saving rate à steady-state capital-per-worker à steady

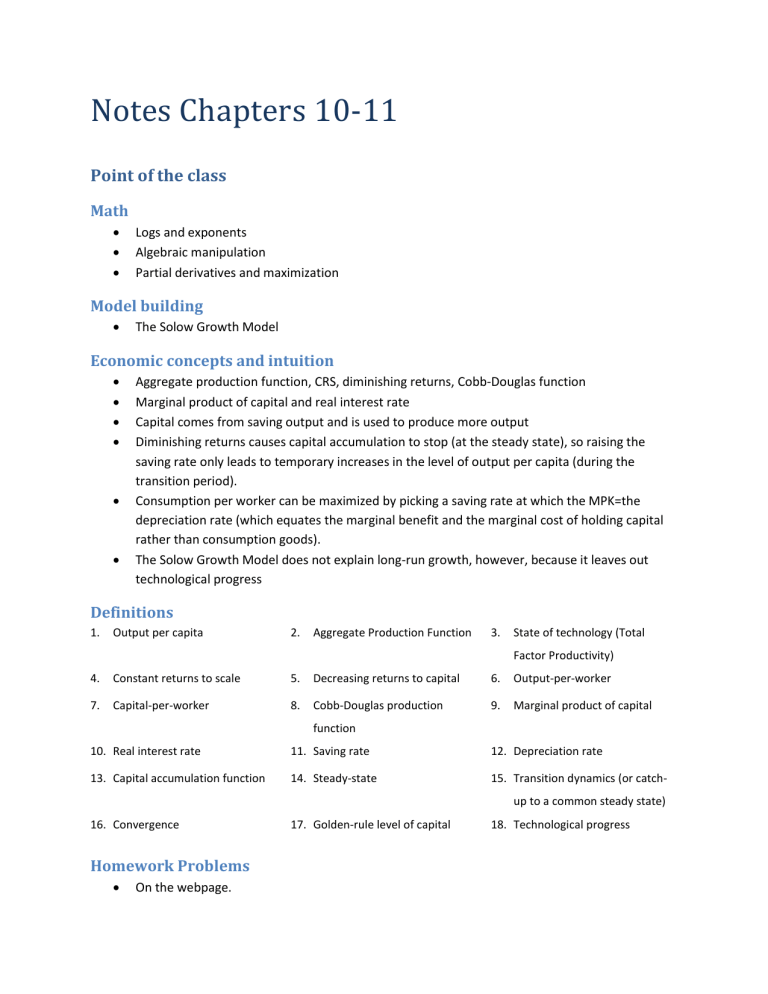

Notes Chapters 10-11

Point of the class

Math

Logs and exponents

Algebraic manipulation

Partial derivatives and maximization

Model building

The Solow Growth Model

Economic concepts and intuition

Aggregate production function, CRS, diminishing returns, Cobb-Douglas function

Marginal product of capital and real interest rate

Capital comes from saving output and is used to produce more output

Diminishing returns causes capital accumulation to stop (at the steady state), so raising the saving rate only leads to temporary increases in the level of output per capita (during the transition period).

Consumption per worker can be maximized by picking a saving rate at which the MPK=the depreciation rate (which equates the marginal benefit and the marginal cost of holding capital rather than consumption goods).

The Solow Growth Model does not explain long-run growth, however, because it leaves out technological progress

Definitions

1.

Output per capita

4.

7.

Constant returns to scale

Capital-per-worker

10.

Real interest rate

13.

Capital accumulation function 14.

Steady-state

16.

Convergence

2.

Aggregate Production Function 3.

State of technology (Total

Factor Productivity)

5.

Decreasing returns to capital 6.

Output-per-worker

8.

11.

17.

Cobb-Douglas production function

Saving rate

Golden-rule level of capital

9.

Marginal product of capital

12.

Depreciation rate

15.

Transition dynamics (or catchup to a common steady state)

18.

Technological progress

Homework Problems

On the webpage.

Facts

Facts about growth

See Notes for Ch 20, ECON 201

Why does GDP per worker increase?

1950 1960 1970 year

1980 1990

Real GDP per capita, Korea

Real GDP per capita, Nicaragua

2000

It would seem that it has a lot to do with the amount of capital that each worker in the economy gets to use, as we can see in the following graph:

PARAGUAY

IVORY COAST

KENYA

POLAND

PHILIPPINES

U.S.A.

IRELAND

SYRIA

GREECE

JAPAN

TAIWAN

AUSTRALIA NORWAY

GERMANY, WEST

FINLAND

SWITZERLAND

0 .5

1

Capital per worker (US=1)

1.5

Real GDP per worker, actual

Penn World Table 5.6. 1985 data

RGDP, predicted

2

Pretty obviously, having more capital-per-worker helps. But if this were the whole explanation, the

United States would be poorer than Finland or Switzerland, which is not the case. As we’ll see below, the extra output that can be obtained from extra capital is limited by diminishing returns.

It turns out that improvements in technology are crucial. A measure of technology is Total Factor

Productivity. What determines TFP? Things like human capital, research and development, and institutions.

U.S.A.

ICELAND

CANADA

NETHERLANDS

AUSTRALIA

U.K.

SWEDEN

NORWAY

PARAGUAY

SPAIN

HONG KONG

MEXICO

VENEZUELA

ARGENTINA

IRAN

JAPAN

FINLAND

YUGOSLAVIA GREECE

MAURITIUS

PORTUGAL

CHILE

TAIWAN

KOREA, REP.

