Market Cap

advertisement

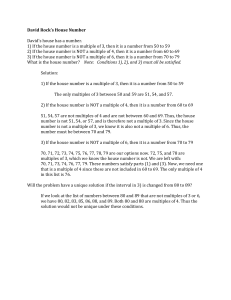

Multiples Analysis Agenda Financial Statements Financial Metrics Liquidity and Solvency Evaluating Firm Value and Size Market Multiples (Comparables) Financial Statements • Recall the 3 statements we care about: Balance Sheet Income Statement Cash Flows Two Important Aspects of the BS Point-in-time Statement: • The values of the accounts on the statement reflect cumulative balances of those accounts at a specific point in time (the balance sheet date) Ex.) A cash balance of $25,000 on the balance sheet tells us that right now, after all cumulative operations of the business’s life, there is $25,000 in their bank. Significant Accounts: • Debt/Liabilities Balance • Denoted by the term “payables” • Tells us how much the company owes • Legal obligations to pay • Cash and Current Assets Balance • Tells us how much money the company has to pay off its debts quickly Income Statement Shows the financial activities of one operational period (quarter or year) Tells us how much we sold- Revenue Tells us how much it cost us- COGS and Expenses Tell us how much was left over- Profit/Net Income Sample Income Statement Revenue Less: Cost of Goods Sold Gross Profit $100,000 ($60,000) $40,000 Less: Operating Expenses except D&A EBITDA ($7,500) $32,500 Less: Depreciation and Amortization Operating Income (EBIT) ($2,500) $30,000 Less: Interest Expense EBT ($5,000) $25,000 Less: Tax Expense Net Income ($5,000) $20,000 Statement of Cash Flows • Usage: Tells us how much cash (not promises of cash) we brought in and put out during the period. • Important figures: – Operating Cash Flow: Cash receipts from customers – cash payments to suppliers, operating expenses, taxes, and interest • Does NOT include: Taking on debt/ paying it off or buying/selling LT assets – Free Cash Flow: Operating Cash Flow – Capital Expenditures Dividends Multiples: Concept • If we want to evaluate a company’s health, profitability, debt burden, etc, it pays to have a standardized number that we can look at: – Ex.) Company ABC generated $10,000 in profit and had $20,000 in assets, $50,000 in debt. – Is this any good? We can use metrics to compare two figures of performance, health, or size or standardize size and multiples to compare two or more similar companies Previous Example • Ex.) Company ABC generated $10,000 in profit and had $50,000 in assets, $20,000 in debt. – Possible Metrics: • Profit/Assets = Return on Assets = how much profit does this company generate for every dollar of productive assets they use? • Profit/Debt = How much profit will it take to pay off their debts? • Assets/Debt = what percentage of the assets in the company are funded by debt? Multiples and Metrics as Comparable Tools • By using multiples or metrics, we have a measurement of value/profitability/health that is not sensitive to the size of the company – So we can use multiples to compare two companies that are similar Company ABC has a Profit/Asset (ROA) ratio of .2 XYZ generates more profit per dollar of productive assets, so is more efficient Company XYZ has a Profit/Asset (ROA) ratio of .3 So what metrics are out there? • Balance Sheet Metrics: – Tell us financial health of the company Current Ratio = Current Assets Current Liabilities Current Assets - Inventory Quick Ratio = Current Liabilities Tells us if the assets that can be converted to cash quickly can cover the liabilities coming due this period If we suddenly can’t sell inventory can we pay off our debts? The higher the better, it means we can pay off our debts more easily (less needs to be sold off in order to generate enough to pay off debts) Income Statement Metrics • Metrics on the income statement represent financial performance: – Some potential values to use: Revenues, Operating Income (EBIT), Earnings, EBITDA – A multiple that takes a profit level divided by revenue is referred to as a margin. Profit Margin = Earnings Revenue Cash Flow Metrics • On its own, Statements of Cash Flows don’t have too many multiples to take within itself – Potential Values: • Operating Cash Flow, Free Cash Flow, Capital Expenditures • This leads us to using different values between statements… Examples of Metrics • There are numerous ways to combine accounts and values to arrive at financial metrics, some of the most used are: – Profit/Balance Sheet Account : Tells