Accounting

advertisement

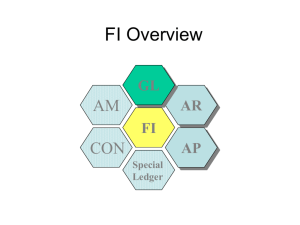

Lecture Notes in SBI401I – Accounting (Major Elective 1 – SAP) In this section, we explain how to define the following organizational entities relevant for Financial Accounting: a) Company b) Company Code c) Credit Control Area d) Business Area e) Consolidation Business Area f) Functional Area g) Controlling Area h) Operating Concern Company A company (also known as an internal trading partner) is an organizational unit used for consolidation purposes. In general, you don’t post directly to a company; instead, you assign a company code to a company and then post to that company code. By assigning a company to a company code, the company inherits the postings of the other company codes assigned to that company. In addition to being assigned to a company code, a company can also be assigned to customers and vendors, which help you keep track of the transactions against your business partners. Company Code You can create a company code in two ways: 1. Copy an existing company code and then change the necessary settings (e.g., the company code description, the currency, etc.). The system automatically performs most of the necessary customizing settings, copying them from the reference company code. 2. Create a company code from scratch; in this case, you need to perform all of the company code customizing settings step by step. Credit Control Area The credit control area is the organizational unit under which the credit management tools of Financial Accounting are managed. It can be company-code-specific, or comprise more than one company code. (See Section 2.2.2, Company Code to Credit Control Area, for more information about the relationship between the credit control area and the company code.) Business Area The business area is an organizational unit that you can use freely for internal or external reporting to depict segmentation of you business within or across company codes. The business area is available in general ledger reporting (in both the classic General Ledger and the new SAP General Ledger), and can be set up in the special ledger tables. Lecture Notes in SBI401I – Accounting (Major Elective 1 – SAP) Functional Area With the functional area, you can keep track of the macro-departments where costs and revenues arise, for example: a) Administration b) Production c) Procurement d) Sales e) Human Resources This type of accounting (i.e., accounting by department) is called cost-of-sales accounting. Controlling Area The controlling area is the organizational unit under which the Controlling (CO) module works. Cost centers, profit centers, WBS elements, internal orders, and cost elements are all objects whose master data are managed under a controlling area. Operating Concern The operating concern is the organizational unit that occupies the highest level of the SAP organizational hierarchy. It is used in the Profitability Analysis module, where you can analyze the profit and loss of your company according to multiple dimensions, such as customers, regions, products, and so on. You assign controlling areas to exactly one operating concern; thus, each company code is also assigned to exactly one operating concern. Refer to a CO manual for a comprehensive guide to the creation of the operating concern and the configuration of the COPA SAP module Business Area to Consolidation Business Area You assign each business area to a consolidation business area using Transaction OBB6. The system presents all of the business areas available in the system and allows you to assign them to a consolidation business area in the Consolidate Business Area column. This is all you need to do under the Enterprise Structure definition. Note that the consolidation business area has a very limited use in the SAP environment; as such, you should make an in-depth investigation before deciding to use this organizational unit in your SAP implementation. For example, unlike the business area, the consolidation business area isn’t updated in the general ledger Company code to Controlling Area You assign each company code to a controlling area to manage your internal controlling in an integrated way. Note that activities such as internal allocations of costs can be performed between objects (such as cost centers) that belong to different company codes only if the two company codes belong to the same controlling area.