business. - Social Enterprise Fund

advertisement

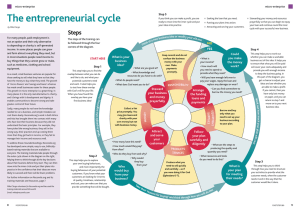

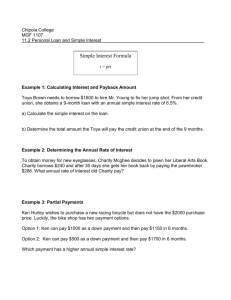

Agenda What is SE? Why SE? The Development Path The SEF What is SE? It is a sophisticated business model. It uses business to meet social, environmental and/or economic challenges. It places these challenges at the centre of the business model. It strives for blended value. It attaches profits to the challenge and not the investor It is a long term strategy to self reliance. I saw how the concept of business could be reformulated simply by disconnecting investors from the expectation of financially gaining from their investment. Where SE Fits … Charity Non-Profit Social Enterprise Social Purpose Business For-Profit Business Examples www.socialenterprisefund.ca Why SE? Something is happening!! What SE brings to the table Trends in the operating environment Risks are surprisingly similar to current risks Its tested; it works Ambition: direction, level and pace of ambition Something is Happening: Change is a foot!! Net Impact is a global network of leaders who are changing the world through business. Mark Albion – co-founder – 2008 in Edmonton – “something in the water – something has changed” “ I believe that social entrepreneurship will be the driving force in the world over the next 100 years, the single biggest movement that’s going to change the way we live. Jeff Skoll ” Blurring boundaries: Interest in Doing Good Charity Non-Profit Social Enterprise Social Purpose Business For-Profit Business 35% of existing SEs were started in the last 2 years (October 19, 2010 Globe and Mail) What SE Brings to the Table Trends Changing demographics Technology change Changes in the role of government Performance measurement Conclusion Big Change is imminent. Risks are surprisingly similar NFP SE Director Director Financial risk Financial risk Revenue risk Revenue risk Program risk Business risk Regulatory risk Regulatory risk Reputational risk Reputational risk HR risks HR risks Environmental risks Environmental risks Revenue Risk So, the question is: If we have been successful managing a set of diverse and significant risk, why do we feel we will not be successful at managing SE risks? Answer: The 3 “Cs” Culture: “The journey from grant funded organization to a sales led SE can require a massive change in org culture. It involves travelling a learning curve with a right angle in it” Competency: Current competencies are not a good fit Comfort: As frustrating as things might be now, we know how to operate in our box – we know the terrain - we know how to managing our risks. It’s tested; it works Today 1956: 1895: 1844: modern co-op movement founded Goodwill Industries – 1st thrift store. Mondragón Corporación Cooperativa. The world’s largest social enterprise by annual sales and size of staff. Ambition: Direction, level and pace What degree of control do you have over the direction and level of ambition and over the pace with which you achieve it? Development Path Organizational Readiness Assessment: (Board decides, “This is a good fit; we are ready & committed”) Development of Minimum Specifications : (Board ratifies the criteria by which to evaluate opportunities) Generation of Many Business Ideas Quick Assessment of 3 Ideas Board approves the short list of ideas that meet the minimum specifications Feasibility Assessment of 1 Idea Business Plan Board selects one idea for market research & financial feasibility Board decides whether or not to complete the plan and prepare launch Catalyst ; Entrepreneur agent of change; steward of org resources Risk Manager Strategic advisor Owner Partner Leverager of social and financial capital Promoter Fiduciary Overseer Balancer of social and economic interests Does SE fit with the mission? Do we have the resources to take this on? Is SE a cultural fit? What is the only way to break even is by hiring fewer disadvantaged folks? Who needs to owner this? If we succeed, we likely will become less reliant on government funding. Is this a good thing? How are we going to balance social and economic goals? Are we prepared to compete in the market place? What is the enterprise cannot afford to pay a “living wage”? What might our donors say and do? How much debt are we prepared to take on? How much equity are we prepared to contribute? Participants Board committee + advisors Board; SMT SMT Stakeholders New Board Stakeholders Board Committee Board Ready organizations are: Stable: mission, funders, clients, board, SMT Resilient: demonstrated Financially Healthy: key financial indicators, reserves, deficits/surplus, growth, diversity, earned revenues History of Achievement Entrepreneurial Cultural Shifts Program Charity trumps economics Public sector Clients Referrals Top Proposal writing Grants Operating statement Shorter Business Balance of charity and business Market Customers Sales Bottom Business planning Market generated revenues Balance sheet Longer Corporate Structure – Legal Considerations Get legal advice Know yourself! Are you are society, a non-profit, a charity, a co-operative? Have you read your articles of association and your by-laws? What are the powers of the organization: are you able to own assets, distribute income, borrow? Remember the CRA Eligibility Non-profits, charities, social purpose cooperatives operating in Edmonton Social entrepreneurs that agree to non-profit format What we Finance … Social enterprise Planning Operating/working capital Capital Social and affordable housing Planning Land acquisition Capital construction Renovations Acquisitions Asset building/strengthening balance sheets What we Assess… Eligibility Ability to execute Resilient, stable, financial strength, track record Business case Feasible, sustainable, doable Blended value Exit strategy Financial Products Term loans Patient capital Terms and Conditions Flexible – fit financing to need Term Interest rate Fees Security Examples … Social Enterprise – Local economy mission Good Food Box Capital and working capital financing Term – 6 year Interest – 5% Repayments: Interest only for 1 year; blended P and I for next 5 years Examples … Social Enterprise – Affordable space to arts community Capital and working capital financing Term – 5 year Interest – 4% Repayments: Interest only for 1 year; blended P and I for next 4 years Examples … Affordable housing: acquisition of supportive seniors complex Term - 1 year Interest - 5% Security - first mortgage Status – Paid in full Examples … Balance sheet strengthening: acquisition of program center Term – Loan # 1 for 1 year; loan # 2 for 2 years Interest – loan # 1 - 5%; loan # 2 – 6.5% Security - first mortgage Status – Paid in full Development Services Path to Loan Grants Seminars Portfolio Clients - SE Loans • Furniture Recycling Planning Clients – Housing Loans Planning Clients – Other Loans Planning Where can I learn more? www.socialenterprisefund.ca