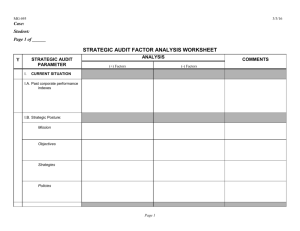

J2-external analysis

advertisement

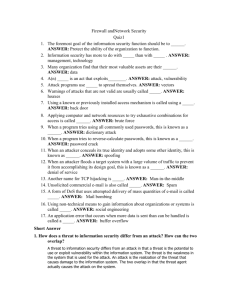

J2-External Analysis A. Out of the entire United States beverage industry, the soft drink industry is by far the largest segment. The domestic soft drink industry employs over 300,000 workers and overall the jobs have better wages than the average wage in the country which makes jobs in this industry attractive. The overall economic climate for this industry is good but factors such as rising fuel prices and a global economic slowdown could create difficulties. Out of the entire global soft drink market, the United States makes up for forty-eight percent of it. The international market for soft drinks is very large, with the largest growth rates taking place in the Middle East and South America. Although the Middle East has a high growth rate, business could be difficult there due to the political chaos currently occurring there. These events could also cause oil prices to rise which would lead to higher costs for all firms. The global and domestic soft drink markets are dominated by “the Big 2” firms. These are two firms which account for about two thirds of all soft drink sales. Although these two firms dominate the industry, there is still a very large and competitive market for the remaining sales. Technological change is a key factor in making companies more efficient and if a soft drink company wants to succeed, they must have a moderate to high level of computerization in their supply chain management and a high level of automated activities in the bottling and production processes. Innovations (aluminum can, vending machines, artificial sweeteners) constantly change the soft drink industry, and firms must at least stay on pace with industry changes to have success. The overall soft drink industry crosses over to practically all age groups, ethnicities, and income levels. As for the high-energy drink market, the target market is trendy and upscale 15-35 year olds. The increase in people who desire to keep up with the fast paced world helps the energy drink market to grow. Another cultural trend which helps the energy drink industry is that energy drinks are very popular when combined with alcoholic beverages. Claims that these drinks help people enjoy a stronger “buzz” and help people stay alert while drinking make them very Technological Change Demgraphic Trends •Production is very computerized •Aluminum can innovations (self chilling can) •New sweeteners •Trendy and upscale 15 to 35 year olds are energy drink target market •Highest consumption of soft drinks come from ages 6-18 •Soft drinks cross almost all demographics Specific International Events Cultural Trends •Middle East has seen recent political turmoil also has one of the biggest growth rates for soft drinks •Middle East chaos may cause rise in oil prices •Energy drinks are often mixed with alcohol •People want quick boost and energy in fast paced world Legal and Political Conditions •Energy drinks banned in France, possibly other locations in the future •There could be states which ban sodas from public schools Economic Climate •Soft drink industry dominates U.S. beverage industry •Large international market •Middle East and South America have largest growth rates for soft drinks popular choices at drinking establishments. Energy drinks may run into some legal challenges due to the unknown long-term effects of the product. France has a ban on them and many industry executives think energy drinks will have to transform into a more health conscious product in the future. B. Threat of Entry: Sun River may face lots of competition from new companies in the soft drink and energy drink industries. In the past five years, over 550 new products were introduced into the energy drink market. This shows that it is relatively easy for firms to enter the industry, but being successful is another story. The successes of other energy drinks have made it very tempting for other firms to get a piece of the market share. Sun River may benefit from learning-curve cost advantages because their other products, sodas, are similar to energy drinks. The threat level of entry is low because the dominate firms have economies of scale and make it very hard for new firms to compete. Threat of Rivalry: Sun River will face the threat of rivalry from other brands outside of the top tier brands, such as Buzz, Jazz, and Excelor. All of these brands and Synergy had revenue market share between 2.9 and 3.5 percent. These will be the main competition for Synergy. The threat of rivalry may be less strong if the market for energy drinks continues to grow as it has in the past decade. Because of the other second tier brands that Sun River will be competing against, the threat of rivalry will be high. Threat of Substitutes: Substitutes for energy drinks can include soda, coffee, and the newly popular energy shots. Sales of energy shots almost doubled in 2009 and are an easier way to get a boost than drinking an entire energy drink. Sun River will have to make sure Synergy’s effects are as good as or better than these shots. Substitutes for energy drinks are very popular so the threat of substitutes is very high. Threat of Suppliers: The threat of suppliers for Sun River should not be a problem compared to some of the other threats to the company. Most of the ingredients for Synergy are commodities which greatly diminishes the threats of suppliers. The taurine used will be bought from one of three chemical companies who all compete with one another. Due to these factors, the threat of suppliers is low. Threat of Powerful Buyers: The threat of buyers should be low because Sun River will be selling to lots of small “mom and pop” type shops and cafes. The threat of buyers is high when a firm sells to a small number of buyers, the product sold is undifferentiated, and when the products being sold are a large portion of the buyer’s overall costs. All of these things do not pertain to Sun River’s case and should almost eliminate the threat of buyers. Sun River eventually relies on grocery and convenience stores for most of their sales, but since they have enjoyed healthy relationships with the firms they do business with, there should not be a big threat. Threat of Entry Threat of Rivalry •Over 550 new energy products in last five years •Threat may be lowered due to Sun River's learning-curve cost advantages •Dominate firms have economies of scale •Threat level is low •May face strong rivalry from energy drinks outside the "top tier" •If energy drink market keeps growing, threat of rivalry may be weaker than it is now •Threat level will be high Threat of Substitutes Threat of Suppliers •Soda and coffee will always be strong threats to energy drinks •Energy "shots" have become increasingly popular in recent years •Energy "shots" are a quick and healthy way to get a boost of energy •Threat level will be high •Most of raw materials are commodoties so threat should be small •Have a choice of three suppliers for taurine •Threat level should be low Threat of Buyers •Sun River is selling to lots of small cafes and eateries which should create a low threat from the buyers •The energy drinks should not be a significant cost for these places which also will create a low threat from buyers •Threat level will be low