SWITZERLAND

TURKEY

THAILAND

NIGERIA

0 .5

Real GDP per worker, 1985

1

So a combination of both is what drives living standards 𝑦 = 𝐴𝑘

1/3

But this just begs the question. Where does capital come from? The following is the Solow Growth

Model, which endogenizes capital accumulation: it explains why countries accumulate capital, and the level of capital-per-worker at which they will reach long-term equilibrium, or the steady state.

Model Building

Simplifications

A worker is a worker, no matter the qualifications (homogenous labor)

A unit of capital is a unit of capital, no matter what it actually is (homogenous capital)

Technology is just the function that connects K and N to Y. An engineering blueprint.

There’s no unemployment (or it doesn’t change)

Constant returns to scale

The economy is closed and the financial market works perfectly, so 𝐼 = 𝑆 + (𝑇 − 𝐺) .

National saving equals investment.

Saving is simply a proportion of income 𝑆 = 𝑠𝑌 .

Building Blocks

If we are trying to explain capital accumulation, we need to explain why capital is accumulated (to produce output) and how capital is accumulated (by saving and purchasing new capital goods).

Aggregate production function

Output is produced with capital and labor … so that’s what capital is used for! Notice the role of A. This is the state of technology, which allows all the factors to be productive and determines how much output will be produced from given quantities of capital and labor.

𝑌 = 𝐴𝐹(𝐾, 𝑁)

Diminishing returns to individual inputs

2𝑌 > 𝑌′ = 𝐹(2𝐾, 𝑁)

Constant returns to scale

2𝑌 = 𝐹(2𝐾, 2𝑁)

Output-per-worker and capital-per-worker. CRS implies that if we divide the right-hand side by a number, “N”, the left-hand side will change by the same factor

𝑌

𝑁

= 𝐴𝐹 (

𝐾

𝑁

,

𝑁

𝑁

) = 𝐴𝐹 (

𝐾

𝑁

, 1) 𝑦 = 𝐴𝑓(𝑘, 1) = 𝐴𝑓(𝑘)

𝑌

From now on,

𝑁

= 𝑦 and

𝐾

𝑁

= 𝑘 . Suppose we double the number of workers and the number of units of capital. What happens to output? It doubles, by CRS. What happens to output per capita? Nothing.

𝑌

𝑁

=

2𝑌

2𝑁

= 𝐴𝐹 (

2𝐾

2𝑁

,

2𝑁

2𝑁

)

We want the “F” function to exhibit both CRS and diminishing returns to K. We can ensure CRS by writing it as a “per worker function”, but we must pick a particular function to make it diminishing returns. Log and square root ( 𝑦 = 𝐴√𝑘 ) both fit the bill. A special kind of very useful function is the

Cobb-Douglas function. capital per worker, k

5000 𝒚 = √𝒌

=sqrt(5000) k

Diminishing returns to capital

5000

k 𝒚 = √𝒌

70.71068

y

6000 1000 77.45967 6.748989

7000 1000 83.666 6.206336

8000 1000 89.44272 5.776716

Cobb-Douglas Production function

𝑌 = 𝐴𝐾 𝛼 𝑁 1−𝛼

, 0 < 𝛼 < 1

Diminishing returns to individual inputs

2𝑌 > 𝑌′ = 𝐹(2𝐾, 𝑁)

Properties of exponents

𝑌′ = 𝐴(2𝐾) 𝛼 𝑁 1−𝛼 = 𝐴2 𝛼 𝐾 𝛼 𝑁 1−𝛼

𝑌 ′ = 2 𝛼 𝑌 < 2𝑌

Constant returns to scale

2𝑌 = 𝐹(2𝐾, 2𝑁)

𝑌

′

= 𝐴(2𝐾) 𝛼 (2𝑁) 1−𝛼

= 𝐴2 𝛼 (𝐾) 𝛼

2

1−𝛼

𝑁

1−𝛼

𝑌 ′ = 𝐴2 𝛼 2 1−𝛼 (𝐾) 𝛼 𝑁 1−𝛼 = 𝐴2 𝛼+1−𝛼 (𝐾) 𝛼 𝑁 1−𝛼 = 2𝐴(𝐾) 𝛼 𝑁 1−𝛼

𝑌 ′ = 2𝑌 𝑥 𝑛 𝑦 𝑛 = (𝑥𝑦) 𝑛 𝑥 𝑛 𝑥 𝑚 = 𝑥 𝑛+𝑚 𝑥 𝑛 𝑥 𝑚

= 𝑥 𝑛−𝑚

(𝑥 𝑛 ) 𝑚

= 𝑥 𝑛𝑚

Per-worker functions

𝑌

𝑁

=

𝐴𝐾 𝛼

𝑁

1−𝛼

𝑁

=

𝐴𝐾 𝛼

𝑁 𝛼

𝑁

1−𝛼

𝑁 1−𝛼

𝑌

𝑁

= 𝐴 (

𝐾

𝑁

) 𝛼

(

𝑁

𝑁

)

1−𝛼 𝑦 = 𝐴𝑘 𝛼 capital per worker, k

0

1000 y=k 0.45

=(B3)^0.45

=(B4)^0.45 y=k 0.5

=(B3)^0.5

=(B4)^0.5 y=k 0.55

=(B3)^0.55

=(B4)^0.55

Allocating Resources

How do firms decide how much capital and how much labor to use? They maximize their profits.

