Noncontrolling Interests

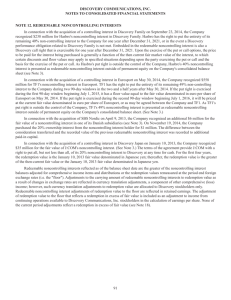

advertisement

1 Stock Ownership Less Than 100% Ownership of more than 50% of voting stock requires consolidation of 100% of subsidiary with a parent’s own accounts Noncontrolling interest Portion of the subsidiary’s stock held by other investors Noncontrolling interest appears as a separate line in the equity section of the balance sheet, and Noncontrolling interest’s share of subsidiary’s income appears as a separate line on the income statement ©Cambridge Business Publishing, 2010 Reasons for Less-Than-100% Acquisitions Subsidiary’s previous owners wanted to retain an interest in the company Acquirer does not want to invest the resources necessary to buy all of the acquiree’s stock Acquirer cannot convince all the stockholders to sell A smaller investment suffices to achieve the acquirer’s goals ©Cambridge Business Publishing, 2010 2 3 Parent’s Acquisition Cost Acquisition cost includes Fair value of shares and debt issued Net of registration and issue costs Cash paid directly to the former shareholders of the acquired subsidiary Any expected conditional payments ©Cambridge Business Publishing, 2010 Valuation of Noncontrolling Interests and Goodwill at Acquisition Current GAAP Noncontrolling interests reported at fair value Revaluations of acquired identifiable net assets and goodwill are attributed to both the controlling and noncontrolling interests In proportion to ownership interests Goodwill is separately attributable to each interest Often in different proportions ©Cambridge Business Publishing, 2010 4 Noncontrolling Interests and Goodwill at Acquisition Example Admiral Casino pays $42,600,000 cash for 80% of the stock of Gold Road Motor Inn, Inc. on January 1, 2010. Gold Road’s book value equals $10 million, consisting of $2.5 million of stock and $7.5 million of retained earnings. The book values of net assets equal fair value except for previously unrecorded customer lists valued at $5 million with a 4-year life. The estimate of the fair value of the 20% noncontrolling interest is $8,400,000. Total Goodwill calculation: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Gold Road Fair value in excess of Gold Road's book value Difference between fair value and book value: Customer lists Goodwill ©Cambridge Business Publishing, 2010 $ 42,600,000 8,400,000 51,000,000 (10,000,000) 41,000,000 (5,000,000) $ 36,000,000 5 Noncontrolling Interests and Goodwill at Acquisition Example 6 To allocate goodwill between controlling and noncontrolling interests: Step 1 – Allocate goodwill to controlling interest: Acquisition cost Less controlling interest in the fair value of Gold Road's identifiable net assets: 80% × ($10,000,000 + $5,000,000) Controlling interest’s share $ 42,600,000 (12,000,000) $ 30,600,000 Step 2 – Allocate balance of goodwill to non-controlling interest: Total goodwill Less goodwill to controlling interest Noncontrolling interest's share $ 36,000,000 (30,600,000) $ 5,400,000 Ownership interests do not govern goodwill allocation. ©Cambridge Business Publishing, 2010 Measuring Fair Value of Noncontrolling Interests Based on current market prices of a publicly-traded company for shares not held by the acquirer, if available Reflects transactions among noncontrolling shareholders Business valuation methods less a discount for lack of control ©Cambridge Business Publishing, 2010 7 Noncontrolling Interests – Premium and Discounts An acquiree’s current market price is $30 per share. The acquirer is willing to pay a 6.67% control premium. Premium = 6.67% × $30 = $2 Cost to acquire per share = $30 + $2 = $32 Using a business valuation at $32 per share, a discount is applied to determine noncontrolling value: Discount = 1 – (1 ÷ (1 + 0.067)) = 6.25% Value per share = $32 × (1 – 0.0625) = $30 ©Cambridge Business Publishing, 2010 8 Measuring Without an Active Market Price Use business valuation methods, such as Capitalization of expected future earnings or cash flows Estimated future returns are discounted using an