Land rents

remained just as high toward the centre. Travel costs as a percentage of total consumption

kept increasing and net residential area per person was not increasing sufficiently with

distance to compensate for this. A vicious circle has thus been formed and, as housing still

continues to increase to very high densities within the city, social diseconomies of scale are

beginning to be felt strongly.

Hopefully, a southern link could trigger off a virtuous circle. Once commuting time

to the CBD is substantially reduced, residential decentralization would follow. This of

course assumes that locational decisions are based upon travelling time to the CBD. Mutual

dependency would then induce employment centres to follow residential development and

once the linkage effects begin to be felt, development can be expected to be reasonably

rapid.

1.2.6 TRANSPORTATION

The first comprehensive investigation involving road traffic in the Bombay area was

conducted by Messsrs. Wilbur Smith and Associates in 1962. In their "Bombay Traffic and

Transportation Study" they recommended the construction of several freeway and

expressway systems. The two most important proposals were the construction of the West

Island and the East Island Freeways to provide relief to the western and eastern corridors of

the island city. The World Bank also gave aid for "Pedestrian and Traffic Flow

Improvement" for schemes such as pedestrian subways, foot over-bridges, widening and

extension of roads and bridges, etc.

All these measures were aimed, however, at improving conditions within the city in

O F T416 UJOMST 6L()6U (N D0M6A

31

(PHA;>Avj)

flOL~IVNC & NAt'

-'ALY

LLW6AIi~~~if !511

5

FM656'

VE'OPX- To biv5- UN"~o'

11LFJ$VN7!5 LdIN

NON6& 1hr, YPWpjT6

32

--HOU5tN(&

ON PITION5

I NTftF t5NUhf

sx--MOM

ABIWIN&

L6OAWION

i6'Vw P25

order to accommodate the existing traffic in the best possible way. None of these helped in

diverting any of the traffic elsewhere. The construction of the BTHL in conjunction with

these earlier measures, however, would substantially help in redistributing traffic loads in a

more efficient manner.

Moreover, if New Bombay is to develop as planned, it would seem logical to

establish major links between Bombay and the Mainland. As already mentioned, the first

and only link to date between the city is the Thane-Creek Bridge, which opened to traffic in

1972. This bridge creates a northern link, connecting the respective northern areas of the

island city and the mainland. The carrying capacity of the bridge has, however, reached

saturation over the past decade. For accelerated development of New Bombay, a link with

the southern areas of the mainland is obviously required. This link would have to cater to

the differing travel demand created by the planned decentralization of economic activities

from Bombay to New Bombay. The traffic survey made by CRRI estimated that such a

7

southern link would carry a load of around 90,000 PCU's by year 2001.

Points 1 through 6 above show the advantages of constructing a link connecting the

respective southern portions of the island and the mainland from many different angles.

Many of these are social benefits, always difficult to quantify and express in monetary

terms. Different ways of capturing these benefits are discussed later in this thesis.

Chapter 2

BTHL: THE SOUTHERN LINK BETWEEN THE ISLAND

AND THE MAINLAND

"BTHL" is an abbreviation for the proposed Bombay Trans-Harbour Link Project.

The proposed project cost was established, in a feasibility study conducted in 1982-83 by

an international consortium of consultants led by Peter Fraenkel and Consultants (UK), and

including Premier Consultants (India), Christiani and Nielson A/s (Denmark), and Dr.

Helmut Homberg (West Germany).

In December 1983, the Steering Group of the Government of Maharashtra appointed

Tata Economic Consultancy Services (TECS) to carry out a study on the economic

feasibility and environmental aspects of the proposed Trans-Harbour communication link

between Bombay and the Mainland. Subsequently a financial study of the same project

was also carried out by TECS.

The results of both these analyses were not quite satisfactory from the Government's

point of view. It was felt that a broader environmental impact analysis of the project would

be needed. The analysis done by the author in this thesis, endeavours to look at the project

from the broader viewpoint of the economy as a whole and it demonstrates a new approach

for the analysis of transport projects.

