L18

advertisement

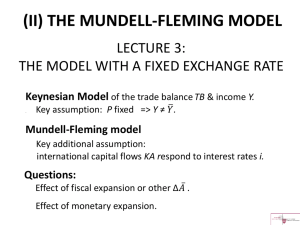

Lecture 18: Crises in Emerging Markets Continuing from Lecture 12 • Boom-bust cycle of inflows & outflows • Sudden stops • • Managing capital outflows Speculative attacks • Contagion • IMF Programs • • Appendices: • • Car crash analogy The most recent cycle • • • The 2003-08 boom Who got hit by the Global Financial Crisis of 2008-09? Who got hit by the “taper tantrum” of 2013? ITF220 - Prof.J.Frankel Cycle in capital flows to emerging markets Cycle prophesied by Joseph in Egypt: 7 fat years followed by 7 lean years. ITF220 - Prof.J.Frankel Cycle in capital flows to emerging markets • 1st developing country lending boom (“recycling petro dollars”): 1975-1981 – Ended in international debt crisis 1982 – Lean years (“Lost Decade”): 1982-1989 • 2nd lending boom (“emerging markets”): 1990-96 – Ended in East Asia crisis 1997 – Lean years: 1997-2003 • 3rd boom (incl. China & India this time): 2003-2008 – Ended in 2008 GFC – at least for the moment. – Crisis of the Euro periphery: 2010-12 • 4th boom: 2010-11 – Hit by end of Fed’s QE? 2013-16 ITF220 - Prof.J.Frankel The role of US monetary policy in the cycle • Low US real interest rates contributed to EM flows in late 1970s, early 1990s & early 2000s. (BP=0 shifts down.) • The Volcker tightening of 1980-82 precipitated the international debt crisis of 1982. (BP=0 shifts up.) • The Fed tightening of 1994 helped precipitate the Mexican peso crisis of that year. – as predicted by Calvo, Leiderman & Reinhart (1993). • Perhaps it is happening again, as i*↑? After Fed “taper talk” in May 2013, capital flows to Emerging Markets reversed again. Jay Powell, 2013, “Advanced Economy Monetary Policy and Emerging Market Economies.” Speech at the Federal Reserve Bank of San Francisco Asia Economic Policy Conference, Nov. http://www.frbsf.org/economic-research/publications/economic-letter/2014/march/federal-reserve-tapering-emerging-markets/ Sudden stop Example: the 3rd wave of flows to EMs was interrupted by the Global Financial Crisis in late 2008. Global Financial Crisis start Alternative Ways to Manage Capital Outflows Say a country finds itself with a deficit, e.g., because i* ↑shifts BP line i A. Allow money to flow out (can cause recession, & banking failures) B. Sterilized intervention (can be difficult, and only prolongs the problem) • C. Allow currency to depreciate (inflationary) D. Reimpose capital controls (probably not very effective) Y ITF220 - Prof.J.Frankel Speculative attack: The capital outflow accelerates so rapidly that the central bank is forced to devalue by its rapid loss of all reserves. 3 generations of models of speculative attacks, with 3 kinds of causes: * Overly expansionary macro policy -- Krugman (1979)… * Excessive speculation: “Multiple equilibria”-- Obstfeld (1994)… * Domestic financial structure: moral hazard (“crony capitalism”) -- Dooley (2000)… ITF220 - Prof.J.Frankel What is the difference between a speculative attack and a regular balance of payments crisis? • In Hemingway’s The Sun Also Rises, a character is asked, "How did you go bankrupt?” His response: "Gradually ... then suddenly." ITF220 - Prof.J.Frankel Traditional balance of payments problem: Reserves gradually run down to zero, at which point CB is forced to devalue. ITF220 - Prof.J.Frankel Sudden exhaustion of Mexico’s reserves in 1994 Peso Crisis 35000.00 30000.00 25000.00 IMF PROGRAM 20000.00 15000.00 CRISIS 10000.00 5000.00 Level 3m Moving Avg ITF220 - Prof.J.Frankel 1995M4 1995M3 1995M2 1995M1 1994M12 1994M11 1994M10 1994M9 1994M8 1994M7 1994M6 1994M5 1994M4 1994M3 1994M2 1994M1 1993M12 1993M11 1993M10 1993M9 1993M8 1993M7 1993M6 1993M5 1993M4 1993M3 1993M2 1993M1 1992M12 0.00 Data source: IMF International Financial Statistics. Modern currencycrises: reserves almost falloff a cliff. Speculative attack (See graph for Mexico, 