Eligible Dividends

advertisement

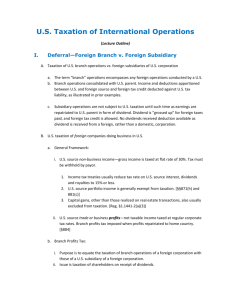

The New Eligible Dividend Rules – A Closer Look Presented for The Canadian Institute of Financial Planners – National Conference Kim G C Moody, CA, TEP RSM Richter LLP June 11, 2007, Calgary, Alberta RSM Richter is an independent member firm of RSM International, an affiliation of independent accounting and consulting firms. A Closer Look at the New Eligible Dividend Rules Agenda • Brief history • What is GRIP and why is it so important? • Traditional remuneration strategies – revisited. • Asset vs. share example • Use of a triangle structure • Shareholder agreements • How should advisors and their clients deal with the changes? 1 Brief History • • • • November 23, 2005 – Department of Finance News Release. Announces that, effective January 1, 2006, taxation will be reduced for “eligible dividends” in order to level the playing field for corporations and income trusts. Many questions/issues. Draft legislation released June 29, 2006 – 66 pages of draft amendments and explanatory notes. 2 Department of Finance Release Brief History (cont’d) • • • September 29, 2006: CICA-CBA Joint Committee on Taxation releases comments to Department of Finance. 2nd round of draft legislation released October 16, 2006 – mostly minor changes but some changes noteworthy. Bill C-28, which contains eligible dividend draft legislation, received First Reading October 18, 2006 and passed by the House of Commons on December 11, 2006. 3 Department of Finance Release Brief History (cont’d) • • • Received 3rd reading on February 14, 2007 and Royal Assent on February 21, 2007. October 31, 2006 – Department of Finance News Release – new “Distribution Tax” for publicly traded income trust and partnerships. October 31, 2006 Release appears to be a response to recent announcements of BCE and Telus and Jack Mintz’s paper “Income Trust Conversions: Estimated Federal and Provincial Revenue Effects” 4 The New Tax Pools • • By definition, dividends are paid out of after-tax corporate retained earnings. New rules introduce two new tax pools: a) General-rate income pool (“GRIP”); and b) Low-rate income pool (“LRIP”) • At most, a given corporation will have one GRIP or one LRIP at any time. 5 What is GRIP and Why is it Important? • • • • • Company can pay eligible dividends to the extent that it has a GRIP balance. Preferential tax treatment to Canadian residents for receipt of an eligible dividend. Gross up of 45% and dividend tax credit of 11/18 of the grossed up amount. Results in an effective tax rate of 17.4493% for 2007. Effective tax rate to decrease to 14.549% in 2009. 6 General Rate Income Pool (“GRIP”) • • • New definition of GRIP will appear in subsection 89(1) of the Act. Applicable only for a taxable Canadian corporation that is a Canadian-controlled private corporation (“CCPC”) or a deposit insurance corporation (“DIC”). DIC’s are ignored for the purposes of this presentation. 7 GRIP - Timing • GRIP is calculated at the end of a particular taxation year. 8 GRIP – Calculation – Overview • • • • • Calculated by formula A – B Can be a positive or negative amount. In broad terms, A is the corporation’s GRIP at the end of the taxation year determined without reference to any specified future tax consequences. Specified future tax consequences includes the carryback of noncapital losses under paragraph 111(1)(a). B adjusts that amount calculated under A to the extent that specified future tax consequences for preceding taxation years reduce the corporation’s taxable income subject to the general corporate rate. 9 GRIP – Calculation of “A” • • • • A = the positive or negative amount that would, before taking into consideration the specified future tax consequences, be determined by the following: A = C + .68 (D-E-F) + G + H – I C = corporation’s GRIP at the end of its preceding taxation year. D = the corporation’s taxable income for the particular taxation year 10 GRIP – Calculation of “A” (con’td) • E = the amount determined by multiplying the amount, if any, deducted by the corporation under subsection 125(1) (the small business deduction) for the particular taxation year by the quotient obtained by dividing 100 by the rate of deduction provided under that subsection for the particular taxation year. • F = if the corporation is a CCPC, the lesser of the corporation’s aggregate investment income or the taxable income for the particular taxation year of a CCPC and if the corporation is not a CCPC nil. 11 GRIP – Calculation of “A” (cont’d) • • G = the total of: a) An eligible dividend received by the corporation in the particular taxation year; or b) An amount deductible under section 113 in computing the taxable income of the corporation in the particular taxation year H = the total of all amounts determined under new subsections 89(4) to (6) in respect of the corporation for the particular taxation year – this is to be discussed in later slides. 12 GRIP - Calculation of “A” (cont’d) • • I = a) unless paragraph (b) applies, the amount, if any, by which i) the total of all amounts of each of which is the amount of an eligible dividend paid by the corporation in its preceding taxation year exceeds ii) the total of all amounts each of which is an excessive eligible dividend designation made by the corporation in its preceding taxation year, or b) if subsection (4) applies to the corporation in the particular taxation year, nil Note that, as stated earlier, the calculation of ‘A’ is calculated before taking into consideration the specified future tax consequences. 13 GRIP – Calculation of “B” • B = 68% of the amount, if any, by which a) the total of the corporation’s full rate taxable incomes (as would be defined in the definition “full rate taxable income” in subsection 123.4(1), if that definition were read without reference to its subparagraphs (a)(i) to (iii)) for the corporation’s preceding three taxation years, determined without taking into consideration the specified future tax consequences, for those preceding taxation years, that arise in respect of the particular taxation year, exceeds 14 GRIP – Calculation of “B” (cont’d) b) the total of the corporation’s full rate taxable incomes (as would be defined in the definition “full rate taxable income” in subsection 123.4(1), if that definition were read without reference to its subparagraphs (a)(i) to (iii)) for those preceding taxation years 15 GRIP – Calculation of “B” (cont’d) • See subsection 248(1) for the definition of “specified future tax consequences”. 16 GRIP Summary • • • • • • GRIP is generally the amount of after-tax income that was subject to the general corporate tax rate, i.e. no small business deduction. “GRIP bump” allowed for the 2000-2005 taxation years. Includes receipt of “eligible dividends” and foreign dividends deduction under subsection 112. Does not include “aggregate investment income”. Deduct “eligible dividends” paid. Adjusted for specified future tax consequences for preceding taxation years. 17 Alberta Dividend Tax Rates Federal - dividend gross up Alberta - dividend gross up Federal dividend tax credit Alberta dividend tax credit* Dividend tax rate 2006 2007 2008 2009 2010 2011 < $300,000 > $400,000 < $400,000 > $430,000 < $400,000 > $460,000 < $400,000 > $500,000 < $400,000 > $500,000 < $400,000 > $500,000 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 25.000% 45.000% 13.333% 18.966% 13.333% 18.966% 13.333% 18.966% 13.333% 18.966% 13.333% 18.966% 13.333% 18.966% 6.000% 7.500% 5.500% 8.000% 4.500% 9.000% 3.500% 10.000% 3.500% 10.000% 3.500% 10.000% 24.5838% 18.1743% 25.2088% 17.4493% 26.4588% 15.9993% 27.7088% 14.5493% 27.7088% 14.5493% 27.7088% 14.5493% * The Alberta dividend tax credit on non-eligible dividends (i.e. income subject to the small business rate) may require minor adjustments due to technical issues related to different Federal and Alberta small business thresholds. 