Their profits might be given by a profit function such as this,

𝑃𝐹(𝐾, 𝐿) − 𝑟𝐾 − 𝑤𝑁 which simply says that profit is the difference between revenue (price times output) minus costs

(rental for capital, wage for labor)

A little bit of Calculus: the Power Rule 𝑓(𝑥) = 𝑎𝑥 𝑛 𝑑𝑓(𝑥) 𝑑𝑥

= 𝑓′(𝑥) = 𝑎𝑛𝑥 𝑛−1 𝑓(𝑥) = 2𝑥

2

+ 3𝑥 + 5 𝑓(𝑥) = 2𝑥 2 + 3𝑥 1 + 5𝑥 0 𝑓 ′(𝑥) = 2(2𝑥 2−1 ) + 3(1𝑥 1−1 ) + 5(0𝑥 0−1 ) 𝑓′(𝑥) = 4𝑥

1

+ 3

So the firm maximize this function by choosing capital and labor. a function max

𝐾,𝑁

[𝑃𝐹(𝐾, 𝐿) − 𝑟𝐾 − 𝑤𝑁] max

𝐾,𝑁

[𝑃𝐴𝐾 𝛼 𝑁 1−𝛼 − 𝑟𝐾 − 𝑤𝑁] max

𝐾,𝑁

[𝑃𝐴𝐾

1/3

𝑁

2/3

− 𝑟𝐾 − 𝑤𝑁] its derivative

To do that, we simply find the slope of the profit function (the derivative) and find where the slope =0.

That would be where the function reaches a maximum.

General version

Profit = 𝐹(𝐾, 𝑁) − 𝑟𝐾 − 𝑤𝑁

𝜕𝐹(𝐾,𝐿)

𝜕𝐾

− 𝑟 = 0

𝑀𝑃𝐾 = 𝑟

Cobb-Douglas, 𝛼 = 1/3 , version

Profit = 𝐴𝐾

1/3

𝑁

2/3

− 𝑟𝐾 − 𝑤𝐿

1

3

𝐴𝐾

1/3−1

𝑁

2/3

− 𝑟 = 0

1 𝐴𝐾

1/3

𝑁

2/3

3 𝐾

= 𝑟

𝑀𝑃𝐾 =

1 𝑌

3 𝐾

= 𝑟

So for a Cobb-Douglas function, the marginal product of capital is proportional to the average amount of output produced by K, where the factor of proportionality is

=1/3. k MPK

27

64

0.037

0.021

125 0.013

216 0.009

To do the same for labor, take a derivative of the profit function with respect to labor and set it equal to zero

1

8

0.333

0.083

𝜕𝐹(𝐾,𝑁)

𝜕𝑁

− 𝑤 = 0

𝑀𝑃𝐿 = 𝑤

2

3

𝐴𝐾

1/3

𝑁

2/3−1

− 𝑤 = 0

2 𝑌

3 𝑁

= 𝑤

So the marginal product of labor is proportional to the average amount of output produced by N, where the factor of proportionality is (1-

)=2/3.

Why does this solution make economic sense?

So the capital share of output is

=1/3:

1

3

= 𝑟

𝐾

𝑌

This also means that the stock market is, actually, savers’ valuation of the stock of capital. So the labor

share of output is (1-

)=2/3:

2

3

= 𝑤

𝑁

𝑌

This has been found to be approximately true in practice. So we’ll keep using

=1/3.

The Real Interest Rate

The Real Interest Rate is the amount of output that a person can earn by saving one unit of output.

Now, a unit of saving is used as a unit of investment, which is a new unit of capital, which produces an extra unit of output (MPK, the marginal product of capital). So the income that can be earned from saving – the real interest rate – is equal to the marginal product of capital.

𝑀𝑃𝐾 = 𝑟 capital stock at its optimal

𝑀𝑃𝐾 > 𝑟 firms can borrow more and earn MPK above the borrowing cost. As they borrow more, they drive the real interest rate up.

𝑀𝑃𝐾 < 𝑟 firms that borrow to buy capital find that the borrowing cost exceeds the returns from buying capital. As they borrow less, they drive the real interest rate down.

Saving Behavior

Nations finance capital accumulation by giving up consumption.

Income is either saved or consumed 𝐶 + 𝑆 = 𝑌

Output is either consumption goods or investment goods 𝐶 + 𝐼 = 𝑌

Saving comes from households or firms ( 𝑆 𝑝𝑟𝑖𝑣𝑎𝑡𝑒

), from the government ( 𝑇 − 𝐺 ), or from foreigners, who send us their capital inflows ( 𝐾𝐼 ), for example in the shape of foreign aid or loans. So national saving 𝑆 = 𝑆 𝑝𝑟𝑖𝑣𝑎𝑡𝑒

+ (𝑇 − 𝐺) + 𝐾𝐼 .

If the financial market works perfectly, so that every unit saved gets lent out to productive uses,

𝐼 = 𝑆

National saving equals investment. How much do people save? Assume that saving is simply a proportion of income

𝑆 = 𝑠𝑌

Although saving rates (s) do vary over time and in response to the real interest rate, they don’t seem to be related to whether the country is poor or rich, and they don’t seem to change as a country grows richer. Combining both equations, we get

𝐼 𝑡

= 𝑆 𝑡

= 𝑠𝑌 𝑡

Y

100

200

I=(0.5)Y

=0.5*$O3

=0.5*$O4

Investment Allocation equation

I=(0.6)Y

=0.6*$O3

=0.6*$O4

I=(0.7)Y

=0.7*$O3

=0.7*$O4

Capital Accumulation

Investment is purchases of capital, so investment = accumulation of new capital … if no capital depreciates. But some capital does depreciate, by a rate

.