The BTHL comprises of a 16 kilometers long road bridge of reinforced concrete

construction spanning the Thane Creek between Sewree in the south of the island city and

Nhava in the south of the mainland. The benefits due to the project are assumed to arise

mainly on account of the quick and easy access which it will provide between Bombay and

the mainland. The opening up of large areas of land for housing would in fact constitute the

most important benefit of the link and is especially significant in relieving the acute

F16UE

LEE0ND

DIAII&AT

11

SAV5DNB.K4

0-10 KMS

917-9

10-20 KM

+62-

120-SO Aus

88-6

OVER3o0Aow'

L-__ - -

CITY

12 1-9

- -- - s - - - -

MAINLAND

D15TAMCE .5AVING5 AfF08PED

pY T"E 5THL

5OMBAY ME TROPOLITAN

REGO4

(CALG

+MILES

1)

2'01

population pressure in Greater Bombay. The link would thus provide a new geographical

focus for the development of Bombay and its environs thereby easing the various problems

associated with congestion that have arisen on account of the city's haphazard and

unplanned growth.

The Central Road Research Institute (CRRI) estimates the traffic on the BTHL to be

92,000 vehicles in year 2001, which is the year when the BTHL is expected to be

7

commissioned for use. The CRRI states that this will save an estimated 17 kms per traveller

per trip, thus saving an estimated 85 million litres of fuel annually. It is the southern part of

New Bombay where a large number of hectares of land are available for housing, which

will benefit most in terms of commuting time by the construction of the link. From this

point, the total commuting time to the central business district in the city will be on an

average 90 minutes.

9

The basic assumptions underlying the appraisal of the BTHL Project are:

1. Construction of the bridge will commence in 1991 and will be complete by

the end of year 2000;

2. The East Island Freeway and the Sewree Expressway will be constructed by

the year 2000; and

3. In the absence of the project, economic activities on the mainland will take

place in accordance with CIDCO's plan for New Bombay, which has been

developed without accounting for the link. The BTHL will accelerate the

development of such activities, thereby generating economic value in the

Bombay region.

The economic costs of the project as computed by Messrs. Peter Fraenkel and

Consultants were estimated basically under two heads, costs of construction of the BTHL

and costs of operations and maintainence. The NetPresent Value of the total costs

discounted at 12% to the year 1990 works out to be = US $110.41 million.

The entire exercise of estimating the benefits and costs was done using shadow

prices, or opportunity costs which represent the value of benefits foregone when resources

are shifted from one process to another productive activity. A Standard Conversion Factor

(SCF) of 0.8 was chosen to convert all relevant to their economic values, based on the

procedure commonly adopted by the World Bank.1

The same procedure is also adopted for calculating benefits at economic prices. The

methods used by Tata Economic Consultancy Services for calculating the project benefits,

as well as the new approach used by the author for the same are both described in the

subsequent chapters of this thesis.

The government will undertake the construction of the BTHL, subject to arriving at a

satisfactory solution to all the following conditions:

1. Optimum location and capacity for the road link.

2. Most appropriate form for the crossing taking into view the following factors:

Possibilities of widening of the road crossing to accommodate

a future capacity estimate of 90,000 PCU's per hour;

Environmental impacts during and after construction;

Suitability from the point of view of Shipping, Defence and

Aviation; and

3. Advice on the cost-benefit analysis and implementation of the project, taking

into view recommendations on possible ways of financing the project and

means of recovering the project costs through tolls or user fees.

The engineering feasibility of the project has been conclusively established by the

earlier consultants. This includes points 1 and 2 mentioned above.

1Foreign

exchange is scarce. It is thus worth more than what would be given by the official exchange rate in

terms of domestic resources. The Bank contends that the UNIDO method of pricing goods domestically at

border prices and inflating the foreign exchange by applying a foreign exchange rate premium to it,tends to

embarrass governments, since the method shows that the domestic economy has been overvalued.

The Bank thus adopts an alternative method, by which all prices are measured such that the denominator is

not domestic currency but the domestic equivalent of foreign currency. Thus, instead of applying a premium

to the foreign exchange, you apply a Standard Conversion Factor (SCF) to domestic prices. Since the World

Bank contends that the foreign exchange premium for India is = 1.25, the SCF which would bring the

domestic prices in appropriate balance with the true value of foreign exchange, would be 1/1.25 = 0.8. Thus,

all economic benefits and costs would equal financial benefits and costs times 0.8.

This thesis, provides at least a partial answer to point 3. Its main emphasis is on the

identification and quantification of overall benefits to society. However, it chooses not to

deal with the issue of recovering project costs through pricing techniques. To do so would

require the compilation of another detailed document and is beyond the scope of this thesis.

