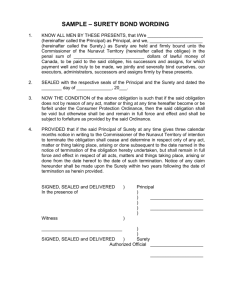

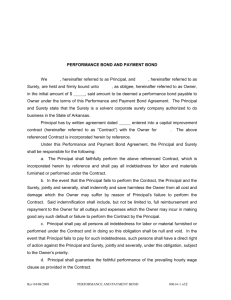

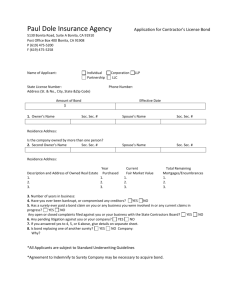

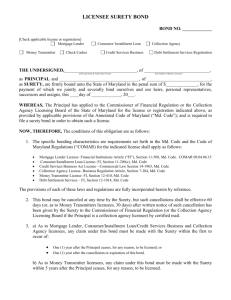

US Small Business Administration Surety Bond Guarantee Program

advertisement

News From the SBA: Successes, Initiatives, and Future Plans Joshua Etemadi, Construction Bonds Inc., a division of Murray Securus Frank Lalumiere, U.S. Small Business Administration Surety Bond Guarantee Program Michael Williams, CCI Surety BIOGRAPHIES Joshua A. Etemadi joined Construction Bonds Inc., a division of Murray Securus in 2007 where he focuses on helping small contractors significantly increase their bonding capacity. He has been very successful in moving contractors from non-standard market/SBA supported bonds to standard market surety credit in short periods of time. Mr. Etemadi serves on a number of NASBP committees including the Automation and Technology Committee, Government Relations, State Government Affairs, 5-15, and he is vice-chair of the Small Business Committee He is a member of the DC Metropolitan Subcontractors Association and serves on the Leadership, Education, Advocacy and Development (LEAD) committee. Joshua Etemadi can be reached at josh@sbabonds.com Michael Williams is president of CCI Surety, Inc. (CCI). CCI is a Managing General Underwriting Company with significant levels of underwriting authority for several corporate surety companies. CCI has the ability to underwrite nationwide and it utilizes many different tools to approve hard-to-place, non-standard, challenged contractor accounts. These tools consist of the US SBA Surety Bond Guarantee Program, Collateral, Funds Control, Bond Backs, and Third Party Indemnity. He is also president of North American Construction Services, Inc. (NACS). NACS is a nationwide Surety and non-surety Funds Control/Escrow Company. NACS has handled over 3000 construction projects since its inception on over $3 billion dollars in contract price. NACS works with many of the top fifty Surety companies in the US, Captive companies and Financial Institutions. Michael Williams can be reached at MWilliams@NacsEscrow.com Frank J. Lalumiere is director of the U.S. Small Business Administration Surety Bond Guarantee Program. He began his Government career in 1978 at the Defense Contract Management Command, Defense Logistics Agency. Prior to assuming his present position at Headquarters SBA in September 2005, he served in a number of operational and staff positions, including Deputy Associate Administrator for Government Contracting & Business Development with SBA, and Chairperson of the Defense Acquisition Regulatory Council Subcommittee on Contract Administration, and Executive Director for Major Program Support at the Defense Contract Management Agency. Frank Lalumiere can be reached at Frank.Lalumiere@sba.gov 2 Surety Bond Guarantee Program Frank J. Lalumiere 7 December 2012 FY 2012Most productive year since 1998… 4 FY 2012• More bonds and larger contracts • More small businesses and 5 new surety companies • 31% increase in bond producers • New “Quick App” 5 FY 2012 at a glance• 9,500 bonds - 10% increase • $4 billion in contract value • 1,125 small businesses - 26% increase • 21 participating surety companies 6 New Surety Participants FCCI Insurance Company, Sarasota, FL Indemnity Company of California, Irwine, CA Developers Surety and Indemnity Company, Irwine, CA Philadelphia Indemnity Insurance Company, Bala Cynwyd, CA Westchester Fire Insurance Company, Philadelphia, PA 7 Participating Surety Companies Prior Approval: Aegis Security Insurance Company American Contractors Indemnity Company American Safety Casualty Insurance Company Bankers Insurance Company Berkley Regional Insurance Company Contractors Bonding & Insurance Company Developers Surety and Indemnity Company 8 Participating Surety Companies Prior Approval: FCCI Insurance Company First Net Insurance Company Great American Insurance Company of New York Indemnity Company of California Philadelphia Indemnity Insurance Company The Guarantee Company of North America USA 9 Participating Surety Companies Prior Approval: The Hartford Fire Insurance Company West Bend Mutual Insurance Company 10 Participating Surety Companies Preferred: CNA: Western Surety Company Great American Insurance Company SureTec Insurance Company Travelers Casualty and Surety Company of America U. S. Specialty Insurance Company 11 Key Performance Measures • Prior Approval Application cycle time – 2 days • Claims cycle time – 6 days 12 Quick Bond App • Used for Initial Contract Amounts of $250,000 or less • Combines two forms • SBA Form 990 – Guarantee Agreement • SBA Form 994 – Application for Guarantee Assistance • Required Forms • SBA Form 912 • General Indemnity Agreement 13 Quick Bond App, Continued • Not Required • Business Financial Statements • IRS Tax Returns • Personal Financial Statement • Letters of Reference • Credit References/Bank 14 Quick Bond App, Continued • Exclusions Apply • Previous default • Work on project has started • Warranty/Maintenance period exceeds 12 months • Liquidated damages exceeds $250 per day • Contract involves asbestos abatement, hazardous waste removal, demolition, or timber sales 15 FY 13 Goals • Continued growth – bonds – small businesses • Refinements to Quick App • More surety companies/more bond producers 16 SBA Headquarters www.sba.gov/osg Frank Lalumiere Director, OSG 409 3rd Street S.W. Washington, D.C. 20416 (202) 205-6540 (202) 401-8275 17