Noble Report

advertisement

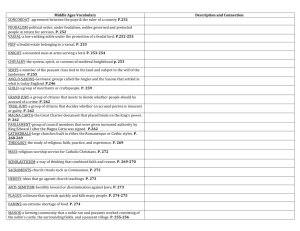

Ticker: NE Sector: Energy Industry: Oil Well Services & Equipment Recommendation: HOLD Pricing Closing Price $34.68 (9/25/10) 52-wk High $45.60 (1/11/10) 52-wk Low $26.23 (6/8/10) Market Data Market Cap $8.5 B Trading Vol. 5 million Valuation EPS $6.27 P/E 7.4 (ttm) P/Sales 2.60 P/Book 1.2 Div Yield 0.30% Profitability & Effectiveness ROA 17.62% ROE 21.92% Profit Margin 43.02% Oper Margin 50.1% Gross Margin 66.2% Analyst: Adam Fletcher Email:awfdm2@mail.missouri.ed u COMPANY OVERVIEW Noble Corporation, a Swiss corporation (“Noble”), is a leading offshore drilling contractor for the oil and gas industry. Noble performs contract drilling services with its fleet of 62 mobile offshore drilling units located worldwide. This fleet consists of 13 semisubmersibles, four dynamically positioned drillships, 43 jack-ups and two submersibles. The fleet count includes two units under construction: one dynamically positioned, ultra-deepwater, harsh environment Globetrotter-class drillship, and one deepwater dynamically positioned semisubmersible. As of January 28, 2010, approximately 87 percent of its fleet was deployed in the following areas: Middle East, India, Mexico, the North Sea, Brazil, and West Africa. Noble and its predecessors have been engaged in the contract drilling of oil and gas wells since 1921. BUSINESS SEGMENTS AND PERFORMANCE Noble’s fleet is composed of four types of units: semisubmersibles, dynamically positioned drillships, independent leg cantilevered jack-ups and submersibles. Several factors determine the type of unit most suitable for a particular job, the most significant of which include the water depth and ocean floor conditions at the proposed drilling location, whether the drilling is being done over a platform or other structure, and the intended well depth. Semisubmersibles (SE) Semisubmersibles are floating platforms which, by means of a water ballasting system, can be submerged to a predetermined depth so that a substantial portion of the hull is below the water surface during drilling operations. These units maintain their position over the well through the use of either a fixed mooring system or a computer controlled dynamic positioning system and can drill in many areas where jack-ups can drill. However, semisubmersibles normally require water depth of at least 200 feet in order to conduct operations. Noble’s semisubmersibles are capable of drilling in water depths of up to 12,000 feet, depending on the unit. Semisubmersibles are more expensive to construct and operate than jack-ups. Dynamically positioned drillships (DR) Noble has four dynamically positioned drillships in the fleet, including its dynamically positioned, ultra-deepwater, harsh environment Globetrotter-class drillship under construction. Drillships are ships that are equipped for drilling and are typically self-propelled. In September 2008 Noble signed contracts for the construction of a new, dynamically positioned, ultradeepwater, harsh environment Globetrotter-class drillship. The drillship, which is currently scheduled to be delivered in the second half of 2011, will have the capacity to drill vertically 40,000 feet and will be capable of drilling in water depths up to 10,000 feet. Jack-ups (JU) Noble currently has 43 jack-ups in the fleet. Jack-ups are mobile, self-elevating drilling platforms equipped with legs that can be lowered to the ocean floor until a foundation is established for support. Noble’s jack-ups are capable of drilling to a maximum depth of 30,000 feet in water depths ranging between eight and 400 feet, depending on the jack-up. Submersibles (SU) 2 Noble has two submersibles in the fleet. Submersibles are mobile drilling platforms that are towed to the drill site and submerged to drilling position by flooding the lower hull until it rests on the sea floor, with the upper deck above the water surface. Performance Net income for 2009 was $1.7 billion compared to net income for 2008 of $1.6 billion. Rig Utilization, Operating Days and Average Day-rates Operating revenues and operating costs and expenses for Noble’s contract drilling services segment are dependent on three primary metrics - rig utilization, operating days and day- rates. The following table sets forth the average rig utilization, operating days and average day-rates for Noble’s rig fleet for 2009 and 2008. Most of the units did better than 2008. Average Rig Utilization 2009 2008 Operating Days 2009 2008 %Change Average Day-rates 2009 2008 %Change JU 82% SE >6000 98% SE <6000 100% DR 91% SU 51% 92% 12,719 13,879 -8% 96% 2,578 2,466 5% 417,177 327,558 27% 100% 67% 66% 1,095 1,098 993 732 418 729 0% 36% -43% 253,557 220,475 254,084 201,819 61,711 54,106 15% 26% 14% Total 90% 17,803 18,904 -6% $197,143 174,506 13% 84% $147,701 $148,532 -1% Contract