Part - JustAnswer

advertisement

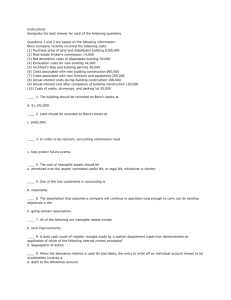

Part I II III IV VII Total Points 4 3 2 3 3 15 Score PART I — MULTIPLE CHOICE (4 points) __B__ 1. In order to be relevant, accounting information must a. be neutral. b. be verifiable. c. help predict future events. d. be a faithful representation. _C___ 2. The following information is available for Lighten Company: Sales $130,000 Ending Merchandise Inventory 12,000 Purchases 100,000 Freight-in Purchase Returns and Allowances Beginning Merchandise Inventory $10,000 5,000 15,000 Lighten’s cost of goods sold is a. $125,000. b. $120,000. c. $108,000. d. $105,000. __B__ 3. One of the two constraints in accounting is a. comparability. b. materiality. c. reliability. d. relevance. __B__ 4. The assumption that assumes a company will continue in operation long enough to carry out its existing objectives is the a. economic entity assumption. b. going concern assumption. c. monetary unit assumption. d. time period assumption. __D__ 5. All of the following are intangible assets except a. patents. b. land improvements. c. goodwill. d. franchises. __C__ 6. The constraint of conservatism is best expressed as a. the cost of applying an accounting principle should not exceed its benefit. b. only material items should be recorded and reported. c. when in doubt, choose the method that will least likely overstate assets and net income. d. the lower of cost or market method should be used for inventories. ____ 7. If merchandise is sold for $2,000 subject to credit terms of 2/10, n/30, the entry to record collection in full within the discount period would include a a. credit to Sales Discounts for $40. b. credit to Cash for $1,960. c. credit to Accounts Receivable for $40. d. none of the above. ____ 8. Barker Company's records show the following for the month of January: Total Retained Earnings at January 1 ...................................... $600,000 Total Retained Earnings at January 31 .................................... 900,000 Total Revenues ....................................................................... 1,005,000 Total Dividends Declared ......................................................... 45,000 Total expenses for January were a. $960,000. b. $1,005,000. c. $705,000. d. $660,000. _____ 9. Jetson Company's financial information is presented below. Sales $ ???? Sales Returns and Allowances 60,000 Net Sales 700,000 Beginning Merchandise Inventory ???? Purchases 340,000 Purchase Returns and Allowances $ 30,000 Ending Merchandise Inventory 70,000 Cost of Goods Sold 360,000 Gross Profit ???? The missing amounts above are: Sales Beginning Inventory a. $760,000 $90,000 b. $640,000 $90,000 c. $760,000 $120,000 d. $640,000 $120,000 Gross Profit $340,000 $400,000 $340,000 $400,000 _____ 10. The necessity of making adjusting entries relates mostly to the a. economic entity assumption. b. time period assumption. c. going concern assumption. d. monetary unit assumption. ____ 11. The preparation of closing entries a. is an optional step in the accounting cycle. b. results in zero balances in all accounts at the end of the period so that they are ready for the following period's transactions. c. is necessary before financial statements can be prepared. d. results in transferring the balances in all temporary accounts to Retained Earnings. ____ 12. Current liabilities are obligations that are reasonably expected to be paid from Existing Creation of Other Current Assets Current Liabilities a. No No b. Yes Yes c. Yes No d. No Yes ____ 13. Which of the following errors will cause a trial balance to be out of balance? The entry to record a payment on account was a. not posted at all. b. posted as a debit to Cash and a credit to Accounts Payable. c. posted as a debit to Cash and a debit to Accounts Payable. d. posted as a debit to Accounts Receivable and a credit to Cash. ____ 14. The primary accounting standard-setting body in the United States is the a. Securities and Exchange Commission. b. Accounting Principles Board. c. Financial Accounting Standards Board. d. Internal Revenue Service. ____ 15 . Which of the following would not be included in the operating activities section of a statement of cash flows? a. Cash inflows from returns on loans (i.e., interest) b. Cash inflows from returns on equity securities (i.e., dividends) c. Cash outflows to governments for taxes d. Cash outflows to reacquire treasury stock ____ 16. Which of the following combinations presents correct examples of liquidity, profitability, and solvency ratios, respectively? Liquidity Profitability Solvency a. Inventory turnover Inventory turnover Times interest earned b. Current ratio Inventory turnover Debt to total assets c. Receivable turnover Return on assets Times interest earned d. Average days collection Payout ratio Return on assets ____ 17. Which of the following pairs of terms in the area of financial