1994.) An irrational stampede? Not necessarily. Rational expectations theory says S can’t jump unless there is news; at the date of the attack the remaining Res is (just barely) enough to satisfy the increase in FX demand without a jump in the price S. ITF220 - Prof.J.Frankel Contagion In August 1998, contagion from the Russian devaluation/default jumped oceans. Source: Mathew McBrady (2002) ITF220 - Prof.J.Frankel Categories/Causes of Contagion • “Monsoonal effects” (Masson, 1999): Common external shocks • E.g., US interest rates ↑ or “Risk off”; • World recession; • $ commodity prices ↓. • “Spillover effects” • Trade linkages; • Competitive devaluations (“currency war”); • Investment linkages. • Pure contagion • Stampede; • Wake-up call: Investor perceptions of, e.g., Asian model or odds of bailouts; • Illiquidity in financial markets. ITF220 - Prof.J.Frankel Major IMF Country-Programs 3 components • Country reforms (macro policy & perhaps structural) • Financing from IMF (& sometimes G-7, now G-20) • Private Sector Involvement (so public money doesn’t go to bail out investors). ITF220 - Prof.J.Frankel Appendix 1: The Car Crash Analogy Sudden stops: “It’s not the speed that kills, it’s the sudden stops” – Dornbusch Superhighways: Modern financial markets get you where you want to go fast, but accidents are bigger, and so more care is required. – Merton ITF220 - Prof.J.Frankel Is it the road or the driver? Even when many countries have accidents in the same stretch of road (Stiglitz), their own policies are also important determinants; it’s not determined just by the system. – Summers Contagion is also a contributor to multi-car pile-ups. ITF220 - Prof.J.Frankel THE CAR CRASH ANALOGY, continued Moral hazard -- G7/IMF bailouts that reduce the impact of a given crisis, in the LR undermine the incentive for investors and borrowers to be careful. Like air bags and ambulances. But to claim that moral hazard means we should abolish the IMF would be like saying drivers would be safer with a spike in the center of the steering wheel column. – Mussa Correlation does not imply causation: That the IMF (doctors) are often found at the scene of fatal accidents (crises) does not mean that they cause them. ITF220 - Prof.J.Frankel Reaction time: How the driver reacts in the short interval between appearance of the hazard and the moment of impact (speculative attack) influences the outcome. Adjust, rather than procrastinating (by using up reserves and switching to short-term $ debt) – J Frankel Optimal sequence: A highway off-ramp should not dump high-speed traffic into the center of a village before streets are paved, intersections regulated, and pedestrians taught not to walk in the streets. So a country with a primitive domestic financial system should not necessarily be opened to the full force of international capital flows before domestic reforms & prudential regulation. => There may be a role for controls on capital inflow (speed bumps & posted limits). -- Masood Ahmed ITF220 - Prof.J.Frankel Appendix 2: More on crises in emerging markets • Cycles of capital flows to developing countries • Are big current account deficits dangerous? • How did the 2003-08 boom differ from past cycles? • Who got hit by the Global Financial Crisis of 2008-09? • Who got hit by the “taper tantrum” of 2013? ITF220 - Prof.J.Frankel Cycles of capital flows to developing countries: 1975-81 -- Recycling of petrodollars, via bank loans, to LDCs 1982 -- Mexico unable to service its debt on schedule => Start of international debt crisis worldwide. 1982-89 -- The “lost decade” in Latin America 1990-96 -- New record capital flows to emerging markets globally 1994, Dec. -- Mexican peso crisis 1997-2002 – EM currency crises: 1997 July -- Thailand forced to devalue => starting East Asia crisis (Indonesia, Malaysia, Korea...) 