Drilling Services The following table sets forth the operating revenues and the operating costs and expenses for Noble’s contract drilling services segment for 2009 and 2008: 2009 Operating revenues: Contract drilling services Reimbursable Other Operating costs and expenses: Contract drilling services Reimbursable Depreciation and amortization Selling, general and administrative 2008 Change $ % $3, 509,755 9 6,161 1, 302 $3, 607,218 $3, 298,850 76,099 1, 275 $3, 376,224 $ 210,905 6% 20,062 26% 27 2% $ 230,994 7% $1, 006,764 82,122 398,572 80,004 $1, 011,882 65,251 349,448 72,381 $ (5,118) -1% 16,871 26% 49,124 14% 7,623 11% 3 (Gain)/Loss on asset disposal/involuntary conversion, net Operating income 31,053 1, 598,515 $2, 008,703 10,000 1, 508,962 $1, 867,262 21,053 ** 89,553 6% $ 141,441 8% I highlighted the increasing percentage from 2008 to 2009. From the table above, we can conclude that the year of 2009 did relatively better than 2008. Operating Revenues Contract drilling services revenue increases for 2009 as compared to 2008 were primarily driven by increasing in average day-rates. Average day-rates increased revenues approximately $428 million for 2009, while fewer operating days reduced revenues approximately $217 million. Average day-rates increased 13 percent in 2009 as compared to 2008. Except for Noble’s jack-up rigs, which were impacted by the weakening demand in the shallow waters worldwide, higher average day-rates were received across all other rig categories as scheduled contractual increases for deepwater rigs. The decrease in operating days in 2009 as compared 2008 was primarily due to downtime of certain rigs in 2009. Unpaid shipyard days increased 498 days in 2009 as compared to 2008, as Noble had 21 rigs spend time in the shipyard during 2009. Noble had only 12 rigs with unpaid shipyard days in 2008. Operating Costs and Expenses Contract drilling services operating costs and expenses decreased $5 million in 2009 as compared to 2008. Noble’s new-build rigs were placed into service in November 2008, June 2009, and October 2009, respectively, added approximately $34 million of operating costs in 2009. Excluding the additional expenses related to Noble’s new-build rigs, its contract drilling costs decreased $39 million in 2009 versus 2008. This change was primarily driven by decrease in local labor costs due to the increased number of rigs stacked during 2009 and along with the insurance costs. Depreciation and amortization increased $49 million in 2009 over 2008 due to depreciation on new-builds placed into service, and additional depreciation related to other capital expenditures on Noble’s fleet since the beginning of 2008. Since the beginning of 2008, Noble has spent $2.6 billion on contract drilling capital expenditures. Loss on asset disposal/involuntary conversion in 2009 primarily consists of a charge of $17 million for Noble’s Jack-up. The $17 million charge includes approximately $9 million for the write-off of the damaged legs and $8 million for non-reimbursable expenses. Revenues from Noble Corporation and Subsidiaries 4 United States Benin Brazil Canada Denmark Equatorial Guinea India Ivory Coast Libya Mexico Nigeria Qatar The Netherlands United Arab Emirates United Kingdom Other Total $ Revenues Year Ended December 31, 2009 2009 2008 811,538 $ $ 676,225 11,976 372,750 268,778 33,338 37,953 127,149 69,417 115,669 121,604 80,669 49,135 132,572 839,312 678,001 153,948 304,844 348,028 438,754 333,440 303,313 68,348 186,601 237,418 285,902 228 375 3,640,784 $ 3,446,501 5 2007 $ 671,482 221,498 36,039 72,650 30,693 76,209 452,161 402,130 322,708 235,595 144,444 329,702 $ 2,995,311 Their revenues are diversely spread throughout the world. This gives Noble potential opportunities to do well in the future if the United States continues to experience weakness in the dollar. There are political risks that should be taken into account. Nigeria is known to be a high risk segment of the world to operate in, due to the frequent violence that has occurred against oil executives. They also are in the midst of a tax dispute with the Nigerian government. They are currently in court litigating over whether their oil rigs constitute vessels, which would lead to a 2% tax if the courts choose to classify their rigs as vessels. Vessels are also subject to other environmental laws which could lead to an increase in operating costs in the region. Until this dispute is settled they are not bidding on future Nigerian projects. The company is also leading an internal investigation to determine if they have violated the Foreign Corrupt Practices Act in this country. They also had temporary permits on two jack-ups in Nigeria expire. However, if the operation causes too much expense for Noble and there are too many restrict to continue operating in Nigeria, Noble would move their