BSBFIA303A NE SF 4 SECTION FOUR 2015 V7

advertisement

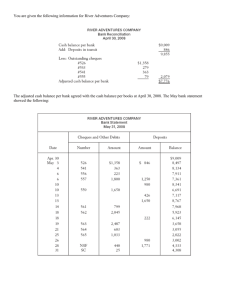

Faculty of Business and Creative Industries PROCESS ACCOUNTS PAYABLE AND RECEIVABLE BSBFIA303A SECTION 4 LEARNER GUIDE – BANK RECONCILIATION Cash Records and Bank Reconciliation Procedures When you have studied this section and completed the exercises, you should be competent in the following skills: comparing cash records the with bank statement adjusting cash journals for dishonoured cheques, bank fees and direct bank debits, totalling cash journals and posting to the Cash at Bank Account in the General Ledger (extract) preparing a bank reconciliation statement incorporating unpresented cheques and deposits not yet credited. THE IMPORTANCE OF CASH In all businesses, many transactions recorded involve a movement of cash either to the business or from the business. In some businesses, many transactions recorded involve a promise of a receipt or payment of cash at a future date (purchase or sale of goods/assets on credit). The asset cash, itself, is important because cash funds present the best opportunity for people with dishonest intentions. It is essential that adequate controls for this asset be put in place. INTERNAL CONTROL OVER CASH It is usual to be able to recognise the following features in any good system of internal control over cash: The duties of employees arranged so that those engaged in receiving or handling cash do not take part in the subsequent recording function. o This prevents the same person being able to misappropriate cash on the one hand and subsequently make entries in the records to disguise the deficiency. o A good system is such that an error made by one person will be discovered by another in the normal course of duties. o Collusion of two or more persons would be necessary to conceal a misappropriation of cash. Recording of the cash receipts so arranged that it is necessary to balance cash received against some independent record daily. The banking intact of all cash received at regular intervals, usually daily. All payments, other than those made out of a petty cash fund kept on an imprest system, to be made by cheque, Bpay, EFTPOS or bankcard. A system of checking of available evidence and authorisation by a responsible officer before cheques are written. Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Accounts Receivable Page 2 of 20 V7 – Jan 2015 The regular checking, by an independent officer, of the cash records against the statement obtained from the bank. This is usually termed ‘bank reconciliation’. COMPARISON OF CASH RECORDS Bank’s Records The bank may have deposits (credits) or withdrawals (debits) that the business is not aware of: Bank Charges Direct Deposits (DD) Periodical Payments Interest on Investments Interest on Overdraft/Mortgage Dishonoured Cheques (RTD or DCh) Electronic Transfers (TFR) EFTPOS BPAY Our Records The business’s Cash at Bank Account and the Bank Statement may disagree because: The business may have drawn cheques that have not been presented to the bank at the time the bank statement was issued—unpresented cheques. The business may have deposited cash, cheques and/or credit card receipts (noted as deposits or C/C on the bank statement)—outstanding deposits. Complete the following Bank Reconciliation exercises: Current reconciliation – worked example Crafts’r’Us Manual Reconciling over two consecutive periods Jackson & Jackson Past/current reconciliation Middle Park Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Accounts Receivable Page 3 of 20 V7 – Jan 2015 BANK RECONCILIATION PROCEDURE 1 2 3 COMPARISON a Compare the previous Bank Reconciliation Statement with the current Bank Statement. Tick items that appear on both the Bank Reconciliation Statement from the previous month and the Current Bank Statement. Circle items on the Bank Reconciliation Statement which do not appear on