Income Tax Continued PowerPoint

advertisement

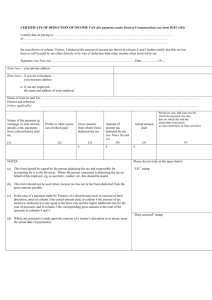

Income Tax Cont’d Employment Income Savings and Investment Income Employment IncomeIncome Tax (Earnings & Pensions) Act 2003 (ITEPA) Earnings from offices and employments Page 12 Offices • ‘Office’ - a position that exists independently of the person holding it • Company directors, public offices such as mayors, etc, church offices, etc Employment • Does the individual have a ‘contract of service’ (employee) OR a ‘contract for services’ (self employed) • Other factors (not conclusive) - taking orders, set hours, sick, holiday, overtime pay (employed) - risking own capital, control over work, providing own equipment (self employed) Earnings • Includes any salaries, fees, wages and any benefits if they are money or money’s worth • A question of fact but generally any payments made by employer to employee will be treated as earnings. Onus on taxpayer to show otherwise Fringe benefits • Three sets of rules: • 1. At common law • 2. Special rules to directors and those earning over £8,500 • 3. Specific provisions applicable to all employees Common law • Convertibility - the benefit will be earnings if the employee could convert it into cash • Employer supplies laptop: employee could sell it, taxed on second hand value • If title remains with the employer, or for some other reason it could not be sold: no tax All directors and employees earning £8,500 or more • Employee taxed on the ‘cash equivalent’ • Cash equivalent is the cost to the employer (less any reimbursement made by employee) • See Pepper v. Hart (school fees case) Company cars • New system from 2002 • Tax is based on car’s exhaust emissions, especially CO2 • Employee charged on ‘cash equivalent’ Take official price of car, multiply by emission rating (between 15% and 35%) e.g. £15,000 x 20% = income of £3,000 Loans to employees • Loans under £5,000 tax free • If loan over £5,000, government fixes official rate of interest • Loans carrying interest below this rate (or no interest) give rise to tax charge on the difference • No charge if employer’s business is to lend money and loan on same terms to equivalent non-employees Housing • Generally, employee taxed on ‘annual value’ of the property (reasonable rent), less any contribution from the employee • Special rules where employee required to live in a particular place for the performance of the duties of the job (eg caretakers) and for very valuable properties where annual value over £75,000 Golden handshakes • Terminal payments up to £30,000 generally tax free • Covers virtually all redundancy payments • Anything above that will be earnings and taxable as income Expenses • What expenses can an employee claim against his/her income ? • Travel expenses tax free if incurred in the course of employment (not travel from home to work) • Other expenses must have been incurred ‘wholly, exclusively and necessarily’ for the employment P.A.Y.E. system • Income tax deducted from employees by the employer under the Pay As You Earn (P.A.Y.E.) system, and sent monthly to HMRC • Employer supplied with employee’s tax code to enable deductions to be calculated • National Insurance also deducted and sent under same system (with employer’s contribution) Rates for employment income • Same as for other non-savings income • Personal allowance - £5,225 • Rates are 10%, 22% and 40% using the bands on pg 7 New Topic – Savings and Investment Income Part 4 ITA 2005 Chp 4 – pg 17 • ‘Pure income’: e.g. interest paid on bank or building society account • Dividends • All savings income is treated as the ‘top slice’ of the taxpayer’s income • Dividends rank above pure income Special tax rates • Pure income – 20% basic rate – 40% higher rate • Company dividends – 10% basic rate – 32.5% higher rate Most savings income is paid net of tax and must be grossed up • Income such as interest on savings held at a Building Society has tax deducted before it is paid to the individual. • The taxpayer receives the income ‘net’ of tax but it must be ‘grossed up’ in order to calculate the tax liability correctly. • Why gross up ? Grossing up • Work back from the net amount received to calculate the gross figure and the tax paid. • Formula on page 8 of the handbook. • Amount received x 100 = gross receipt (100 - tax rate deducted) Example – pg 18 • Interest received of £80 • Tax has been deducted at rate of 20% • 80 x 100 = £100- the gross income (100-20) • So the tax paid was £20 Interest on savings has tax deducted at 20% • Taxpayer’s income is the grossed up amount, but basic rate tax treated as paid so if this income falls within the basic rate there is no further tax liability. • Higher rate taxpayers pay additional 20% (to meet 40% higher rate) on submission of their tax return Example, page 18 • Interest of £1,000 • 20% tax deducted, taxpayer receives £800 • Treated as £1,000 income on which basic rate tax has been paid • If higher rate taxpayer, liable to 40% tax on £1,000 = £400 • But £200 paid at source, so further £200 to pay Company dividends, etc • No tax actually deducted, but taxpayer gets tax credit of 10% of the grossed up amount • e.g. Net dividend of £900 • Gross income is 900 x 100 / (100 – 10) = £1000 • Tax credit = £100 • If basic rate taxpayer, no more tax • If higher rate taxpayer, pay additional 22.5% of the gross figure = £225 (to meet 32.5% higher rate) Practice question Patrick receives a net dividend from his shares in Manchester United of £350. 1) Work out the gross dividend income. 2) How much tax will he have to pay if the dividend falls into a) the basic rate band; or b) the higher rate band ? Answer 1) 350 x 100 / (100 – 10) = £388.88 gross 2) a) nil because the tax credit (£38.88) satisfies the basic rate b) 22.5% of £388.88 = £87.50 or say 32.5 % of £388.88 = £126.39 then minus tax credit of £38.88 = £87.50 Next lecture Capital Gains Tax Reading – chps 6 and 7