Chapter 6: Income and Rent Determinations

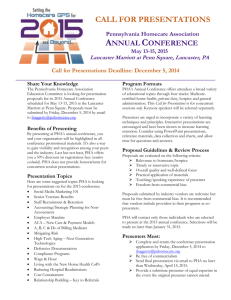

advertisement