the Bank Statement. b Compare the current Cash Receipts and Cash Payments Journals with the current Bank Statement. Tick items which appear on the Bank statement and the journals (Cash Receipts will appear in the credit column of the Bank Statement, Cash Payments will appear in the debit column of the Bank Statement). Circle any items which have not been ticked. ADJUSTMENT a Complete the Cash Receipts Journal - use the circled items in the CR column on the Bank Statement. b Complete the Cash Payments Journal - use the circled items in the DR column on the Bank Statement. c Total the journals, post to the Cash at Bank A/c and strike a balance. d Compare the final balance in the Cash at Bank A/c with the final balance on the Bank Statement. If the values do not agree, then carry out Step 3. RECONCILIATION a By using the circled items in our records (Cash Receipts and Cash Payments Journals and previous Bank Reconciliation Statement), make the final balance on the Bank Statement equal to the final balance in our Cash at Bank A/c by preparing the Bank Reconciliation Statement. This guide and its contents are subject to copyright under the laws of Australia and, through international treaties, other countries. The copyright is owned by TAFE NSW, or in the case of some materials, third parties. You must not reproduce, transmit (including broadcast), adapt or otherwise exercise the copyright in the whole or any part of this guide.except as expressly permitted by TAFE NSW's prior written consent. Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Accounts Receivable Page 4 of 20 V7 – Jan 2015 CRAFTS’r’US Using the instructions on page 4, carry out the bank reconciliation for JUNE using the following records. Make sure you complete ALL of step 1 – COMPARISON. BANK RECONCILIATION STATEMENT OF CRAFTS’r’US as at 30 June 20XX CREDIT ADD Balance as per Bank Statement Outstanding deposits LESS Unpresented cheques DEBIT 33183 33184 Balance as per Cash at Bank A/c in Gen Led 3,762.80 420.60 4,183.40 72.80 195.60 268.40 $3,915.00 GENERAL LEDGER OF CRAFTS’r’US (extract) CASH AT BANK ACCOUNT Date JUL Particulars 1.1 Folio 01 Balance b/d 31 Sundry Receipts CR1 Sundry Payments CP1 Debit 2011 Credit 13 2332 35 Balance 3915 00 DR 5926 13 DR 3593 78 DR BANK RECONCILIATION STATEMENT OF CRAFTS’r’US as at 31 July 20XX CREDIT $3534.38 Balance as per Bank Statement ADD Outstanding deposits 219.45 3753.83 LESS Unpresented Cheques 33189 51.37 33194 108.68 DEBIT Balance as per Cash at Bank A/c in Gen Led Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Accounts Receivable 160.05 3593.78 Page 5 of 20 V7 – Jan 2015 NEWCASTLE BANK PTY LIMITED Statement of Account Crafts’r’Us A/c Number 03449295 BSB Number 790-886 Statement Period 01/07 to 28/07 Date JUL Transcription Description 01 Opening Balance 02 DEPOSIT 33183 33184 03 BANK CHARGES DEPOSIT Debit Credit Balance 3762.80 CR 420.60 4183.40 CR 72.80 4110.60 CR 195.60 3915.00 CR 23.70 3981.30 CR 177.65 4068.95 CR 331.98 4400.93 CR 05 DEPOSIT 06 33186 198.00 4202.93 CR 33187 620.00 3582.93 CR DEPOSIT 209.00 3791.93 CR 09 DEPOSIT 203.50 3995.43 CR 11 DEPOSIT 176.00 4171.43 CR 08 33188 15 DEPOSIT 16 33190 17 DEPOSIT 19 33192 33191 20 DEPOSIT 21 DEPOSIT—Eileen’s Gifts BANK CHARGES 26 33193 209.00 150.00 188.10 83.60 15.00 4150.53 CR 4000.53 CR 134.75 620.00 253.00 3962.43 CR 4135.28 CR 3515.28 CR 3431.68 CR 205.70 3637.38 CR 165.00 3802.38 CR 3787.38 CR Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Accounts Receivable 3534.38 CR Page 6 of 20 V7 – Jan 2015 CASH RECEIPTS JOURNAL OF CRAFTS’r’US Rec No Account Credited 03 05 08 09 11 15 17 20 26 262 CRR 263 CRR CRR 264 CRR CRR 265 Puff & Stuff Sales Spotlight Galore Sales Sales Puff & Stuff Sales Sales Annie’s Haberdashery 23 BS Eileen’s Gift Date 200X JUL Credits Debits Folio Cash at Bank Folio CR 1 177 331 209 203 176 188 134 205 219 65 98 00 50 00 10 75 70 45 165 00 2011 13 Discount