College Goal Sunday January 17, 2009

advertisement

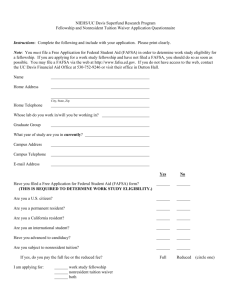

Applying for Financial Aid 2009-2010 1 Sponsors/Partners: Presenter: 2 What Will You Learn Today? • • • Types and sources of financial aid • Answers to your individual question Required financial aid application forms How to complete the Free Application for Federal Student Aid (FAFSA) 3 Types of Financial Aid • Gift Aid - Grants or • • scholarships that do not need to be repaid Work - Money earned by the student as payment for a job on or off campus Loans - Borrowed money to be paid back, usually with interest 4 Sources of Financial Aid • Federal government • State government • • Colleges and universities Private agencies, companies, foundations, and your parents’ employers 5 TOPS The TOPS program was created by the Louisiana legislature in 1997 under the administration of Governor Mike Foster 1998 was the first award year for both 1997 and 1998 graduates TOPS is funded through the State General Fund and the Millennium Trust Fund TOPS funds must be appropriated each year by the Legislature 6 TOPS: Academic Requirements • All TOPS core curriculum courses must be completed by the date of high school graduation 7 TOPS: Core Curriculum GPA The grade point average (GPA) used to determine eligibility for the TOPS program will be calculated using only those grades achieved in the TOPS core curriculum courses Uses the highest grade in each core category Courses not graded on a 4.00 scale must be converted to a 4.00 scale Letter grades of “P” are not included TOPS Core GPA cannot be rounded up 8 TOPS: ACT ACT Registration TOPS Code 1595 Social Security Number ACT Deadlines for 2009 Graduates Without penalty: April 4, 2009 Loss of one semester eligibility: June 13, 2009 Highest composite score will be considered TOPS does not consider the Essay portion of the ACT 9 TOPS: SAT SAT Registration Scholarship Code 9019 Social Security Number SAT Test Deadlines Without Penalty: March 14, 2009 Loss of 1 semester eligibility: May 2, 2009 and June 6, 2009 An equivalent SAT score may be substituted for the ACT score TOPS does not consider the Essay portion of the SAT 10 TOPS: Application Two methods for applying for TOPS: FAFSA (Free Application for Federal Student Aid) – www.fafsa.ed.gov • Preferred application • Must be completed if the student is eligible for federal grant aid (Pell Grant) • Must be completed if the student is seeking any other form of financial aid • The only application needed for TOPS TOPS Online Application – www.osfa.la.gov • May only be completed by students who can certify that they do not qualify for federal grant aid • In the event of a budget shortfall, students completing the TOPS Online Application will be the first to lose their TOPS award • Do not complete if you have completed the FAFSA 11 TOPS: Application Deadlines 2009 Graduates Initial Application Receipt Date Receives TOPS funding for: Jan. 1 – July 1, 2009 8 semesters (12 quarters) Beginning 2009-2010 July 2, 2009 – July 1, 2010 8 semesters (12 quarters) Beginning Fall 2010 July 2, 2010 – Aug. 29, 2010 7 semesters (10 quarters) Beginning Fall 2010 Aug. 30, 2010 – Oct. 29, 2010 6 semesters (9 quarters) Beginning Fall 2010 Initial Applications Received After October 29, 2010 Ineligible for TOPS 12 TOPS: Processing Cycle Student applies by completing the FAFSA or TOPS Online Application LOSFA receives ACT or SAT scores electronically based on the inclusion of the TOPS code on the test registration LOSFA receives transcript data from the La. Department of Education after high school graduation 13 TOPS: Processing Cycle Once all required data is received, TOPS eligibility is determined each Thursday night TOPS eligibility letters are mailed each Friday. Students can also check their award status on the TOPS Portal located on www.osfa.la.gov Most students will be notified of their TOPS eligibility by early July A Master Roster of TOPS eligible students is available for colleges and universities to download each Monday 14 TOPS: Processing Cycle Most colleges and universities will include an anticipated TOPS credit on the student’s fee bill after receiving the TOPS Master Roster Colleges and universities may begin billing LOSFA for TOPS eligible students who are full-time students after the 14th class day of the term LOSFA will send all TOPS funds to the institution to be applied