Financial Provision of the Constitution

advertisement

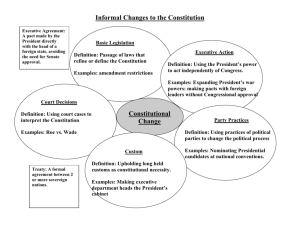

TP60404 Pengurusan Kewangan Dalam Pendidikan Lecture 2 (16 November 2013) UNDANG-UNDANG DAN PERATURAN KEWANGAN • • • • Perlembagaan Malaysia; Akta Acara Kewangan 1957; Arahan Perbendaharaan; Pekeliling dan Surat Pekeliling Perbendaraan; • Surat Pekeliling Kontrak; dan • Surat Pekeliling Akauntan Negara. KONSEP ASAS PERAKAUNAN Dasar Perakaunan Kerajaan Persekutuan adalah berdasarkan dua konsep: • Konsep Kumpulan Wang Disatukan iaitu segala hasil yang didapatkan atau diterima oleh persekutuan hendaklah dibayar masuk ke dalam satu kumpulan wang yang dinamakan Kumpulan Wang Disatukan KECUALI kutipan Zakat, Fitrah, Baitul Mal atau Hasil Agama Islam yang seumpamanya. (Perkara 97 Perlembaan Persekutuan) • Konsep bahawa tiada wang kecuali perbelanjaan tanggungan tertentu boleh dikeluarkan dari Kumpulan Wang Disatukan melainkan diperuntukan atau dibenarkan oleh Parlimen. (Perkara 104 Perlembagaan Persekutuan) Legal Provision Relating to Public Finance • Financial Provision of the Constitution - Article 96 – 112 - Schedules 9 & 10 - Financial Principles of Government - Various grants payable by the Federal to States - Relationship between Federal & States What is The Federal Constitution • A document containing the supreme law of the country (Article 4) • Basis of other laws • Any law inconsistent with the constitution will be null and void • Two-third majority is needed to amend the constitution …What is The Federal Constitution Different with other laws: • Acts – Laws passed by Parliament • Enactments – Law passed by state legislative assemblies • Ordinance – Law passed before independence & also laws passed in Sabah & Sarawak • Only simple majority is needed to amend other laws …What is The Federal Constitution Features of the Constitution: • Determines the structure & responsibilities of govt. institutions • Determines the distribution of power among various govt. bodies • Provides general principles on the execution of govt. powers • Provide rules & laws governing a country …What is The Federal Constitution Other Features of the Constitution: • Provides Malaysia as a federation • A constitutional monarchy – power of the Ruler, advisory power of the Executive • A Parliamentary democracy – General Election in every 5 years to elect members of Parliament …What is The Federal Constitution …Other Features of the Constitution: • Islam is the official religion • Supremacy of the Constitution • Separation of powers of Government • Provides for the independence of Judiciary – free of control by Executive & Legislative • Provides special rights to the Malays (Article 153) Relationship between Federal & States • The Federal Constitution defines the legislative & executive powers of Federal & States • Constitutionally, there are two levels of government – Federal & States • In the Federation YDA is the source of all authority • In the States, Ruler or YDN is the head of the State Legislative Powers • Article 73 of the Constitution provides the Federal Legislature, known as Parliament, with the power to make laws applicable throughout Malaysia • State Legislature, known as the State Legislative Assembly, is empowered to make laws of the states • Legislative powers are powers to make or amend laws Legislative Responsibilities The Ninth Schedule of the Constitution divides the Legislative responsibilities into 3 lists: • The Federal List • The State List • The Concurrent List Powers of Parliament/State Legislature • Parliament is empowered to make laws on any matter in the Federal List & the Concurrent List • The State Legislature has power to make laws relating to State List & the Concurrent List Matters on Concurrent List • Federal or State matter is determined by the applicability of the matter • If to be applicable to the whole country, then Federal matter • Otherwise, it is state matter Provision of Article 75 • If any State Law is inconsistent with the Federal Law, the Federal Law shall prevail and the State Law will be void • Examples of matters in Federal List:Foreign relation, defense, internal security, finance, administration of justice, citizenship & education • State Matters include:- Islamic matters, customs, land, agriculture, forestry & local govt. Overlapping Authority • Article 76 provides that Parliament may legislate State matters for these reasons: - To implement any treaty, agreement, convention or any decision with international organization. - To promote