2.1 WHY IS BTHL DESIRABLE FROM THE PLANNER'S POINT OF VIEW?

Given the above background, an obvious solution to the decongestion of the island

city lies in locating housing not in Greater Bombay, but in the rest of the BMR. The

available locations would thus be either toward the north or in New Bombay. The northern

locations as previously noted are handicapped by the long commuting time to the city

which is in excess of two hours. This leaves New Bombay as the only efficient solution to

Bombay's needs for expanding and absorbing more land.

The northern region of New Bombay is already served by the Thane- Creek Bridge,

and the central and eastern regions by the East- West Railway Corridor. The southern half

of New Bombay will however benefit most by the BTHL in terms of lower commuting

time. Average commuting time between the southern half of the mainland and the CBD on

the island will then be restricted to 90 minutes on average.

Thus in terms of average radial distance to the CBD the overall city size would be

actually getting smaller, and resources would then be used more efficiently. The more the

urban boundary expands, more will be the social diseconomies of scale to be felt in

Bombay.

Seen in this perspective, the BTHL project will not merely provide the most efficient

solution to Bombay's acute accommodation problem, but it would also be the most viable

solution open to the city. As said before, in the absence of this project, Bombay's growing

population will have only two equally unpalatable alternatives open. One would be to

expand into the farflung suburbs in the BMR, outside of Greater Bombay from where

commuting to work in the CBD would be synonymous with long distance travel. A second

alternative would be to remain within already congested regions, in which case, population

densities would rise well above normally accepted ceilings. The demand for social

amenities would fall well above the capacity of the city's already overburdened

infrastructure to supply it. This would also mean the quality of life for vast numbers of the

city's population would deteriorate to unacceptable levels.

There is of course a third, albeit theoretical alternative, which is perhaps open only to

more developed countries. In these countries, social diseconomies of scale would induce a

dispersal of population and jobs to other cities and towns. This is however unlikely to have

much validity in the case of Bombay. Developing countries have, almost by definition, a

much narrower range of alternative industrial agglomerations available to choose from, if

for no other reason than that industrial development is itself so limited in scope and

intensity. Secondly, any progress made in creating jobs, or even residential accommodation

in dispersed locations is frequently eroded by a rapid growth in the country's population.

A large amount of land would thus have to be opened at one time in order that bulk

shifting of various sectors could be achieved, and agglomeration benefits would soon start

to be felt.

2.1.1 ENVISAGED DEVELOPMENT SCENARIO

Both SICOM and MIDC have long discussed creating "Counter Magnets" elsewhere

in the state of Maharashtra as a solution to the situation in Bombay. But despite

considerable discussion on this topic and some measure of success, this is still an uphill task

at a practical level.

The experience of Vashi node showed for example that an isolated development has

the danger of ultimately degenerating into a mere "dormitory township". One possible

solution would be to have integrated development where New Bombay and Greater

Bombay develop together, complementing each other and functioning as one large single

metropolis. This would also give New Bombay a chance to develop the needed cluster of

economic activities since it would be in close proximity to Bombay, the nearest industrial

agglomeration.

The BTHL could provide this organic link, where both the island city and the

mainland could contain residential and commercial development so that people would be

commuting both ways. Only through such uniform, two-way traffic flows would distant

industrial areas receive an all round stimulus. In this manner Bombay would be able to

escape its geographical constraints, and develop radially instead of being forced to develop

into a linear corridor.

The identification and quantification of the precise benefits of such a development

scenario is, as said earlier, relatively difficult, in many cases necessitating the use of

subjective judgement. The various methods followed for these tasks are discussed in the

following chapters.

F1609F3~ Q202

A MAWI 6MfI-MiA,~A fPAOCT

jEc

6OIUZA710N clN 1IfU NiA[NLAIP

P-160UP 2'0.4

fp(e5UF

20c4

T1IP MAINLANQ I00?i

1o t At., Poe/vi5 !5~N iN lHc; ro4e:&PovNP>

IN CON 14t57 2 uW55.NOW

ftl15 -,oN:57MV6(oN OF I

I&LV 6-41

-

6P~~~Wc~f' N~ow~7(N

~

ii6WPA~

01I

4r~-

!PI6PR f'c25

I

60WA&bD UF?0K7

Y?/ 1fF 6 N38 T

70 AS-057MU(C1 t4(LCW -INafflFt

-fY6VVM & ON 1&F MjAINLW

t=)6VAi 2,07

_0VIjf&N~ 7 pfFoI37r 10 -A71p,.46r PtFOPWd 70 1ftt MAiNP WvN Lkz &It ; rAjf4LV W6aVA v OFo

O a0F -A AM gov'IONIor0

Watt ZK/ 6::11/ - N4AY6 TVt L . afV1 6aT~ AN6 1

flLOW.

