chapter 10 quiz

advertisement

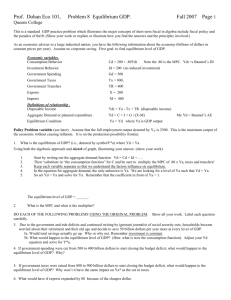

AP ECONOMICS: CHAPTER 10 QUIZ 1. A private closed economy includes: A. households, businesses, and government, but not international trade. B. households, businesses, and international trade, but not government. C. households and businesses, but not government or international trade. D. households only. 2. Refer to the above data. The MPS is: A. 7/10. B. 3/10. C. 2/5. D. 3/5. 3. Refer to the above data. At the $370 billion level of DI the APS is approximately: A. 4 percent. B. 7 percent. C. 1 percent. D. 16 percent. 4. Refer to the above data for a private closed economy. If gross investment is $12 billion, the equilibrium level of GDP will be: A. $380. B. $370. C. $360. D. $350. 5. The equilibrium level of GDP in a private closed economy is where: A. MPC = APC. B. unemployment is about 3 percent of the labor force. C. consumption equals saving. D. aggregate expenditures equal GDP. 6. Refer to the above diagram for a private closed economy. The equilibrium GDP is: A. $60 billion. B. $180 billion. C. between $60 and $180 billion. D. $60 billion at all levels of GDP. 7. At equilibrium real GDP in a private closed economy: A. the MPC must equal the APC. B. the slope of the aggregate expenditures schedule equals the MPS. C. aggregate expenditures and real GDP are equal. D. planned saving and consumption are equal. 8. If the above economy was closed to international trade, the equilibrium GDP and the multiplier would be: A. $300 and 5. B. $350 and 4. C. $400 and 4. D. $350 and 5. 9. Refer to the above table. For the open economy the equilibrium GDP and the multiplier are: A. $300 and 2.5. B. $450 and 5. C. $400 and 4. D. $400 and 5. 10. If net exports decline from zero to some negative amount, the aggregate expenditures schedule would: A. shift upward. B. shift downward. C. not move (net exports do not affect aggregate expenditures). D. become steeper. 11. Assume the MPC is .8. If government were to impose $50 billion of new taxes on household income, consumption spending would initially decrease by: A. $100 billion. B. $90 billion. C. $40 billion. D. $50 billion. 12. If a lump-sum income tax of $25 billion is levied and the MPS is 0.20, the: A. saving schedule will shift upward by $5 billion. B. consumption schedule will shift downward by $25 billion. C. consumption schedule will shift downward by $20 billion. D. consumption schedule will shift upward by $25 billion. 13. If APC = .6 and MPC = .7, the immediate impact of an increase in personal taxes of $20 will be to: A. have no effect on consumption. B. decrease consumption by $14. C. decrease consumption by $12. D. increase consumption by $14. 14. Which of the following is a correct statement of the impacts of a lump-sum tax? A. Disposable income will increase by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the MPC. B. Disposable income will decline by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the multiplier. C. Disposable income will decline by the amount of the tax and consumption at each level of GDP will also decline by the amount of the tax. D. Disposable income will decline by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the MPC. The following information is for a closed economy: 15. Refer to the above information. If both government spending and taxes are zero, the equilibrium level of GDP is: A. $200. B. $300. C. $400. D. $500. 16. Refer to the above information. If government now spends $80 billion at each level of GDP and taxes remain at zero, the equilibrium GDP: A. will rise to $700. B. will rise to $600. C. will rise to $500. D. may either rise or fall. 17. Refer to the above information. The introduction of $80 billion of government spending has: A. lowered the multiplier from 2.5 to 2.0. B. increased the multiplier from 2.5 to 3.0. C. increased the multiplier from 2.0 to 2.5. D. had no effect on the size of the multiplier. 18. Refer to the above information. If in addition to spending $80 billion at each level of GDP, government imposes a lump-sum tax of $100: A. equilibrium GDP will now be $350. B. equilibrium GDP will now be $400. C. equilibrium GDP will now be $300. D. the equilibrium GDP cannot be determined. 19. Refer to the above information. The addition of a $100 billion lump-sum tax: A. reduces the MPC and increases the multiplier. B. increases the MPC and decreases the multiplier. C. increases both the MPC and the multiplier. D. has no effect on either the MPC or the multiplier. 20. Suppose government finds it can increase the equilibrium real GDP $45 billion by increasing government purchases by $18 billion. On the basis of this information we can say that the: A. MPS in this economy is .4. B. MPC in this economy is .4. C. multiplier does not apply in this economy. D. multiplier is 3. KEY 1. C 2. B 3. A 4. C 5. D 6. B 7. C 8. D 9. D 10. B 11. C 12. C 13. B 14. D 15. B 16. C 17. D 18. A 19. D 20. A