Chapter – 1 Consignment Accounting

advertisement

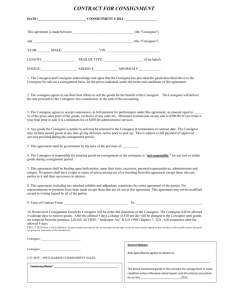

Chapter – 1 Consignment Accounting Chapter outcomes: 1. Meaning and nature of consignment; 2. Terms used in consignment operations; 3. Difference between consignment and sale; 4. Valuation of unsold stock lying with the consignee; 5. Treatment of abnormal loss; 6. Accounting entries in the books of consignor; 7. Accounting entries in the books of consignee; 8. Practical exercises; Meaning of consignment Consignment means the transaction of sending goods by one person to another, who is to sell goods on behalf of the first person. The person who sends the goods is known as consignor and the person whom the goods are sent is known as consignee. The legal relationship between these two persons is that of principal and agent. Important terms in consignment 1. Pro forma invoice: when the consignor sends the goods to the consignee, he prepares only a pro forma invoice and not an invoice. A pro forma invoice looks like an invoice but is really not one. The objective of the pro forma invoice is only to convey information to the consignee regarding particulars of goods sent and not to make him liable like a trade debtor. 2. Del-credere commission: Del-credere commission is an additional commission paid by the consignor to the consignee for bearing the loss on account of bad debts, if any, arising out of credit sale of consignment goods. Such commission may be allowed on credit sales or total sales. However, in the absence of any such agreement, the consignor allows such commission on total sales. Important terms in consignment (contd.) 3. Accounting sales: An account sales is a statement sent by the consignee to the consignor periodically. It contains the information the following information: 1. Sales made; 2. Expenses incurred on behalf of consignor; 3. Commission earned; 4. Advance money paid; 5. The balance of amount due to the consignor. An account sale is different from sales account which gives the details of the sales made. Distinction between consignment and sale Basis of distinction Consignment Sale 1. Nature of relationship The relationship between The relationship between the consignor and the the seller and the buyer is consignee is that of that of creditor and debtor. principal and agent 2. Ownership and possession of goods Only the possession and not the ownership is transferred to the consignee Both ownership and possession is transferred from the seller to the buyer 3. Risk of goods Risks remain with the consignor because ownership remains with the consignor Risk remains with the buyers as the ownership in the goods is transferred to the buyer 4. Pro forma invoice Consignor prepares a pro Seller prepares a sales forma invoice only invoice 5.Subject matter of dealing Only moveable property Any property may be its may be its subject matter subject matter 6. Profit or loss Consignee is not any way After the sale is complete, Valuation of unsold stock of the consignment Basically stock is to be valued at cost price or market price whichever is lower on the base of ‘conservatism’. Cost price for this purpose means the purchase price plus expenses which are incurred to bring the goods to their present location and condition. Market price here refers to net realizable value, that is, the value which shall be realized if unsold goods in stock are disposed off in the market and not the ‘replacement value’ . Treatment of abnormal loss Abnormal loss an avoidable loss and is usually caused by fire, theft, abnormal spoilage leakage/breakages/ pilferages, etc. It is not treated as a part of cost. Its value is calculated in the same manner as the value of unsold stock. The following entry is passed in the account for the abnormal loss: Profit and loss account Dr. XXXX Insurance Company A/C Dr. XXXX Consignment Account Cr XXXX Pro forma Journal entries in the books of Consignor The following journal entries are passed in the books of consignor: 1. When the goods are sent on consignment: Consignment Account Dr. XXXX Goods sent on consignment account Cr. XXXX (Being the goods sent on consignment) 2. When expenses are incurred by the consignor: Consignment Account Dr. XXXX Bank/Cash account Cr. XXXX (Being the expenses paid on consignment) 3.When any advance money is received from the consignee: Cash/Bank/Bills Receivable Account Dr. XXXX Consignee Account XXXX (Being the advance money received) 4. When the expenses are incurred by the consignee: Consignment account Dr. XXXX Consignee account Cr. XXXX (Being the expenses incurred by the consignee) 5. When goods are sold by the consignee: Consignee account Dr. XXXX Consignment account Cr. XXXX (Being the goods sold by the consignee) 6. When the commission is due to the consignee: Consignment account Dr. XXXX Consignee account Cr. XXXX (Being the commission due to the consignee) 7. When there is stock in consignment: Consignment stock account Dr. XXXX Consignment account Cr. XXXX (Being the stock on consignment 8. When there is any abnormal loss: Profit and loss account Dr. XXXX Insurance Company Ac. Dr. XXXX Consignment account Cr. XXXX (Being the abnormal loss in consignment) 9. Profit or loss in consignment: If profit: Consignment account Dr. XXXX Profit and loss account Cr. XXXX If loss : Profit and loss account Dr. XXXX Consignment account Cr. XXXX 10. When the balance amount is received from consignee: Bank/Cash/ Bills Receivable account Dr. XXXX Consignee account Cr. XXXX (Being the balance received from the consignee) 11. Transfer of goods sent on consignment: Goods sent on consignment account Dr. XXXX Trading account Cr. XXXX (Being the consignment account transferred to trading account) Pro forma Journal entries in the books of Consignee 1. When the advance money is sent to consignor: Consignor account Dr. XXXX Bank/ Cash/ Bills payable account Cr. XXXX (Being the advance money paid to consignor) 2. When expenses are incurred by the consignee: Consignor account Dr. XXXX Bank account Cr. XXXX (Being the expenses incurred by the consignee on consignment) 3. When goods are sold by the consignee: Cash/bank/ debtors account Dr. XXXX Consignor account Cr. XXXX (Being the goods sold) 4. When the commission is due from consignor: Consignor account Dr. XXXX Commission account Cr. XXXX (Being the commission due from the consignor) 5. When the balance money is remitted to the consignor: Consignor account Dr. XXXX Bank/Cash/ Bills Receivable Account Cr. XXXX (Being the balance remitted to the consignor) 6. Transfer of commission to profit and loss account: Commission account Dr. XXXX Profit and loss account Cr. XXXX (Being the commission transferred to the profit and loss account)