05.Chapter Five 2009

advertisement

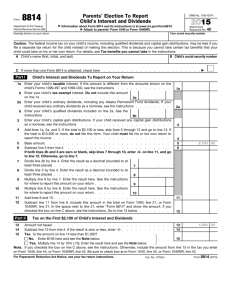

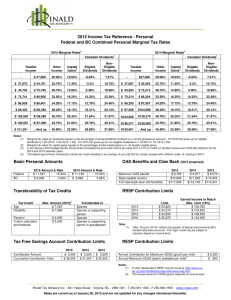

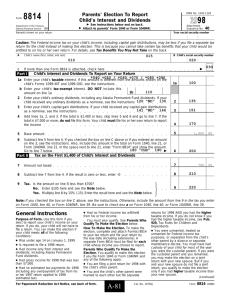

Liberty Tax Service Online Basic Income Tax Course. Lesson 5 1 HOMEWORK CHAPTER 4 HOMEWORK 1: Answer the questions for each situation. 1. Frankie is employed by Sherman Bros. Insurance. In 2008, his salary was $48,500. Frankie participates in the 401(k) retirement plan his employer has set up. In 2008, Frankie contributed $4,000 to the plan. Frankie also received the following from his employer in 2008: A Florida vacation worth $3,264 as a prize for meeting his sales goals. Frankie was not able to take the vacation until January 2008. $200 tickets to a pro basketball game as a Christmas present. Group health insurance premiums valued at $3,400. $2,500 as reimbursement for his travel costs. Frankie does not have to account to Sherman Bros. for the reimbursements or return any money he does not spend. a. Which of the above 4 items are taxable to Frankie in 2008? Florida vacation, pro basketball tickets, travel cost reimbursements b. What is the amount of employee compensation that will be shown in box 1 of Frankie’s Form W-2? $50,464 which consists of:$48,500 (wages) - $4,000 (401(k) contribution) + $3,264 (vacation) + $200 (tickets) + $2,500 (travel) 2 HOMEWORK CHAPTER 4 HOMEWORK 1: Answer the questions for each situation. 2. Cameron Smith worked for a cab company for 6 months in 2008. He received the following Form W-2. 3 HOMEWORK CHAPTER 4 HOMEWORK 1 Cameron reported his tips as required to his employer. The monthly totals in his tip diary are as follows: January $34 February $20 March $18 April $25 May $16 June $28 a. What is the total amount of tips that Cameron reported to his employer? $107 ( $34 + $20 +$25 + $28 = $107) b. What is the total amount of Cameron’s tips that is subject to income tax? $141 ($107 + $18 + $16 = $141) c. What amount does Cameron enter on Form 1040, line 7? $ 10,357 ($10,323 + $18 + $16 = $10,357) a. How much is his federal withholding? $1,032 4 HOMEWORK CHAPTER 4 HOMEWORK 2: Fill out page 1 of Form 1040 through line 7 and page 2, line 62, for the following using the information and forms provided. 1. Austin L. (SSN 032-78-6543, born 5/16/1975) and Felicity N. Geary (SSN 044-65-4321, born 7/18/1977) are married and lived together in 2008 at 14 Shady Way, Brooklyn, NY 11201. Their son Ronnie (SSN 511-33-9999, born 8/25/1996) and their daughter Darlene (SSN 511-51-1111, born 5/31/2000) are qualifying children for the child tax credit. 5 HOMEWORK CHAPTER 4 6 HOMEWORK CHAPTER 4 7 HOMEWORK CHAPTER 4 8 HOMEWORK CHAPTER 4 9 HOMEWORK CHAPTER 4 10 HOMEWORK CHAPTER 4 2. Craig R. Gregory (SSN 333-98-7654, born 9/24/1973) is divorced. He keeps up a home for himself and his son Barry (SSN 233-32-3232, born 6/7/1999), who lives with him. Craig has stated in writing that his former wife can claim the exemption for Barry. Craig pays 70% of the total support for his widowed stepfather Lucian Alexander (SSN 277-77-8787, born 12/12/1935), who does not live with him. Lucian’s gross income in 2008 was $2,400. On some weekends, Craig works as a waiter at a banquet hall. In January his tips were $17 and in March his tips were $19 in cash plus two tickets to the Bulls game (value $55). He did not report these tips to his employer. For every other month, Craig received $20 or more in tips and he reported these to his employer. 11 HOMEWORK CHAPTER 4 12 HOMEWORK CHAPTER 4 13 HOMEWORK CHAPTER 4 14 Chapter 5: Interest, Dividends, and Other Income Chapter Content Taxable Interest U.S. Savings Bonds Tax-Exempt Interest Dividends Taxable State and Local Income Tax Refunds Alimony Received Unemployment Compensation Other Income Key Ideas Objectives Determine the Reporting of Interest and Dividends Know How to Distinguish Between Taxable and Tax-Exempt Interest and Dividends Understand How to Report Taxable Refunds, etc., From State and Local Income Taxes Identify Taxable Alimony and How to Report It Learn About Unemployment Compensation and How to Report It Report Other Sources of Taxable Income Identify when Back up Withholding is Required 15 Key Terms and Definitions Earned Income – All amounts received from providing a service, including wages, tips, bonuses and self-employment income in the form of money, services or property. Investment income, such as dividends and interest, is not counted as earned income. Unearned Income – Money received for the investment of money or other property, such as interest, dividends and royalties. It also includes pensions, alimony, unemployment compensation and other income that is not earned for services performed. Taxable Interest – Includes interest you receive from bank accounts, loans you make to others, and other sources. Tax-Exempt Interest - Interest income that is not subject to income tax. Tax-exempt interest income is earned from bonds issued by states, cities, or counties and the District of Columbia. 