rigs out of Nigeria. Mexico also provides risk for Noble. Due to the countries laws companies that contract with companies like Noble have the ability to cancel contracts with only 30 days notice. Since 37% of Nobles revenues come from Mexico this provides substantial risk to the firm. Reasons to be Bullish Although uncertainty has plague the deepwater oil drilling industry, Noble will stand tall as nearly all of their operations are in international waters, where potential regulations from the oil spill in the Gulf will be minimal. This will potentially give Noble a heavy competitive advantage over its competitors. Although the oil spill will not affect the company in a good way, Noble will be less affected than many competitors. If operations in the Gulf continue to be stagnant, Noble will also to be able to grab a larger share of the market in the short term. Future revenue potential is very important for current stock price safety. Noble has a larger backlog of future jobs lined up, which many analysts see as keeping the company with strong revenues until 2016. Oil exploration equipment is in constant need of repair, and if a company is focused on keeping its fleet well maintained, then they will reap much fewer profit killing repairs in the future. Noble does an extremely well job at keeping its fleet in top shape. The company spends close to $3 million a year per rig on upkeep. This kind of effort will, and has translated into increased rig productivity as can be seen in the rig utilization chart above. One of the best and most effective ways to keep productivity high in a company is to keep employees happy. One way to do this is by keeping the workplace safe. Oil exploration is a very dangerous field, and Noble has kept one of, if not the best safety record in the industry. This will not only retain good employees, but attract quality new ones and keep worker moral high. Worker moral is especially important for oil rig workers as many work on the rig for 6-8 months straight. Reasons to be Bearish Day rates can have an incredible affect on Noble, and the volatility of its segments day rates proves to be a very heavy risk with the company. From 2002 to 2004, Semisubmersible day rates declined 21%, and declined 70% from 1998 to 1999. Jackup day rates also declined the same 70% during 1997 to 1999. The market for jackups is also almost all controlled by 10 companies, and if one of these decreases spending, then it could have a very negative effect on Noble. These drop offs could, and most likely will repeat themselves at one point. As always, Noble will depend on the oil market, which is based upon very volatile oil and gas prices that are out of the companies control. A possibly damaging event for Noble is the BP Oil Spill. Although as stated earlier that is a potentially good thing for the company, it still could prove to be damaging as not only will regulations be higher in the US, but demand in the Gulf, a large deep-water market, could plummet in the long term. The event will most likely increase insurance, taxes, and regulations in the US, and it may prove difficult for Noble to pass all of the cost to the consumer. Although it is very likely that oil will be the world’s primary source for fuel and power for years, renewable energies are coming to the forefront and in many ways provide much more growth potential. In the last 15 years, renewable energy demand, from nuclear to wind and solar has increased exponentially. Not only are these alternative operations cleaner, but can be much more effective. Nuclear, for example, provides energy at $15/mwh compared to the $40/mwh of gas. The push to use renewable energy is also increasing in the world’s largest economy, China, which has started building massive wind farms. INDUSTRY OUTLOOK There will be more than 100 rigs being delivered during the next few years without a contract in place, so I think the jack-up and mid-water rig markets will suffer from rig oversupply in 2010. In the jack-up market, nearly 90% of the rigs delivered during the next few years do not have a contract. I think Noble might will stack rigs as they roll off contracts to help curb the decline in day-rates for the rigs, which have already fallen 30%-70% in some cases. There might be some more declines in mid-water day-rates because more mid-water rigs roll off their long-term contracts. However, the deep-water rig market will continue to perform relatively better, with dayrates stabilizing in the near term at $500,000-$550,000 per day. The long-term contracts and strong market fundamentals should lead to Noble's deep-water revenue continuing increase in the following years. Deep-water rig availability is still extremely low across the industry during 2010-2012, which places the drillers in a relatively stronger contract negotiating position for any new