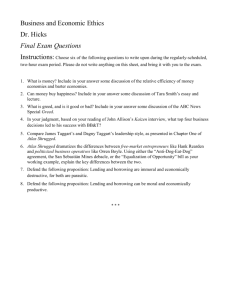

Experience of Municipal Finance Institutions and

advertisement

International Experience with Specialized Municipal Finance Institutions and Lessons for the Philippines Most countries of the developed and developing world have some sort of specialized institution to facilitate borrowing by local governments. Examples from advanced economies • • • • • • • • • • USA Canada Norway Sweden Netherlands Italy Denmark Finland Japan Etc. 17 State Bond Banks 6 Provincial Municipal Finance Corps Kommunal Bankan Kommuninvest Bank of Netherlands Municipalities Crediop KommuneKredit Municipality Finance plc Finance Corp. for Muni Enterprises Examples from developing economies • • • • Columbia Parana State Tamil Nadu Tunisia • Sri Lanka • Jordan • Etc. Findeter Paranacidade Tamil Nadu Urban Dev authority Caisse des Prets et de Soutien des Collectivity Local Local Government Loans Fund Banque de Development des Villes et des Villages In advanced economies LGs have options but bond floatation favored • Brings in institutional investors, insurance funds, etc, and often provides lower interest rates, longer maturities and larger debt size than bank loans; • Can lead to structured products including securitizations to fill special needs. But: • Documentation and due diligence required is expensive since all investors need information on risks and likely performance of issue. High fixed cost of issuing a bond means that only large bonds have cost advantage over bank loans. • Small and medium sized local governments cannot avail of bonds --- even in advanced economies Specialized financial intermediaries for local government in developed economies fill a market niche Function: To help small and medium sized local governments take advantage of the more favorable terms of bonds by pooling borrowing needs and sharing risks; Municipal finance institutions in advanced economies Operations: • Aggregate the borrowing needs of member LGs on periodic basis; • Float a large bond in their own name and distribute proceeds through sub-loans to LGs; • Minimize interest rate and maturity risk by closely matching amount, tenor and timing of its borrowings with those of its sub-loans to LGs MFIs in Advanced Economies Enhancement of security to bond investors: • Over-collateralization through maintenance of reserve fund, e.g. equal to peak future year debt service amount; • Pledge of full faith and credit from borrowing LGs; sometimes joint and several obligations. • Other guarantees or security from LGs e.g. intercept, pledge of property tax receipts, etc. • Due diligence is on structure of issue and on the MFI not individual LGs; Nordic Countries Local Government Driven • Local Government Associations were instrumental in establishing first MFIs in Nordic countries; • Operate similar to credit union • Member deposits and the joint-and-several obligation of members provide security to investors in MFI bonds. • Some require member LGs to pass eligibility test to join US State Revolving Funds for Water and Sanitation • Federal and State level subsidies for water and sanitation are channeled to state revolving fund rather than applied to specific projects; • Several States use these subsidies to create dedicated reserve fund to collateralize pooled bond floatation to support needs of local governments in state. This creates leverage. • Pooled SRF bonds of NY State are AAA rated even when many participating local governments have lower ratings or not rated at all. Municipal funds in developing countries are very different • Set up as simple pass-through revolving funds for Multilateral Bank lending; • Help create a credit culture among local governments • Help establish track record of repayment • Help encourage fiscal discipline among LGs But… • Neither the national government nor IFIs can satisfy all investment needs of local governments; • Foreign borrowing from IFIs and government funds are not leveraged. (IFIs should play a small but catalytic role.) Questions for many countries • How to bring in domestic private capital and reduce the dependence of local government on national budgets; • How to foster competition among multiple lending sources for LGU business so that margins will be lowered and interest rates and tenors improved. • How can MDFs evolve to play the market niche role played by such institutions in developed economies? • How to use domestic subsidies and IFI funds to gain leverage in raising private domestic funds; Three examples of enhancing access to domestic private capital Columbia, and Czech Republic • Second tier institutions that rediscount private bank loans