Chapter 3

A LOOK AT THE FINANCIAL AND ECONOMIC ANALYSIS

OF THE BTHL DONE BY TATA ECONOMIC CONSULTANCY

SERVICES.

Sections 3.1 and 3.3 of the following chapter briefly discuss the most traditional

methods that have been used to evaluate the benefits of transportation projects such as the

BTHL. Part I looks at the traditional economic analysis as carried out by TECS whereas

Part II looks at the financial analysis, also done by TECS.

Measuring of financial costs and benefits is usually a fairly uncontroversial issue,

since monetary profitability to the project entity is the only measure for determining

financial viability. In case of an economic analysis, where project viability is determined by

the 'welfare maximization' accruing to the economy as a whole, measuring the economic

costs of a project is substantially simpler than measuring its economic benefits and can

usually be limited to making adjustments in the actual expenses to the extent that they do

not adequately reflect real economic costs. This thesis does not concern itself with the

calculation of costs. The emphasis rather is on the various methodologies used for the

identification and quantification of benefits which are then weighed against the costs earlier

calculated by Messrs. Peter Fraenkel and Consultants.

Sections 3.2 and 3.4 of the following chapter deal with the question of why the

measurement of benefits is such a controversial and difficult issue. In view of these

difficulties, each part proceeds to critique the traditional methodologies used to date. These

methodologies have been discussed in the specific context of the Bombay Trans-Harbour

Link Project. The following chapter presents a new modelling technique for the same

purpose. It is shown to overcome quite a few of the difficulties experienced in the methods

presented in Chapter 3.

3.1 ECONOMIC APPRAISAL OF THE BTHL PROJECT AS DONE BY TECS

The Steering Group of the Government of Maharashtra wished to have a study

conducted with regard to a social cost-benefit analysis of the BTHL Project. The terms of

reference stated the need to examine the 'socio-economic' and 'environmental' aspects of

the proposed link on the society or economy as a whole. Hence, the present study, done by

Tata Economic Consultancy Services in March 1985.9

Part I of this chapter describes the methodology as carried out by TECS, which was

on very traditional lines. This methodology, described in the following pages is based

mainly on desk research about economic benefit-cost methodologies including past

investigations on relevant topics, and certain basic data from the previous consultants'

reports. Part II of this chapter offers a critique of this methodology with respect to some of

the more obvious flaws.

3.1.1 IDENTIFICATION OF BENEFITS OF TRANSPORT PROJECTS

The study revealed that the economic benefits arising out of transport projects such as

the BTHL are generally more difficult to measure than their corresponding costs. This is

mostly because many of the benefits are such that there are no corresponding market prices

available. A good example is the benefit derived due to savings in time which is difficult to

measure because the savings take place over a fairly long time horizon which necessitates

fairly long range forecasts to be made. The same is true about the quantification of many

other benefits. The most commonly observed benefits arising from transport projects as

stated in the consultants' report encompass the following:

-

3.1.1.1 Reduced Operating Expenses In Areas Now Served By A New Facility

These are perhaps the only benefits of transport projects easily measurable in

monetary terms. These mainly arise from items such as fuel savings, maintainence,

depreciation, etc. These can be directly measured as the difference between the 'With

Project' scenario and the 'Without Project' scenario.

46

3.1.1.2 Stimulus To Economic Development Now Served By The New Facility

These benefits can be measured in terms of the net value of additional output arising

from the provision of a transport facility. The difficulty, however, is in judging how much

of the stimulus to economic development can be allocated to transport and how much to

other complementary investments. Again, the best way of doing this is with the help of the

"With" and the "Without" Project scenarios, even though in doing so, a considerable

amount of value judgement is involved.

3.1.1.3 Savings In Time For Passengers And Freight

These are comparatively more difficult to identify and measure. The valuation of

savings in time is a function of the opportunity costs involved. Moreover, the type of

externalities that would arise would depend upon the amount of time saved on account of

the new facility in relation to original trip duration. If this is substantial, then one could

quantify benefits such as bringing new areas into easy commuting distance of workplaces,

and making it possible for existing commuters to enjoy more leisure time.

There would be an opportunity cost,"t", the time saved if it were substantial enough

to pursue other meaningful activity, even leisure. The valuation of these commodities

could be done through the computation of 'Aggregate Consumption Benefits'.