16 Key Terms and Definitions Dividends – A stockholder’s share of the profit paid on an investment in a corporation reported on Form 1099-DIV. “Dividends” from a savings and loan association or from a credit union are actually reported as interest. Capital Gain Distribution – Shareholder’s portion of gain from the sale of capital assets, such as mutual funds and real estate investment trusts. Capital gain distributions are taxed in the year received and are always considered to be held long term. Unemployment Compensation – Includes benefits to unemployed individuals that a state or the District of Columbia paid from the Federal Unemployment Trust Fund. 17 Reporting Interest Income and Dividends Interest income and dividends are common types of unearned income. They are considered unearned income because money, and not a person, is working to earn the income. Most types of interest and dividends are taxable. All interest and dividends must be reported on your tax return. Interest over $10 is usually reported to you on a Form 1099-INT. Dividends over $10 are reported to you on a Form 1099-DIV. Substitute Forms 1099-INT and 1099-DIV may also be used Interest and dividends over $1,500 must be reported on Schedule B of Form 1040. Taxable interest is reported on line 8a of Form 1040. Tax-exempt interest is reported on line 8b. 18 Reporting Interest Income and Dividends Form 1099-INT 19 Reporting Interest Income and Dividends Form 1099-DIV 20 Taxable Interest Most interest income is taxable. In general, any interest that you receive or that is credited to your account and can be withdrawn is taxable income. Sara earned $49 in interest on money in her bank savings account. She must report the $49 as interest income even though she did not withdraw it from the bank. 21 Taxable Interest Taxable interest income includes interest from: bank accounts interest on loans you make to others interest from most other sources. Report the total taxable interest income on line 8a of Form 1040. If your total interest income is more than $1,500, Part I and III of Schedule B must be completed. 22 Taxable Interest Zachary received $1,500 in interest income from BBT Bank this year. He will report the $1,500 directly on line 8a of Form 1040. If his interest income from BBT Bank were $1,501, he would also need to report the $1,501 on Part I of Schedule B as in the second example below. Form 1040, Page 1 23 Taxable Interest Some of the other common sources of taxable interest come from interest on: Certificates of deposit (CDs) Deposits or share accounts from credit unions, mutual savings banks, cooperative banks, and federal and domestic savings and loan associations U.S. obligations such as U.S. Treasury bills, notes and bonds U.S. savings bonds Installment sale payments Life insurance proceeds remaining with the insurance company Tax refunds Gifts for opening accounts 24 U.S. SAVINGS BONDS Interest on U.S. Savings Bonds is reported in box 3 of Form 1099-INT. If you use the cash method of accounting, as most individual taxpayers do, you generally report interest on U.S. savings bonds in the year that you receive it. There are three types of U.S. Savings Bonds: HH bonds EE bonds I bonds HH Bonds are purchased at face value. Interest is paid semiannually. You report the interest as income in the year it is received. EE Bonds are purchased at a discount and the interest on these bonds is taxed when the bond is redeemed. The taxable interest is the difference between the purchase amount and the redemption value. I Bonds are newer U.S. bonds. They are purchased at face value and interest is paid at maturity. You can report the interest on series EE, series E, and series I bonds in either of the following ways: Method 1. Report the interest at maturity of the bond or when you cash it. Method 2. Report the increase in redemption value as interest each year. 25 U.S. SAVINGS BONDS Sometimes U.S. Savings Bonds are owned by more than one person. Table 5-1 clarifies who pays tax on U.S. Savings Bond interest. Interest on U.S. savings bonds is exempt from state and local taxes Table 5-1. Who Pays the Tax on U.S. Savings Bond Interest 26 OTHER INTEREST CERTIFICATE OF DEPOSIT (CD) 1. If you buy CDs with maturity of more than one year, include part of the interest as income each year. 2. Early withdrawal penalty is reported in box 2 of Form 1099-INT and reported on line 30 of Form 1040. 