to Local Governments; • Extend tenor of private bank loans and “introduce” private banks to LG market Tamil Nadu State Municipal Fund in India • Private management; • Successful domestic bond floatation Lessons from International Experience • Organization: Corporate structures with Boards of Directors and independent management; • Security: Collateral from borrowing LGs in form of intercept, reserve fund or other assets; • Competition: Multiple sources and types of lenders to help extended tenor and lower i rates; • Special Privileges: Private bank lending should not be discouraged by giving government lending institutions special advantages; • I rates: Market determined to spur competition Establishing a lending Institution is not sufficient in LDCs • Maintenance of stable macro environment; • Domestic capital market regulation; • Solid legal framework, including strong LG code, regulation of banking and securities; regulation of LG borrowing; • Local government reform: budget, taxation, planning, project analysis, transparent procurement, use of private sector; • Clear, accurate, consistent, timely, information on LGs Philippines • Decentralization supported by strong Local Government Code –1991; • Well defined system of transfers of centrally collected taxes to LGs; • Well defined own-source revenue base for LGs ( but very poorly used) Philippines MDF Experience • MDF established in 1984 as revolving fund for ODA to local governments. MDF is department of DOF; • NG allows intercept of its flows to borrowing local government as security; • MDF Staff review project feasibility and the paying capacity of LG borrowers; • Good lending record: essentially zero arrears; OED found loans to be productive. Other lending to LGs in the Philippines Government Owned Financial Institutions (GFIs) have significantly picked up lending to LGs in past 5 years; Private lending to LGUs in Philippines • No private bank lending to LGs’; local banks express need for protection from political risk; • 8 bonds issued in recent years supported by private bond guarantee, demonstrating some market appetite; high cost of issuing bond compared to bank loans limits demand. Issues • Only GFIs and MDF allowed to access intercept; • Only GFIs allowed to be LG depositories; • Government has matching grant program BUT only projects supported by MDF loans eligible; • All LG loans made by National Government institutions, using National Government flows as security; • As dept of government, MDF hamstrung: – “Freezes” that prevent hiring needed staff – Budget rules hinder new lending – All decisions made by public officials • MDF role now being duplicated by GFIs » Risks are too concentrated, there is limited choice by LGs Next Steps for Philippines • Encourage gradual entry of private bank lending to better off LGUs by leveling playing field with GFIs; better off LGUs should “graduate” to private sector. • Convert MDF into market friendly institution that begins to facilitate LG access to domestic private capital markets, and leverages IFI and public funds. Key steps required to encourage private bank lending • Allow a limited number of accredited private banks to be depository banks of LGUs and obtain recourse to IRA intercept; • Re-examine matching grant program; allow an LGU to obtain a loan for a project eligible for a matching grant from any source (including a private bank) and still receive grant. Bond market access for all but largest LGs will depend on An intermediary that pools needs and risks of multiple LGUs and floats bonds on their behalf, or formation of an LGU credit union style institution Significant access to private capital will require simultaneous and continuous efforts to build capacity of LGUs • Financial reforms including budgeting, planning, accounting, collections, and resource mobilization • Improved project management and monitoring • Better public information and consultation with community groups LGUs should have a choice. • A healthy LG finance system in Philippines needs : – Private bank lending for better off LGUs; – Direct bond market access; and – Market oriented specialized financial intermediaries for smaller LGs • Competition among sources and institutions is essential • DOF needs to move simultaneously on several fronts Key Recommendations • Allow a few accredited private banks to become depository banks for LGUs; • Corporatize MDF; decide among market friendly options that will leverage IFI funds and tap domestic markets; • Expand capacity building for LGUs • Reform Loan-grant-equity mix to have sustainable matching grants that apply to eligible projects no matter where LGU borrows.