Keynesian Economics Good Bad

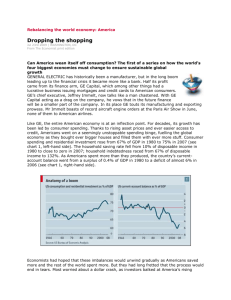

advertisement