Chapter 1

advertisement

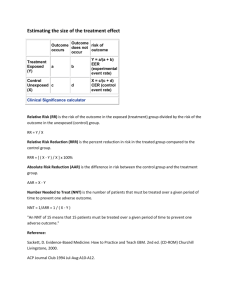

Chapter 1: Strategic Management and Strategic Competitiveness Overview: Nature of Competition I/O Model of Above-Average Returns (AAR) Resource-Based Model of AAR Strategic Vision and Mission Stakeholders Strategic Leaders The Strategic Management Process What is Performance? 1 Nature of Competition: Basic concepts Strategy Integrated and coordinated set of commitments and actions designed to exploit core competencies and gain a competitive advantage Competitive Advantage (CA) When a firm implements a strategy that competitors are unable to duplicate or find too costly to imitate Strategic Competitiveness Achieved when a firm successfully formulates & implements a valuecreating strategy Above Average Returns Returns in excess of what investor expects in comparison to other investments with similar risk 2 The Strategic Management Process 3 Industrial Organizational (I/O) Model of Above-Average Returns (AAR) Underlying Assumptions External environment imposes pressures and constraints that determine the strategies resulting in AAR Most firms that compete within a particular industry control similar resources and pursue similar strategies Resources for implementing strategies are highly mobile across firms Organizational decision makers are rational and committed to acting in the firm's best interests, as shown by their profit-maximizing behaviors Limitations Only two strategies are suggested for competing in an industry: Cost Leadership or Differentiation Internal resources & capabilities are not considered AAR are earned when a firm implements the strategy dictated by external environment (general, industry, and competitor) 4 Industrial Organizational (I/O) Model of AboveAverage Returns (AAR) 5 The Resource-Based Model of AAR Resources Inputs into a firm's production process Includes capital equipment, employee skills, patents, highquality managers, financial condition, etc. Basis for competitive advantage: When resources are valuable, rare, costly to imitate, and nonsubstitutable 3 categories of internal/firm-specific resources Physical, Human, Organizational capital Capability Capacity for a set of resources to perform a task or activity in an integrative manner Core Competency A firm’s resources and capabilities that serve as sources of competitive advantage over its rival 6 The Resource-Based Model of AAR Basic Premise - a firm's unique resources & capabilities is the basis for firm strategy and AAR Each organization is a bundle of unique resources and capabilities Performance difference between firms emerge over time due to these unique resources and capabilities (versus industry’s structural characteristics) Combined uniqueness should define the firms’ strategic actions A firm has superior performance because of Unique resources and capabilities, and the combination makes them different, and better, than their competition – driving the competitive advantage 7 The ResourceBased Model of AAR 8 Vision and Mission Purpose: Chart the company’s long-term direction (vision) Describe the company’s purpose (mission) Give the firm a strong identity Create a roadmap of the company’s future Kind of company to become – direction we are headed Indicates the long-term course management has charted for the company Together mission and vision provide foundation for strategy formulation and implementation 9 Vision and Mission Mission Also called business purpose or business definition Addresses “who we are and what we do” Outlines the organization’s activities and business make-up More specific than the vision Focuses on present business and purpose Businesses and industries company is in now Customer needs currently being served Should pin down the company’s real area of business interest Serves as a boundary for what to do and not do 10 Vision and Mission Vision Concerns future business path – “where we are going” The kind of company we are trying to become Customer needs to be satisfied in the future A guiding concept for the organization Charts a company’s future strategic course – defines the business makeup in 5 to 10 years Requires the exercise of strategic thinking and management foresight The responsibility of a firm's top strategic leader – the CEO Serves as foundation for mission 11 Vision and Mission Why is it important to develop vision and mission? Provides a clear long-term direction for the organization Guides employee actions and gives them and the organization a sense of purpose Guides managerial decision-making Helps stakeholders (who, how) understand your business (investors, bank-loans, outside legitimacy) 12 Stakeholders Basic Premise – a firm can effectively manage stakeholder relationships to create a competitive advantage and outperform its competitors Stakeholders – individuals and groups who can affect, and are affected by, the strategic outcomes achieved and who have enforceable claims on a firm’s performance Must minimally meet the expectations of each stakeholder group Above average returns (AAR) makes this easier to do 3 Major Stakeholder Groups 13 The Three Stakeholder Groups 14 Strategic Leaders People (primarily managers) located in different parts of the firm using the strategic management process to help the firm reach its vision and mission The Work of Effective Strategic Leaders Must be able to think strategically Involved in internal and external analyses, development of vision and mission, strategy formulation and implementation, and constant review, evaluation, and adjustment Create and sustain organizational structure and culture Can exist at different organizational levels Corporate, business, functional, operating 15 The Strategic Management Process 16 What is Performance? Performance is central to the study and practice of strategy Organizational performance is complicated Numerous definitions, approaches, and types of performance Can be an elusive concept Examples: Goal attainment - Vision/mission, objectives Effectiveness – A hospital curing sick people Quality – Customer service Efficiency - Inputs to outputs Financial/accounting/economic returns – ROA, EPS Can also vary by type of firm For-profit versus not-for-profit Publicly traded? Government 17 Measuring Performance Stakeholders View An organization’s performance should be evaluated relative to the preferences and desires of stakeholders that provide resources to a firm Different stakeholders can have different interests and different criteria for evaluating performance May need to choose which stakeholders to satisfy Must minimally satisfy the interests of each stakeholder group 18 Measuring Performance Simple Accounting Measures Most popular approach Publicly available for many firms They communicate a great deal of information Most often rely on ratio analysis 4 Major categories of ratios Profitability Liquidity Leverage Activity 19 Measuring Performance Profitability Ratios Ratios with some measure of profit in the numerator and some measure of firm size or assets in the denominator ROA, ROE, margins, EPS, p/e ratio Liquidity Ratios Ratios that focus on the ability of a firm to meet its short–term financial obligations Current ratio, quick ratio 20 Measuring Performance Leverage Ratios Ratios that focus on the level of a firm’s indebtedness Debt to assets, debt to equity, times interest earned Activity Ratios Ratios that focus on the level of activity in a firm’s business Inventory turnover, average collection period 21 The Relative Nature of Performance Performance is always relative to other firms Performance should be compared to industry average(s) AAR are above industry average Normal and below normal returns Industry adjustments Some industries are more profitable than others Can adjust for industry performance and compare performance levels across industries Looking at trends can also be useful From earlier I/O Model - Pick attractive industry(ies) to compete in Resource-Based Model - Develop unique bundles of resources and capabilities 22