appropriate discount rate Capitalization of excess earnings Firm value is estimated as the fair value of tangible net assets plus capitalized earnings in excess of earnings attributable to the tangible assets Direct comparison approach Using the terms of a similar acquisition Such as a multiple of book value or billings ©Cambridge Business Publishing, 2010 9 Disclosure of Initial Valuation of Noncontrolling Interest Must disclose in year of acquisition per SFAS 141(R) Information to disclose Fair value of the noncontrolling interest in the acquiree at acquisition date Valuation technique(s) and significant inputs used to measure the fair value of the noncontrolling interest ©Cambridge Business Publishing, 2010 10 Consolidation Eliminating Entries at Acquisition Date Goals of eliminating entries Eliminate the investment account Eliminate the subsidiary’s equity accounts Revalue the subsidiary’s assets and liabilities to fair value at acquisition date Create the noncontrolling interest in equity to be reported on the consolidated balance sheet ©Cambridge Business Publishing, 2010 11 12 Eliminating Entries Entry E Allocates subsidiary’s book value (equity) between the controlling interest (investment account) and the noncontrolling interest in proportion to ownership interests Entry R Revalues subsidiary’s identifiable net assets and allocates between controlling interest (investment) and noncontrolling interest in proportion to ownership interests Goodwill allocated based on each interest’s share in the goodwill If noncontrolling interest valuation discount exists Goodwill allocation to noncontrolling interest equals a percentage basis less than the ownership interest ©Cambridge Business Publishing, 2010 13 Acquisition Date Elimination Entries Example Admiral Casino pays $42,600,000 cash for 80% of the stock of Gold Road on January 1, 2010. Gold Road’s book value is $10 million, consisting of $2.5 million of stock and $7.5 million of retained earnings. Previously unrecorded customer lists are valued at $5 million. Goodwill is $36 million, allocated $30.6 million to controlling interest and $5.4 million to noncontrolling interest. To eliminate Gold Road's equity accounts and recognize the book value of the noncontrolling interest: (E) Capital stock Retained earnings Investment in Gold Road (80%) Noncontrolling interest in Gold Road (20%) 80% × $10 million ©Cambridge Business Publishing, 2010 2,500,000 7,500,000 8,000,000 2,000,000 20% × $10 million 14 Acquisition Date Elimination Entries Example Admiral Casino pays $42,600,000 cash for 80% of the stock of Gold Road on January 1, 2010. Gold Road’s book value of its net assets is $10 million with $2.5 million of stock and $7.5 million of retained earnings. Previously unrecorded customer lists are valued at $5 million. Goodwill is $36 million, allocated $30.6 million to controlling interest and $5.4 million to noncontrolling interest. To revalue Gold Road's net assets to fair value and allocate the revaluations to the controlling and noncontrolling interest: (80% × $5,000,000) + $30,600,000 = $34,600,000 (20% × $5,000,000) + $5,400,000 = $6,400,000 (R) Customer lists 5,000,000 Goodwill 36,000,000 Investment in Gold Road 34,600,000 Noncontrolling interest in Gold Road 6,400,000 ©Cambridge Business Publishing, 2010 15 Consolidation Working Paper for Admiral and Gold Road – January 1, 2010 Exhibit 5.1 ©Cambridge Business Publishing, 2010 16 Reporting Noncontrolling Interests Reported on the consolidated balance sheet Appears as a separate component of consolidated equity Stockholders' equity Capital stock Retained earnings Total Admiral stockholders’ equity Noncontrolling interest $ 5,000,000 20,000,000 25,000,000 5,200,000 Noncontrolling Interest is reported as a separate component of consolidated equity ©Cambridge Business Publishing, 2010 Controlling Interest Noncontrolling Interests on the Balance Sheet – January 1, 2010 ©Cambridge Business Publishing, 2010 17 Consolidating Variable Interest Entities Primary beneficiaries (PB) of VIEs fall under