Ch 8 Simple Interest

advertisement

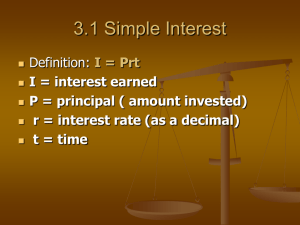

Ch 9 Simple Interest Basics of Simple Interest Simple Interest Used for: Billing purposes Short-term (< 1 year) or Informal loans Amortization Schedules (Interest Owed each month) Amortization Schedule Loan Invoice $85,000 at 6.35% Bill loansborrowed his sister $500 Balances unpaid after 30at for 30 years. 4% for 8 months. daysinterest are subject to a 12% Monthly Payment = $528.90 (1% monthly) finance 1st Month’s Interest = $449.79 charge. Simple Interest Formula I = PRT Interest ($) amt. earned or owed I is the _______________________________ (amt invested or borrowed) P is the Principle _______________________________ R is the Rate _______________________________ (interest rate - %) T is the Time _______________________________ (years) Ch 9 Simple Interest Computing Interest with I = PRT The Basics… Using the Simple Interest Formula What is the interest owed on a $580 loan at 3% simple interest for 4 years? I = PRT I = $580(3%)(4) $580(0.03)(4) I = $69.60 Ch 9 Simple Interest Computing Interest with I = PRT Dealing with time other than years. Using the Formula Time What is the interest owed on a $4,600 loan at 4.1% simple interest for 5 months? Maturity Value is principle and interest combined: I = PRT M = Principle + Interest I= 5 $4,600(0.041)( 12 5) M = $4,600 + $78.58 M = $4,678.58 I = $78.58 Using the Formula Time What is the interest earned if $1,200 is invested at 3.7% simple interest for 13 weeks? Maturity Value is principle and interest combined: I = PRT M = Principle + Interest I= 13 $1,200(0.037)( 52 ) M = $1,200 + $11.10 M = $1,211.10 I = $11.10 Application: Compute Penalty Charges $208.20(0.22)( I == PRT $2.89 23 365 Invoice Date: Dec. 05, 2010 Acme Repair Inc. Parts $36.95 Labor 4.5 hr x $32.50/hr = $146.25 Trip Charge $25.00 Total $208.20* *Payment is due within 30 days of receipt of this invoice. Payments made after 30 days of receipt are assessed a penalty of 22% annual interest rate. ) Amount Borrowed: Application: Amortization Schedule Length of Loan: Interest Rate: Monthly Payment: Payment Number 1 2 3 4 5 6 7 8 9 10 11 12 $35000.00 7.00 years 6.00% $511.30 Beginning Balance 35000.00 34663.70 34325.72 33986.05 33644.68 33301.60 32956.81 32610.30 32262.05 31912.06 31560.32 31206.82 Interest 175.00 173.32 171.63 169.93 168.22 166.51 164.78 163.05 161.31 159.56 157.80 156.03 Interest >0 I = 35,000 x 6% x 1 12 I = 175 Principal 336.30 337.98 339.67 341.37 343.08 344.79 346.52 348.25 349.99 351.74 353.50 355.27 Ending Balance 34663.70 34325.72 33986.05 33644.68 33301.60 32956.81 32610.30 32262.05 31912.06 31560.32 31206.82 30851.56 Practice Ch 9, Section 1 – Basics of Simple Interest Textbook Exercise 9.1 (pages 353 – 355) _____ #2 – 4 Ch 9 Simple Interest Exact and Ordinary Interest Simple Interest Exact Interest & Ordinary Interest What is the interest owed on a $2,400 loan at 4.5% simple interest for 120 days? I = PRT I= 120 $2,400(0.045)( 360 365 ) Ordinary Interest Exact Interest I = $35.51 I = $36.00 Exact Interest Ordinary Interest Ordinary Interest Referring to the middle of page 351 “Use ordinary or banker’s interest throughout the remainder of this book unless stated otherwise.” Practice Ch 8, Section 1 – Basics of Simple Interest Textbook Exercise 9.1 (pages 353 – 355) _____ #10 – 12 _____ # 22 – 24 (maturity value portion only, skip the “Date Loan is Due” for now.) Ch 9 Section 1 Compute the number of days… Determine the number of days How much interest is due on a $2,500 loan at 3.0% simple interest that began on March 10 and is due on August 20? I = PRT ? I = $2,500(0.03) 360 Reference: Textbook, page 349 Number of Days 1 of 3 How long is a loan that goes from Mar. 10 to Aug. 20? Aug. 20 – Mar. 10 232 – 69 = 163 days Day of Month Jan. 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 23 23 Feb. 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 Mar 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 Apr 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 May 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 Jun 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 Jul 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 Aug 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 Determine the number of days How much interest is due on a $2,500 loan at 3.0% simple interest that began on March 10 and is due on August 20? I = PRT I = $2,500(0.03) I = $33.96 163 ? 360 Number of Days 2 of 3 How long is a loan that goes from Jan. 5 to July 23? July 23 – Jan. 5 204 – 5 = 199 days Day of Month Jan. 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 23 23 Feb. 