Allowed GST Collected 8 50 0 85 187 00 10 00 1 00 220 00 9 10 38 00 50 00 0 1 3 90 05 80 Accounts Receivable 198 Other Accounts Sales 301 80 30 18 185 160 00 00 18 16 50 00 122 187 50 00 12 18 25 70 15 00 110 63 00 231 00 150 00 986 00 956 30 CASH PAYMENTS JOURNAL OF CRAFTS’r’US 200X CH No JUL 04 05 11 15 16 18 19 22 30 03 23 186 187 188 189 190 191 192 193 194 BS BS Date Account Debited Purchases Wages Gifts and Things Advertising Petty Cash (Imprest) Crazy Bargains Wages Rent Expense Purchases Bank Charges Bank Charge Folio Folio CP 1 Credits Debits Accounts Payable Purchases 180 220 88 Other Accounts 00 620 00 46 150 70 00 GST Outlaid 18 00 4 67 00 00 98 308 00 GST Collected 278 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation 620 230 00 00 23 15 70 00 1705 40 80 80 23 9 00 88 55 55 Page 7 of 20 V7 – Jan 2015 Cash at Bank 198 620 209 51 150 83 620 253 108 23 15 00 00 00 37 00 60 00 00 68 70 00 2332 35 Discount Received GST Outlaid 10 00 1 00 4 00 0 40 14 00 1 40 JACKSON & JACKSON Carry out bank reconciliation for March and April. BANK RECONCILIATION STATEMENT OF JACKSON & JACKSON as at 28 February 20XX CREDIT ADD Balance as per Bank Statement Outstanding deposits 7,552.60 684.90 8,237.50 LESS DEBIT Unpresented cheques 280 281 283.00 98.24 381.24 Balance as per Cash at Bank A/c in Gen Led $7,856.26 GENERAL LEDGER OF JACKSON & JACKSON (extract) CASH AT BANK ACCOUNT Date MAR APR Particulars 1.1 Folio 01 Balance b/d 31 Sundry Receipts CR1 Sundry Payments CP1 Sundry Receipts CR2 Sundry Payments CP2 30 Debit 2116 Credit 32 1636 1925 Balance 90 34 2163 67 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation 7856 26 DR 9972 58 DR 8335 68 DR 10261 02 DR 8097 35 DR Page 8 of 20 V7 – Jan 2015 Statement of Account Jackson & Jackson A/c Number 03449295 BSB Number 790-886 Statement Period 01/03 to 27/03 Date MAR Transcription Description 01 Debit Credit Opening Balance Balance 7552.60 CR DEPOSIT 684.90 8237.50 CR 03 DEPOSIT 269.50 8507.00 CR 10 281 11 DEPOSIT 98.24 8408.76 CR 324.75 8733.51 CR 283 331.50 8402.01 CR 12 285 72.60 8329.41 CR 15 DEPOSIT 175.50 284 20 BANK CHARGES 22 DEPOSIT 26 159.50 8345.41 CR 25.00 8320.41 CR 457.20 288 8504.91 CR 126.50 8777.61 CR 8651.11 CR DEPOSIT—Andy Williams 220.00 8871.11 CR DEPOSIT 450.00 9321.11 CR BANK RECONCILIATION STATEMENT OF JACKSON & JACKSON as at 31 March 20XX CREDIT Balance as per Bank Statement Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation $9,321.11 Page 9 of 20 V7 – Jan 2015 CASH RECEIPTS JOURNAL OF JACKSON & JACKSON Folio CR 1 Debits Date 20XX Rec No MAR 03 11 CRR 141 CRR 142 143 CRR 144 145 15 22 26 29 Account Credited Folio Cash at Bank Sales Perry Como Sales Dean Martin Frank Sinatra Sales Peter Lawford Bing Crosby 269 50 324 175 75 50 457 450 219 20 00 37 Credits Discount Allowed 2 4 2 5 95 09 27 12 GST Collected 0 0 0 0 30 Accounts Receivable 130 Other Account s Sales 245 00 24 50 180 00 18 00 327 00 32 70 00 41 23 180 100 00 00 51 450 225 00 00 CASH PAYMENTS JOURNAL OF JACKSON & JACKSON Date 20XX CH No MAR 04 11 283 284 285 286 287 288 289 290 15 18 20 25 28 Folio CP 1 Debits Account Debited Louis Armstrong Electricity Purchases Advertising Ray Charles Purchases Michael Jackson Rent Expense Folio Accounts Payable 340 Purchases Credits Other Accounts GST Outlaid 00 66 118 00 410 00 115 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation GST Collected 145 00 80 00 00 00 14 6 8 11 290 00 29 50 60 00 50 00 Page 10 of 20 V7 – Jan 2015 Cash at Bank 331 159 72 88 115 126 399 319 50 50 60 00 05 50 75 00 Discount Received GST Outlaid 7 73 0 77 2 68 0 27 9 32 0 93 NEWCASTLE BANK PTY LIMITED Statement of Account Jackson & Jackson A/c Number 03449295 BSB Number 790-886 Statement Period 01/04 to 28/04 Date APR Transcription Description 01 02 Debit Credit Opening Balance Balance 9321.11 CR DEPOSIT 219.37 9540.48 CR DEPOSIT 604.60 10145.08 CR 291 264.55 9880.53 CR 09 286 88.00 9792.53 