Understanding Surety Bonds - National 8(a) Association

advertisement

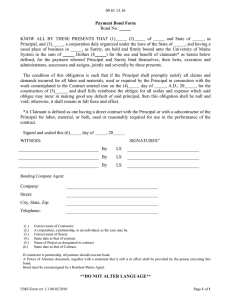

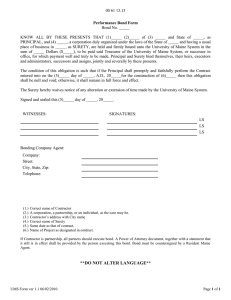

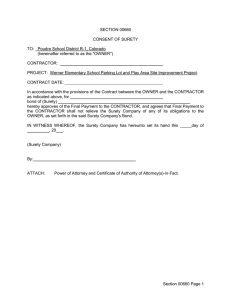

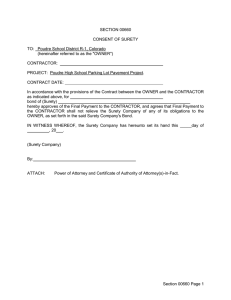

By: Scott Mahorsky A surety bond is a written agreement where one party, the surety, obligates itself to a second party, the obligee/owner, to answer for the default of a third party, the principal/contractor. Surety Contractor Owner Bid Bond Performance & Payment Maintenance Others – Supply, Subdivision, Judicial, Mining, etc… Agent ◦ Execution ◦ Role ◦ Large Markets Travelers CNA Arch Liberty Zurich ◦ Small/Medium Markets Aegis Capitol Hudson IFIC NAS Surety Differing Sizes ◦ Large Sureties = Larger Contractor Preferences ◦ Federal Work ◦ State Work ◦ Smaller Markets = Smaller Contractor ◦ Subdivisions ◦ Commercial Surety Character Financials Bank Line of Credit Experience/Work History ◦ Resumes of Key Employees ◦ Job References ◦ Awards Working Capital Equity Total Bond Program Cost to Complete Bond Program Total Bond Program $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $0 Total Bond… Elite agencies will look support your business. Quality of Agent Agent Relationship with Sureties Technical Ability Focus on Surety Understands Federal Marketplace Sureties ◦ Track Record Overall - Losses Resumes ◦ ◦ ◦ ◦ Construction Accountants & Financial Reporting Project Types & Profitability ◦ IDIQ ◦ SATOC ◦ MATOC/MACC Build a Team Construct a Long Range Plan/Strategy Profits Letters – Better Opportunities Less Dependence on Large Contractors Economy ◦ Increased risk for owners, contractors & sureties caused by current economy ◦ Continued disciplined underwriting, exposure management & project analysis ◦ More competition, fewer projects Mergers