18 2007 Top Marginal Rates, Dividend Tax Credit Rates and Amount of Dividends that May be Received Without Incurring Tax in 2007* Combined Top Eligible Dividend Amount of Eligible Marginal Rates Tax Credit Rate Dividends Received Tax Free Eligible Dividends Applied to Applied to Actual Dividend Taxable Dividend Actual Taxable Dividend Dividend Federal 14.55% 27.50% 18.97% $66,420 $96,310 British Columbia 18.47 17.40 12.00 150,840 218,720 Albertab 17.45 11.60 8.00 53,225 77,175 Saskatchewan 20.35 15.95 11.00 59,780 86,680 Manitoba 23.83 15.95 11.00 46,930 68,050 Ontarioc 24.64 9.72 6.70 45,535 66,025 Québec 29.69 17.26 11.90 26,580 38,540 New Brunswick 23.02 17.40 12.00 56,715 82,235 Nova Scotia 28.35 12.83 8.85 28,045 40,665 Prince Edward Island 24.44 15.23 10.50 40,890 59,290 Newfoundland 32.52 9.64 6.65 13,780 19,980 *Source: taxnetpro.com; Carswell. 19 Proposed Corporate Tax Rates Table 3: Proposed Corporate Income Tax Rates, 2007 - 2011 2006 2007 2008 2009 2010 2011 (percent) Federal Rates Alberta Total 22.12 21.0 20.5 20.0 19.0 18.5 10.0 10.0 10.0 10.0 10.0 10.0 32.12 31.0 30.5 30.0 29.0 28.5 • Source – Department of Finance Backgrounder – October 31, 2006 20 Traditional Remuneration Strategies - Revisited • The following slide illustrates the cash flow difference between paying a bonus from a Corporation versus incurring full corporate taxes and paying taxable (non-eligible and eligible) dividends. 21 Traditional Remuneration Strategies - Revisited (cont’d) Alberta - Bonus v. No Bonus Bonus 2006 No Bonus Bonus 2007 No Bonus Bonus 2008 No Bonus Bonus 2009 No Bonus Bonus 2010 No Bonus Bonus 2011 No Bonus Taxable income Bonus Taxable income after bonus $ 1,000,000 $ 700,000 $ 300,000 $ 1,000,000 $ $ 1,000,000 $ 1,000,000 $ 600,000 $ 400,000 $ 1,000,000 $ $ 1,000,000 $ 1,000,000 $ 600,000 $ 400,000 $ 1,000,000 $ $ 1,000,000 $ 1,000,000 $ 600,000 $ 400,000 $ 1,000,000 $ $ 1,000,000 $ 1,000,000 $ 600,000 $ 400,000 $ 1,000,000 $ $ 1,000,000 $ 1,000,000 $ 600,000 $ 400,000 $ 1,000,000 $ $ 1,000,000 Corporate income tax Federal - small business rate Federal - general rate Alberta - small business rate Alberta - general rate Total corporate income tax $ $ $ $ $ 39,360 9,000 48,360 $ $ $ $ $ 39,360 154,840 12,000 62,220 268,420 $ $ $ $ $ 52,480 12,000 64,480 $ $ $ $ $ 52,480 132,720 12,900 57,000 255,100 $ $ $ $ $ 46,000 12,000 58,000 $ $ $ $ $ 46,000 123,000 13,800 54,000 236,800 $ $ $ $ $ 44,000 12,000 56,000 $ $ $ $ $ 44,000 120,000 15,000 50,000 229,000 $ $ $ $ $ 44,000 12,000 56,000 $ $ $ $ $ 44,000 114,000 15,000 50,000 223,000 $ $ $ $ $ 44,000 12,000 56,000 $ $ $ $ $ 44,000 111,000 15,000 50,000 220,000 Dividend Pool Non-eligible - Federal Non-eligible - Alberta Eligible - Federal Eligible - Alberta $ $ $ $ 251,640 251,640 - $ $ $ $ 248,640 348,640 482,940 382,940 $ $ $ $ 335,520 335,520 - $ $ $ $ 334,620 364,620 410,280 380,280 $ $ $ $ 342,000 342,000 - $ $ $ $ 340,200 400,200 423,000 363,000 $ $ $ $ 344,000 344,000 - $ $ $ $ 341,000 441,000 430,000 330,000 $ $ $ $ 344,000 344,000 - $ $ $ $ 341,000 441,000 436,000 336,000 $ $ $ $ 344,000 344,000 - $ $ $ $ 341,000 441,000 439,000 339,000 $ $ 203,000 70,000 $ $ - $ $ 174,000 60,000 $ $ - $ $ 174,000 60,000 $ $ - $ $ 174,000 60,000 $ $ - $ $ 174,000 60,000 $ $ - $ $ 174,000 60,000 $ $ - $ 273,000 $ - $ 234,000 $ - $ 234,000 $ - $ 234,000 $ - $ 234,000 $ - $ 234,000 $ - Personal income tax Salary - Federal Salary - Alberta Total personal income tax on Salary Personal income tax Eligible Dividend - Federal Eligible Dividend - Alberta Total personal income tax on eligible dividend $ $ - $ $ 70,264 13,882 $ $ - $ $ 59,693 11,028 $ $ - $ $ 61,544 5,263 $ $ - $ $ 62,562 - $ $ - $ $ 63,435 - $ $ - $ $ 63,871 - $ - $ 84,146 $ - $ 70,721 $ - $ 66,807 $ - $ 62,562 $ - $ 63,435 $ - $ 63,871 $ $ 49,281 12,582 $ $ 48,693 17,432 $ $ 65,707 18,873 $ $ 65,531 20,510 $ $ 66,976 23,513 $ $ 66,624 27,514 $ $ 67,368 27,950 $ $ 66,781 35,831 $ $ 67,368 27,950 $ $ 66,781 35,831 $ $ 67,368 27,950 $ $ 