to the student’s account 15 TOPS: Award Acceptance Must enter an eligible institution as a full-time student by the fall semester following the first anniversary of high school graduation Exceptions: • Returning Out-of-State Students • Military Service 16 TOPS: Retention Requirements Should apply annually by July 1st by completing the Renewal FAFSA Must be continuously enrolled on a full-time basis during the academic year Must earn 24 credit hours each academic year Failure to earn 24 hours will result in permanent award cancellation Exceptions to the continuous enrollment or 24 hour requirement may be granted for reasons beyond the student’s control 17 TOPS: Retention Requirements GPA At the end of each Spring term, the following cumulative college GPA must be achieved: • Opportunity Award: 2.30 first academic year 2.50 all subsequent academic years Opportunity Award recipients who fail to maintain the retention GPA will be suspended • Performance and Honors Awards: 3.00 Performance or Honors award recipients who fail to maintain a 3.00 cumulative GPA will revert to the Opportunity Award (see above requirements) • Tech Award: 2.50 18 TOPS: Retention Requirements At the end of any other term, Steady Academic Progress of a 2.00 cumulative college GPA must be maintained or the award will be suspended 19 Other State Aid Programs • • • • • Go Grant LA LEAP Grant Rockefeller State Wildlife Scholarship Louisiana Guaranteed Loans Healthcare Educator Loan Forgiveness Program www.osfa.la.gov 20 Need-Based Grants • Federal Grants • Pell Grants • $4,731 maximum per year • Academic Competitiveness Grants • $750 for the first year • $1,300 for the second year • Supplemental Educational Opportunity Grants (SEOG) • $4,000 maximum per year 21 Need-Based Grants College Grants • (List various community college grants here) • (List various state college and university grants here) • Independent College Grants amounts vary 22 Types of Applications • FAFSA Other applications or forms as required by the college such as: • CSS Financial Aid PROFILE • Institutional scholarship and/or financial aid applications • 2008 federal tax returns (along with schedules and W-2s) or other income documentation 23 FAFSA Information & Tips • File as soon as possible • Use estimated 2008 income information if taxes are not complete at time of FAFSA submission • Student and at least one parent whose information is required must complete and sign the FAFSA 24 Federal PIN • PIN (Personal Identification Number) serves as the electronic signature on ED documents • Both student and at least one parent need PIN to sign the FAFSA electronically • May be used to: • Check on FAFSA status • Verify and correct FAFSA data • Add additional schools to receive FAFSA data • Change home and e-mail addresses • If an e-mail address is provided, PIN will be e-mailed to the PIN applicant within hours Apply for student and parent PINs TODAY at: www.pin.ed.gov 25 Getting Ready • Before starting the FAFSA, gather: • Student driver’s license • Student Alien Registration Card • Student and Parent Social Security cards 2008 W-2 Forms and other records of money earned 2008 federal income tax form (even if not completed) Records of untaxed income Current bank statements Business, farm, and other real estate records Records of stocks, bonds, and other investments Create a file for copies of all financial aid documents submitted 26 Getting Started • • Read all application instructions If planning to submit the paper FAFSA: • Use pen with black ink • Print clearly in CAPITAL letters • Fill in ovals completely • Do not leave blanks (unless directed by instructions) • Do not write comments or notes anywhere on form • Do not use correction fluid 27 FAFSA on the Web The 2009-2010 FAFSA on the Web Worksheet may be used for the January 1, 2009 through June 30th, 2010 federal aid application cycle 28 The FOTW Worksheet A Five Section Form Section 1 – is about the student Section 2 – determines student dependency status Section 3 – collects parental information for dependent students Section 4 – collects student finances and information about the independent student Section 5 – allows students to list up to ten schools to receive information from the FAFSA 29 Section 1 (page 2) STUDENT INFORMATION 30 Section 1 Your Last Name Jones • • The FOTW will ask for the student’s first and last name as well as a middle