REAL OPTIONS

advertisement

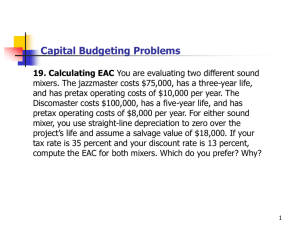

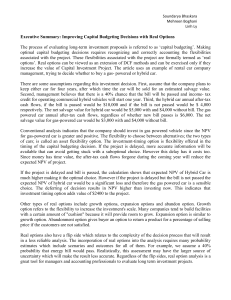

FIN 453: Cases In Strategic Corporate Finance REAL OPTIONS OLD FASHION IDEAS FOR NEW METHODOLIGIES IN CAPITAL BUDGETING 1 GOAL OF THIS PRESENTATION ARE THE TRADITIONAL CAPITAL BUDGETING METHODS OPTIMAL? DO REAL OPTIONS ADD SOMETHING TO THE TRADITIONAL METHODS? CONCERNS WITH REAL OPTIONS IN CAPITAL BUDGETING 2 PROBLEMS WITH THE TRADITIONAL NPV Expected Cash Flows cannot be altered by managers. No operating flexibility. The discount rate is known and constant. NPV is additive: no interactions or synergies. The variability of the expected cash flows reduces the value of the project. 3 VALUATION WITH REAL OPTIONS time (t) + Options Risk() + Interest (r) - + + Project’s Value Beta - Basic NPV Project Value = Basic NPV + Options 4 OPTIONS APPLIED TO PROJECTS OPTION TO DELAY AN INVESTMENT: Option to delay the investment and to undertake it at a future time. It is usually associated to patents, copyrights or ownership of land. (Pharmaceutical Industry) OPTION TO EXPAND: It gives the option to the management to do follow-on investments. (Movie Industry: Lord of the Rings). OPTION TO EXTEND: It gives the option to the management to extend the life of an asset. OPTION TO ABANDON: Option to sell the project obtaining a liquidation value. OPTION TO PAUSE: Option to pause the production under a bad environment. (Mining industry) OPTION TO LEARN: Option to transfer knowledge gained to future projects. (Consulting) 5 Tendency to keep the options until a weaker competitor exercises them, Shared options Lack of opportunity to obtain the whole value of an investment opportunity. Fast exercise of the option to defend or to surpass competitors Maximum Competition Risk of being surpassed by competitors, but dominant companies have a high probability of obtaining the whole value of the option. Minimum Competition STRATEGIC MAP FOR REAL OPTIONS Dominant companies are able to obtain the whole value of the option. No risk of being surpassed by competitors. Keep the options until the vesting date. Exclusive Option No expropriation risk by competitors, but their actions can reduce the option value. Trend to an early exercise of the option, for obtaining the higher value of it. KESTER, W. Carl :”Today’s options for tomorrow’s growth” Harvard Business Review, March-April 1984, pp 153-160 6 GOAL OF THIS PRESENTATION ARE THE TRADITIONAL CAPITAL BUDGETING METHODS OPTIMAL? DO REAL OPTIONS ADD SOMETHING TO THE TRADITIONAL METHODS? CONCERNS WITH REAL OPTIONS IN CAPITAL BUDGETING 7 EXAMPLE a) b) c) d) An oil company has the right to exploit a property during one year to find petroleum. Being A0 the outlays from the operating costs, construction of paths and the creation of other infrastructure needed. In addition, A1 is the outlays needed to get the new process system; whose are made later than A0. After the last outlay the company will be able to generate cash flows. The management has flexibility to make the decisions: Continue with the project Reduce the scale of production a x%, saving a part of the payments Ac Design a flexible production process. When prices exists one determined level, the company can increase the production in x% with a associated cost of AE At any time management can liquidate the investment obtaining the residual value 8 TRADITIONAL NPV ANALYSIS Initial Investment A0 = 104 PV (FCF) PV+1=180 50% PV (FCF) PV-1=60 50% 0,5 180 100 0,5 60 k =20% rf = 8% NPV = - A0+ PV0= - 104 + (0,5 x 180)+ (0,5 x 60 ) = -104 + 100 = - 4 < 0 1,20 9 CREATING RISK NEUTRAL PROBABILITIES Use the concept of arbitrage = calculate risk neutral probabilities. p PV+1 + (1-p)PV-1 (1+ rf ) PV0 - PV-1 PV0 = P= PV+1 - PV-1 (1+ rf ) Risk Neutral Probabilities Probability (good) P= (1+ rf ) PV0 - PV-1 PV+1 - PV-1 Probability (bad) (1+0,08)x 100 - 60 = = 0.4 180 - 60 P = 1 – p = 0.6 10 CREATING RISK NEUTRAL PROBABILITIES PV Project (E0) pE+1 +(1 – p) E-1 0,4 x 180 + 0,6 x 60 = Eo = (1+ rf ) = 100 1 + 0,08 11 OPTION TO DELAY THE INVESTMENT Possibility to delay the project investing A1 at the end of the year E = Max [ PV1-A1;0] A1=104 x 1,08 = 112,32 Present value of the project at t=1: E1+ = Max [ PV+1-A1;0] = Max [180 – 112,32;0] = 67,68 E1- = Max [ PV-1-A1;0] = Max [60 – 112,32;0] = 0 Project’s value including the option to delay is pE+1 +(1 – p) E-1 E0 = 0,4 x 67,68 + 0,6 x 0 = (1+ rf ) = 25,07 1 + 0,08 12 Try to apply the same rationality to the following proposed situations 13 OPTION TO EXPAND When product prices are much more favorable than expected management can expand the production x%, incurring in a cost AE. Call Option at AE. Assumption: the company can increase production a 50% (x=50%) with a cost of 40 million (AE) 14 OPTION TO REDUCE With unfavorable prices management may reduce production (x%) saving some percentage of the estimated cash outflows (AR). Assumptions: Initial outlay 104 million, in two stages 50 million at t=0 and 58.32 million at t=1, which can be divided in 18.32 million in fixed costs and the rest is variable, being 33.32 million in marketing and 6.68 million in maintenance. Next year management can decrease production 50% (C=0.5) with an outlay of 25 million (savings 33.32) 15 OPTION TO ABANDON In a adverse environment management can make the decision to abandon the project. The company will get the residual value (RV). This is an American Put option on the sale value. Residual Value Scheme 180 120 108 80 72 64,5 RV0= 80 million < PV0 =100 16 OPTION TO ABANDON 17 OPTION TO PAUSE Assumptions: Initial outlay 104 million, in two stages 50 million at t=0 and 58.32 million at t=1, which can be divided in 20 million in maintenance (20m fixed and the rest variable) and 33.32 million in marketing (variable). That is, Fixed Costs = 20m and Variable Costs = 38.32m Income is expected to be equal to 30% of the present value of the project at that time: C+ =0,3 VA+ = 0,3 x 180 = 54 C- =0,3 VA- = 0,3 x 60 = 18 Management will have to incur in variable cost in order to achieve those revenues. 18 OPTION TO PAUSE 19