Dell v4

advertisement

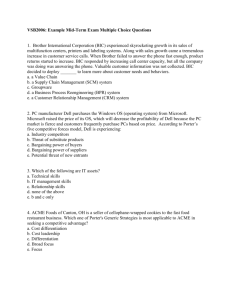

Dell Dan McLindon Kyle McDaniel Jeremy Smiley Tom Anderson Ray Moorman Key Question for Dell • What is Dell? A computer manufacturer? A consumer electronics company? An online retailer? An IT service partner? What is their focus? Secondary Questions • • • • • What contributed to Dell’s success and rapid growth in the late 1990’s? Is Dell’s build to order model still an advantage? Why is Dell choosing to become more like HP and HP more like Dell? What does Dell do well and where does it struggle? Can Dell ever be successful in B2C market in developing countries with Direct to Consumer distribution? • What is Dell? A computer manufacturer? A consumer electronics company? An IT service partner? What is their focus? • What is Dell doing today to set itself apart from the competition in the highly competitive and rapidly evolving computer hardware industry? Dell Computer Company Overview Founded 1984 by Michael Dell Vision PC’s could be built to order & sold directly to customers 2 Major Advantages of Business Concept 1. Bypass distributors & retailers eliminated markups 2. B2O reduced risks & costs of having inventory Sell Direct & B2O Business Model Success 2003 – most efficient procurment, mfg, & dist in PC industry. Gave profit & costs advantage over rivals Dell Inc. Product Timeline Year Product Current Position In Market Success of Failure? 1984 PCs 2nd behind HP (15% market share) Success 1995 Website Revenues greater than Yahoo, Google, eBay and Amazon combined Success Late 1990’s X86 Servers 1st domestically, 2nd behind HP globally (11% global market share) Success 2001 Data-routing switches and Data storage devices Storage – 5% market share Routing – 2% market share TBD 2002 Large Enterprise IT services <1% market share Success, rapidly growing revenues 2002 White label PC N/A TBD, forecast to achieve $380 million in sales (2003) 2003 Printers 20% market share in US, 5% global TBD 2003 Consumer Electronics N/A TBD 2003 Retail POS systems N/A TBD Conclusion – Expanding product set into several highly competitive markets with well established players. Strategy is be the low cost leader. Build to Order Advantages Disadvantages Selling direct to customers cuts out the middleman, which increases Dell’s margins. Customers not able to touch and feel the product, which is a large ticket purchase Mass customization using standard parts allows Dell to control their costs and enables them to pass savings to customer. Build to order requires innovation and investment in manufacturing technologies and facilities. Build to order allows for JIT, reducing costly inventories of components, which may quickly become obsolete. Competitors have been able to outsource to third party manufactures, pushing the burden of component inventory costs onto suppliers. Conclusion – Dell has spent its time and money on innovation to become an efficient manufacturer of computer hardware. Was that an effective use of their resources? Is Build to Order still an advantage? • Dell low cost leader • Improved reputation for quality. Allowed Dell to control quality and be first to market with new products Enabled success in late 1990’s • Competitors tried to copy, but with limited success. Long learning curve • Businesses like to customize a solution that fits exactly what they need • BTO gives Dell the ability to control quality and the opportunity to sell additional value Still works well adds to enterprise customers in B2B Struggling in B2C • Difficulty with distribution in emerging BRIC countries, especially China • Competitors have closed the gap on price and product offerings by outsourcing manufacturing • Dell even starting to in laptops PEST Analysis for Dell Category Issue Threats/Opportunities Ranking (1-5) Political 2008 Economic downturn Threat – economy also impacting govt. spending 3 Economic 2008 Economic downturn Threat – companies and individuals cut down IT spending 3 Social Rising incomes and demand for IT in BRIC countries, especially SE Asia and Eastern Europe Opportunity - ½ of world’s population 4 Growth in popularity of social networking and mobile society Opportunity – increasing demand for servers and network gear 4 Explosion in data information and content Opportunity – Dell can provide hardware and services to drive 4 Global expansion of Internet Opportunity – requires installation of millions of servers 5 Technological Industry Overview (Supply) Porter’s five forces: Threat of substitute products High