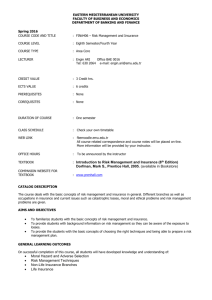

Handout 1

advertisement

In Support of Federal Catastrophe Reinsurance: HR-21 and S. 1361 Gordon K. Hay October 2000 CAS Special Interest Seminar (Same as 2000 CAS Spring Meeting) Outline • • • • • • Context: Sources of Financial Response Why a Federal Role? HR-21 -- After House Markup How different from a year ago? Senate “companion” bill S. 1361 Questions Sources of Financial Response Return Interval (Years) ??? Disaster Aid (Government & Private Sector) or Non-Recovery? 500 250 Federal Reinsurance? Securitization and Reinsurance? 100 Reinsurance? 75 50 25 0 Tax-Favored Primary Catastrophe Carriers' Reserves? Retained Capital And Current Pre-Tax Earnings Traditional Reinsurance Securitization ( Mortgages, Etc. ) People Cope Self Insurance (includes deductibles, loss above limits) Prevention / Mitigation -- Pre-Loss and Post-Loss Insurance Capacity Sustainable? • Capacity to pay for catastrophes comes from capital accumulation (high recently) and operating profit (low recently). • Recent high asset values fueled by record length economic expansion, bull stock market and low interest rates in the 1990’s • Primary product prices aren’t sufficient to retain capital, esp. for cat-prone products. • Structural change coming? How fast? Why Did the American People Create a Federal Government? Why Did the American People Create a Federal Government? • Confront problems too big for the states Why Did the American People Create a Federal Government? • Confront problems too big for the states • Confront problems shared across state lines Why Did the American People Create a Federal Government? • Confront problems too big for the states • Confront problems shared across state lines • CATASTROPHES ARE A “NATURAL.” A Relevant Example • After riots in the late 1960’s, urban property insurance markets failed • Underlying reasons took years to study • Urgent mandate to create FAIR plans • States enabled by Federal Riot Reinsurance • FAIR plans turned out to be self-sustaining • No sustained demand for riot reinsurance • Basis of Need: Social/Political Catastrophe A Second Example • Recall the Savings and Loan crisis? • The basic cause? Short duration deposits mismatched with long duration mortgages • Big and small S&L’s failed, drowning the Federal Savings and Loan Insurance Corp. • Fannie Mae was created, with Federal backing, to help revive the mortgage market • Federal backing gave an early boost to your private market for securitized mortgages Enacting HR-21 Means • Federal reinsurance, available if, and only if privately unavailable • Capacity far above any state’s • Capacity beyond what compassion alone inspires in post-event disaster aid • Buyers of Federal coverage must support mitigation Indirect Benefits • If vulnerable structures are built in harm’s way, less justification for post-event aid • Encouragement for risk-based primary insurance prices • Mitigation and prevention more clearly a property owner’s responsibility • Commercial property owners seem more cognizant than residential Current HR-21 Provisions • December 7, 1999 “Final Discussion Draft” • After markup in House Banking Committee (Nov. 10, 1999) • Question & answer format to summarize and highlight actuarial issues Who Would Buy? • Eligible State Programs, under Sec. 6 • Any interested entity, by bidding for Sec. 7 Auction Contracts • Fractions of Sec. 7 Auction Contracts could be resold to anybody in the secondary market “Eligible State Program?” • State interest & operation, no industry pools • Exists to assure availability, and terminable • Not supplant coverage “that is otherwise reasonably available and affordable” • Exempt from all Federal income taxation • Provide adequate protection • Single peril, residential property only • Rates no less than full actuarial costs Covering What Perils? • Earthquake & ensuing perils, including fire and tsunami , or • Hurricane, or • Tornado, or • Volcanic eruption, or • Coverage following Eligible State Program • In any case, no multi-peril contracts What Retention Per Event? • • ° ° ° • • Treasury Secretary sets for each contract General minimum triggers per state/region: Greatest of $2 Billion to $5 Billion, or Loss from a 100-250 year event, or for Sec. 6, state program capacity May be set higher Must be high enough to prevent displacing or competing with private markets. More on