unity of the Laws - If requested by State Legislative Assembly • During any emergency, Parliament has power to make any law on State matters. Distribution of Executive Powers • Executive powers are powers of the government to formulate policies • The executive powers of the Federal is wider than the States • The executive authority extends to matters in the concurrent list as empowered by the relevant laws Financial Relationship • The financial provisions in Article 96-112 of the Constitution provides for the financial relationship between the Federal and the States • General framework for control of public expenditure by the legislators • Contain broad requirements of a good financial management system in govt. • Govern methods by which public funds are to be administered and accounted for Revenue Distribution • The power to rise and control the expenditure of public money in the Federation is in the hand of the Federal Govt. • States receive revenues from lands, mines, and forest • Other State revenues are listed in Part 3 of 10th Schedule of the Constitution …Revenue Distribution • The States revenues are not sufficient to meet the annual budget • So annual grants are given by the Federal to Sates in accordance with certain criteria • For more detail refer Article 109 of the Constitution • power to rise and control the expenditure of public money in the Federation is in the hand of the Federal Govt. FINANCIAL PROCEDURE ACT 1957 • Guidance for control & mgt of public finance for whole nation • Financial acc procedure • Collection, custody & payment of public monies …FINANCIAL PROCEDURE ACT 1957 • Procedure for purchase, custody & disposal of public properties • Provides authority for investment of money standing in the consolidated funds • Defines the three accounts of the consolidated funds • To enforce provisions of the Federal Constitution relating to finance FINANCIAL PROCEDURE ACT 1957 • Section 3: Accounting officer – - includes every public officer who is charged with the duty of collecting, receiving or accounting for, or who in fact collect, receives or account for, any public moneys, or who is charged with the duty of disbursing …FINANCIAL PROCEDURE ACT 1957 • Section 3: Accounting officer – or who does in fact disburse, any public money, and every public officer who is charged with the receipt, custody or disposal of, the accounting for, public stores or who in fact receives, holds or disposes or public stores …FINANCIAL PROCEDURE ACT 1957 Defines: • Consolidated funds • Banks • Receipt • Public moneys • Financial authority - refers to the Treasury for Federal - Principal officer in charge of financial affairs of a state …FINANCIAL PROCEDURE ACT 1957 • Federal & State keep separate Consolidated Funds and are managed differently. • Federal Consolidated Funds are managed by the Federal Minister of Finance • State Consolidated Funds are managed by the State authority …FINANCIAL PROCEDURE ACT 1957 Consolidated Funds Account (Section 7) - Consolidated Revenue Account – all money except loan & trusts - Consolidated Loan Account – all moneys received by way of loan - Consolidated Trusts Account – all moneys received subject to a trust & to be applied in accordance with the terms of the trust …FINANCIAL PROCEDURE ACT 1957 • Consolidated Funds Account (Section 8) – Custody & Investment of money: - Money in Consolidated Funds should be kept in banks - Those moneys are deemed public moneys - Those moneys can be invested as deposit in banks - Or in any investment authorized by Trustee Ordinance or Trustee Investment Act for trust funds …FINANCIAL PROCEDURE ACT 1957 • Consolidated Funds Account (Section 8) – Custody & Investment of money: - For States, they can invest in securities of the Federal govt. - Interests received from those investments are accounted in the Consolidated Revenue Account - Except interest on investment in trust funds shall go back to that trust accounts …FINANCIAL PROCEDURE ACT 1957 • Consolidated Funds Account (Section 9) – Trust Account: - Trust Accounts are open for proper accounting of money in the Consolidated Trust Account - Money to be credited to the respective trusts accounts: - all moneys appropriated for any trust account - all moneys received from sale of items purchased using trust money - all moneys paid by any person for the purpose of trust - repayment of loan made from trust - A trust account may be closed after all its terms & purpose have been met …FINANCIAL PROCEDURE ACT 1957 • Government Trust Funds (Section 