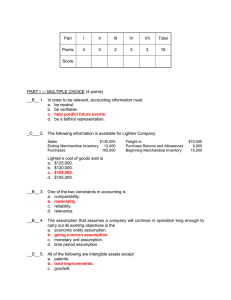

Instructions Designate the best answer for each of the following

advertisement

Instructions Designate the best answer for each of the following questions. Questions 1 and 2 are based on the following information: Bono Company recently incurred the following costs: (1) Purchase price of land and dilapidated building $350,000 (2) Real estate broker's commission 14,000 (3) Net demolition costs of dilapidated building 39,000 (4) Excavation costs for new building 44,000 (5) Architect's fees and building permits 30,000 (6) Costs associated with new building construction 950,000 (7) Costs associated with new furniture and equipment 250,000 (8) Actual interest costs during building construction 168,000 (9) Actual interest cost after completion of building construction 120,000 (10) Costs of walks, driveways, and parking lot 55,000 ____ 1. The building should be recorded on Bono's books at d. $1,192,000. ____ 2. Land should be recorded on Bono's books at c. $403,000. ____ 3. In order to be relevant, accounting information must . . c. help predict future events. ____ 4. The cost of intangible assets should be a. amortized over the assets' estimated useful life, or legal life, whichever is shorter. ____ 5. One of the two constraints in accounting is . b. materiality. ____ 6. The assumption that assumes a company will continue in operation long enough to carry out its existing objectives is the b. going concern assumption. ____ 7. All of the following are intangible assets except b. land improvements. ____ 8. A daily cash count of register receipts made by a cashier department supervisor demonstrates an application of which of the following internal control principles? b. Segregation of duties ____ 9. When the allowance method is used for bad debts, the entry to write off an individual account known to be uncollectible involves a d. debit to the Allowance account. ____ 10. Bates Company has a $300,000 balance in Accounts Receivable and a $2,000 debit balance in Allowance for Doubtful Accounts. Credit sales for the period totaled $1,800,000. What is the amount of the bad debt adjusting entry if Bates uses a percentage of receivables basis (at 10%)? c. $32,000 ____ 11. The constraint of conservatism is best expressed as c. when in doubt, choose the method that will least likely overstate assets and net income. . ____ 12. Barker Company's records show the following for the month of January: Total Retained Earnings at January 1 $600,000 Total Retained Earnings at January 31 900,000 Total Revenues 1,005,000 Total Dividends Declared 45,000 Total expenses for January were d. $660,000. ____ 13. Jetson Company's financial information is presented below. Sales $ ???? Purchase Returns and Allowances $ 30,000 Sales Returns and Allowances 60,000 Ending Merchandise Inventory 70,000 Net Sales 700,000 Cost of Goods Sold 360,000 Beginning Merchandise Inventory ???? Gross Profit ???? Purchases 340,000 The missing amounts above are: Sales Beginning Inventory Gross Profit c. $760,000 $120,000 $340,000 ____ 14. The necessity of making adjusting entries relates mostly to the . b. time period assumption. ____ 15. The preparation of closing entries d. results in transferring the balances in all temporary accounts to Retained Earnings. ____ 16. Allowance for Doubtful Accounts is reported in the a. balance sheet as a contra asset. ____ 17. Current liabilities are obligations that are reasonably expected to be paid from Existing Creation of Other Current Assets Current Liabilities b. Yes Yes ____ 18. Which of the following errors will cause a trial balance to be out of balance? The entry to record a payment on account was c. posted as a debit to Cash and a debit to Accounts Payable. ____ 19. The primary accounting standard-setting body in the United States is the c. Financial Accounting Standards Board. ____ 20. Which of the following would not be included in the operating activities section of a statement of cash flows? d. Cash outflows to reacquire treasury stock ____ 21. Which of the following combinations presents correct examples of liquidity, profitability, and solvency ratios, respectively? &n bsp; Liquidity Profitability Solvency c. Receivable turnover Return on assets Times interest earned ____ 22. Which of the following pairs of terms in the area of financial statement analysis are synonymous? b. Horizontal — Trend ____ 23. The statement of cash flows is a(n) b. required basic financial statement. ____ 24. Which of the following should be classified as an extraordinary item? c. Loss from the expropriation of facilities by a foreign government ____ 25. A Discount on Bonds Payable account a. is a contra account to Bonds Payable. ____ 26. In order to be considered extraordinary, an item must be d. infrequent and unusual. ____ 27. If the market rate of interest is lower than the stated rate, bonds will sell at an amount d. higher than face value. PART II — MATCHING (5 points) Instructions Designate the terminology that best represents the definition or statement given below by placing the identifying letter(s) in the space provided. No letter should be used more than once. A. Additions and improvements B. Allowance method C. Amortization D. Available-for-sale securities E. Average cost method F. Book value G. Capital expenditure H. Cash debt coverage ratio I. Consistency J. Contra asset account K. Cost method L. Credit memorandum M. Debit memorandum N. Declining-balance method X. Full disclosure principle Y. Going-concern assumption Z. Held-to-maturity securities AA. Internal control AB. Last-in, first-out method AC. LIFO reserve AD. Matching principle AE. Materiality AF. Monetary unit assumption AG. Net purchases AH. Periodic inventory system AI. Permanent accounts AJ. Perpetual inventory system AK. Ratio analysis O. Depreciable Cost P. Depreciation Q. Direct write-off method R. Discontinued operations S. Earnings