Chapter 14: Forward & Futures Prices

advertisement

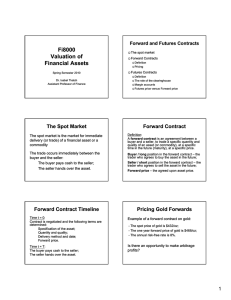

Finance School of Management Chapter 14: Forward & Futures Prices Objective • How to price forward and futures • Storage of commodities • Cost of carry • Understanding financial futures 1 School of Management Finance Chapter 14: Contents Distinction Between Forward & Futures Contracts The Economic Function of Futures Markets The Role of Speculators Relationship Between Commodity Spot & Futures Prices Extracting Information from Commodity Futures Prices Spot-Futures Price Parity for Gold Financial Futures The “Implied” Risk-Free Rate The Forward Price is not a Forecast of the Spot Price Forward-Spot Parity with Cash Payouts “Implied” Dividends The Foreign Exchange Parity Relation The Role of Expectations in Determining Exchange Rates 2 Finance School of Management Features of Forward Contracts Two parties agree to exchange some item on a specified future date at a delivery price specified now. The forward price is defined as the delivery price which makes the current market value of the contract zero. No money is paid in the present by either party to the other. The face value of the contract is the quantity of the item specified in the contract times the forward price. 3 School of Management Finance Features of Forward Contracts The party who agrees to buy the specified item is said to take a long position, and the party who agrees to sell the item is said to take a short position. “Customization”, difficulty of “closing out” positions, low liquidity The risk of contract default, credit risk 4 School of Management Finance Characteristics of Futures Futures are – standard contracts – immune from the credit worthiness of buyer and seller because exchange stands between traders contracts marked to market daily margin requirements (enough collateral) 5 School of Management Finance Terms Futures List Monday Aug.5,2007 WHEAT(CBT)5,000bu; cents per bu Open High 292 2941/2 289 Low Settle 2943/4 Change Lifetime High -71/4 326 Lifetime Low Open Interest 258 16.168 Mark-to-market Margin requirement Margin call 6 School of Management Finance An Illustration You place an order to take a long position in a September wheat futures contract on August 4, 1991. The broker requires you to deposit an initial margin of $1,500 in your account. On August 5, the futures price closes 71/4 cents per bushel lower. – You have lost 71/4 cents*5,000 bushels = $362.50 that day. – Marking to Market: the broker takes that amount out of your account and transfers it to the future exchange, which transfers it to one of the parties who was on the short side of the contract. – If you do not have enough money in your account to meet the margin requirement (variation / maintenance margin), you’ll receive a margin call from the broker asking you to add money. – If you do not respond immediately, then the broker liquidates your position at the prevailing market price. 7 School of Management Finance Spot-Futures Price Parity for Gold There are two ways to invest in gold. – buy an ounce of gold at S0, store it for a year at a storage cost of $hS0, and sell it for S1. – invest S0 in a 1-year T-bill with return rf , and purchase a 1-ounce of gold forward, F, for delivery in 1-year. S1 S 0 S F h rgold rgold( syn) 1 rf S0 S0 F (1 r f h)S0 8 School of Management Finance Arbitrage Opportunities of Forwards: An Illustration The spot price of gold is $300, the storage costs is 2% per year, and the risk-free rate is 8%. – If the forward price is $340 (too high) Arbitrage Position Sell a forward contract Borrow $300 Buy an ounce of gold Pay storage costs Net cash flows Immediate Cash Flow Cash Flow 1 Year from Now 0 $300 -$300 $340-S1 -$324 S1 -$6 $340-$330=$10 0 9 School of Management Finance – If the forward price is $320 (too low) Arbitrage Position Sell short an ounce of gold Buy a forward contract Invest $300 in 1-year pure discount bond Receive storage costs Net cash flows Immediate Cash Flow $300 0 Cash Flow 1 Year from Now -$300 $324 0 $6 $330-$320=$10 0-S1 S1 -$320 10 School of Management Finance Spot-Futures Price Parity for Gold A contract with life T: F 1 rf h S 0 T – This is not a causal relationship, but the forward and current spot are jointly determined in the market. – If we know one, then the law of one price determines that we know the other. 