CR 11 290 319.00 9473.53 CR 12 DEPOSIT 9898.78 CR 292 380.60 9518.18 CR 294 254.98 9263.20 CR 22.90 9240.30 CR 200.00 9040.30 CR 15 BANK CHARGES 17 296 24 DEPOSIT 298 BANK CHARGES 28 425.25 219.90 182.60 9077.60 CR 15.00 9062.60 CR WOOLWORTHS DIVIDENDS 287 9260.20 CR 210.00 115.05 9272.60 CR 9157.55 CR BANK RECONCILIATION STATEMENT OF JACKSON & JACKSON as at 30 April 20XX CREDIT Balance as per Bank Statement Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation $9,157.55 Page 11 of 20 V7 – Jan 2015 CASH RECEIPTS JOURNAL OF JACKSON & JACKSON Date 200X APR 02 12 24 29 Rec No 145 CRR 146 CRR CRR 147 CRR 148 Account Credited Foli o Perry Como Sales Dean Martin Sales Sales Frank Sinatra Sales Andy Williams Folio CR 2 Debits Cash at Bank Credits Discount Allowed GST Collected 6 0 27 63 Accounts Receivable 276 60 425 25 219 90 2 82 0 28 124 00 465 59 7 23 0 72 318 00 68 0 57 250 305 00 30 50 165 90 00 00 16 9 50 00 141 40 14 14 00 CASH PAYMENTS JOURNAL OF JACKSON & JACKSON Date 200X CH No APR 02 05 291 292 293 294 295 296 297 298 299 10 17 24 29 Account Debited Purchases Insurance Col Joye Rent Expense Louis Armstrong Petty Cash (Imprest) Ray Charles Advertising Purchases Foli o Folio CP 2 Debits Accounts Payable Purchases 240 244 180 280 GST Collected 00 604 5 Other Accounts Sales Credits Other Accounts 50 GST Outlaid 346 00 24 34 05 60 231 80 23 18 200 00 166 00 00 00 00 142 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation 40 16 14 60 24 Page 12 of 20 V7 – Jan 2015 Cash at Bank 264 380 237 254 175 200 273 182 156 55 60 90 98 50 00 00 60 64 Discount Received GST Outlaid 5 55 0 55 4 09 0 41 6 36 0 64 As bookkeeper for Middle Park Distributors you are required to perform the following tasks: 1 You are required to RECONCILE THE CASH RECORDS for the month of March. Comparison Adjustment Reconciliation BANK RECONCILIATION STATEMENT OF MIDDLE PARK DISTRIBUTORS as at 28 February 20XX CREDIT ADD Balance as per Bank Statement Outstanding deposits LESS Unpresented cheques DEBIT 5000.00 300.00 5300.00 295 297 Balance as per Cash at Bank A/c in Gen Led 140.00 160.00 300.00 $5000.00 LOSTPACK PTY LIMITED Statement of Account Middle Park Distributors A/c Number 03897295 BSB Number 114-886 Statement Period 01/03 to 29/03 Date March 01 02 04 06 08 09 10 14 19 21 24 25 27 29 Transcription Description Opening Balance Cash and/or Cheques Cheque Number 299 BPAY – Electricity Corporation – 564321 Transaction Fee Cash and/or Cheques Cheque Number 297 Credit Interest Cash and/or Cheques Cheque Number 300 EFTPOS – Office Works (Printer) Electronic Payment Cash and/or Cheques Electronic Payment Cheque Number 302 Cheque Number 303 Cash and/or Cheques Cash and/or Cheques Bank Charges Cash and/or Cheques Cash and/or Cheques Telstra Share Dividend Cheque Number 305 Debit Credit 300.00 500.00 1100.00 1.50 970.20 160.00 9.20 1516.02 880.00 1320.00 689.70 786.50 876.55 1210.00 600.00 1419.00 555.50 18.40 630.63 924.00 30.40 121.00 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Balance 5000.00 CR 5300.00 CR 4800.00 CR 3700.00 CR 3698.50 CR 4668.70 CR 4508.70 CR 4517.90 CR 6033.92 CR 5153.92 CR 3833.92 CR 3144.22 CR 3930.72 CR 3054.17 CR 1844.17 CR 1244.17 CR 2663.17 CR 3218.67 CR 3200.27 CR 3830.90 CR 4754.90 CR 4785.30 CR 4664.30 CR Page 13 of 20 V7 – Jan 2015 GENERAL LEDGER of MIDDLE PARK DISTRIBUTORS (extract) CASH AT BANK ACCOUNT Date MAR 1.1 Particulars Folio 01 Capital G1 31 Sundry Receipts CR1 Sundry Payments CP1 Debit 14046 Credit 05 9698 93 Balance 5000 00 DR 19046 05 DR 9347 12 DR BANK RECONCILIATION STATEMENT OF MIDDLE PARK DISTRIBUTORS as at 31 March 20XX CREDIT Balance as per Bank Statement Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation $4,664.30 Page 14 of 20 V7 – Jan 2015 CASH PAYMENTS JOURNAL OF MIDDLE PARK DISTRIBUTORS Date 20XX Folio CP 1 Credits Debits CH No Account Debited Folio Accounts Payable Purchases Other Accounts 02/03 299 Petty