−𝛿 𝐾 𝑡

K

1000

2000

K=(0.1)K

100

200

K=(0.125)K

125

250

So next period’s capital is 𝑛𝑒𝑥𝑡 𝑝𝑒𝑟𝑖𝑜𝑑 ′ 𝑠 𝐾

= 𝑙𝑎𝑠𝑡 𝑝𝑒𝑟𝑖𝑜𝑑 ′ 𝑠 𝐾

+ 𝐼 ⏟ 𝑡 𝑛𝑒𝑤 𝐾 𝑝𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑠

−

𝐾 𝑡ℎ𝑎𝑡 𝑑𝑖𝑠𝑎𝑝𝑝𝑒𝑎𝑟𝑠

K=(0.15)K

150

300

𝐾 𝑡+1

− 𝐾 𝑡

= 𝐼 𝑡

− 𝛿𝐾 𝑡

Time

0

K t

1000

I t

200

K t

100

K t

100

1

1100 200 110 90

2

1190 200 119 81

3 1271 200 127.1 72.9

4 1343.9 200 134.39 65.61

5 1409.51 200 140.951 59.049

Combining the Capital Accumulation equation with the Investment Allocation equation and writing it as a per-worker function

𝐾 𝑡+1

= 𝐼 𝑡

+ (1 − 𝛿)𝐾 𝑡

𝐾 𝑡+1

= 𝑆 𝑡

+ (1 − 𝛿)𝐾 𝑡

𝐾 𝑡+1

= 𝑠𝑌 𝑡

+ (1 − 𝛿)𝐾 𝑡

𝐾 𝑡+1

𝑁

𝑌

= 𝑠

𝑁 𝑡

+ (1 − 𝛿)

𝐾 𝑡

𝑁 𝑘 𝑡+1

= 𝑠𝑦 𝑡

+ (1 − 𝛿)𝑘 𝑡

The change of capital-per-worker is 𝑘 𝑡+1

− 𝑘 𝑡

= 𝑠𝑦 𝑡

− 𝛿𝑘 𝑡

∆𝑘 𝑡

= 𝑠𝑦 𝑡

− 𝛿𝑘 𝑡

Capital Accumulation equation

If we were wondering at what point capital doesn’t change, that would be

∆𝑘 𝑡

= 0 = 𝑠𝑦 𝑡

− 𝛿𝑘 𝑡 𝑠𝑦 𝑡

= 𝛿𝑘 𝑡

So capital accumulation stops when investment-per-worker (new capital-per-worker; the portion of output-per-worker that is saved) is equal to the portion of old capital-per-worker that depreciates away.

This point is called the Steady State 𝑠𝑦 𝑡

= 𝛿𝑘 𝑡 𝑠𝑦 𝑡

> 𝛿𝑘 𝑡 capital stock is constant, capital stock grows,

∆𝑘 𝑡

= 0 ,

∆𝑘 𝑡

> 0 , the economy is at the steady state the economy is below the steady state 𝑠𝑦 𝑡

< 𝛿𝑘 𝑡 capital stock declines,

Production Function

∆𝑘 𝑡

< 0 , the economy is above the steady state 𝑦 = 𝐴𝑘 1/3

Labor and Technology

For the moment, assume that both labor and technology are constant.

Production function

We don’t need a C=(1-s)Y equation: it’s already implied in all the above.

Putting the Building Blocks Together

Solow Diagram

What is the graph of 𝑠𝑦 𝑡

, with k in the horizontal axis? Plug the production function into it, assuming the saving rate s=0.75: 𝑠𝑦 𝑡

= 𝑠𝐴𝑘 𝑡

1/3

= 0.75𝐴𝑘 𝑡

1/3

What is the graph of 𝛿𝑘 𝑡

? A linear function, since the depreciation rate doesn’t depend on the level of capital.

Put them together

The Principle of Transition Dynamics – “Catch up”

∆𝑘 𝑡

= 𝑠𝑦 𝑡

− 𝛿𝑘 𝑡

∆𝑘 𝑡

= 𝑠𝐴𝑘

1 𝑡

3

− 𝛿𝑘 𝑡

∆𝑘 𝑡

= 0.75𝐴𝑘 𝑡

1/3

− 0.05𝑘 𝑡

When the capital stock is low, o it is highly productive (its MPK is very high) o high MPK means a relatively high real interest rate, which attracts saving o lots of saving lead to lots of investment on new capital, o lots of investment overwhelm the amount of depreciation, so capital accumulates

The farther below the steady state the economy is, the faster capital accumulates. k y

𝑨𝒌 𝟏/𝟑

I

𝟎. 𝟕𝟓𝑨𝒌 𝟏/𝟑

k

𝟎. 𝟎𝟓𝒌

8

20

27

2.00

2.71

3

1.5

2.04

2.25

0.4

1.0

1.35

58.09475019 3.872983346 2.90473751 2.90473751

64

125

216

4

5

6

3

3.75

4.5

3.2

6.25

10.8

𝟏

k 𝒔𝑨𝒌 𝟑 𝒕

− 𝜹𝒌 𝒕

1.1

1.04

0.9

0

-0.2

-2.5

-6.3

When the capital stock is high, o it is not very productive (its MPK is rather low) o low MPK means a relatively low real interest rate, which fails to attract saving o little saving leads to little investment on new capital, o little investment fails to maintain existing capital as it depreciates, so capital de-accumulates

The farther above the steady state the economy is, the faster capital de-accumulates.

When the capital stock is at the steady state, o the MPK is such that

… the resulting real interest rate attracts just the right amount of saving

… that generates just the right amount of investment

… so that the amount of new capital is exactly equal to the amount of capital that depreciates o so the capital stock doesn’t change.

Steady State and its determinants

How do we find the steady state?

The definition of steady-state capital-per-worker (denoted as 𝑘 𝑡

∗

) is

∆𝑘 𝑡

∗

= 0 o For this reason, steady-state output-per-worker doesn’t change ( 𝑦 𝑡

∗

).