initial Make sure to report the student’s name exactly as it appears on the student’s Social Security card 31 Section 1 Your Social Security Number 1 2 3 4 5 6 7 8 9 Double check your Social Security Number when entering it on the FOTW. Both your name and Social Security Number will be compared through a database match 32 Section 1 Citizenship Status • • If U.S. citizen, status will be confirmed by Social Security match If eligible noncitizen, status will be confirmed by Department of Homeland Security (DHS) match. This includes: • U.S. permanent residents with I-551 • Conditional permanent residents with I-551C • Eligible noncitizens with I-94 • If neither a citizen or eligible noncitizen, you are ineligible for federal/state aid, but might still be eligible for institutional funds 33 Section 1 Alien Registration Number 0 1 2 3 4 5 6 7 8 If eligible noncitizen, write in your eight- or nine-digit Alien Registration Number (ARN) • Precede an eight digit ARN with a zero • Copy of Permanent Registration Card might be requested by the financial aid office 34 Section 1 Citizenship Status NOTE: if you are undocumented or under-documented • if you are applying to any public college or university, check to see if you might be eligible for in-state tuition costs • check with colleges and universities to see if institutional financial aid is available • apply for all private scholarships for which you may be eligible • watch for changes in federal and state laws regarding the eligibility of undocumented or under-documented students • start inquiring in elementary, middle or high school to see if it is possible for younger students to become permanent residents For more information and a list of scholarships, go to www.maldef.org/pdf/scholarships.pdf or www.latinocollegedollars.org 35 Section 1 Your State of Legal Residence GA • Residency relates to your permanent home state • if you are dependent, the state of legal residence is usually the state in which your custodial parents live • State of legal residence is also used • to determine eligibility for state grants • in the need calculation to determine the appropriate allowance for state and other taxes paid by that state’s residents 36 Section 1 Selective Service Registration • Male students who are 18 years of age or older must be registered with Selective Service to receive federal and state aid • Answer “Register me” only if you are male, aged 18-25, and have not yet registered. You may also register by going to: www.sss.gov 37 Section 1 Federal Student Aid Question • Answer “No” if you have never received federal student grants, federal student loans or federal work-study • You should also answer “No” if you have never attended college. If you answer “No” to this question, skip question 23 38 Section 1 Drug Conviction Question • • Answer “YES” if you have been convicted of possessing or selling illegal drugs while you were receiving federal student financial aid Answer “NO” if: • • • You have no drug-related convictions of any kind but simply received student financial aid while a college student Conviction was for alcohol or tobacco Conviction was removed from your record or occurred before age 18 (unless tried as an adult) 39 Section 1 Parents’ Educational Level Indicate highest level of schooling completed by your biological or adoptive parents (for state award purposes only) • Use birth parents or adoptive parents - not stepparents or foster parents • This definition of parents is unique to these two questions 40 Section 1 Degree Objective Indicate your most immediate degree or certificate objective for 2009-2010 41 Section 1 Your Expected Enrollment Status at the Start of the 2009-2010 Academic Year • Report your enrollment plans for the college you are most likely to attend • If unsure, report “Full-time” 42 Section 1 Work-Study and Student Loans If you are interested in either work-study (student employment) or student loans, or both, mark the appropriate box • Indicating interest does not obligate you to either work or borrow, nor will it cause you to lose grants and scholarships • Answering “neither” may restrict some options for limited work-study or loan funds 43 Section 2 (page 3) STUDENT DEPENDENCY STATUS 44 Section 2 Determination of Student Dependency Status 45 Section 2 Determination of Student Dependency Status 46 Section 2 Determination of Student Dependency Status • • If you answer “no” to all questions in this section, go to Section 3. For FAFSA filing purposes, you are considered a dependent student and are required to provide parental information If you answer “yes” to any question in this section, skip Section 3 and go to Section 4. You are considered an independent student for FAFSA filing purposes and are NOT required to provide parental information 47 Section 3 (page 4) PARENTAL INFORMATION 48 Section 3 Parental Information See Page 4 of FAFSA on the Web Worksheet about who is considered a parent • Biological or adoptive parent(s) • Stepparent (regardless of any prenuptial agreements) 49 Section 3 Parental Information • Do not provide information on: • Foster parents or legal guardians • If the student is in foster care or has a legal guardian, he/she is automatically considered an independent student • Grandparents or other relatives • The student must attempt to get biological parental information • Colleges may use Professional Judgment to allow the student to file as independent 50 Section 3 Parental Information • If the answer to any question is zero or the question does not apply, enter 0: $ , • Report whole dollar figures: $ • Recommendation: If your parents have not filed their 2008 federal tax return, use W-2 forms and/or other employment records to estimate total income 12 ,356 0 (no cents) 51 Section 3 Parents’ Marital Status as of Today Month and Year Your Parents were Married, Separated, Divorced, or Widowed M M Y Y Y Y 52 Section 3 Parent E-Mail Address PJONES@YAHOO.COM Fill in your parents’ e-mail address that will be valid at least until you start college • If you provide your parents’ email address, the FAFSA processor will let them know your FAFSA has been processed • 53 Section 3 Father’s and Mother’s SSN, Last Name, and Dates of Birth 2 3 4 5 6 7 8 9 0 JONES 0 5 0 0 0 0 3 0 0 1 9 5 9 0 0 0 0 PARKER 0 7 NOTE: 1 9 1 9 6 0 Provide this information for your parent(s) who complete Section 3 of the worksheet 54 Section 3 Parents’ State of Legal Residence GA M M Y Y Y Y • Indicate the two-digit state code for your parents’ permanent address • Leave question 74 blank if at least one of your parents whose information is used on this form began living in the state before January 1, 2004 55 Section 3 Parents’ Tax Return Filing Status for 2008 • Indicate your parents’ current tax filing status for 2008 • Which tax return did or will your parents file for 2008? • Even if your parent(s) did not file a 1040A or 1040EZ, read the instructions to see if they would have been eligible to do so • The FOTW Web site will ask if your parents have completed their 2008 tax return 56 Section 3 Parents’ Household 2008 Federal Benefits Indicate if you, your parents, or anyone in your parents’ household received benefits in 2007 or 2008 from any of the federal programs listed 57 Section 3 Parent Dislocated Worker A person may be considered a dislocated worker if he or she: • is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation • has been laid off or received a lay-off notice from a job • was self-employed but is now unemployed due to economic conditions or natural disaster • is a displaced homemaker 58 Section 3 Parent 2008 Adjusted Gross Income 45,250 • If your parents have not yet filed their 2008 federal tax return information, it is fine to estimate information for these questions • If your parents have completed their 2008 federal tax return, use 2008 tax return information to complete this item. Pay attention to specific line-items on 2008 federal tax return, if completed Reminder: If the answer is zero or the question does not apply, enter 0 59 Section 3 Money Earned from Work by Parent(s) in 2008 45,250 40,500 Use W-2 forms and other records to list all income in 2008 earned from work (including income earned from self-employment) 60 Section 3 Parents’ Income Tax Paid in 2008 2,130 • What was the amount your parents paid in income tax for 2008? – Use U.S. Income tax paid (or to be paid) • not the amount withheld from your parents’ paychecks 61 Section 3 Parents’ 2008 Tax Exemptions 05 • Enter your parents’ exemptions for 2008 Exemptions can be found on their IRS tax return • Be sure to include all persons being claimed on your parents’ 2008 federal tax return, regardless of whether they are included in your parents’ household size question 62 Section 3 Parents’ Household Information