Cash Imprest 500 00 04/03 300 Gas 800 00 07/03 EP M Finch 10/03 301 Purchase EP L McDonough Ltd 302 Rent 14/03 303 Wages 20/03 304 Stationery 28/03 EP H Sanders 29/03 305 Petty Cash Reimbursement AP1 726 AP4 889 186 80 00 00 900 AP2 GST Outlaid 00 90 00 90 1100 00 600 00 1100 00 110 110 00 00 32 - Postage 60 00 6 00 - Stationery 50 00 5 00 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Page 15 of 20 V7 – Jan 2015 Cash at Bank 500 00 880 00 689 70 990 00 876 55 1210 00 600 00 1210 00 181 78 121 00 Discount Received GST Outlaid 33 00 3 30 12 14 1 21 4 13 0 41 CASH RECEIPTS JOURNAL OF MIDDLE PARK DISTRIBUTORS Rec No 04/03 140 J Cunningham AR2 06/03 141 P Gibson & Sons AR1 CSS Sales 142 D Smith Ltd CSS Sales 143 Display Cabinet CSS Sales 21/03 144 J Sarowski AR4 555 50 24/03 145 P Gibson & Sons AR1 630 63 25/03 CSS Sales 31/03 146 Capital CSS Sales 19/03 Credits Debits Date 20XX 09/03 Folio CR 1 Account Credited Folio Cash at Bank 970 20 Discount Allowed GST Collected Accounts Receivable 18 00 1 80 990 00 11 80 1 18 649 00 1516 02 AR3 6 00 0 60 Sales Other Accounts GST Collected 800 00 80 00 421 00 42 10 330 00 786 50 700 00 1419 00 70 00 590 00 59 00 840 00 84 00 555 50 11 70 1 17 643 50 924 00 7000 00 7204 60 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation 186 00 Page 16 of 20 V7 – Jan 2015 18 60 Faculty of Business and Creative Industries Completing the Bank Reconciliation using MYOB Open Middle Park.myo Select Banking from the Command Centre Select Reconcile Accounts Enter closing balance from Bank Statement – $4664.30 Enter Bank Statement date – 31/03/XX Tick transaction that appear on the Bank Statement Transactions on the Bank Statement but not shown in our records need to be recorded. Click Actions Transactions performed by the bank can be entered through Bank Entry, Spend Money, Pay Bills, Receive Money or Receive Payments. If you use Bank Entry, bank charges are entered in the top section and interest income Remember to select the correct account and tax code Using Bank Entry enter the following bank charges – you will need to record each transaction Bank Charges - $1.50 Bank Charges - $18.40 Credit Interest - $9.20 (Acct 8-1000) Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Page 17 of 20 V7 – Jan 2015 You will note that after being entered they are automatically ticked for you in the bank reconciliation screen. Enter the following payment transactions through Spend Money by clicking on the Actions and selecting Spend Money Cash Payments Electricity - $1100.00 (incl GST) Office Works – Printer $1320.00 (incl GST) – select account 1-2510 Enter the following deposit through Receive Money by clicking Actions and selecting Receive Money Cash Receipts Dividend – Telstra - $30.40 You will need to go back into Bank Reconciliation screen to tick the above entries. Once you have entered all the transactions from your bank statement the Out of Balance at the top of the Bank Reconciliation should be nil. Remember that is ok to have items unticked on your screen. Click on Reconcile Print the statement or Reconcile if printing is not required NOTE: If the out of balance is not nil the missing transaction/s must be found before the account can be reconciled. You need to check: all electronic transactions have been added only items on the bank statement have been ticked off all transactions have been entered correctly This version of MYOB has a feature “Undo Reconciliation” that can be used if an error is detected after the reconciliation. This can be accessed through “Actions”. Only the last Reconciliation can be undone. Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Page 18 of 20 V7 – Jan 2015 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Page 19 of 20 V7 – Jan 2015 Faculty of Business and Computing BSBFIA303A – Process Accounts Payable and Receivable – Section 4 Learner Guide Bank Reconciliation Page 20 of 20 V7 – Jan 2015