∆𝑦 𝑡

∗ = 0

If the capital stock is not changing ( ∆𝑘 𝑡

∗

= 0 ), then

∆𝑘 𝑡

∗

= 𝑠𝑦 𝑡

∗

− 𝛿𝑘 𝑡

∗

= 0

∆𝑘

∗ 𝑡

= 𝑠𝐴(𝑘 𝑡

∗ ) 𝛼

− 𝛿𝑘 𝑡

∗

= 0 𝑠𝐴(𝑘 𝑡

∗ ) 𝛼 = 𝛿𝑘 𝑡

∗ 𝑠𝐴 𝛿

=

(𝑘 𝑘 𝑡

∗ 𝑡

∗ ) 𝛼 𝑠𝐴 𝛿

= (𝑘 𝑡

∗ ) 1−𝛼 𝑘 𝑡

∗

1

= ( 𝑠𝐴 𝛿

)

1−𝛼

So the steady-state level of capital-per-worker will be o a positive function of the saving rate (s) o a positive function of total factor productivity (A) o a positive function of the contribution of capital to production (

). o a negative function of the depreciation rate (

). 𝑦 𝑡

∗ = 𝐴(𝑘 𝑡

∗ ) 𝛼 = 𝐴 [( 𝑠𝐴 𝛿

1

)

1−𝛼

] 𝛼 𝑦 𝑡

∗

1

= (𝐴) 1−𝛼 𝛼

⁄ )

1−𝛼

Notice that this means that the steady-state level of output-per-worker really depends on the level of productivity. Not only A is part of the production function, making capital more productive – it’s also a key determinant of capital-per-worker itself.

1

And yet, as important as Total Factor Productivity is in the Solow Growth Model, it is left as an exogenous variable.

A useful concept is the “capital/output ratio”: 𝑘 𝑡

∗ 𝑦 𝑡

∗

=

1

( 𝑠𝐴 𝛿

)

1−𝛼

1

𝐴 [( 𝑠𝐴 𝛿

)

1−𝛼

] 𝛼

=

( 𝑠𝐴 𝛿

1−𝛼

)

1−𝛼

𝐴

= 𝑠 𝛿

Interestingly, this doesn’t depend on productivity (A) or on

.

1 One way to note how important TFP is in the Solow Growth Model is to note that the exponent on A in the

1 formula for steady-state output-per-worker is larger than in the plain production function: > 1.

1−𝛼

Testing the Solow Growth Model

To test a model, we need to get it to generate a prediction. A simple, single, sharp prediction that involves actual data that we can get our hands on.

The Capital-Output Ratio

It turns out that we can get our hands on the “capital/output ratio”, the ratio of the capital stock in an economy to GDP.

The biggest shortcoming of the Solow model is that it doesn’t take into account TFP (which we denote as

A) . But since the capital/output ratio doesn’t depend on A, perhaps we can use it to test the Solow

Growth Model. If the model cannot explain the data even after we’ve kept A out of the picture, it’s a pretty useless model indeed. But we will accept the Solow Growth Model if the data supports the idea that, more or less, 𝑘 𝑡

∗ 𝑦 𝑡

∗

= 𝑠 𝛿

The problem of this little formula, though, is that it has two variables in it. We can deal with this through multi-variable regression, but what if the depreciation rate is very similar across the world?

Then the capital/output ratio should simply depend positively on the saving rate (or the investment rate). This turns out to be true!

Convergence

Suppose we have two economies with the same level of productivity, the same depreciation rate, the same investment rate and the same production function. Then they must have the same steadystate level capital-perworker.

Now imagine one has a lower level capital-perworker. If an economy grows faster if its father away from the steady state, then it must be the case that this economy is growing faster. So if we plot the growth rate of countries that are pretty similar, such as the countries in the Organization for Economic Cooperation and Development, against the actual output-per-capita a few decades ago, we should find that the countries that were poorest have grown the fastest. This is the principle of transition dynamics at work: it implies the convergence, or catch-up over time, of the GDP-per-capita of countries that have similar enough technologies.

What about countries that don’t have the same technology or production function? We would expect them to have different steady states. It’s perfectly plausible that, the economy of the United States and the economy of

Zimbabwe are already at their steady states, so we would expect their average growth rates to be pretty darn close to independent of how rich they are.

Comparative Statics in the Solow Growth Model

𝛼 = 1/3 , 𝑠 = 0.50

, 𝛿 = 0.05

, and 𝐴 = 1

∆𝑘 𝑡

= 0.75(1)(𝑘 𝑡

∗ ) 1/3 − 0.05𝑘 𝑡

= 0

0.75(1)(𝑘

∗ 𝑡

) 1/3

= 0.05𝑘 𝑡

∗

0.75(1)

0.05

=

(𝑘 ∗ 𝑡 𝑘 𝑡

∗

) 1/3

0.75(1)

0.05

= (𝑘 𝑡

∗ )

1−

1

3 𝑘 𝑡

∗ = ( 𝑠𝐴 𝛿

1

)

1−𝛼

= (

0.75(1)

0.05

)

1

1−

1

3 = (15) 3/2 = 58.09

𝑦 𝑡

∗ = 𝐴(𝑘 𝑡

∗ ) 𝛼 = 𝐴[58.09] 𝛼 = 1[58.09] 1/3 = 3.87

Change the saving rate so now 𝑠 = 0.375

.

The production function is as high as it was before: the MPK will behave just as it used to, capital will be just as productive. But now people aren’t saving as much per unit of output – they are not thinking about the future that much. They are perfectly content to stop capital accumulation sooner, which makes them poorer in the long run (but since before they were barely eating and now they get to eat more, perhaps they’ll be better off – see below).