3. Early withdrawal penalty is for withdrawing money from CDs or other time-deposit savings accounts before the maturity date. It is a forfeit of some of the interest paid 27 OTHER INTEREST LIFE INSURANCE PROCEEDS Life insurance proceeds paid to a beneficiary are not usually taxable unless the benefits received are more than the amount that would have been payable at time of insured person’s death. (Interest can accrue before distribution) 28 OTHER INTEREST TAX REFUNDS Interest received on tax refunds is taxable income. GIFT/OPENING AN ACCOUNT The fair market value of a gift or service you receive for opening an account in a savings institution must be reported as interest in the year you receive it. 29 OTHER INTEREST Tom has a CD that matures in January 2009 and paid $75 in interest in 2008. Does Tom include the $75 interest as income on his 2008 return? Yes or No? 30 OTHER INTEREST Tom has a CD that matures in January 2009 and paid $75 in interest in 2008. Does Tom include the $75 interest as income on his 2008 return? Yes 31 TAX-EXEMPT INTEREST Some types of interest are exempt from federal income tax. If you are required to file a return you must show any tax-exempt interest you receive for informational purposes only. Tax-exempt interest is reported on line 8b of Form 1040 and generally you will not receive a Form 1099INT. 32 DIVIDENDS Distributions of money, stock, or other property paid to you by a corporation. Report dividends over $1,500 on Part II of Schedule B. Dividends may also come from a partnership, estate, trust, or an S corporation and be reported to you on a Form K1. Major types of dividends are: ordinary dividends, capital gain distributions, nondividend distributions, and other distributions. 33 DIVIDENDS Ordinary dividends are taxable income and are paid out of the earnings and profits of a corporation. They are NOT capital gains. 34 DIVIDENDS Schedule B, Part II 35 DIVIDENDS Pauline Adams received a Form 1099-DIV for $1,646 from NY Money Market Fund. 36 DIVIDENDS Qualified dividends are the ordinary dividends that are subject to the same 0% or 15% maximum tax rate that applies to net capital gain. Qualified dividends should be shown in box 1b of Form 1099-DIV. Capital gains will be covered in Chapter 11. 37 DIVIDENDS Capital Gain Distributions Mutual funds pass capital gains to investors as capital gain distributions. Capital gain distributions are reported in box 2a of 1099-DIV and are reported directly on line 13 of Form 1040 if a Schedule D is not required. 38 DIVIDENDS Corey does not have to file a Schedule D. He received a capital gain distribution of $695 from JTH investments in 2008. Form 1040, Page 1 39 DIVIDENDS Nondividend distributions A return of capital is reported to you on box 3 of Form 1099-DIV. Report the return of capital as a capital gain once your basis has been reduced to zero. 40 DIVIDENDS Jesse purchased stock in 1996 for $4,000. He received a return of capital of $500 on the stock in 1999. Jesse reduced his basis in the stock to $3,500 ($4,000-$500). In 2008, he received a return of capital of $4,500. Since he only had a basis of $3,500, his basis was reduced to zero. What is the taxable amount for 2008? A. $4,500 B. $3,500 C. $1,000 41 DIVIDENDS Jesse purchased stock in 1996 for $4,000. He received a return of capital of $500 on the stock in 1999. Jesse reduced his basis in the stock to $3,500 ($4,000-$500). In 2008, he received a return of capital of $4,500. Since he only had a basis of $3,500, his basis was reduced to zero. What is the taxable amount for 2008? C. $1,000 42 OTHER DISTRIBUTIONS Alaska Permanent Fund Dividends are not dividends. They are reported on line 21 of Form 1040 as other income. 43 BACKUP WITHHOLDING ON INTEREST AND DIVIDENDS Interest and dividends are generally not subject to withholding. However, if you fail to give the payer your social security number or you give an incorrect number, the payments are subject to mandatory withholding (backup withholding). Backup withholding will be shown in box 4 of Form 1040-INT or Form 1040-DIV. 44 TAXABLE STATE AND LOCAL INCOME TAX REFUNDS State or local income tax refunds, etc. Reported on Form 1099-G. If you itemized deductions and claimed state and local income taxes as an itemized deduction and receive a state or local refund, generally reported on line 10 of Form 1040. If you either took standard deduction or claimed state and local general sales taxes as a deduction then the state or local tax refund is not taxable. 