Bargaining power of suppliers Rivalry among existing competitors Bargaining power of buyers Low High High Threat of new entrants High Porter’s Five Forces Factor Analysis Impact Growing popularity and sophistication of mobile and smart phones. Servers need to run the networks behind phones. Bargaining power of suppliers Several suppliers of PC components. Technology has become standardized. Dell has decided to form long term partnerships with key suppliers to take advantage of volume-based discounts Relationship with suppliers may suffer as Dell shifts to outsourcing laptop manufacturing. Bargaining power of buyers Many options in terms of what type of computer hardware and software to use. B2B customers can also negotiate prices on hardware, software, and service contracts. With standardization comes commoditization. Competitive rivalry Lots of well established players in all markets that Dell competes in. Majority competing on cost in a race to the bottom Compression of profit margins . As price decreases sole focus is cutting costs. Threat of new entrants Growth of white-label PC makers and resellers, especially in Asian market, shows how easy it is to enter market, as industry moves to standardized technologies. PC companies need to find a way to differentiate themselves Threat of substitute products Industry Overview (Supply) Factor Threat of substitute products Bargaining power of suppliers Bargaining power of buyers Ranking (1-5) Industry Overview (Supply) Factor Rivalry among existing competitors Threat of new entrants Ranking (1-5) Dell Versus HP HP Dell Operating philosophy Build to Stock, outsource manufacturing, large distribution network of retailers and resellers around the world Build to Order, control manufacturing, direct to customer sales on own website Key products Global leader in PCs, servers, and printers. 67% sales outside USA. US leader in PCs and servers, 2nd behind HP globally . 39% of sales outside USA. Market Share in PC Sales 18.8% Globally 23.9% in USA 14.9% Globally 28% in USA Financials $104.3 billion revenue, $7.3 billion profit (2007) $61.1 billion revenue, $3 billion profit (2008) Key Acquisitions 2002 – Compaq 2008 – EDS 2005-2008 - $7 billion on other software, tech, and service companies 2007-2008 spent $2 billion on software capabilities for value-added services US Market Share – Dell vs HP 40 % of Market Share 35 30 25 Dell HP 20 15 10 5 0 1998 2000 2002 2004 2005 2006 2007 World Market Share – Dell vs HP 20 18 % of Market Share 16 14 12 Dell HP 10 8 6 4 2 0 1998 2000 2002 2004 2005 2006 2007 • Conclusion – From 2005 declining trend in both US & World Market Share for Dell. HP has gained market share during that time. Possible reason for HP’s success is acquisitions (Compaq 2002, EDS 2008) Is Dell’s Build to Order model still a competitive advantage or has it become a liability? Internal Analysis – Markets Served Conclusion – Dell is strong in the US B2B market, but that strategy does not translate to success in B2C. Only 39% of sales generated outside US, compared to 67% global sales by HP. Internal Analysis – Core Competencies Core Competency Build to order Description •Build to order business model allows for JIT, keeping inventory costs down. Keeping manufacturing in-house enables control of quality and faster new product releases. Direct to Customer Sales •Cuts out retail markup. Allows Dell to maintain higher profit margins and charge lower price. B2B value added services •Services like asset tagging and software downloading differentiate Dell from competitors. Enabled by inhouse manufacturing. Build to order B2B valueadds Direct to Customer Sales Red – Easy for competitors to develop Yellow – Possible for competitors to develop Green – Very difficult for competitors to develop Internal Analysis - Manufacturing Heavily invested in facilities and technology Hampering growth in emerging BRIC markets Already starting to outsource laptops Enables valueadds for B2B Build to Order/D2C Sales No longer low cost leader due to outsourcing Conclusion – Dell already starting to outsource its competitive advantage. Can it still compete with HP in the B2C market? Will outsourcing manufacturing impact their advantage in B2B market? Recommendations Develop a more focused strategy. Examine where the company is creating the most value for customers and invest in that business line Focus on growth in B2B channel and the continued development of value-added IT services Everyone competing on price, need to find new ways to create value