3.1.1.4 Reductions In Accidents And Damage

These arise only in certain kinds of transport projects, for example, the result of

widening an existing highway into a dual carriageway. The most obvious difficulty in the

measuring of this benefit is that it involves judgements on the value of human life, always a

highly controversial issue.

3.1.1.5 Increased Convenience And Comfort

The TECS study stated that these benefits are unlikely to be of a magnitude large

enough to affect the economic viability of most kinds of transport projects. Though some of

these are not directly quantifiable, they can all be said to give rise to positive externalities.

Quantification would thus be largely a value judgement involving the internalization of the

associated externalities.

3.1.2 BENEFITS SPECIFIC TO THE BTHL PROJECT

The TECS study revealed that the most obvious benefits from the construction of the

BTHL would arise mainly on account of the quick and easy access which it will provide

between Bombay and the mainland. Provision of such an access would result in savings in

commuting time across the harbour and therefore cost. It would also help accelerate the

industrial and socio-economic development of the mainland. The anticipated aversion of the

housing crisis has already been elaborated upon earlier. Thus, substantial benefits could

flow to the region's economy from the generation of value added by industries, provision of

employment opportunities, availability of additional housing, resource savings in

transportation, etc., all of which will have a favourable impact on the island city in terms of

decongestion of all civic services.

Indirect benefits which can perhaps be described only in qualitative terms would

include benefits such as environmental benefits due to decongestion of Bombay city,

improvement of the quality of life of residents on the island and the mainland, reduction in

pollution, social development of the mainland, etc. These would be much more difficult to

quantify than the directly felt ones.

Prima facie, therefore, the study identified the principal benefits of the BTHL Project

as accruing from savings in vehicle operating expenses, stimulus to the industrial

development of the region, and savings in time.

The following few pages discuss the methodology followed by Tata Economic

Consultancy Services for the identification and quantification of these benefits. Following

this, 3.4 of the same chapter, critiques this methodology used by TECS. Chapter IV then

provides an insight into a new method for the identification and quantification of transport

benefits.

3.1.3 IDENTIFICATION OF BENEFITS

3.1.3.1 Savings In Vehicle Operating Expenses

The BTHL would substantially reduce the distance and provide quicker access

between Bombay city and Nhava-Sheva on the mainland for both long distance as well as

intra-hinterland traffic. As compared to the existing alternative of using the Thane-Creek

Bridge, there will be benefits accruing directly and immediately, such as savings on fuel,

and some indirectly and after some time such as savings in vehicle maintainence.

CRRI surveys showed that long distance traffic, all of which presently uses the

Thane-Creek Bridge, would form a substantial component of the traffic on the new bridge.

From the mainland south of Nhava to the city south of Sewri, the reduction in trip length

would be about 17 kms. The total savings in fuel and maintainence costs would thus depend

upon the projections of such traffic for the coming decades, through the use of a traffic

model, and then calculating the savings by comparing the "With" and "Without" Project

9

scenarios. Such projections would then have to take into account the following:

1. The location of the proposed port at Nhava-Sheva, which would itself

generate and divert a certain amount of traffic from Bombay Port;

2. In addition to long distance traffic, social and economic developments on the

mainland will necessitate interaction between the city and the mainland which

will generate traffic movement across the harbour; and

3. The proposed location of the new international airport in New Bombay, will

also generate new two-way traffic.

3.1.3.2 Value Added In Industry

With the construction of the proposed link, it is envisaged that new areas will be

"opened up" for industrial location, especially in the south and the south-east of the lower

half of New Bombay. The link will bring such areas closer to Bombay and make possible

active interaction between the city and the mainland.

Past experience reveals that the Thane-Creek Bridge proved to be an indispensable

link between Bombay and the MIDC industrial belt on the Thane-Belapur road, and

between Bombay and New Bombay itself. Though undoubtedly a few industries had

already been established even before the construction of the Thane-Creek Bridge, most of

the speedy development took place only after the project was sanctioned. The BTHL would

have the same basic advantages in as much as the areas would become much more

accessible and travelling time would be cut substantially.

Most of the industries postulated to come here are in the nature of expansion or

diversification of already existing Bombay based companies, for whom communication

with the city would be a distinct advantage. Further advantages would be easy access to

Bombay's market, to the various sources of raw material and skilled manpower, and to the

excellent communication facilities.

These are what were described before as the

agglomeration benefits.

