Presentation Title

advertisement

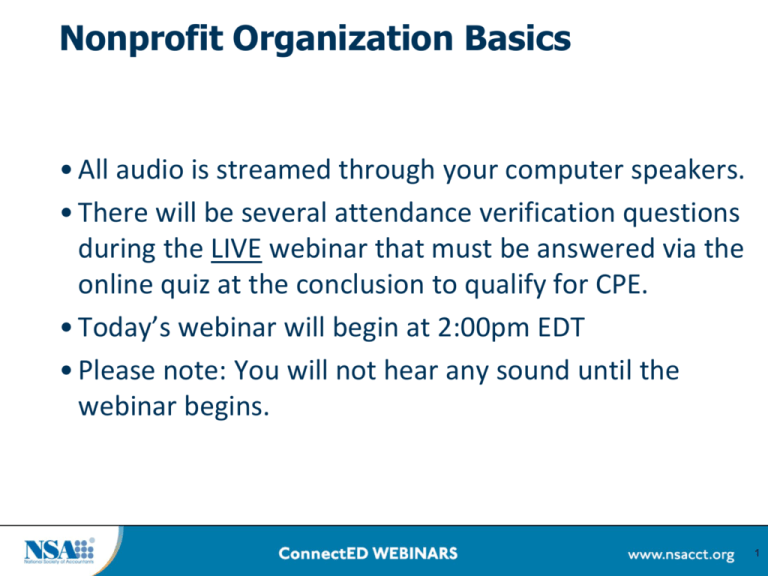

Nonprofit Organization Basics • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • Today’s webinar will begin at 2:00pm EDT • Please note: You will not hear any sound until the webinar begins. 1 Nonprofit Organization Basics Presented by: Kay K. Mortimer, EA Learning Objectives At the end of this webinar, you should be able to: • Identify steps to properly form a C3 NPO • Recognize what the pre-formation process involves • Prepare the application paperwork • Identify the policies and procedures to ensure compliance and operating success • Operate while waiting on approval • Identify the C3s obligations – donors, governmental agencies, payroll, etc. • Cite the pitfalls to beware of with C3s 3 Nonprofit Organizations Dream to make a difference History of C3s NPOs vs. C3s and other definitions Where to Begin? Dream and vision Pre-formation steps Qualifying as a C3 How to Form Board Governing and organizational documents Policies Accounting and accountability 1st of the 3-Leg Process State filing Certified docs Other filings? Step 2 EIN Separate entity Why wait – “name” Step 3 Applying for C3 Form 1023EZ or Form 1023 Brief intro – Form 1024 (not for C3s) User Fee 1023 EZ Qualifying Completing Submitting Form 1023 (long form) Checklist Pre-completion preparations Qualifications Form 1023-preparation Section by section Schedules Attachments Sequence What to attach Required Form and Schedules Organizational Documents Additional supporting documents Organization information How to File Deadline Procedure for filing IRS inquiries “Waiting” Proper wording concerning tax-deductibility Form 990 State filings Payroll, etc. Operating and accounting Approval Permanent Files Grant app Banking or other Moving Forward Tax-deductibility wording Donor statements Public inspection Annual Filings Operating a C3 Accounting Legal – consult attorney Grants, Fund-raising Accountable Plans Employees, Volunteers Required Filings Form 990 series (and additional forms) State & local Payroll Grant funding reqs Watch out Legal – ask attorney Automatic Revocation Violations Don’t jeopardize your status Tax-exempt purpose Private inurement, excess benefits Political and lobbying activities Others? Dissolving a C3 State process “Final” return and attachments Distribution of remaining assets State and local Record Retention Donor statements and other concerns Resources and Links • Publication 4220 – Applying for Tax-Exempt Status • Publication 557 – Tax-Exempt Status for Your Organization • Publication 598 – Tax on Unrelated Business Income… • Publication 4573 – Group Exemptions • Form 1023 and instructions • Form 1024 (for other than C3’s) and instructions • www.irs.gov • State Secretaries of State and Revenue Departments 23 Additional Resources Publication 78 database www.guidestar.org Sample Bylaws Sample policies and procedures “Church and Clergy Tax Guide” – Dr. Richard Hammar Questions? Questions? 25 Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http://webinars.nsacct.org/postevent.php?id=15787 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314-1574 Phone: (800) 966-6679 members@nsacct.org 26