consolidation procedures in FIN46(R) Similar to SFAS 141(R) but feature two valuation alternatives If PB and VIE are under common control, assets and liabilities of the VIE are included on consolidated balance sheet at book value Not considered acquired since already part of the corporate family ©Cambridge Business Publishing, 2010 18 Consolidating Variable Interest Entities If PB and VIE are not under common control, assets and liabilities of the VIE and noncontrolling interest consolidated at fair value Goodwill valuation follows SFAS 141(R) Excess of acquisition cost and the fair value on noncontrolling interests over the fair value of identifiable net assets of the VIE ©Cambridge Business Publishing, 2010 19 Noncontrolling Interests in Subsequent Years Two additional considerations The noncontrolling interest in consolidated income Share of subsidiary’s reported net income adjusted for the noncontrolling interest’s share of revaluation write-offs Changes in equity value of the noncontrolling interest over time Initial fair value adjusted for the noncontrolling interest’s share of accumulated income and dividends after acquisition ©Cambridge Business Publishing, 2010 20 21 Consolidation at End of First Year Assume Gold Road reports net income of $5 million and pays cash dividends of $600,000 in 2010. Impairment testing reveals that goodwill is impaired by $500,000 during 2010. Admiral uses the complete equity method to report its share of Gold Road’s net income. Calculation of equity in net income and noncontrolling interest in net income: Total Gold Road's reported income - 2010 Adjustment for revaluation write-offs: Customer lists ($5,000,000 ÷ 4) Goodwill (85:15 ratio) Totals Noncontrolling Interest Equity in Net Income in Net Income $ 5,000,000 $ 4,000,000 $ 1,000,000 (1,250,000) (1,000,000) (500,000) (425,000) $ 3,250,000 $ 2,575,000 (250,000) (75,000) $ 675,000 Write-offs of revaluations of identifiable net assets attributed to ownership interests, in this case, 80:20. Goodwill controlling interest = $30.6 million Goodwill noncontrolling interests = $5.4 million ©Cambridge Business Publishing, 2010 $30.6 ÷ $36 = 85% $5.4 ÷ $36 = 15% Write-Offs of Subsidiary’s Asset and Liability Revaluations No specific authoritative guidance on how to attribute write-offs Text assumes revaluation write-offs shared in same proportions used to attribute the original revaluations ©Cambridge Business Publishing, 2010 22 23 Write-Offs of Revaluations Example Assume Gold Road reports net income of $5 million and pays cash dividends of $600,000 in 2010. Impairment testing reveals that goodwill is impaired by $500,000 during 2010. Admiral uses the complete equity method to report its share of Gold Road’s net income. To record equity in net income for 2010: Investment in Gold Road Equity in income of Gold Road 2,575,000 2,575,000 To record dividends received in 2010: $480,000 = 80% x $600,000 Cash Investment in Gold Road ©Cambridge Business Publishing, 2010 480,000 480,000 Investment in Gold Road 42,600,000 2,575,000 480,000 44,695,000 24 Elimination Entries Required Eliminate current year’s equity method entries Eliminate subsidiary’s beginning-of-year stockholders’ equity account balances Revalue the subsidiary’s assets and liabilities as of the beginning of the year Recognize current year write-offs of the subsidiary’s asset and liability revaluations Recognize the noncontrolling interest in net income ©Cambridge Business Publishing, 2010 Eliminating Entries C and E for Admiral and Gold Road - 2010 25 To eliminate equity in net income on the parent's books, the parent's share of the subsidiary's dividends, and restore the investment account to its beginning-of-year value: (C) Equity in income of Gold Road Dividends Investment in Gold Road 2,575,000 480,000 2,095,000 To eliminate the subsidiary's beginning-of-year equity accounts against the investment account and recognize the beginning-of-year book value of the noncontrolling interest: (E) Capital stock Retained earnings, January 1 Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 