45 TAXABLE STATE AND LOCAL INCOME TAX REFUNDS In 2008, Natalie, age 42, received a Form 1099-G for her state refund of $325. Her total itemized deductions in 2007 were $7,200. Her filing status was single. Using the worksheet on the next page, Natalie will report $325 on line 10 of her Form 1040. 46 TAXABLE REFUNDS, CREDITS, OR OFFSETS OF STATE AND LOCAL INCOME TAXES Form 1040, Page 1 47 ALIMONY RECEIVED Report alimony received on line 11 of Form 1040. Child support payments are NOT alimony. Use Table 5-2 (page 5-13) to clarify alimony requirements Child support payments are NOT alimony. If you make child support payments, do not deduct them. If you are receiving child support payments, you do not have to include them as income. 48 ALIMONY RECEIVED The following table shows what is, and what is not considered alimony. Table 5-2 Alimony Requirements (Instruments Executed After 1984) 49 ALIMONY RECEIVED Wanda receives $250 per month of alimony. What amount is reported on Form 1040? A. $250 B. $3,000 C. $2,500 50 ALIMONY RECEIVED Wanda receives $250 per month of alimony. What amount is reported on Form 1040? B. $3,000 She reports the $3,000 ($250 x 12) on line 11 of Form 1040. 51 UNEMPLOYMENT COMPENSATION Unemployment compensation is taxable. Reported to you on Form 1099-G You report it on line 19 of Form 1040. 52 UNEMPLOYMENT COMPENSATION Anthony Sanders (073-22-8990) received $463 in unemployment compensation in 2008 and it was reported on the following Form 1099-G. He records the amount from box 1 on line 19 of Form 1040. Form 1040, Page 1 53 OTHER INCOME Report other income not covered on lines 7-20b on line 21 of Form 1040. 1. Includes prizes, awards, lottery winnings, and jury duty 2. Gambling income includes winnings from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes such as cars, houses, trips or other noncash prizes. Gambling winnings of $600 or more are reported on Form W-2G. Describe the type of income on dotted line next to line 21. 54 OTHER INCOME Donna won $2,500 in her state lottery. It was reported to her on a Form W-2G. Line 21 of Form 1040 is shown below. Form 1040, Page 1 55 WITHHOLDING ON GAMBLING INCOME Certain types of gambling winnings are subject to mandatory withholding. Generally, tax will be withheld from winnings of more than $5,000. All gambling winnings are taxable even if you do not receive a Form W-2G. 56 VOLUNTARY WITHHOLDING If you receive income from unemployment compensation, you can choose to have income tax withheld from the payments. To make this choice, you will have to fill out a Form W-4V, Voluntary Withholding Request. Box 4 of Form 1099-G, Certain Government Payments, shows the taxes withheld from your unemployment compensation. For unemployment compensation, the payer is permitted to withhold 10% from each payment. No other percentage or amount is allowed. 57 Interest, Dividends, and Other Income KEY IDEAS Report interest and/or dividend income over $1,500 on Schedule B, Form 1040. Report early withdrawal penalties on line 30 of Form 1040. Report capital gain distributions on lines 13 of Form 1040 if you are not required to file Schedule D. State and local tax refunds are included in taxable income if you itemized deductions for the refund year and you received a tax benefit by including the state and local tax in itemized deductions. Alimony and separate maintenance payments are taxable income to the recipient of these payments and reported on line 11 of Form 1040. Other income, such as prizes, awards, gambling winnings, and jury duty pay, is reported on line 21 of Form 1040; include the amount and a description of the income. You can choose to have income tax withheld from other types of income such as unemployment compensation. 58 Interest, Dividends, and Other Income CLASSWORK 1: True or False 1. Interest income of less than $10 is not required to be reported. 2. Total interest income of more than $1,500 must be reported on Schedule B, Part I. 3. Report a dividend from a credit union of less than $1,500 on line 8a of Form 1040 if you have no other similar income. 4. Interest credited to a savings account is unearned income. 5. Interest on a Roth IRA is reported on line 8b of Form 1040. 6. Interest on an EE or I bond can only be reported at the maturity date or when you cash it. 7. Interest on U.S. savings bonds is taxable on the state return. 8. If money is withdrawn from a CD before the maturity date and you forfeited some of the interest paid, report this amount on line 30 of Form 1040 as an early withdrawal penalty. 59 Interest, Dividends, and Other Income CLASSWORK 1: True or False 9. Interest received on tax refunds is not taxable income. 10. Life insurance proceeds you receive as a beneficiary are usually not taxable. 11. Jury duty pay is reported as income on line 21 of Form 1040. 