10) – - Money in the Consolidated Funds may be appropriated for the purpose of trust into each of the fund specified in Second Schedule of the Act for Federal; or the Third Schedule for the States • The list in Schedule 2 & 3 may be amended, deleted or added by the Federal Legislature of the State Legislative Assembly …FINANCIAL PROCEDURE ACT 1957 • Contingencies Funds (Section 11) – - Created by Article 103 of Federal Constitution - Moneys in this fund shall be applied by the Minister to meet urgent & unforseen need of expenditure for which no other provision exists - Amount used must be replaced by supply bill …FINANCIAL PROCEDURE ACT 1957 • State Reserve Funds (Section 12) – - Created by Article 109(6) of Federal Constitution - Shall be applied as approved by the Minister after consultation with the National Finance Council - Mainly for making grant to states for purpose of development, or - To supplement State’s revenue or to cover deficit in State’s account …FINANCIAL PROCEDURE ACT 1957 • Payment of Moneys (Section 13) – - No money shall be withdrawn for the Consolidated Funds except in the manner as provided by this section; - By warrant approved by Minister to meet for Charged Expenditure; - By warrant to meet expenditure appropriated by a Supply Act, or as authorized by Article 102 of the Federal Constitution …FINANCIAL PROCEDURE ACT 1957 • …Payment of Moneys (Section 13) – - Money in Trust Accounts only for the purpose of trusts - Minister has power to limit or suspend any expenditure authorized; - Warrant issued for any year shall lapse at the close of one calendar month following the financial year …FINANCIAL PROCEDURE ACT 1957 • Guarantees (Section 14) - No financial guarantee shall be binding on the government unless it is entered into with written authority of Treasury/Federal Govt. & in accordance with Federal/State Law …FINANCIAL PROCEDURE ACT 1957 • Refunds etc. charged on Consolidated Funds (Section 14A) – Payment of any refund, rebate or drawback from the Consolidated funds shall be charged on the Consolidated Funds …FINANCIAL PROCEDURE ACT 1957 • Estimates & Virement (Section 15) – - The estimates are required to show clearly divisions and sub-divisions of every purpose of expenditure - The estimate should show as near as possible the amount expected to be received or spent during the year - The estimate of expenditure in respect of any financial year shall show purposes & subdivision of such expenditure …FINANCIAL PROCEDURE ACT 1957 • …Estimates & Virement (Section 15) – - The estimates of personal emolument should show approved number of public offices for each purpose of expenditure - No addition to public offices (position) or alteration of rate of personal emolument under any purpose of expenditure may be made without prior approval of Treasury/CM. …FINANCIAL PROCEDURE ACT 1957 • …Estimates & Virement (Section 15) – - Virement or transfer of allocation between subheads within the same head is allowable but with prior approval from Treasury/State Fin. Authority - Supplementary budget should be prepared after all possible virements have been made - Restriction – no virement from personal emoluments …FINANCIAL PROCEDURE ACT 1957 • Controlling officers (Section 15A) – - MOF or CM may appoint a Controlling Officer (CO) in respect of each purpose of expenditure - A CO is the chief accounting officer for each purpose of expenditure - He is to control the authorized estimates for that particular purpose …FINANCIAL PROCEDURE ACT 1957 • …Controlling officers (Section 15A) – • Also for all public moneys collected., received, held or disbursed and all public store received, held and dispose • He should secure proper exercise or performance of his duty • He is also required to report to the appropriate Service Commission and finance authority every event of possible surcharge arises or occurs under his control …FINANCIAL PROCEDURE ACT 1957 • Section 16 – Yearly statement of account • Section 17 – Write off • Section 18 – Surcharge ISU-ISU PENGURUSAN SEKOLAH • KUASA SEKOLAH UNTUK MENGENAKAN CAJ KEPADA PELAJAR DAN LAIN-LAIN PIHAK – DALAM DAN LUAR SEPERTI KOPERASI, PIBG DAN ORANG AWAM. • BENTUK DANA YANG PERLU DIWUJUKAN OLEH SEKOLAH. • SUMBER KEWANGAN SEKOLAH – PERUNTUKAN PUSAT, NEGERI DAN PENJANAAN SUMBER KEWANGAN USAHA SENDIRI – APA YANG BOLEH AND APA YANG TIDAK BOLEH. • PENEDIAAN PENYATA KEWANGAN SEKOLAH. • PERANAN GURU BESAR / PENGETUA. • ISU-ISU AUDIT – APA DAN SIAPA YANG BERTANGGUNG JAWAB. • BAJET DAN PERMOHONAN PEUNTUKAN TAHUNAN UNTUK SEKOLAH.