contracts. Over the long term, I believe Noble's operating margins will steadily increase and the supply for deep-water rigs will have improved from the current extremely tight levels. COMPETITOR COMPARISON Market Cap: Employees: Qtrly Rev Growth (yoy): Revenue (ttm): Gross Margin (ttm): Oper Margins (ttm): Net Income (ttm): EPS (ttm): P/E (ttm): NE 7.49B 5,700 -6.20% 3.59B 68.45% 54.17% 1.62B 6.273 4.67 DO 8.58B 5,500 -2.90% 3.61B 63.69% 51.71% 1.32B 9.479 6.51 NBR 5.45B 15,242 -24.70% 3.40B 45.25% 6.96% -170.52M -0.601 N/A RIG 15.92B 19,300 -16.50% 11.04B 53.22% 37.58% 2.90B 9.02 5.52 2.03 2.31 1.62 1.44 P/S (ttm): Industry 183.19M 73.00 32.60% 63.27M 54.08% 8.28% N/A N/A 17.12 3.14 DO = Diamond Offshore Drilling Inc. NBR = Nabors Industries Ltd. RIG = Transocean Ltd. Industry = Oil & Gas Drilling & Exploration As seen from this table, Noble has relative smaller effect than other energy companies have. Noble, compared to its competitors, has a high growth rate and net income although the company size is smaller than its competitors. The company also maintains higher margins and higher returns then it competitors, with the exception of Diamond Offshore. From a relative comparison, it compares well against all of its competitors. Above is a chart comparing Noble’s competitors against the S&P 500. It can be seen that the many of the oil and gas exploration industry has been trailing the S&P 500, sometimes significantly. Noble has found a way to be at the top of its industry as of late, most likely evidence of its position in international waters as stated earlier. STOCK PERFORMANCE Noble has also done well when compared to the oil and gas industry as a whole over the past year, but has still declined dramatically since the BP Oil Spill in May, as can be seen in the chart above. An interesting point, is that another stock in our portfolio that is a direct competitor, Transocean, and many like it, have continued to decline since may, while Noble has steadily increased. Please also note that the last stock split was a 2:1 split on August 29th of 2007. VALUATION I used the Two-Stage Discounted Free Cash Flow Model to find the intrinsic value of Noble Corporation. I calculated the discount rate taking the risk free rate, beta, and the market risk premium. I used a beta of 1.1, which was around the average of many analysts, and on the more conservative end. A risk-free rate of 3% and a market return of 11% were also used. Using these numbers, the discount rate works out to be: K= 0.03 + 1.10*(0.11-0.03) = 12.9% Noble Corporation’s intrinsic value came to be $45.17 per share. Its stock is currently trading around $33.60. Sensitivity Analysis First Year -2% 0% 11.00% $52.93 $54.01 1% 2% 3% $54.55 $55.09 $55.63 Discount Rate 12.00% 12.90% $47.41 $43.4 $48.38 $44.29 $48.86 $49.34 $49.53 $44.73 $45.17 $45.62 14.00% $39.41 $40.21 $40.62 $41.02 $41.42 Morningstar Value = $50/Share Most others between = $40-$60/Share My Value = $45.17/Share (-$5) RECOMMENDATION HOLD Noble stands tall in the difficult contract drilling industry, delivering some of the best returns on capital and operating margins. In addition, it was ranked first in customer satisfaction for deep-water operations, and first in the Latin America and North Sea regions. I think Noble’s strong safety record also helps to attract and retain employees which make a tremendous amount of respect for Noble’s management team. However, the company does not have an economic moat. Limited negotiating power and minimal rig differentiation from its competitors create a difficult blueprint for longterm success. Noble does have the second-largest offshore fleet in industry, but it is only about half the size of larger peer Transocean (RIG), another large holding in our portfolio. Regardless of the size of Noble's fleet, it still faces the risk of the oil and gas industry. The company will have to manage an aggressive rig construction program, and its unique two-phase rig construction process means more opportunities for cost overruns and late rig deliveries. Late rig deliveries could mean the cancellation of lucrative rig contracts. Noble has many pros and cons going into the future as written about above, but from my research, Noble is a solid company. I believe that we as a class should begin to diversify within our energy holdings. We currently hold 100% of our energy stocks in the oil and gas exploration industry. It should be considered that the class should begin to diversify away from this industry and into more high growth potential renewables. In our portfolio we hold 500 shares of Noble stock. Based on our allocation projections, a hold seems like the best option as we discuss further how we would like to allocate within energy. It also depends highly on the buy/sell decision of Transocean and ExxonMobil FINANCIAL STATEMENTS (Annual Dec. 31) 10