Schedule D – In the Real World! Presenters

advertisement

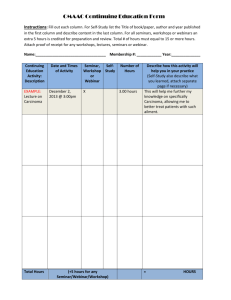

Schedule D in the Real World • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • Today’s webinar will begin at 2:00pm EDT • Please note: You will not hear any sound until the webinar begins. 1 Schedule D – In the Real World! Presenters: Kathy Hettick, EA, ABA, ATP and Gene Bell, EA, ATA, CFP® Date: June 25, 2015 Time: 2:00-3:00 PM Eastern 2 Learning Objectives Upon completion of this course, you will be able to: • Report the sale of a capital asset on Schedule D • Determine when to use Form 8949 • Recognize the reportable aspects of a 1099-B • Apply the process of reporting correct information for the sale of a capital asset 3 Schedule D Summary Information Form 8949 Covered vs. Non Covered Basis, basis & more basis Adjustment Codes 4 Schedule D Form 1099-B (Proceeds From Broker and Barter) Form 1099-DIV (Capital Gain Distributions) Form 4797 (Business Assets) Form 6252 (Installment Sales) Form 8824 (Like-Kind Exchanges) Form K -1 (Partnerships, S Corps, Estates, Trusts) 5 Why do we have a Schedule D? Tax code complexities Capital gains tax rates Netting rules Tax computation worksheet Capital loss carryforward Prior year due diligence 6 What is a Capital Asset? IRC §1221 Any property held by a taxpayer, except..... Inventory Accounts or notes receivable from trade or business Depreciable property used in trade or business Real estate used in trade or business, or rental property Supplies used in a trade or business US Govt publications Commodities-derivative instruments held by dealer The right to receive future ordinary income payments Self created copyrights, literary, musical or artistic comps, etc. 7 What is a Capital Asset? Malat v. Riddell, 383 U.S. 569, 572 (1966) U.S. Supreme Court Case Differentiate the profits and losses from everyday business operations and the long term realization of appreciation. United States v. Winthrop, 417 (1969) 7 factors for consideration No one factor controls 8 What is a Capital Asset? Suburban Realty Co. v. U.S. 615 (1980) 1) Was the taxpayer engaged in a trade or business? 2) Was the taxpayer holding the property primarily for sale in that business? 3) Were sales “regular and ordinary”? Flood v. Commissioner (2012) T.C. Memo 2012-243 9 Type of Sale Directly on Schedule D Form 8949 Covered Securities ≤1 year - Part I, line 1a >1 year - Part II, line 8a Only if adjustment necessary Non-Covered Securities ≤1 year - Part I, Box B >1 year - Part II, Box E Personal Use Property Sold at a Gain ≤1 year - Part I, Box C >1 year - Part II, Box F Form 4797 Depreciable trade or business property Sold at a Gain ≤1 year - Part II, line 10 >1 year - Part III – §1245, §1250 Depreciable trade or business property Sold at a Loss ≤1 year - Part II, line 10 >1 year - Part I, line 2 IRC §179 recapture Part III - §1245, §1250 Nonbusiness bad debt Part I, line 1 10 Holding Period IRC §1222 Short term - one year or less Long term - more than one year Begins on the day after the day the property was acquired Includes the date of disposition Inheritance is always long term Non-business bad debt is always short term 11 Capital Gains Taxes Short Term: Gains are taxed at the ordinary tax rates Long Term Rates: 0% 15% 20% 25% 28% If ordinary tax rate is 10%, 15% If ordinary tax rate is 25%, 28%, 33%, 35% If ordinary tax rate is 39.6% Un-recaptured Section 1250 gain Collectables (held more than 1 year); Section 1202 QSBS gain 12 Capital Gains Taxes Net Investment Income Tax 3.8% Additional Tax! Applies when MAGI is $250K (MFJ), $200K (S), $125K (MFS) Capital Loss Deductible up to $3,000 per year Additional is carried forward 13 Form 8949 New form effective as of 2011 IRS matching program Separate pages for short term & long term Covered vs. Non Covered Can summarize and attach details Sale of personal residence Reportable or non reportable losses 14 15 Form 1099 B How Do I Read It Basis issues Didn’t get it Correcting it Consolidated forms 16 17 Adjustment Codes Correcting reporting errors How do I use them? When do I use them? Where do I put them? Will they cause IRS correspondence? Asking the right questions to get the right answers 18 19 Basis Issues Getting it right when the form is wrong! Use adjustment codes Inherited property Basis is FMV at date of death Gifts Basis is lesser of FMV or donor’s basis Burden of proof…. WHO? * Preparers * Clients * Brokers 20 Who’s Doing the Return? Preparers beware Software input \ tax return output Check the result of your input Did it show up where expected Be diligent 21 Practice Management Tip Ask yourself, have you Been Reasonable Been Prudent Been Ethical Asked the Right Questions 22 Upcoming Webinars and Presentations by Kathy Hettick & Gene Bell Catch us at the 2015 IRS Tax Forums National Harbor, Denver, Atlanta, San Diego & Orlando Check out all the great information and get the member discount; http://www.nsacct.org/education-events/irs-tax-forums Be sure to check out our webinar schedule at; http://webinars.nsacct.org/ 23 Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http://webinars.nsacct.org/postevent.php?id=15875 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314-1574 Phone: (800) 966-6679 members@nsacct.org 24