Servicing Shareholders

advertisement

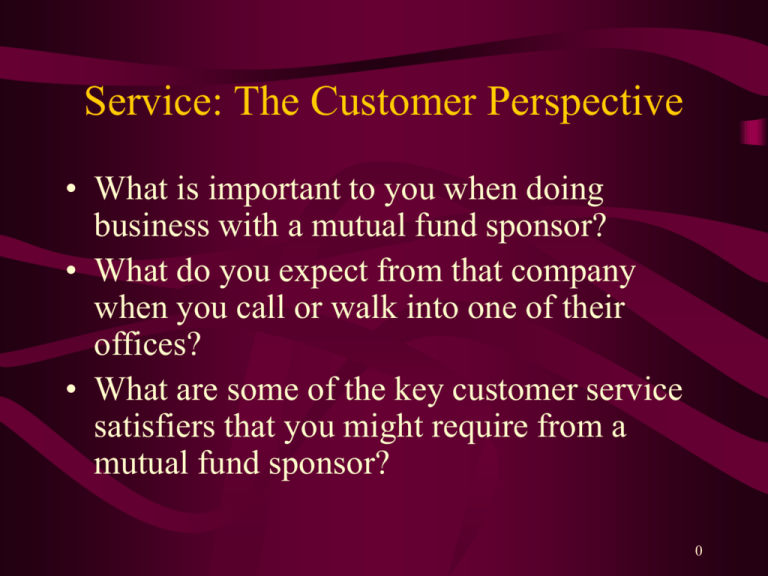

Service: The Customer Perspective • What is important to you when doing business with a mutual fund sponsor? • What do you expect from that company when you call or walk into one of their offices? • What are some of the key customer service satisfiers that you might require from a mutual fund sponsor? 0 Service: The Customer Perspective • • • • • • • • Automatic Investment Check Writing Privileges Dividend and Capital Gains Reinvestment Exchange Privileges Information Via Telephone and Internet Investment Help Low minimum Investment Amount Reinstatement Privileges 1 Service: The Customer Perspective • • • • • • Shareholder Report Simplified Record keeping Systematic Withdrawal Plan Tax-deferred Retirement Account Web-based Screening Tools Wire Transfer 2 Mutual Fund Customer Service Satisfiers • Typical high priority services – Accurate transaction processing – Knowledgeable representatives to turn to for help – Full array of products • Other desired services – Easy-to-read communications and statements – Effective problem resolution processes – Easy ways of doing business 3 Organizational Position of a Transfer Agent 4 Role of the Transfer Agent • Process accurately all shareholder transactions • Handle all customer service inquiries and requests • Send out transaction confirmations, periodic account statements, and tax summaries/reports • Maintain books/accounts to ensure proper share allocation • Ensure that transactions are in compliance with regulations • Resolve customer problems 5 Organization of a Transfer Agent • Shareholder services segment – Performs front-office operations and interacts with customers – Responds to written correspondence • Transaction processing segment – Ensures accurate account transactions – Posts dividend payments – Reconciles cash daily 6 Organization of a Transfer Agent (cont.) • Operations support segment – Maintains accurate records of customer accounts and transactions – Sorts and distributes mail – Produces confirmations and periodic statements • Fund administration segment – Provides audit support – Bills and tracks fees between the fund and the transfer agent – Monitors blue sky registration fees 7 Technology and Shareholder Servicing Trends • Typical technological aids to phone reps include – Intelligent workstations that allow access to complete account information and provide instant answers to many questions – “Imaged” or scanned customer documents that allow the phone rep to call up and view documents on-line – Advances in voice recognition and automated systems may help free phone reps’ time to respond to more complex queries 8 Technology and Shareholder Servicing Trends (cont.) • Internet – Has transformed the delivery of service to fund shareholders – Has begun to merge with other consumer media, so phone reps may have an interactive chat with a customer; moving toward voice and video capabilities – May be utilized for more transactions as security advances are made and older investors become more comfortable with this technology 9 Technology and Shareholder Servicing Trends (cont.) • Other servicing trends include – Programs to reduce mailing/production costs (e.g., installing high-speed sorters) – Moving transfer agent operations to lower cost locations 10 Decisions for Directors • Internal versus external transfer agent— factors to consider – Costs of in-house support versus external vendor – Quality of customer service – Size of the mutual fund complex – Nature of the sales arrangements 11 Decisions for Directors (cont.) • Quality control – Directors must monitor performance and establish acceptable level – Objective measures and customer satisfaction • Pricing – Must agree on structure of billing arrangement – Should fairly compensate transfer agent, while fairly allocating costs among shareholders 12 Transfer Agent Pricing Strategies • Per account charges – “Flat fee” is charged per account – May depend on factors such as account size, mandatory reports, and ancillary services • Transaction charges – Based on the number of purchases, redemptions, exchanges, etc. • Basis point charges – Based on the average amount of assets per account 13 Transfer Agent Pricing Strategies (cont.) • Combinations/Other strategies – Relatively low flat fee per account plus transactional charges – Relatively low flat fee per account plus basis point charge – “Variable” or “allocated” methods 14