12. Unemployment compensation is not taxable. 13. Alimony payments you receive are reported on Form 1040, line 11 and are taxable. 14. Child support payments you make can be deducted from your total income. 15. A state income tax refund is reported to you on Form 1099-G. 16. All state tax refunds are nontaxable. 60 Interest, Dividends, and Other Income CLASSWORK 1: True or False 17. Income from the Alaska Permanent Fund is reported on line 9a of Form 1040. 18. Interest and dividends are considered unearned income. 19. Gambling winnings are not taxable. 20. Child support payments are required to be reported on line 21. 61 Interest, Dividends, and Other Income CLASSWORK 1: True or False 1. Interest income of less than $10 is not required to be reported. F 2. Total interest income of more than $1,500 must be reported on Schedule B, Part I. T 3. Report a dividend from a credit union of $1,500 or less on line 8a of Form 1040 if you have no other similar income. T 4. Interest credited to a savings account is unearned income. T 5. Interest on a Roth IRA is reported on line 8b of Form 1040. F 6. Interest on an EE or I bond can only be reported at the maturity date or when you cash it. F 7. Interest on U.S. savings bonds is taxable on the state return. F 8. If money is withdrawn from a CD before the maturity date and you forfeited some of the interest paid, report this amount on line 30 of Form 1040 as an early withdrawal penalty. T 62 Interest, Dividends, and Other Income CLASSWORK 1: True or False 9. Interest received on tax refunds is not taxable income. F 10. Life insurance proceeds you receive as a beneficiary are usually not taxable. T (only interest earned after death is taxable) 11. Jury duty pay is reported as income on line 21 of Form 1040. T 12. Unemployment compensation is not taxable. F 13. Alimony payments you receive are reported on Form 1040, line 11 and are taxable. T 14. Child support payments you make can be deducted from your total income. F 15. A state income tax refund is reported to you on Form 1099-G. T 16. All state tax refunds are nontaxable. F 63 Interest, Dividends, and Other Income CLASSWORK 1: True or False 17. Income from the Alaska Permanent Fund is reported on line 9a of form 1040. F 18. Interest and dividends are considered unearned income. T 19. Gambling winnings are not taxable. F 20. Child support payments are required to be reported on line 21. F 64 Interest, Dividends, and Other Income CLASSWORK 2: Tom and Sally are filing a joint return. They have the following interest and/or dividend income: Nations Savings and Loan (joint) $1,390 First Federal Bank (Sally) $125 Citizens Credit Union (Tom) $40 U.S. Series HH Savings Bonds (joint) $45 Pullman Mutual Fund (joint) $1,590 Determine the total amount of interest and/or dividend income and where it is reported on Form 1040 or other tax form. 65 Interest, Dividends, and Other Income Classwork 2 Nations Saving and Loan First Federal Bank Citizens Credit Union U.S. Series HH Savings Bonds $1,390 125 40 45 $1,600 $1,600 would be reported on Schedule B, Part I and line 8a of Form 1040. Pullman Mutual Fund $1,590 $1,590 would be reported on Schedule B, Part II and line 9a of Form 1040. 66 Interest, Dividends, and Other Income CLASSWORK 3: Assuming no other interest or dividend income, where are the following reported on the Federal tax return? (line of Form 1040 and the appropriate schedules, if any.) Ordinary dividends over $1,500 Credit union dividends over $1,500 Savings account interest of $8 Tax-exempt interest of $325 U.S. Treasury notes interest of $1,150 Early withdrawal penalty on a CD of $750 Capital gain distributions of $2,333 Alaska Permanent Fund dividends of $68 67 Interest, Dividends, and Other Income CLASSWORK 3: Assuming no other interest or dividend income, where are the following reported on the Federal tax return? (line of Form 1040 and the appropriate schedules, if any.) Ordinary dividends over $1,500 - reported on Schedule B, Part II and line 9a of Form 1040 Credit union dividends over $1,500 – reported on Schedule B, Part I and on line 8a of Form 1040 Savings account interest of $8 – reported on line 8a of Form 1040 Tax-exempt interest of $325 – reported on line 8b of Form 1040 68 Interest, Dividends, and Other Income CLASSWORK 3: U.S. Treasury notes interest of $1,150 – reported on line 8a of Form 1040 Early withdrawal penalty on a CD of $750 – reported on line 30 of Form 1040 Capital gain distributions of $2,333 – reported on line 13 of Form 1040 and on Schedule D, (if required to file a Schedule D) Alaska Permanent Fund dividends of $68 - reported on line 21 of Form 1040 69 Questions and Answers 70