COURSE OUTLINE SPRING 2016

advertisement

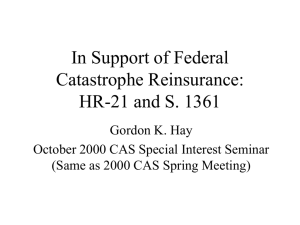

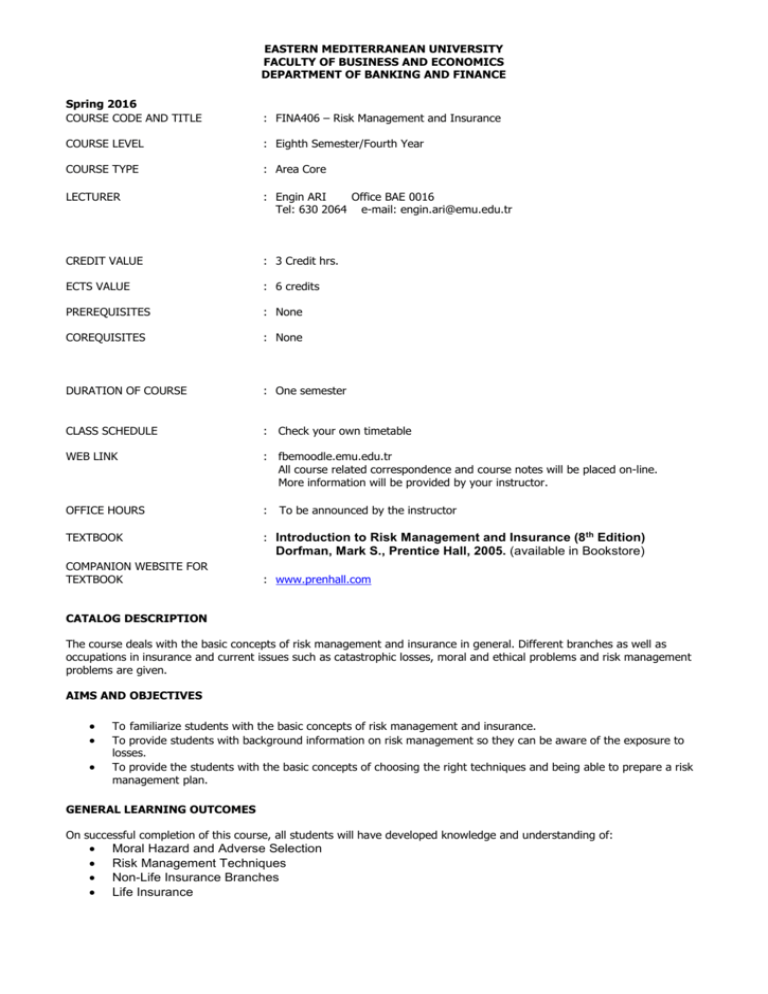

EASTERN MEDITERRANEAN UNIVERSITY FACULTY OF BUSINESS AND ECONOMICS DEPARTMENT OF BANKING AND FINANCE Spring 2016 COURSE CODE AND TITLE : FINA406 – Risk Management and Insurance COURSE LEVEL : Eighth Semester/Fourth Year COURSE TYPE : Area Core LECTURER : Engin ARI Office BAE 0016 Tel: 630 2064 e-mail: engin.ari@emu.edu.tr CREDIT VALUE : 3 Credit hrs. ECTS VALUE : 6 credits PREREQUISITES : None COREQUISITES : None DURATION OF COURSE : One semester CLASS SCHEDULE : Check your own timetable WEB LINK : fbemoodle.emu.edu.tr All course related correspondence and course notes will be placed on-line. More information will be provided by your instructor. OFFICE HOURS : TEXTBOOK : Introduction to Risk Management and Insurance (8th Edition) To be announced by the instructor Dorfman, Mark S., Prentice Hall, 2005. (available in Bookstore) COMPANION WEBSITE FOR TEXTBOOK : www.prenhall.com CATALOG DESCRIPTION The course deals with the basic concepts of risk management and insurance in general. Different branches as well as occupations in insurance and current issues such as catastrophic losses, moral and ethical problems and risk management problems are given. AIMS AND OBJECTIVES To familiarize students with the basic concepts of risk management and insurance. To provide students with background information on risk management so they can be aware of the exposure to losses. To provide the students with the basic concepts of choosing the right techniques and being able to prepare a risk management plan. GENERAL LEARNING OUTCOMES On successful completion of this course, all students will have developed knowledge and understanding of: Moral Hazard and Adverse Selection Risk Management Techniques Non-Life Insurance Branches Life Insurance On successful completion of this course, all students will have developed their skills in: Risk Management Plan Insurance Mathematics- Premium Calculations Life and Non-Life Insurance Branches On successful completion of this course, all students will have developed their appreciation of and respect for values and attitudes regarding the issues of: Understanding the terminologies used in Insurance Understanding the reasoning for preparing a risk management plan for companies and individuals Importance of probable and possible chance of loss Reinsurance and Catastrophic Losses RELATIONSHIP WITH OTHER COURSES. Some approaches involve topics that are given as basics in law courses. LEARNING/TEACHING METHOD Lectures, application exercises by cases in classes, presentations and assignments. ASSIGNMENTS Assignments will be given to enhance the students’ understanding of the topics covered and to hone their analytical and writing skills. Students will be grouped and each group will be required to prepare PPT and make a presentation on given topic. Each student will be responsible for summarizing every presentation. INDICATIVE BASIC READING LIST None EXTENDED READING LIST None SEMESTER OFFERED Fall and Spring Semesters CONTENT AND SCHEDULE WEEK CHAPTER 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Definition of Insurance: Financial, Legal. Exposure to Loss, Insurance System. Loss, Chance of Loss, Direct Losses, Indirect Losses. Peril, Hazard, Moral Hazard, Morale Hazard, Proximate Cause. Insurer, Insured, Beneficiary, Insurance Policy. Law of Large Numbers. Risk, Risk management, Pure Risk and Speculative Risk. Underwriting, Cashflow Underwriting. Benefits and Costs to Society of Insurance System. Arson Chapter 2 – Insurable Loss Exposures 1. 2. 3. 4. 5. 6. 7. 8. Characteristics of an Ideally Insurable Risk. Characteristics of an Ideally Insurable Risk. Accidential and Unintentional Loss Catastrophic Loss, catastrophic Loss Exposures. Insurance Pool, Pooling Operation. Risk Classification, Subsidization, Adverse Selection. Being Indifferent to Losses, Insurable Interest and Legal Interest. Branches of Insurance and New Coverages Chapter 3– Risk Management 1: Essentials 1. 