0.375(1)(𝑘 𝑡

∗ ) 1/3

= 0.05𝑘 𝑡

∗

0.375(1)

=

0.05

𝑘 𝑡

∗

(𝑘 𝑡

∗ ) 1/3

= (𝑘 𝑡

∗ )

1−

1

3 𝑘 𝑡

∗

= (

1

0.375(1)

0.05

)

1−

1

3 = (7.5)

3/2

= 20.54

𝑦 𝑡

∗

= 𝐴(𝑘 𝑡

∗

) 𝛼

= (1)[20.54]

1

3 = 2.74

Change TFP so now 𝐴 = 0.5

. Return the saving rate to 𝑠 = 0.75

The production function shifts down, so each level of capital-per-worker produces much less output-perworker, so there’s less available for saving and accumulating capital. Hence capital accumulation stops much sooner. A lower TFP makes workers less productive, so the marginal product of capital is smaller, the real interest rate is smaller, less saving is attracted, and less capital is accumulated – which means that the point where new investment doesn’t compensate for depreciation is reached earlier.

0.75(0.5)(𝑘 𝑡

∗ ) 1/3

= 0.05𝑘 𝑡

∗

0.75(0.5)

0.05

= (𝑘 𝑡

∗ )

1−

1

3 𝑘 𝑡

∗

= (

0.75(0.5)

0.05

)

1

1−

1

3 = (7.5)

3/2

= 20.54

𝑦 𝑡

∗

= 𝐴(𝑘 𝑡

∗ ) 𝛼

= 0.5[20.54]

1/3

= 1.37

Is the effect of lowering the saving rate the same as the effect of lowering A? Steady-state capital-perworker, though lower than in the initial setting ( 𝑠 = 0.75, 𝐴 = 1 ) is the same as it was in the previous example ( 𝑠 = 0.375, 𝐴 = 1 ).

A s k*

1.00

0.50

0.75

0.75

0.05

0.05

0.33

0.33

58.09

20.54

1.00 0.375 0.05 0.33 20.54

(In the k* function, halving A or halving s give the same result.) y*

3.87

1.37

2.74

But changing TFP changes both the production function and steady-state capital-per-worker. Relatively un-productive workers have less capital-per-worker, so when TPF falls by 50%, steady-state output falls by even more.

The economy can do less with the same level of capital: the production function is lower than previously, so this same level of k* is less productive. Output per worker is lower, even though the level of capital is the same.

Change the depreciation rate so now 𝛿 = 0.04

. Return to 𝑠 = 0.75

and 𝐴 = 1 .

Because the capital stock depreciates more slowly, capital-per-worker keeps growing for a longer time before it stops.

0.75(1)(𝑘

∗ 𝑡

) 1/3

= 0.10𝑘 𝑡

∗ 𝑘 𝑡

∗ = (

0.75(1)

0.04

)

1

1−

1

3 𝑘 𝑡

∗ = (18.75) 3/2 = 81.19

𝑦 𝑡

∗

= 𝐴(𝑘 𝑡

∗ ) 𝛼

= (1)[81.19]

1

3 = 4.33

Change the capital contribution to output so now 𝛼 = 0.25

. Return to 𝛿 = 0.05

, 𝑠 = 0.75

and 𝐴 = 1 .

Remember that the formula for the MPK (in the Cobb-Douglas function) is 𝑀𝑃𝐾 = 𝛼

𝑌

𝐾

. So when

contracts, capital becomes less productive: the production function shifts in and it becomes harder to attract savings. People’s incentive to pass up current consumption and buy (now less productive) capital is diminished, so capital accumulation stops sooner.

0.75(1)(𝑘

∗ 𝑡

) 1/4

= 0.05𝑘 𝑡

∗ 𝑘 𝑡

∗

= (2.5)

1

1−

1

4 = (15)

4

3 = 36.99

𝑦 𝑡

∗ = 𝐴(𝑘 𝑡

∗ ) 𝛼 = (1)[36.99]

1

4 = 2.47

A

A2

1.00

0.50

1.00

1.00

1.00 s

B2

0.75

0.75

0.375

0.75

0.75

C2

0.05

0.05

0.05

0.04

0.05

D2

0.33

0.33

0.33

0.33

0.25 k* y*

E2=(A2*B2/C2)^(1/(1-D2)) =A2*E2^(D2)

58.09

20.54

3.87

1.37

20.54

81.19

36.99

2.74

4.33

2.47

Steady State and Saving

1.

The saving rate is positively correlated with steady-state capital-per-worker and steady-state output-per-worker.

Experiment with different levels of the saving rate

Notice that the intersection of the saving curve with the depreciation curve happens sooner if the saving rate is smaller: steady-state capital-per-worker is lower if the saving rate is lower.

This means that steady-state output-per-worker is lower. s

0.80

0.75

0.50 k*

64.00

58.09

31.62 y*

4.00

3.87

3.16

0.25

0.10

11.18

2.83

2.24

1.41

A high saving rate suggests that economic agents value future consumption relatively more than they value current consumption. This “thrifty” behavior allows them to have very tight belts today but a large amount of consumption in the future.

2.

The saving rate has no effect on the growth rate of output in the steady state.

In the steady state, capital-per-worker doesn’t change. That follows from the definition of the steady state.

∆𝑘 𝑡

∗ = 0

For the same reason, output-per-worker doesn’t change.

∆𝑦 𝑡

∗

= 0

So what is the effect of a change in the saving rate on the growth rate of output in the steady state? None.

The reason is diminishing returns to capital. Dedicating a greater proportion of income to capital accumulation doesn’t change the fact that, eventually, capital stops being very productive.

3.

But changing the saving rate affects the growth rate of output in the transition to the steady state.

