Service Provider Compensation – Are There New Limits?

advertisement

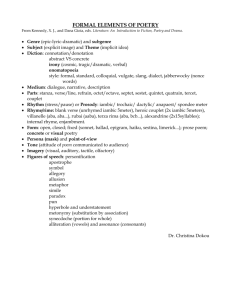

Service Provider Compensation – Are There New Limits? April 9, 2008 Lisa J. Bleier Center for Securities, Trusts & Investments American Bankers Association lbleier@aba.com 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION • ERISA dictates the rules for the conduct of fiduciaries • Along with these rules are certain prohibited transactions • On top of the prohibited transactions, are exemptions. 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Prohibited Transactions ERISA Sec. 406(b)(3): “A fiduciary with respect to a plan shall not receive any consideration for his own personal account from any party dealing with such plan in connection with a transaction involving the assets of the plan.” 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION What does 406(b)(3) mean? • It is a prohibited transaction for there to be a transaction between a plan and a fiduciary, unless specifically allowed – i.e. a PTE • What is “consideration”, “personal account”? “in connection with”? 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION In a Nutshell • Gifts and Entertainment is where the DOL is focused – – – – – 1-800-BANKERS www.aba.com Golf outing Nice dinner Training seminar Motorcycle? Boat? © 2005 AMERICAN BANKERS ASSOCIATION What is New? Is there a proposed change to the law? No What has changed? 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION What is New? • Comments of Virginia Smith, DOL Office of Enforcement • Activities of OLMS – Revised LM-10 – Revised LM-30 – FAQs 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Comments from the DOL Virginia Smith, Director of Enforcement, EBSA, “Fiduciaries must be very careful about accepting any gift or gratuity from a service provider, even items of modest value.” 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION What are LM-10/LM-30? • The Forms that must completed under the Labor Management Reporting and Disclosure Act of 1959 • LM-30 – filed by the union officer or employee • LM-10 – filed by the employers and service providers 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION What are LM-10/LM-30? • Must report any payment or loan, direct or indirect, of money or other things of value given to any union, union official, agent or employee • There are certain exceptions 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION LM-10/LM-30 Exceptions in the FAQs • De minimis of aggregate $250 • Exception for widely-attended events • Bank exception 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION LM-10/LM-30 • Creates a paper trail • Helps EBSA target enforcement 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Questions to ask before making a payment or receiving a payment • Is it permissible? Look to ERISA rules • If a union client, is it reportable? Look to LMRDA 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION But what does this have to do with service providers who do not service unions? 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION This entire exercise in the union context has focused DOL on gifts and entertainment throughout the industry – not just unions. 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Where do we go from here: • Can a service provider pay expenses for trustees which could be properly paid by the plan? • Is there any “bright line” to follow? 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Request for DOL Guidance IAA and SIFMA have requested guidance from the DOL based on Rule NASD 3060. 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION NASD Rule 3060 • Prohibits any person from giving anything of value in excess of $100 per individual per year • Does not apply to gifts of de minimis value • Does not apply to promotional items of nominal value that display the firm’s logo 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION For Banks: Bank Bribery Act Internal Policies and Procedures Ethical Rules 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Bank Bribery Amendments Act of 1985 • Requires that the financial institution regulatory agencies publish guidelines to assist employees, officers, directors, agents and attorneys of financial institutions in complying with the law 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Bank’s Code of Conduct • Bank's code of conduct should prohibit any employee, officer, director, agent or attorney from (1) soliciting for themselves or for a third party anything of value from anyone in return for any business, service or confidential information of the bank and (2) accepting anything of value (other than bona fide salary, wages and fees referred to in 18 U.S.C. 215(c)) from anyone in connection with the business of the bank, either before or after a transaction is discussed or consummated 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Some of the Exceptions: • Personal relationships • Marketing expenses - to foster better business relations • Advertising or promotional material, such as pens, pencils, note pads, key chains, calendars and similar items • Gifts of reasonable value that are related to commonly recognized events or occasions, such as a promotion, new job, wedding, retirement, holiday or birthday; or • Civic, charitable, educational, or religious organization awards for recognition of service and accomplishment 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Do we want or need any further guidance? 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION Thank you for your time! Lisa J. Bleier Center for Securities, Trusts & Investments American Bankers Association lbleier@aba.com 1-800-BANKERS www.aba.com © 2005 AMERICAN BANKERS ASSOCIATION