how much profit is generated per dollar of asset, debt funding, equity invested • ROE, ROA, ROIC – Cash Flow/ Debt Account: Tells if cash generated this period could pay off/ how long it will take to pay off debt – Profit/Cash Flow: tells how much of profits are actually turned into cash during the year Example of Using Metrics • Company ABC has a net operating cash flow of $50M and net profit of $200M for 2013. Company XYZ, a similar competitor has a net operating cash flow of $25M and net profit of $50M. What conclusions can you make regarding the financial performance of the two companies? Net Operating Cash Flow 50M = Net Profit = 25% conversion for ABC 200M 25M = = 50% conversion for XYZ 50M Based on the multiples, ABC converts only 25% of its sales to cash, and by comparison, XYZ is doing better. Internal Metrics • What do all of these metrics we have seen have in common? – They are internal, meaning that they tell us only about the company’s state of being. – While good for evaluating health of the company, it tells us nothing about the worth of a company Market Multiples • Previously, we found that in order to get value from metrics, we had to compare against similar companies to get a gauge of “what’s good”. • We can apply the same thinking in comparing price to a measurement, then comparing this multiple to other similar companies to see if a company is cheap, expensive, or at market value General Form of Market Multiples Size/ Value Measurement Financial Performance Measurement What are ways we can measure the size of a company? Measuring Company Size Market Capitalization “Market Cap” Enterprise Value “EV” Price x Shares outstanding Market Cap + Net Debt - Cash Tells us how much it would take to buy all of a company’s stock on the public markets Measures the “takeover value” of a company, how much you would have to pay to buyout all investors and creditors What is the problem with this? We take out cash because you’re paying cash for cash, cancels out. Does not take into account a firm’s full capital structure: meaning it accounts for a firms equity value, not its debt value Best way to measure size of a company because it takes into account capital structure Market Multiples • Now that we know size measurements, and we already know financial performance metrics, we can create a market multiple Size/ Value Measurement Financial Performance Measurement Market Cap P/E Multiple = = Earnings Price Price x Shares Outstanding = Earnings per share x shares outstanding Earnings per Share Other Market Multiples • • • • • Price to Earnings Price to Book Value Per Share (Mcap/Assets-Liabilities) Price to Revenue (Mcap/Revenue) Enterprise Value/EBITDA Enterprise Value/EBIT Market Multiple Example: • Company ABC is trading at $50 per share and had EPS of $5 for the last period. Company XYZ is trading at $100 per share and had an EPS of $20. What are the P/E multiples for each? ABC $50/$5 = 10x XYZ $100/$20 = 5x So for every dollar of earnings, you pay 10x the amount in market price So for every dollar of earnings, you pay 5x the amount in market price So in this case, XYZ is trading at a cheaper price relative to ABC because you are paying less per dollar of earnings of the company. We can make the argument that XYZ is undervalued relative to ABC. Comps • The previous example illustrates the ideology behind a comps model: – We assemble similar companies to our target company in a peer group, then compare their average/median multiples in order to determine if a company is undervalued, over valued, or trading at market relative to their peers. Valuing a company using Multiples Avg. Comp’s Price to Earnings x Company Earnings = Company Market Cap Company Market Cap / Company Shares Outstanding = Implied Share Price For an enterprise value multiple, after you get Company Total Enterprise Value (TEV) simply add their Debt and subtract out their Cash to arrive at Market Cap LTM, TTM, T12M, FTM, NTM, WTF? • When looking at multiples online, you see this terminology, but what does it mean? – Last Twelve Months (LTM), Trailing Twelve Months (TTM and T12M) are multiples that obtain their financial performance metric from the last twelve months worth of data – Forward Twelve Months (FTM), Next Twelve Months (NTM) are a current size measurement divided by an estimate of financial performance for the next twelve months.