for 2009-10 05 • Include in your parents’ household: • yourself • your parent(s) • your parents’ other dependent children, if your parents provide more than half their support or the children could answer “no” to every question in Section 2, regardless of where they live • other people, if they now live with your parents and will continue to do so from 7/1/09 through 6/30/10, and if your parents provide more than half their support now, and will continue to provide support from 7/1/09 through 6/30/10 63 Section 3 Family Members Attending College in 2009-10 2 • • • Always include yourself even if you will attend college less than half-time in 2009-2010 Include other household members only if they will attend at least half time in 2009-2010 in a program that leads to a college degree or certificate Never include your parents NOTE: Some financial aid offices will require proof that other family members are attending college 64 Section 3 2008 Additional Financial Information 2,500 12,200 Enter the total from this Additional Financial Information sheet to Question 94 on page 5, Section 3 65 Section 3 2008 Untaxed Income 1,700 6,200 500 Enter the total from this 2008 Untaxed Income sheet to Question 95 on page 5, Section 3 66 Section 3 Parent Asset Information • List the net value of your parents’ assets as of the day you complete the FAFSA • If net worth is one million dollars or more, enter $ 9 9 9 , 9 9 9 • If net worth is zero, enter 0 $ , 0 NOTE: Some financial aid offices may request supporting documentation for the answers to these questions 67 Section 3 Parent Cash, Savings, and Checking 2,155 Report the current balance of your parents’ cash, savings, and checking accounts as of the day you complete the FAFSA 68 Section 3 Parent Investments 7,900 • • Net Worth means current value minus debt Investments include: • real estate (other than parents’ home) • trust funds • UGMA and UTMA accounts • money market and mutual funds • certificates of deposit • stocks and stock options • bonds and other securities • Coverdell IRAs • 529 plans owned by • • parents installment and land sale contracts commodities, etc. 69 Section 3 Parent Business and Investment Farms 23,600 • Business/Investment Farm includes: – market value of land, buildings, machinery, equipment, and inventory. Debt means only those debts for which the business was used as collateral NOTE: DO NOT include the home you live in, the value of life insurance and parent retirement plans (pension funds, annuities, non-education IRAs, Keogh plans, etc), or the value of a family owned and controlled small business with 100 or fewer full-time or full-time equivalent employees 70 Section 4 (page 6) STUDENT FINANCES 71 Section 4 Student Finances • Questions (34 – 40) are identical to the parent financial questions we covered in Section 3 • In these questions in Section 4: • • Report your 2008 income • If you are married, report spouse’s income and assets If you are single, ignore references to “spouse” 72 Section 4 Student Veterans’ Education Benefits For more information on Veterans’ Education Benefits, contact the VA at: (800) 827-1000 or www.va.gov 73 Section 4 Student Finances (Independent Students) Answer questions (96 – 103) in Section 4 only if you answered “yes” to at least one question in Section 2 – Student Dependency Status 74 Section 4 Student Finances (Independent Students) Include in your household: • • • you (and your spouse if married) your children, if you will provide more than half their support other people, if they now live with you and you provide more than half their support, and will continue to provide that level of support from 7/1/09 through 6/30/10 75 Section 4 Student Finances (Independent Students) • Count yourself even if you will attend college less that half-time in 20092010 • Include others only if they will attend at least half-time in 2009-2010 in a program that leads to a college degree or certificate 76 76 Section 4 Household Federal Benefits (Independent Students) Indicate if you, your spouse, or anyone in your household received benefits in 2007 or 2008 from any of the federal programs listed 77 Section 4 Dislocated Worker (Independent Students) A person may be considered a dislocated worker if he or she: • is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation • has been laid off or received a lay-off notice from a job • was self-employed but