2. 3. 4. Role of Risk Mangement, RM Staff, Risk Management Fuction. Statement of Objectives and Principles. Risk Management Process, Steps in Risk Management. Loss Control Activities and Risk Finanacing Alternatives. February 22 – 28 Chapter 1 – Fundamentals and Terminology Feb 29 - Mar 06 March 07 – 13 OBJECTIVES 2 March 14 – 20 March 21 – 27 Mar 28 – April 03 April 04 -10 April 08 - 20 April 18 – 24 1. 2. 3. 4. 5. QUIZ – Chapters 1-3 Risk Management Information Systems. Deductible and Policy Limits. Overinsurance, Underinsurance. International Risk Management, Foreign Insurance. Financial Risk Management. QUIZ –Chapters 1-3 Chapter 5 – Insurance Occupations 1. 2. 3. 4. 5. 6. Insurance Agent, Duties of Agents, Authority, Principal. Insurance Brokers, Independent Agents. Life Insurance Agents and Brokers, Life Insurance Agent’s Duties. Loss Adjusters. Underwriter. Actuaty Chapter 6 – Insurance Contracts 1. 2. 3. 4. Contract, Voidable, Void, Valid, Breached, Uneforcable Contracts. Binders, Conditional Receipt. Elements of a Valid Cotract. Distinguishing Characteristics of Insurance Contracts. Revising Chapter 1-4 and Discussing on Mid-term Mid-term examinations Chapters 1 – 4 Chapter 7 – Commercial Property Insurance 1. 2. 3. 4. 5. 6. Commercial Insurance, Real Property, Personal Property. Commercial Package Policy – CPP, Common Conditions. “Cause-of-Loss” Forms, Basic Form, perls Covered. Hostile Fire, Friendly Fire. Transportation Insurance, Ocean and Inland Marine Insurances. Bailment, Annual Transit Policy, Motor Truck Cargo Insurance. May 09 - 15 GROUP PRESENTATIONS May 16 -22 Chapter 8 – Bonding, Crime Insurance, 1. Bonding, Types of Bonds – Fidelty, Commercial and Surety Bonds. Reinsurance. 2. Crime Insurance, Surety Bonding. 3. Reinsurance, Facultative and Treaty Reinsurances. 5. Reinsurance Coverage, Prorata (Quata) Treaty Reinsurance. 6. Excess of Loss, Catastrophe Reinsurance. 19 MAY HOLIDAY – NATIONAL DAY May 23 – 29 May 02 - 08 Chapter 4 - Risk management:2 Advanced Topic GROUP PRESENTATIONS FINAL EXAMINATION (Chapters 5, 6, 7, 8) June 01 – 15 Final Exams 3 METHOD OF ASSESSMENT Midterm Examination Final Examination Assignments Quiz Class Participation Presentation and Summary TOTAL 25 35 5 15 5 15 % % % % % % 100 % NOTE: COURSE GRADES ARE DETERMINED BY YOUR PERFORMANCE AND NOT BY INDIVIDUAL NEEDS OR PROBLEMS. FAILURE TO COMPLETE ONE OF THE COURSE COMPONENTS LISTED ABOVE WILL RESULT IN A “NG”. COURSE POLICIES 1. Attendance is compulsory. Regular class attendance is strictly required. You are also expected to be present in the classroom on time. 2. Exams will include assigned readings in your text as well as material covered during the class meetings. 3. During the course of the semester, you will give some oral presentations. Make sure that you prepare your Powerpoint slides in a professional manner, as if your audience consists of your co-workers and superiors. 4. You will be given one midterm exam during the midterm exam period and a final examination at the end of the semester. The final examination will include the topics which are not covered for the mid-term exam. 5. Make-up Policy You are expected to take the exams on the days at which they are given. Therefore you should make every effort to take good care of yourselves in order not to get sick during the exam periods. Any student absent from an exam and able to provide a reasonable excuse within three days following the exam will be able to write the make-up exam. 6. Behavior befitting a mature university student is expected of you at all times. 7. Mobile phones should definitely be turned off during the class meetings, examinations, and quizzes. Important note: Academic Honesty: Plagiarism will not be tolerated under any circumstances. Plagiarism is intentionally failing to give credit sources used in writing regardless of whether they are published or unpublished. Plagiarism (which also includes any kind of cheating in exams) is a disciplinary offence and will be dealt with accordingly. Note that “CUT AND PASTE” IS A FROM OF PLAGIARISM. 4