2,500,000 7,500,000 8,000,000 2,000,000 Eliminating Entry R for Admiral and Gold Road - 2010 To revalue Gold Road's net assets to fair value and allocate the revaluations to the controlling and noncontrolling interest: 80% × $5,000,000 + $30,600,000 = $34,600,000 20% × $5,000,000 + $5,400,000 = $6,400,000 (R) Customer lists 5,000,000 Goodwill 36,000,000 Investment in Gold Road 34,600,000 Noncontrolling interest in Gold Road 6,400,000 ©Cambridge Business Publishing, 2010 26 Eliminating Entries O and N for Admiral and Gold Road - 2010 To write off the revaluations for the current year: (O) Goodwill impairment loss Other operating expenses Goodwill Customer lists 500,000 1,250,000 500,000 1,250,000 To recognize the noncontrolling interest in the subsidiary's income and dividends for the current year: Dividends = 20% × $600,000 = $120,000 (N) Noncontrolling interest in net income Dividends Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 675,000 120,000 555,000 27 Consolidated Working Paper for Admiral and Gold Road, December 31, 2010 Exhibit 5.2 ©Cambridge Business Publishing, 2010 28 Noncontrolling Interests in the Consolidated Income Statement 29 Face of consolidated income statement Consolidated net income in total Portions of net income attributable to controlling and noncontrolling interests EPS only for controlling interest Either face of income statement or notes Amounts attributable to controlling interest Income from continuing operations Discontinued operations Extraordinary items ©Cambridge Business Publishing, 2010 Admiral Consolidated Statement of Income and Retained Earnings - 2010 ©Cambridge Business Publishing, 2010 30 Admiral Consolidated Balance Sheet December 31, 2010 ©Cambridge Business Publishing, 2010 31 32 Consolidation at End of Year 2 Gold Road reports net income of $6 million and pays cash dividends of $500,000 in 2011. Goodwill is impaired by $200,000 in 2011. Calculation of equity in net income and noncontrolling interest in net income: Total Gold Road's reported income for 2011 Adjustment for revaluation write-offs: Customer lists ($5,000,000 ÷ 4) Goodwill (85:15 ratio) Totals Noncontrolling Equity in Net Interest in Net Income Income $ 6,000,000. $4,800,000. $1,200,000. (1,250,000) (1,000,000) (250,000) (200,000) (170,000) (30,000) $ 4,550,000. $3,630,000. $ 920,000. Revaluations of identifiable net assets attributed to ownership interests, 80:20. Goodwill controlling interest = $30.6 million Goodwill noncontrolling interests = $5.4 million ©Cambridge Business Publishing, 2010 $30.6 ÷ $36 = 85% $5.4 ÷ $36 = 15% 33 Consolidation at End of Year 2 Entries Gold Road reports net income of $6 million and pays cash dividends of $500,000 in 2011. Goodwill is impaired by $200,000 in 2011. To record equity in net income for 2011: Investment in Gold Road Equity in income of Gold Road 3,630,000 3,630,000 To record dividends received in 2011: $400,000 = 80% × $500,000 Cash Investment in Gold Road 400,000 Investment in Gold Road 44,695,000 3,630,000 400,000 47,925,000 ©Cambridge Business Publishing, 2010 400,000 Eliminating Entries C and E for Admiral and Gold Road - 2011 34 To eliminate equity in net income on the parent's books, the parent's share of the subsidiary's dividends, and restore the investment account to its beginning-of-year value: (C) Equity in income of Gold Road Dividends Investment in Gold Road 3,630,000 400,000 3,230,000 To eliminate the subsidiary's beginning-of-year equity accounts against the investment account and recognize the beginning-of-year book value of the noncontrolling interest: (E) Capital stock Retained earnings, January 1 Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 2,500,000 11,900,000 11,520,000 2,880,000 Eliminating Entry R for Admiral and Gold Road - 2011 To revalue Gold Road's net assets to fair value and allocate the revaluations to the controlling and noncontrolling interest: [80% × $3,750,000] + [85% × $35,500,000] = $33,175,000 [20% × $3,750,000] + [15% × $35,500,000] = $6,075,000 (R) Customer lists 