Increasing the saving rate gives an economy more new capital per unit of old capital, so it manages to keep depreciation at bay for a longer time.

Imagine two countries that have identical technologies and that start out with the same level of capital-per-worker. Both country A and country B take their existing (for the moment identical) amount of capital, produce (identical) output with it. The countries then save some output – but because at the same time, some of the capital depreciates, not all the saving goes to new capital. Some of it merely replaces the worn out capital.

The only difference between country A and country B is their saving rates. Country A saves a greater proportion of its income, perhaps because it has a better financial system, one that makes it easier and safer to save rather than to spend thoughtlessly.

Country A will have more capital left over after depreciation to put in more new capital, which allows it to continue growing. Diminishing returns eventually will stop growth, but at a higher k t

. k t

10.000 y

2.154

0.75 y t

1.616

k t

0.500

k t

1.116

11.116

12.234

57.000

58.090

59.000 k t

10.000

10.577

11.146

31.000

31.620

32.000

2.232

2.304

3.849

3.873

3.893 y

2.154

2.195

2.234

3.141

3.162

3.175

1.674

1.728

2.886

2.905

2.920

0.50 y t

1.077

1.098

1.117

1.571

1.581

1.587

0.556

0.612

2.850

2.905

2.950

k t

0.500

0.529

0.557

1.550

1.581

1.600

1.118

1.116

0.036

0.000

-0.030

k t

0.577

0.569

0.560

0.021

0.000

-0.013

The Optimal Level of Saving – the Golden Rule

More saving means more capital accumulation and more output. What about consumption? A country that saves a lot will have a lot of output, but won’t eat a whole lot – consumption will be very low. A country that saves a little will have little output, will eat almost all of it … and consumption will be very low, too. Viewed in a different way, a society could choose to increase its consumption for today – have

a big nice party, at the expense of consumption future generations. Or a society could also choose allow for more consumption for future generations, but only by reducing today’s consumption.

We want to know the saving rate that gives the optimal level of consumption. Choosing an “optimum” means choosing saving rate steady-state capital-per-worker steady-state output-per-worker

biggest steady-state consumption-per-worker

At the “optimum”, switching things around must make everyone worse off. The optimum point would be such that everyone, present and future, is better off than in any other point.

The Golden Rule level of steady-state capital-per-worker is that which gives the same level of consumption to current and future generations. Optimal consumption (and therefore optimal 𝑦 𝑡

∗

and 𝑘 𝑡

∗ and s) is that which makes everyone best-off.

The graph below shows three different economies in their steady states. (Notice the three economies depicted are all in the steady state).

Now, if consumption is the difference between output and saving, and if output is denoted by the blue line while saving (and investment) are denoted by the red line (or the maroon or the orange lines), the vertical distance between the two lines must be equal consumption (at any level of capital).

𝐶

𝑁

=

𝑌

𝑁

−

𝑆

𝑁

This is also true at the steady state.

𝐶 ∗

𝑁

=

𝑌 ∗

𝑁

−

𝑆 ∗

𝑁

Notice, too, that the level of consumption-per-worker is different at different steady states, which are determined by the different saving rates.

Saving Rate

0.50

0.40

0.30

0.20

0.10

0.00 s

1.00

0.90

0.80

0.70

0.60

Steady-State

Capital- per-worker k*

89.44

76.37

64.00

52.38

41.57

31.62

22.63

14.70

8.00

2.83

0.00

Steady-State

Output-perworker y*

4.47

4.24

4.00

3.74

3.46

3.16

2.83

2.45

2.00

1.41

0.00

Steady-State

Saving- per-worker

S*/N

4.47

3.82

3.20

2.62

2.08

1.58

1.13

0.73

0.40

0.14

0.00

Steady-State

Consumptionper-worker

C*/N

0.00

0.42

0.80

1.12

1.39

1.58

1.70

1.71

1.60

1.27

0.00

So if steady-state consumption-per-worker is income-per-worker minus saving-per-worker and saving per worker is a proportion s of income, while income is determined by the production function

𝐶 ∗

𝑁

= 𝑦 𝑡

∗

− 𝑠𝑦 𝑡

∗

= 𝑓(𝑘 𝑡

∗ ) − 𝑠𝑓(𝑘 𝑡

∗ )

Now remember that in the steady state, ∆𝑘 𝑡

∗ consumption-per-worker is given by

= 0 implies 𝑠𝑓(𝑘 𝑡

∗ ) = 𝛿𝑘 𝑡

∗

. Then steady-state

𝐶

∗

𝑁

= 𝑓(𝑘 𝑡

∗ ) − 𝛿𝑘 𝑡

∗

We know that the saving rate is positively related to the steady-state capital-per-worker. So we can focus on finding 𝒌 ∗ 𝒕

. We do this by taking a derivative of the above function with respect to 𝑘 𝑡

∗

and setting it equal to zero. 𝑑

𝐶 𝑑𝑘

𝑁 𝑡

∗

∗

= 𝑓′(𝑘 𝑡

∗ ) − 𝛿 = 0 𝑓′(𝑘 𝑡

∗ ) = 𝛿

𝑀𝑃𝐾 = 𝛿

This tells us that the consumption-maximizing steady state is one were the MPK is equal to the rate of depreciation. This is a basic “micro” conclusion: marginal benefit must equal marginal cost.

What is the benefit of owning capital? You get to produce output. What is the benefit of an

extra unit of capital? The extra output, the MPK. So the MPK is the benefit of giving up some current consumption to purchase a long-lived asset for the future.

What is the cost of owning capital? If you had partied away your wealth at least you’d have had the good times. But if you hold capital, after a while you get a rusty, moth-eaten bit of junk.