11 School of Management Finance Implied Cost of Carry Implied cost of carry = F − S0 = (rf + h) S0 The implied cost of storing the gold (per $spot) is h = (F − S0)/S0 − rf Suppose F = $330, S0 = $300, and rf = 8%, then – Implied cost of carry = $330 − 300 = $30 – Implied storage cost = (330 − 300)/300 − 8% = 2% 12 School of Management Finance Financial Futures Financial futures contracts are usually settled in cash. With no storage cost, the relationship between the forward and the spot is F S 1 rf T – Any deviation from this will result in an arbitrage opportunity. 13 School of Management Finance Replication of Non-Dividend-Paying Stock Using a pure Discount Bond and a Stock Forward Contract Position Buy a share of stock Immediate Cash Flow Cash Flow 1 Year from Now –S S1 Replicating Portfolio (Synthetic Stock) Go long a forward contract 0 on stock Buy a pure discount bond – F/(1+r f ) with face value of F Total replicating portfolio – F/(1+r f ) S1 – F F S1 14 School of Management Finance Arbitrage in Stock Futures The spot price of a stock is $100, and the risk-free rate is 8%. The forward price is $109. Arbitrage Position Sell a forward contract Borrow $100 Buy a share of stock Net cash flows Immediate Cash Flow 0 $100.00 -$100.00 0 Cash Flow 1 Year from Now $109-S1 -$108.00 S1 $1 15 School of Management Finance The “Implied” Risk-Free Rate Rearranging the formula, the implied interest rate on a forward given the spot is 1 T F F S0 r 1; if T 1, r S0 S0 – This is reminiscent of the formula for the interest rate on a discount bond. 16 School of Management Finance Replication of a Pure Discount Bond Using a Stock and a Forward Contract Position Immediate Cash Flow Cash Flow 1 Year from Now Buy a T-bill with face value – F/(1+r f ) of F Replicating Portfolio (Synthetic T-Bill) Buy a share of stock –S Go short a forward contract 0 Total replicating portfolio –S F S1 F – S1 F 17 Finance School of Management The Forward Price is not a Forecast of the Spot Price Following the diagrams in Chapter 13 we might suppose that the expected price of a stock is S1 S 0 (1 r f risk premium) S 0 (1 r f ) F If this is indeed correct, then the forward price is not an indicator of the expected spot price at the maturity of the forward. 18 School of Management Finance Forward-Spot Parity with Cash Payouts The S − F relationship becomes DF S F S rf S D 1 rf – Note: (forward price > the spot price) if (D < rf S) – Because D is not known with certainty, this is a quasi-arbitrage situation. 19 School of Management Finance Replication of Dividend-Paying Stock Using a Pure Discount Bond and a Stock Forward Contract Immediate Cash Flow Buy a share of stock -S Replicating Portfolio (Synthetic Stock) Go long a forward contract 0 on stock Buy a pure discount bond - (D + F)/(1+r f ) with face value of D + F Position Cash Flow 1 Year from Now D + S1 S1 – F D+F 20 School of Management Finance “Implied” Dividends From the last slide, we may obtain the implied dividend D 1 rf S F 21 School of Management Finance Exchange Rate Example Time Japan 15000 ¥ (Borrowed) U.K. 150 ¥/£ 3% ¥/¥ (direct) 3% ¥/£/£/¥ 15450 ¥ 15450 ¥ (Repaid) £100 (Invested) 9%£/£ Forward ¥/£ £109 (Matures) 22 School of Management Finance The Foreign Exchange Parity Relation We used the diagram to show that $ Denominated Forward on Yen 1 r$ t $ Denominated Spot for Yen 1 rY t 23