is now unemployed due to economic conditions or natural disaster • is a displaced homemaker 78 Section 5 (middle of page 7) COLLEGES TO RECEIVE INFORMATION 79 Section 5 School Information 001170 001328 023456 034567 List the schools you are most likely to attend, and then list others to which you are applying for admission 80 Section 5 School Information • • • List up to ten schools to which you are applying For faster and more accurate processing, write in both the Title IV school code and the school name • Check with each college’s financial aid office, your high school counselor, or the U.S. Department of Education’s website (www.fafsa.ed.gov) for a listing of federal school codes of the colleges to which you are applying Select the housing plan that best describes the type of housing you expect to have while attending each listed school 81 Section 5 School Information Strategies for Listing Colleges • • List those schools with the earliest financial aid deadlines, regardless of whether they are in-state or out-of-state If the student is applying to more than ten schools, wait for the processed Student Aid Report (SAR) and add additional schools via the Web or by phone 82 83 TYPES OF FAFSAs • • FAFSA on the Web Paper FAFSA 84 FAFSA ON THE WEB • Internet application used by students and parents to complete electronic FAFSA at www.fafsa.ed.gov • Processed more quickly than paper version • Sophisticated on-line edits so that errors are less likely to be made • Student and at least one custodial parent should get a federal PIN at www.pin.ed.gov 85 Application Filing Tips FAFSA on The Web • • Gather necessary documents ahead of time • Allow ample time to complete form for submission by deadline • Check the FAFSA for accuracy prior to submission • • Save all work periodically • Print out a copy of the FAFSA before submitting data • Keep a copy of the Submission Confirmation Page Complete a FAFSA on the Web Worksheet available at www.fafsa.ed.gov Sign the application using student and at least one parent’s PIN 86 Application Filing Tips Paper FAFSA • File early and meet all deadlines • Check the FAFSA for completeness and accuracy • • Sign and date FAFSA Make a copy of the FAFSA before mailing • Mail the FAFSA • Do not write any comments on the FAFSA • Do not include letters, tax forms, or worksheets • Use regular mail (not Registered or Certified) • Obtain a U.S. Postal Service Certificate of Mailing (cost is only $1.10) 87 Student Aid Report (SAR) • • • Regardless of whether the student uses FAFSA on the Web or submits a paper FAFSA, a SAR will be sent to the student • An electronic SAR will be sent if student provides an email address • A paper SAR will be mailed if no student e-mail address is provided An electronic copy of the data will be sent to each college or university listed by the student in Section 5 Keep a copy of the SAR with other financial aid documents 88 What Happens Next? Students and the colleges the student listed receive Student Aid Report (SAR) from federal processor (CAR) Students and families review SAR and CAR for important information and accuracy of data Colleges match admission records with financial aid applications and determine aid eligibility Colleges mail notices of financial aid eligibility to admitted students who have completed all required financial aid forms 89 Special Circumstances Contact the Financial Aid Office if there is: Loss or reduction in parent or student income or assets Death or serious illness Natural disasters affecting parent income or assets Unusual medical or dental expenses not covered by insurance Reduction in child support or other untaxed benefits Financial responsibility for elderly grandparents Any other unusual circumstances that affect a family’s ability to contribute to higher education 90 Summary of the Financial Aid Process • • • • • • • Submit all required forms, including the FAFSA, by each college’s published deadlines (insert any special state deadlines) Keep a copy of all forms submitted Review the electronic Student Aid Report (SAR) Acknowledgement or the paper SAR sent to the student Watch for financial aid award notifications from colleges to which the student has been admitted Be sure to apply for financial aid this year and every year as soon as possible after January 1 to receive the best financial aid award possible ASK QUESTIONS! 91 Questions and Answers 92