Capital decays. What is the benefit of owning an extra bit of steady-state capital-per-worker? It wears and tears, at the rate of depreciation. So the cost of saving a bit more to accumulate capital is the depreciation rate.

So we adjust our foregoing of consumption until the marginal benefit of amount of capital we hold (the

MPK) is equal to the cost of holding capital (the depreciation rate). That is the optimal amount of rate of saving, of foregoing consumption.

For example, for the Cobb-Douglas function

𝑀𝑃𝐾 ∗ = 𝛼 𝑦 𝑡

∗ 𝑘 𝑡

∗

If the consumption-maximizing steady-stead level of capital-per-worker is given by 𝑀𝑃𝐾 = 𝛿 𝛼

𝐴(𝑘 𝑡

∗ ) 𝛼 𝑘 𝑡

∗

= 𝛿 𝛼𝐴(𝑘

∗ 𝑡

) 𝛼−1

= 𝛿

And since we found above that 𝑘 𝑡

∗

1

= ( 𝑠𝐴 𝛿

)

1−𝛼

, MPK=

means

𝛼𝐴(𝑘 𝑡

∗

) 𝛼−1

= 𝛼𝐴 [( 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙 𝐴 𝛿

)

1

1−𝛼

] 𝛼−1

= 𝛿 𝛿 𝛼𝐴 ( 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙 𝐴

) = 𝛿 𝛿 𝛼 ( 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙

) = 𝛿 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙 = 𝛼

In the specific case of 𝛼 = 1/3 , 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙 =

1

3

. So if the capital contribution to output (

) is about onethird across the world, more or less, the optimal saving rate should average one-third, across the world.

Using the definitions of the steady state, 𝑠 𝑜𝑝𝑡𝑖𝑚𝑎𝑙

=

1

3

means 𝑘 𝑡

∗ = ( 𝑠𝐴 𝛿

1

)

1−𝛼

1

= (

(1/3)(1)

(0.05)

)

1−1/3

= (

20

3

3

)

2

= 17.21

𝑦 𝑡

∗

= 𝐴 [(

1 𝑠𝐴 𝛿

)

1−𝛼

] 𝛼

= (1)(17.21)

1/3

= 2.58

𝑀𝑃𝐾

∗

= 𝛼 𝑦 𝑡

∗ 𝑘 𝑡

∗

=

1 2.58

3 17.21

= 0.05

So this economy accumulates capital until the extra benefit from holding it and foregoing consumption

(the MPK) is equal to the extra cost of holding capital instead of eating it (the depreciation rate).

Compare this with a low-saving economy 𝑠 = 0.10

and a high-saving economy 𝑠 = 0.60

.

At a saving rate of 10%, the steady-state level of capital is 2.83. At that level, the MPK (the slope of the production function) is larger than the depreciation rate. 𝑘 𝑡

∗

1

= ( 𝑠𝐴 𝛿

)

1−𝛼

= (

1

(0.10)(1)

(0.05)

)

1−1/3

= (

20

10

3

)

2

= 2.83

𝑦 𝑡

∗

= 𝐴 [( 𝑠𝐴 𝛿

1

)

1−𝛼

] 𝛼

= (1)(2.83)

1/3

= 1.41

𝑀𝑃𝐾

∗

= 𝛼 𝑦 𝑡

∗ 𝑘 𝑡

∗

=

1 1.41

3 2.83

= 0.16

This means that, for each unit of forgone consumption in the steady-state, this economy is getting a 16% return in terms of more output (MPK). It would make sense to keep accumulating capital, but the citizens of this economy are kind of short-sighted and prefer to consume today. Because they don’t save much, there are so few units of (high-productivity) capital that it is just enough to offset depreciation.

At a saving rate of 60%, the steady-state level of capital is 41.57. At that level, the MPK (the slope of the production function) is smaller than the depreciation rate. 𝑘 𝑡

∗

1

= ( 𝑠𝐴 𝛿

)

1−𝛼

1

= (

(0.60)(1)

(0.05)

)

1−1/3

= 41.57

𝑦 𝑡

∗

= 𝐴 [(

1 𝑠𝐴 𝛿

)

1−𝛼

] 𝛼

= (1)(41.57)

1/3

= 3.46

𝑀𝑃𝐾

∗

= 𝛼 𝑦 𝑡

∗ 𝑘 𝑡

∗

=

1 3.46

3 41.57

= 0.0278

This means that, for each unit of forgone consumption in the steady-state, this economy is getting a

2.78% return: not a whole lot, given that the cost of holding capital rather than eating is 5%. But this economy is saving a lot, so even though their capital is very unproductive, the citizens forego so much consumption that they manage to offset depreciation.

Strengths and Weaknesses of the Solow Growth Model

Strengths

It explains why countries are rich or poor in the very long run 𝑦 𝑡

∗

1

= (𝐴) 1−𝛼 𝛼

⁄ )

1−𝛼

Total Factor Productivity (related perhaps to education, legal environment, etc.)

Saving and investment (related perhaps to culture and the quality of the financial system)

Low rate of depreciation (related perhaps to weather or the quality of machinery)

It explains why growth rates differ between countries with similar steady states

Countries that are closer to the steady-state (like the US) grow more slowly

Countries that are farther away from the steady-state (like Ireland) grow more slowly

Weaknesses

Leaves saving rates as exogenous. Saving rates are probably related to how well the financial system functions, how patient people are, or how the tax system punishes or rewards saving

Leaves Total Factor Productivity as exogenous. Because capital accumulation cannot lead to long-run growth (eventually, output growth stops in the steady state), the Solow Growth

Model is not a theory of long-run growth, but a theory of transition dynamics.