1998, August -- Russia devalues & defaults on much of its debt. => Contagion to Brazil; LTCM crisis in US. 2001, Feb. -- Turkey abandons exchange rate target 2002, Jan. -- Argentina ends “convertibility plan” (currency board) 2003- - New capital flows into developing countries, incl. China, India.. - interrupted by GFC 2008-09 & “taper tantrum” 2013. ITF220 - Prof.J.Frankel Are big current account deficits dangerous? Neoclassical theory: if a country has low capital/labor ratio or transitory negative shock, large CAD can be optimal. In practice: Developing countries with big CADs often get into trouble. Traditional rule of thumb: “CAD > approx. 4% GDP” is a danger signal. “Lawson Fallacy” -- CAD not dangerous if government budget is balanced, so borrowing goes to finance private sector, rather than BD. Amendment after Mexico crisis of 1994 – CAD not dangerous if BD=0 and S is high, so the borrowing goes to finance private I, rather than BD or C. Amendment after East Asia crisis of 1997 – CAD not dangerous if BD=0, S is high, and I is well-allocated, so the borrowing goes to finance high-return I, rather than BD or C or empty beach-front condos (Thailand) & unneeded steel companies (Korea). In taper tantrum of 2013 – CA deficit countries vulnerable (“Fragile Five”). ITF220 - Prof.J.Frankel How did the 2003-08 boom differ from past cycles? • BRICs China & India were big recipients of private capital inflows. • Most EM countries did not use inflows to finance CA deficits, – but rather to pile up international reserves. • Most middle-income countries no longer fix their exchange rate. • Perhaps as a consequence, many borrowed less in $, – more in their own currency. – And more FDI. • • => less vulnerability to a sudden stop. • In global crisis of 2008, some developing countries were relatively “decoupled” from the shock • The big exception was much of Central & Eastern Europe: – Ex ante: Lots of borrowing denominated in € (& even Swiss Francs) – Ex post: The worst-hit, in 2008-09. ITF220 - Prof.J.Frankel The Global Financial Crisis was quickly transmitted to emerging market currencies in September 2008. Source: Benn Steil, Lessons of the Financial Crisis, CFR, March 2009 24 Spreads had been low, but rose again in Sept.2008, esp. in Central/Eastern Europe. World Bank ITF220 - Prof.J.Frankel Best and Worst Performing Countries in Global Financial Crisis -- F&S (2012), Appendix 4 GDP Change, Q2 2008 to Q2 2009 Lithuania Latvia Ukraine Estonia Macao, China Russian Federation Bo tto m 10 Georgia Mexico Finland Turkey Australia Poland Argentina Sri Lanka Jordan Indonesia To p 10 Egypt, Arab Rep. Morocco 64 countries in sample India China -25% -20% -15% -10% -5% 0% 5% 10% The variables that show up as the strongest predictors of country crises are: (i) reserves and (ii) currency overvaluation 0% 10% 20% 30% 40% 50% 60% Reserves Real Exchange Rate GDP Credit Current Account Money Supply Budget Balance Exports or Imports Inflation Equity Returns Real Interest Rate Debt Profile Terms of Trade Political/Legal Contagion Capital Account % of studies where leading indicator was found to be statistically signficant (total studies = 83, covering 1950s-2009) External Debt Source: Frankel & Saravelos (2012) 70% Global investor interest in government debt resumed for some Emerging Markets in 2010 Serkan Arslanalp & Takahiro Tsuda, The Trillion Dollar Question: Who Owns Emerging Market Government Debt, March 5, 2014, iMFdirect Countries with worse current accounts were hit by greater currency depreciation after “taper tantrum” of May 2013. Mishra, Moriyama, N’Diaye & Nguyen, “Impact of Fed Tapering Announcements on Emerging Markets,” IMF WP 14/109 June 2014 Countries with higher inflation rates, also, were hit by greater currency depreciation after May 2013. Mishra, Moriyama, N’Diaye & Nguyen, “Impact of Fed Tapering Announcements on Emerging Markets,” IMF WP 14/109 June 2014