Naked Economics Ch.2 Incentives Matter Part 2 Study Guide 6.0

advertisement

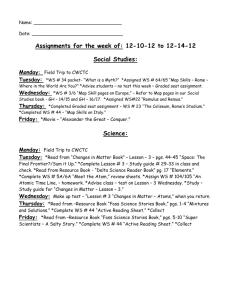

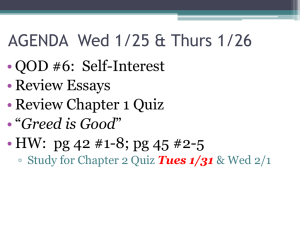

Click on the sound icon to listen Study Points • • • • • • • Principle-Agent Problem CEO-Shareholder Relationship Selling Off Toxic Assets Self-Interest over Clients Interest Is Greed Actually Good? Underground Economies Deadweight Tax Study Point #1 Principle-Agent Problem • Located on Pg. 39 • Companies hire agents (workers) to run their businesses. However, these workers are not always thinking about the companies best interest. That is why companies try to incentivizes the customer to report when these workers are doing something they shouldn't be doing. Study Point #2 CEO-Stockholder Relationships • Located on Pgs. 39-41 • The CEO is the person who runs the company, but they are not the people who own the company. Those people are the shareholders. The CEO can make decisions that benefit him in the short term, but hurt the shareholders in the long run. Study Point #3 Selling off Toxic Assets • Located on Pgs. 41-42 • Banks are the ones that loan you the money to make purchases, known as loans. However, instead of waiting years for you to pay off your loan, they bundle your loan with other peoples loans and sell then off to a third party. Study Point #4 Self-Interest over Clients Interest • Located on Pgs. 43-44 • When we need help getting a job or deal done we hire people to do it for us. Such as when you are selling you house you hire a real estate agent. However, many times these people we hire put their interest over our interest their clients. Study Point #5 Is Greed Actually Good? • Located on pg. 44 • Economics teaches us how to get the incentives right. As Gordon Gekko says greed is good, so make sure that you have it on your side. However, greed can be bad. Some of the most interesting problems in economics involves situations in which a rational individual acting in their own best interest do things that make themselves worse off. Study Point #6 Underground Economies • Located on Pgs. 50-51 • If tax rates get high enough, individuals and firms may slip into the “underground economy” where they opt to break the law and avoid taxes entirely. Study Point #7 Dead Weight Taxes • Located on Pgs. 51-52 • We should not place a tax on the sale of red sports cars. The tax could be avoided, easily and legal, by buying cars in a different color. The government collects no revenue and sports car enthusiast do not get to drive red cars. This phenomenon, whereby taxes make individual worse off without making anyone else's better.