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 Mar 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 Apr 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 May 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 Jun 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 Jul 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 Aug 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 Number of Days 3 of 3 Number of days from Sept. 15 to Feb. 20 of the following year. Number of days until the end of the year: 365 – 258 = 107 days 107 days + 51 days = 158 days Day of Month Jan. 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 23 23 24 24 25 25 26 26 27 27 28 28 29 29 30 30 31 31 Feb. 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 Mar 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 Apr 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 May 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 Jun 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 Jul 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 Aug 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 Sep 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 Oct 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 Nov 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 334 Dec 335 336 337 338 339 340 341 342 343 344 345 346 347 348 349 350 351 352 353 354 355 356 357 358 359 360 361 362 363 364 365 Review Problem Loan Amount: $45,000 354 – 196 = 158 days 8% simple interest rate Borrowed on July 15 and due on December 20. Determine the amount due under I = PRT Exact Interest I = $45,000 0.08 158 = $1,558.36 Ordinary Interest 365 I = $45,000 0.08 158 = $1,580 360 Practice Ch 9, Section 1 – Basics of Simple Interest Textbook Exercise 9.1 (pages 353 – 355) _____ #6 – 8 _____ #22- 24 (Date Loan is Due portion) Ch 9 Section 1 Define the basic terms used with notes. Terminology – Promissory Note Promissory Note: a legal document in which one person or firm agrees to pay a certain amount of money, on a specific day in the future, to another person or firm. Promissory Note Charlotte, North Carolina ___________ March 6 Ninety days after date, ________ ____________ promise to pay to the order of I / Charles D. Miller $2,500.00 ______________________________________________________ 12% per year Two _________________________ thousand, five hundred and 00/100 Dollars with interest at __________ Wells Fargo Bank Country Club Center Office ______________, payable at ______________________________ June 4 Due _____________ Madeline Sullivan ____________________ Terminology – Promissory Note Payee: The person loaned the money and who Term: The length ofwho time until the note isthe due. Makervalue or payer: The person money. Face or principle: Theborrowing amount being borrowed. will receive the payment. Promissory Note Charlotte, North Carolina ___________ March 6 Ninety days after date, ________ ____________ promise to pay to the order of I / Charles D. Miller $2,500.00 ______________________________________________________ 12% per year Two _________________________ thousand, five hundred and 00/100 Dollars with interest at __________ Wells Fargo Bank Country Club Center Office ______________, payable at ______________________________ June 4 Due _____________ Madeline Sullivan ____________________ Terminology – Promissory Note Maturity Value $2,500 +value $2,500 x 0.12 x 90/360 Value:=the face interest. $75 =plus $2575 Face Value + Interest Promissory Note Charlotte, North Carolina ___________ March 6 Ninety days after date, ________ ____________ promise to pay to the order of I / Charles D. Miller $2,500.00 ______________________________________________________ 12% per year Two _________________________ thousand, five hundred and 00/100 Dollars with interest at __________ Wells Fargo Bank Country Club Center Office ______________, payable at ______________________________ June 4 Due _____________ Madeline Sullivan ____________________ Terminology – Promissory Note Maturity Date or due date: The date the loan must be paid off with interest. Promissory Note Charlotte, North Carolina ___________ March 6 Ninety days after date, ________ ____________ promise to pay to the order of I / Charles D. Miller $2,500.00 ______________________________________________________ 12% per year Two _________________________ thousand, five hundred and 00/100 Dollars with interest at __________ Wells Fargo Bank Country Club Center Office ______________, payable at ______________________________ June 4 Due _____________ Madeline Sullivan ____________________ Practice Ch 9, Section 1 – Basics of Simple Interest Textbook Exercise 9.1 (pages 353 – 355) _____ #13 – 20 _____ #30, 33, 35 (application problems) Practice Ch 9, Section 1 – Basics of Simple Interest Textbook Exercise 9.1 (pages 353 – 355) _____ #2 – 4, 6 – 8, 10 – 12, 13 – 20, 22 – 24, 30, 33, 35