statement analysis are synonymous? a. Ratio — Trend b. Horizontal — Trend c. Vertical — Ratio d. Horizontal — Ratio ____ 18. The statement of cash flows is a(n) a. required supplemental financial statement. b. required basic financial statement. c. optional basic financial statement. d. optional supplementary statement. ____ 19. Which of the following should be classified as an extraordinary item? a. Effects of major casualties not infrequent in the area b. Write-off of a significant amount of receivables c. Loss from the expropriation of facilities by a foreign government d. Losses due to a bitter, lengthy labor strike ____ 20. In order to be considered extraordinary, an item must be a. frequent and uninsured. b. unusual and uninsured. c. uninsured and infrequent. d. infrequent and unusual. PART II — MATCHING (3 points) Instructions Designate the terminology that best represents the definition or statement given below by placing the identifying letter(s) in the space provided. No letter should be used more than once. A. B. C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. S. T. U. V. W. Additions and improvements Allowance method Amortization Available-for-sale securities Average cost method Book value Capital expenditure Cash debt coverage ratio Consistency Contra asset account Cost method Credit memorandum Debit memorandum Declining-balance method Depreciable Cost Depreciation Direct write-off method Discontinued operations Earnings per share Economic entity assumption Equity method Extraordinary items First-in, first-out method X. Y. Z. AA. AB. AC. AD. AE. AF. AG. AH. AI. AJ. AK. AL. AM. AN. AO. AP. AQ. AR. AS. AT. Full disclosure principle Going-concern assumption Held-to-maturity securities Internal control Last-in, first-out method LIFO reserve Matching principle Materiality Monetary unit assumption Net purchases Periodic inventory system Permanent accounts Perpetual inventory system Ratio analysis Relevance Reliability Revenue expenditure Revenue recognition principle Stock dividend Stock split Temporary accounts Time period assumption Units-of-activity method ___ 1. The periodic write-off of an intangible asset. ___ 2. The total amount subject to depreciation. ___ 3. The principle that efforts be matched with accomplishments. ___ 4. An expenditure charged against revenues as an expense when incurred. ___ 5. The inventory costing method that assumes that the costs of the earliest goods purchased are the first to be recognized as cost of goods sold. ___ 6. Use of the same accounting principles and methods from period to period by the same business enterprise. ___ 7. A measure of solvency calculated as cash provided by operating activities divided by average total liabilities. ___ 8. An assumption that economic events can be identified with a particular unit of accountability. PART II — MATCHING (cont.) ___ 9. A characteristic of information that means it is capable of making a difference in a decision. ___ 10. Used by a bank when a previously deposited customer’s check “bounces” because of insufficient funds. ___ 11. The assumption that the enterprise will continue in operation long enough to carry out its existing objectives and commitments. ___ 12. The methods and measures adopted within a business to safeguard its assets and enhance the accuracy and reliability of its accounting records. ___ 13. Revenue, expense, and dividends accounts whose balances are transferred to retained earnings at the end of an accounting period. ___ 14. A technique for evaluating financial statements that expresses the relationship among selected financial statement data. ___ 15. Events and transactions that are unusual in nature and infrequent in occurrence. ____ 16. The disposal of a significant segment of a business. 1. 2. 3. 4. 5. C O AD AN W 6. 7. 8. 9. 10. I H T AL M 11. 12. 13. 14. 15. Y AA AR AK V 16. R PART III — ADJUSTING ENTRIES (2 points) The trial balance of Timlin Company shows the following balances for selected accounts on November 30, 2008: Prepaid Insurance Equipment Accumulated Depreciation $12,000 60,000 6,600 Unearned Revenue Notes Payable Interest Payable $ 4,800 30,000 450 Instructions: Using the additional information given below, prepare the appropriate monthly adjusting entries at November 30. Show computations. A. Revenue for services rendered to customers, but not yet billed, totaled $6,000 on November 30. Accounts Receivable ............................................................................. Service Revenue .................................................................. B. 225 450 450 An insurance policy was acquired on June 30, 2008; the premium paid for 2 years was $14,400. Insurance Expense ($14,400 ÷ 24) ....................................................... Prepaid Insurance ............................................................... E. 225 The equipment was purchased on January 2, 2007, for $60,000. It has an estimated life of 10 years and an estimated salvage value of $6,000. Timlin uses the straight-line depreciation method. Depreciation Expense [($60,000 - $6,000) ÷ 120] ............................... Accumulated Depreciation ................................................. D. 6,000 The note payable is a 9%, 1 year note issued September 1, 2008. Interest Expense ($30,000 × 9% × 1/12) .............................................. Interest Payable ................................................................... C. 6,000 600 600 Timlin received $4,800 fees in advance from a customer on November 1, 2008. Threefourths of this amount was earned by November 30. Unearned Revenue ($4,800 × 3/4) ........................................................ Service Revenue .................................................................. 3,600 3,600 PART IV — BANK RECONCILIATION (3 points) A review of the November 30 bank statement and other data of James Company reveals the following: 1. 2. 3. 4. 5. 6. 7. 8. Balance per bank statement on November 30 .................................................... Balance per books on November 30 .................................................................. NSF Check from J. Smith in payment of account ............................................... Collection of $3,000, 4-month, 9% note with a $30 collection fee. No interest had been accrued .............................................................................................. Deposits in transit at November 30..................................................................... Outstanding checks at November 30.................................................................. A check written by James to Green for equipment on November 10 was recorded as $463 but correctly cleared the bank as $436. A check drawn on the account of Johns Company for $200 was mistakenly charged against James' account by the bank. $17,300 $12,173 $480 3,060 4,200 6,920 Instructions: Prepare the November 30 (a) bank reconciliation (omit heading) and (b) related journal entries. (a) BANK RECONCILIATION: Balance per bank statement Amount $17,300 Balance per books Amount $12,173 Adjusted balance per bank $ Adjusted balance per books $ Balance per Bank Statement Add: Deposits in Transit Add: Bank Error Less: Outstanding Checks Adjusted Balance per Bank (b) James Company Bank Reconciliation $17,300 Balance per Books $12,173 $4,200 Add: error in Recording Check $27 $200 $21,700 Note Collection $3,060 $15,260 ($6,920) Less: NSF ($480) $14,780 Adjusted Balance per Books $14,780 ENTRIES: Account Titles Cash Miscellaneous Expense Notes Receivable Interest Revenue Accounts Receivable Cash Debit $3,060 $30 $3,000 $90 $480 $480 Credit Cash Equipment $27 $27 PART VII — RATIO ANALYSIS (3 points) The condensed financial statements of Jenner Corporation for 2008 are presented below. Jenner Corporation Balance Sheet December 31, 2008 Assets Current assets Cash and short-term investments Accounts receivable Inventories Total current assets Property, plant, and equipment (net) Total assets Jenner Corporation Income Statement For the Year Ended December 31, 2008 $ 30,000 70,000 140,000 240,000 760,000 $1,000,000 Revenues Expenses Cost of goods sold Selling and administrative expenses Interest expense Total expenses Income before income taxes Income tax expense Net income $2,000,000 960,000 740,000 50,000 1,750,000 250,000 100,000 $ 150,000 Liabilities and Stockholders' Equity Current liabilities $ 100,000 Long-term liabilities 350,000 Stockholders' equity 550,000 Total liabilities and stockholders' equity $1,000,000 Additional data as of December 31, 2007: Inventory = $100,000; Total assets = $800,000; Stockholders' equity = $450,000. Instructions: Compute the following listed ratios for 2008 showing supporting calculations. (a) Current ratio = _______________________________________________________________________ . (b) Debt to total assets ratio = ______________________________________________________________ . (c) Times interest earned = _________________________________________________________________ . (d) Inventory turnover = ___________________________________________________________________ . (e) Profit margin = _______________________________________________________________________ . (f) Return on stockholders' equity = _________________________________________________________ . (g) Return on assets = _____________________________________________________________________ . (a) Current ratio = $240,000 / $100,000 = 2.4. (b) Debt to total assets ratio = ($100,000 + $350,000) / $1,000,000 = 0.45. (d) Inventory turnover = $960,000 / [($140,000 + $100,000)/2] = 8. (e) Profit margin = $150,000 / $2,000,000 = 7.5% (f) Return on stockholders' equity = $150,000 / [($550,000 + $450,000)/2] = 30%. (g) Return on assets = $150,000 / [($$1,000,000 + $800,000)/2] = 16.67%.