Retentions • Retentions apply to total event insured loss in state/region, not contract buyer’s loss • Transition rules for existing state programs, new state programs and state programs whose capacity is down due to losses paid • Transition rules essentially give 5 years for convergence to generally applied retentions • Annual inflation adjustments Maximum Federal Liability? • Limits apply to annual aggregate losses, not individual events • U.S. total aggregate payout in a year to be “unlikely to exceed $25 Billion,” with annual inflation adjustment • Each state/region annual aggregate limit <= (500 Yr Loss - 100 Yr Loss) X 50% • Treasury Secretary sets each contract limit Source of Technical Expertise? • Loss Cost Commission must be consulted to determine return period loss distribution by state/region, expected losses (called “risk based price”) and risk loads. • “… program must be founded upon sound actuarial principles and priced in a manner that minimizes the potential impact on the Treasury.” How Does Pricing Work? • Loss Cost Commission does the actuarial and ratemaking analysis • Minimum pricing formula is stated in bill • Treasury Secretary sets state program prices • For auction contracts, Treasury Secretary sets reserve prices; auction sets actual prices • Secondary market for auction contracts Minimum Technical Pricing • State programs minimum price = expected losses + Treasury and Commission expenses + risk load • Auction contracts minimum price = expected losses + Treasury and Commission expenses - Adj. for mitigation efforts + risk load • Expected losses from Loss Cost Commission • Risk load no less than expected losses • Treasury may not sell coverage for less Market Pricing: State Programs • No less than technical minimum, based on recommendation of Loss Cost Commission • Treasury Secretary considers private reinsurance market pricing • Any private party is empowered to issue coverage instead, if found credit worthy • Federal program effect on availability and affordability in States to be studied annually Market Pricing: Auctions • Reserve price = technical minimum • Regional auction markets generate actual sale prices • If market price < reserve price, no sale • If market price >= reserve price, winning bidders may subdivide contracts for resale in secondary market What if Some Offered Auction Contracts Are Reserved? • Contract purchasers receive an option to purchase additional contracts from among those offered at the beginning of the term, at prices prorated to the end of the term • Effect is replaced or added coverage to end of term, not retroactive coverage • The program sunsets at 10 years -- could be earlier based on annual report to Congress Big Changes from Last Year? • Specific guidance on pricing, especially risk loads and considering private market input • Retentions raised as far as needed so as not to displace or compete with private capital • Perils added: tornado, volcanic eruption • “Eligible losses” definition • Region/state areas no longer limited to six in number, and goal is rough homogeneity • Exposure to prorated paid claims is gone Companion Bill S. 1361 • “Natural Disaster Protection and Insurance Act of 1999” • Senate Committee on Commerce, Science, and Transportation -- Hearing on 4/13/2000 S. 1361 Contrasted to HR-21 • • • • Natural Disaster Insurance Corporation Not for profit membership corporation. NDIC to sell federally backed reinsurance In place of the Commission on Loss Costs, an Independent Board of Actuaries • S. 1361 mandates state mitigation plans • No automatic sunset Contrast, cont.. • Add to HR-21 perils: wildfire and windstorm other than hurricane and tornado • State pools, broadly, would be eligible purchasers of NDIC reinsurance • To be eligible, state pools must use actuarially sound rates, use available local financing and employ reasonable underwriting standards. Even Moderate Catastrophes • • • • • Prompt Federal disaster appropriations Cause some insurer failures Trigger retreat in private insurance markets Reveal risk management opportunities Show insured property loss is only an subset of economic damage and human misfortune • Public interest is broader and deeper than just insurance! What’s Right? Watch while history rewinds and replays over and over on the expanding screen? or Confront the risk management shortfall in catastrophe exposed residential markets?