66,781 35,831 $ 61,863 $ 66,125 $ 84,580 $ 86,041 $ 90,489 $ 94,138 $ 95,318 $ 102,612 $ 95,318 $ 102,612 $ 95,318 $ 102,612 Total taxes $ 383,223 $ 418,691 $ 383,060 $ 411,862 $ 382,489 $ 397,745 $ 385,318 $ 394,174 $ 385,318 $ 389,047 $ 385,318 $ 386,483 Net cash flow (income minus total taxes) $ 616,777 $ 581,309 $ 616,940 $ 588,138 $ 617,511 $ 602,255 $ 614,682 $ 605,826 $ 614,682 $ 610,953 $ 614,682 $ 613,517 Net cash flow after tax per $ of income $ 0.61678 $ 0.58131 $ 0.61694 $ 0.58814 $ 0.61751 $ 0.60226 $ 0.61468 $ 0.60583 $ 0.61468 $ 0.61095 $ 0.61468 $ 0.61352 Personal income tax Non-eligible dividend - Federal Non-eligible dividend - Alberta Total personal income tax on non-eligible dividend 22 Traditional Remuneration Strategies - Revisited Summary of cash flows: 2006 2007 2008 Bonus 616,777 616,940 617,511 No Bonus 581,309 588,138 602,255 2009 2010 2011 614,682 614,682 614,682 605,826 610,953 613,517 23 Traditional Remuneration Strategies - Revisited Summary • • • • • By 2009 there is a nominal difference between a bonus down to small business deduction (“SBD”) limit and no bonus (i.e. full dividend). Allows for a deferral of personal taxes if funds kept inside the corporation, i.e. tax deferral of approximately 8% for 2007 (increasing to 10.5% for 2011). Need to determine what the cash needs are of shareholder and corporation; automatic bonus down to SBD limit is not necessary. Reduction of bonus will reduce section 67 risks. Watch SR + ED issues. 24 Asset Sale vs. Share Sale • The following example illustrates the cash flow difference between: 1. Selling the shares of a corporation personally, and 2. Selling the assets of a corporation and paying a dividend to the shareholder. 25 Asset Sale vs. Share Sale - Example Facts – Share sale • • • • • Mr. Apples sells shares. FMV = $1,000,000 ACB = $0 Mr. Apple is a resident of Alberta. No ECGD 26 Asset Sale vs. Share Sale – Example (cont’d) Proceeds ACB Capital Gain ½ Taxable Tax Rate Personal Tax 1,000,000 0 1,000,000 500,000 39% 195,000 Total Cash Flow Proceeds 1,000,000 Personal Taxes (195,000) Total Cash Flow 805,000 27 Asset Sale vs. Share Sale – Example (cont’d) Facts – Asset Sale • • • • • Mr. Apples owns 100% of Opco. Opco’s only asset is goodwill. FMV = $1,000,000 Corporation and Shareholder are resident of Alberta. Assume SBD for Opco is not available. 28 Asset Sale vs. Share Sale – Example (cont’d) Corporation Proceeds Taxable portion – 50% Tax Rate 1,000,000 500,000 31% 155,000 Proceeds 1,000,000 Corporate Taxes (155,000) Cash to Distribute 845,000 CDA Dividend (500,000) Eligible Dividend (340,000) Non-eligible Dividend (5,000) $ 845,000 29 Asset Sale vs. Share Sale – Example Consequences Dividend Tax Rate Tax Payable CDA Dividend 500,000 0% 0 Eligible Dividend 340,000 17.45% 59,330 5,000 25.2% 1,260 Non-Eligible Dividend $845,000 $60,590 30 Asset Sale vs. Share Sale – Example Consequences (cont’d) Total Cash Flow Proceeds 1,000,000 Corporate Taxes (155,000) Personal Taxes (60,590) Total Cash Flow $ 784,410 31 Asset Sale vs. Share Sale – Example Summary Total Cash flow: Share Sale Asset Sale • • • $805,000 $784,410 Difference between proceeds share sale and asset sale is narrowing. Not as big a bias for seller to sell shares. May defer taxes personal taxes if funds are invested in corporation. 32 Triangle Structure Trust 100% 99% HoldCo 1% OpCo 33 Advantages of Triangle Structure • • • Can push GRIP to Holdco. QSBC preservation. Reinvest after-tax corporate proceeds in Holdco (by paying tax-free inter-corporate dividends from Opco to Holdco). 34 Shareholder Agreements • • Should be flexible to allow manipulation and distribution of GRIP. Necessity if have non-resident shareholders. 35 How Should Advisors and Their Clients Deal With the Changes? • • • • New rules are complicated. Rules of thumbs no longer applicable. Each situation must be evaluated to ensure proper tax planning is undertaken. General practitioner need to exercise extreme caution. 36