per share T. Economic entity assumption U. Equity method V. Extraordinary items W. First-in, first-out method AL. Relevance AM. Reliability AN. Revenue expenditure AO. Revenue recognition principle AP. Stock dividend AQ. Stock split AR. Temporary accounts AS. Time period assumption AT. Units-of-activity method ___ 1. The periodic write-off of an intangible asset. C ___ 2. The total amount subject to depreciation. O ___ 3. The principle that efforts be matched with accomplishments. AD ___ 4. An expenditure charged against revenues as an expense when incurred. AQ ___ 5. The inventory costing method that assumes that the costs of the earliest goods purchased are the first to be recognized as cost of goods sold. W ___ 6. Use of the same accounting principles and methods from period to period by the same business enterprise. I ___ 7. A measure of solvency calculated as cash provided by operating activities divided by average total liabilities. H ___ 8. An inventory costing method that assumes that the latest units purchased are the first to be allocated to cost of goods sold. AB ___ 9. An assumption that economic events can be identified with a particular unit of accountability. AF PART II — MATCHING (cont.) ___ 10. A characteristic of information that means it is capable of making a difference in a decision. AE ___ 11. An assumption that the economic life of a business can be divided into artificial time periods. P ___ 12. This method of accounting for uncollectible accounts is required when bad debts are significant in size. B ___ 13. An accounting method in which cash dividends received are credited to Dividend Revenue. K ___ 14. Used by a bank when a previously deposited customer’s check “bounces” because of insufficient funds. M ___ 15. The assumption that the enterprise will continue in operation long enough to carry out its existing objectives and commitments. Y ___ 16. A system in which detailed records are not maintained and cost of goods sold is determined only at the end of an accounting period. AH ___ 17. The difference between inventory reported using LIFO and inventory reported using FIFO. AC ___ 18. The methods and measures adopted within a business to safeguard its assets and enhance the accuracy and reliability of its accounting records. AA ___ 19. Revenue, expense, and dividends accounts whose balances are transferred to retained earnings at the end of an accounting period. AR ___ 20. A technique for evaluating financial statements that expresses the relationship among selected financial statement data. AK ___ 21. A depreciation method that applies a constant rate to the declining balance book value of the asset and produces a decreasing annual depreciation expense over the useful life of the asset. N ___ 22. A pro rata distribution of a corporation’s own stock to its stockholders. AQ ___ 23. Events and transactions that are unusual in nature and infrequent in occurrence. V ___ 24. The disposal of a significant segment of a business. R ___ 25. The net income earned by each share of outstanding common stock. S PART III — ADJUSTING ENTRIES (2 points) The trial balance of Timlin Company shows the following balances for selected accounts on November 30, 2008: Prepaid Insurance $12,000 Unearned Revenue $ 4,800 Equipment 60,000 Notes Payable 30,000 Accumulated Depreciation 6,600 Interest Payable 450 Instructions: Using the additional information given below, prepare the appropriate monthly adjusting entries at November 30. Show computations. A. Revenue for services rendered to customers, but not yet billed, totaled $6,000 on November 30. Account Receivable Dr. 6000 Services Revenue Cr.6000 B. The note payable is a 9%, 1 year note issued September 1, 2008. Interest expenses Interest payable Dr225 Cr225 (30000x9/100x30/360) C. The equipment was purchased on January 2, 2007, for $60,000. It has an estimated life of 10 years and an estimated salvage value of $6,000. Timlin uses the straight-line depreciation method. Depreciation expense DR450 Accumulated Depreciation – equipment Cr.450 (60000-6000/10 x1/12) D. An insurance policy was acquired on June 30, 2008; the premium paid for 2 years was $14,400. Insurance Expenses Dr.600 Prepaid Insurance Cr.600 (14400/2 x1/12) E. Timlin received $4,800 fees in advance from a customer on November 1, 2008. Three-fourths of this amount was earned by November 30. Unearned Revenue DR3600 Services Revenue Cr3600 (4800x ¾) PART IV — RATIO ANALYSIS (3 points) The condensed financial statements of Jenner Corporation for 2008 are presented below. Jenner Corporation Jenner Corporation Balance Sheet Income Statement December 31, 2008 For the Year Ended December 31, 2008 Assets Revenues $2,000,000 Current assets Expenses Cash and short-term Cost of goods sold 960,000 investments $ 30,000 Selling and administrative Accounts receivable 70,000 expenses 740,000 Inventories 140,000 Interest expense 50,000 Total current assets 240,000 Total expenses 1,750,000 Property, plant, and Income before income taxes 250,000 equipment (net) 760,000 Income tax expense 100,000 Total assets $1,000,000 Net income $ 150,000 Liabilities and Stockholders' Equity Current liabilities $ 100,000 Long-term liabilities 350,000 Stockholders' equity 550,000 Total liabilities and stockholders' equity $1,000,000 Additional data as of December 31, 2007: Inventory = $100,000; Total assets = $800,000; Stockholders' equity = $450,000. Instructions: Compute the following listed ratios for 2008 showing supporting calculations. (a) Current ratio = 240000/100000 = 2.4 :1 (b) Debt to total assets ratio = 100000+350000/1000000 = 45% (c) Times interest earned = 220000/50000 = 4.4 times (d) Inventory turnover = 960000/(140000+100000)/2 = 8 times (e) Profit margin = 150000/2000000 = 7.5% (f) Return on stockholders' equity = 150000/(550000+450000)/2 =30% (g) Return on assets = .150000/1000000 = 15% or 150000/900000 (Avg. total assets_ = 16.67%