3,750,000 Goodwill 35,500,000 Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 33,175,000 6,075,000 35 Eliminating Entries O and N for Admiral and Gold Road - 2011 To write off the revaluations for the current year: (O) Goodwill impairment loss Other operating expenses Goodwill Customer lists 200,000 1,250,000 200,000 1,250,000 To recognize the noncontrolling interest in the subsidiary's income and dividends for the current year: Dividends = 20% × $500,000 = $100,000 (N) Noncontrolling interest in net income Dividends Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 920,000 100,000 820,000 36 Consolidation Working Paper for Admiral and Gold Road at December 31, 2011 Exhibit 5.3 ©Cambridge Business Publishing, 2010 37 Admiral Consolidated Statement of Income and Retained Earnings - 2011 ©Cambridge Business Publishing, 2010 38 Admiral Consolidated Balance Sheet December 31, 2011 ©Cambridge Business Publishing, 2010 39 Noncontrolling Interest on the Balance Sheet ©Cambridge Business Publishing, 2010 40 Noncontrolling Interest on the Income Statement ©Cambridge Business Publishing, 2010 41 42 Bargain Gain Occurs when an acquirer’s acquisition cost is less than fair value of the identifiable net assets Calculation of bargain gain on acquisition Firm Value Fair value of identifiable net assets Less acquisition cost Less fair value of noncontrolling interest Gain on acquisition SFAS 141(R) requires the bargain gain be attributed entirely to the controlling interest. ©Cambridge Business Publishing, 2010 Consolidation at Date of Acquisition When a Bargain Gain Exists Admiral Casino pays $11 million for 80% of the stock of Gold Road on January 1, 2010. Gold Road’s book value equals $10 million, consisting of $2.5 million of stock and $7.5 million of retained earnings. The book value of net assets equals fair value except for previously unrecorded customer lists valued at $5 million with a 4-year life. The estimate of the fair value of the 20% noncontrolling interest is $2,500,000. Book value Revaluation of identifiable net assets: Customer lists Fair value of identifiable net assets Less acquisition cost Less fair value of noncontrolling interest Gain on acquisition ©Cambridge Business Publishing, 2010 $10,000,000 5,000,000 15,000,000 (11,000,000) (2,500,000) $ 1,500,000 43 Consolidation at Date of Acquisition When a Bargain Gain Exists continued Admiral Casino pays $11 million for 80% of the stock of Gold Road on January 1, 2010. Gold Road’s calculated gain on acquisition is $1,500,000. (slide 47) Admiral Casino’s (acquirer) books: To record 80 percent acquisition of Gold Road: Investment in Gold Road Cash Gain on acquisition of Gold Road 12,500,000 11,000,000 1,500,000 Because a bargain price was paid……….. The investment account and noncontrolling interest do not reflect the ownership shares of the revaluation of identifiable net assets. ©Cambridge Business Publishing, 2010 44 Eliminating Entries E and R for Bargain Gain - 2010 To eliminate the subsidiary's beginning-of-year equity accounts against the investment account and recognize the beginning-ofyear book value of the noncontrolling interest: (E) Capital stock 2,500,000 Retained earnings, January 1 7,500,000 Investment in Gold Road 8,000,000 Noncontrolling interest in Gold Road 2,000,000 To revalue Gold Road's net assets to fair value and allocate the revaluations to the controlling and noncontrolling interest: $12,500,000 – $8,000,000 = $4,500,000 $2,500,000 – $2,000,000 = $500,000 (R) Customer lists Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 5,000,000 4,500,000 500,000 45 Bargain Purchase Consolidation at End of First Year Gain is not shared with noncontrolling interest Revaluations of acquired assets and liabilities are not fully shared Must track the value at the end of the previous year, and use entry R to set the beginning-of-year value Noncontrolling Equity in Net Interest in Net Income Income Total Gold Road's income for 2010 $5,000,000 Adjustment for revaluation write-offs: Customer lists ($5,000,000 ÷ 4) (1,250,000) Totals $ 3,750,000. ©Cambridge Business Publishing, 2010 $4,000,000. $1,000,000. (1,000,000) $3,000,000. (250,000) $ 750,000. Investment in Gold Road 12,500,000 3,000,000 480,000 15,020,000 46 Eliminating Entries C and E When a Bargain Gain Exists - 2010 47 To eliminate equity in net income on the parent's books, the parent's share of the subsidiary's dividends, and restore the investment account to its beginning-of-year value: (C) Equity in income of Gold Road Dividends Investment in Gold Road 3,000,000 480,000 2,520,000 To eliminate the subsidiary's beginning-of-year equity accounts against the investment account and recognize the beginning-of-year book value of the noncontrolling interest: (E) Capital stock Retained earnings, January 1 Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 2,500,000 7,500,000 8,000,000 2,000,000 Eliminating Entry R When a Bargain Gain Exists - 2010 To revalue Gold Road's net assets to fair value and allocate the revaluations to the controlling and noncontrolling interest: $12,500,000 – $8,000,000 = $4,500,000 $2,500,000 – $2,000,000 = $500,000 (R) Customer lists 5,000,000 Investment in Gold Road 4,500,000 Noncontrolling interest in Gold Road 500,000 ©Cambridge Business Publishing, 2010 48 Eliminating Entries O and N When a Bargain Gain Exists - 2010 To write off the revaluations for the current year: (O) Operating expenses Customer lists 1,250,000 1,250,000 To recognize the noncontrolling interest in the subsidiary's income and dividends for the current year: Dividends = 20% × $600,000 = $120,000 (N) Noncontrolling interest in net income Dividends Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 750,000 120,000 630,000 49 Consolidation Working Paper When a Bargain Gain Exists - 2010 Exhibit 5.4 ©Cambridge Business Publishing, 2010 50 Bargain Purchase Consolidation at End of Second Year - 2011 Gold Road reports net income totaling $6 million and pays cash dividends of $500,000 in 2011. Calculation of equity in net income and noncontrolling interest in net income for 2011: Noncontrolling Equity in Net Interest in Net Income Income Total Gold Road's income for 2011 $6,000,000 Adjustment for revaluation write-offs: Customer lists ($5,000,000 ÷ 4) (1,250,000) Totals $ 4,750,000. ©Cambridge Business Publishing, 2010 $4,800,000. $1,200,000. (1,000,000) $3,800,000. (250,000) $ 950,000. Investment in Gold Road 15,020,000 3,800,000 400,000 18,420,000 51 Eliminating Entries C and E When a Bargain Gain Exists - 2011 52 To eliminate equity in net income on the parent's books, the parent's share of the subsidiary's dividends, and restore the investment account to its beginning-of-year value: (C) Equity in income of Gold Road Dividends Investment in Gold Road 3,800,000 400,000 3,400,000 To eliminate the subsidiary's beginning-of-year equity accounts against the investment account and recognize the beginning-of-year book value of the noncontrolling interest: (E) Capital stock Retained earnings, January 1 Investment in Gold Road Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 2,500,000 11,900,000 11,520,000 2,880,000 Eliminating Entry R When a Bargain Gain Exists - 2011 To revalue Gold Road's net assets to fair value, eliminate the remaining investment balance, and bring the noncontrolling interest balance to its beginning-of-year value of $3,130,000: (R) Customer lists 3,750,000 Investment in Gold Road 3,500,000 Noncontrolling interest in Gold Road 250,000 ©Cambridge Business Publishing, 2010 53 Eliminating Entries O and N When a Bargain Gain Exists - 2011 To write off the revaluations for the current year: (O) Operating expenses Customer lists 1,250,000 1,250,000 To recognize the noncontrolling interest in the subsidiary's income and dividends for the current year: Dividends = 20% × $500,000 = $100,000 (N) Noncontrolling interest in net income Dividends Noncontrolling interest in Gold Road ©Cambridge Business Publishing, 2010 950,000 100,000 850,000 54 Consolidation Working Paper When a Bargain Gain Exists - 2011 Exhibit 5.5 ©Cambridge Business Publishing, 2010 55