Bombay is the administrative capital of the state of Maharashtra as well as the

financial capital of the country. Thus, even for virgin companies to be located in New

Bombay, the existence of such a nearby metropolis would be a distinct advantage, and

interaction with this metropolis could be considered an inevitable stimulus to growth. In

addition these new industries would have a concentration of skilled manpower to draw on

from population centres in the CIDCO region or otherwise. On this basis, industrial

development is estimated within and without the immediate borders of the BMR.

Ideally, the construction of this link would induce the development of specific growth

centres in this area with MIDC providing basic infrastructure. Favourable conditions for

setting up new industries already exist in the southern part of the mainland within the BMR.

With plentiful utilities likely to be available in this area, and with the advantage of the

Nhava- Sheva Port in the vicinity, the region has a considerable potential for development.

In addition, there is already a large demand for industrial areas.

To the extent that part of this development can be identified as being mainly on

account of the link, it would be considered as an external benefit of the link project which

can then be valued and internalized. The contribution of these industries to the gross

national income could be valued as the difference between benefits gained in the "With"

and "Without" Project scenarios, and attributing the incremental benefits to the link. The

net benefit to society from the link would then be the value added, net of all additional costs

of infrastructure, land development, and related facilities - without which the incremental

benefit would not be realized.

The consultants' report however, stated the difficulty of the need to rely on value

judgement in order to forecast the levels of value added under different assumptions.

Observed trends in existing industrial area were used by the consultants as a guideline for

this exercise.

3.1.3.3 Savings In Time

The consultants' study identifies the benefits due to savings in time as follows. The

most positive externality of the link would be to bring a large area on the mainland within

reasonable commuting time of the island city. This would have the very important effect of

reducing some of the pressure of housing in Bombay which would otherwise reach

unreasonably high levels at the end of the century.

Admittedly, some of the residential areas of the BMR are scheduled to be developed

independently of the Link Project. The main contributions of the link to these projects

would be to improve accessibility, and subsequently to stimulate the development of these

areas so that the construction of residences would take place at a more rapid pace. Further,

the link would lend a significant appreciation to land and property values on the mainland,

especially regions in close proximity to the link and in hitherto inaccessible regions in the

southern part of the BMR.

This latter contribution, i.e. the appreciation in property values, is then assumed to be

the reflection of the social value of benefits of agglomeration, which was made possible by

the link. This is to say that, in the absence of the link, residential areas in most of New

Bombay would be poorly connected to the island city in terms of commuting time. The

residents would then feel a comparatively poor identification with the megalopolis that is

Bombay, especially its commercial centre, the southern tip of the island.

As the "Without Project" scenario outlined earlier shows, the anticipated increase in

Bombay's population by the turn of the century is phenomenal, totalling around 20 million

by 2001 A.D. There will be little choice other than to live in the suburbs on the virtual

periphery of feasible commuting time from the city.

In this situation, New Bombay,

especially its southern regions, would be no more attractive to the commuter than the

distant suburbs of Greater Bombay. The 'critical mass' of people that is needed to develop a

CBD would then be denied or at least delayed to New Bombay. This would give rise to yet

another vicious circle, in which the growth and development of the entire region would be

more uneven.

In Bombay, a broad inverse relationship is seen to exist between property values and

system commuting time and thus commuting costs. This empirical correspondence was

used by the consultants to determine the various property values on the island city. These

observed rates in different localities were then applied to areas on the mainland which were

at comparable system travel times. These property rates which can be charged on the

mainland were then assumed to be the "consumer's willingness to pay" which formed a

measure of the housing benefits or indirectly of the benefits due to savings in time.

3.1.4 QUANTIFICATION OF BENEFITS

For the purposes of this critique, only the methodology of quantification of the

housing benefits has been elaborated upon, since this involves the maximum amount of

subjectivity. As said before, to quantify the housing benefits the consultants mainly

concerned themselves with the benefits accruing due to savings in time. "Savings in time"

are taken to be of consequence only in as much as they make it possible to 'open up' large

amounts of land on the mainland chiefly for residential dwellings, within reasonable

commuting time of the island city. Housing opportunities will accrue from the expectation

that the link will accelerate the housing development in New Bombay.

The 'social value' of these 'time savings' is therefore the value of 'provision of new

housing within reasonable commuting time' measured in terms of 'aggregate consumption'

i.e. in terms of "consumer's willingness to pay". The "consumers" were assumed to be the

people who are expected to occupy the newly opened up areas on the mainland.

To measure the net benefits two scenarios "With Project" and "Without Project" were