Chapter 12.2 notes - Effingham County Schools

advertisement

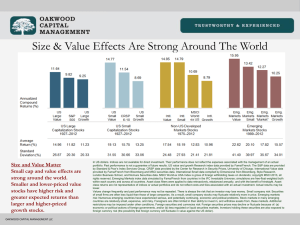

Chapter 11.2 notes Why invest? Basic Investment Considerations • Risk-return relationship – the more your risk, the higher the potential return • Investment objectives – retirement, vacations, college fund? • Simplicity – don’t invest in something you don’t understand • Consistency – invest consistently over long periods of time diversification • Putting money into different investments, different risk levels, etc. Chapter 11.3 notes Stocks The basics • You invest in a stock at a certain price per share • You make money when the price goes up • Called capital gains 2 types of stock • Common – gives voting rights • Preferred – gives a share of profits, but no voting rights Organized Stock Exchanges • • • Stock is sold through exchanges Securities Exchanges – places where buyers and sellers meet to trade securities New York Stock Exchange (NYSE) – oldest and largest original exchange; in NYC; use auctioning process through face to face trading; now a lot of trades are electronic What it looks like Outside on Wall St. Inside on the floor Over-the-Counter Markets • OTC – electronic marketplace for securities that are not traded on an organized exchange. National Association of Securities Dealers Automated Quotation (NASDAQ) • • • • • most important OTC largest electronic stock market trading is done w/ a computer and telecommunications network that connects investors in over 80 countries over 4,000 stocks Measures of Stock Performance • • Dow-Jones Industrial Average – most popular and widely publicized measure of stock performance. 30 stocks including B of A, Exxon, Coke, GE, Wal-mart and Disney; measured in points Standard and Poor’s 500 – measures price changes of 500 stocks Bull vs. Bear • Bull v. Bear Markets – Bull = strong w/ prices going up for a while; Bear = “mean” market, w/ prices falling sharply for several months The Bronze Bull