Effects of Taxation

advertisement

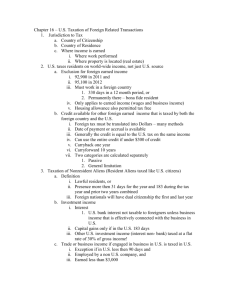

Public Finance (2) 1 Economic effects of direct taxes 1. An increase in income tax rate Effect on working incentive Effect on consumption and general price level The net income of workers will ________. decrease Some workers will prefer _______ leisure to work. Labour supply will decrease _______. People’s ________________ disposable income will be lower. consumption leading They will reduce their ___________, standard of living to a lower _______________. Since people’s demand for goods and services decreases fall ________, the general price level will ____. Public Finance (2) 2 Economic effects of direct taxes 2. An increase in profit tax rate Effect on investment incentive As the ________ net profit from investment is lower, fall producers’ incentive to invest will ____. As profit is an important source of capital, fall producers’ ability to invest will ____. Investment will ________. decrease Government The reward for my hard work! Retained profit for investment Public Finance (2) 3 Economic effects of direct taxes 3. An increase in property tax rate Landlords’ _________ net income from property will be Effect on real lower. estate Their incentive for investing in property will business decrease ________. The demand for property will ________ decrease fall and investment in property will ____. Public Finance (2) 4 Economic effects of direct taxes 4. Income tax system Effect on income inequality Under a progressive tax system, the high-income group have to pay a _______________ higher percentage of their income as tax than the low-income group. The income of the high-income group will drop relatively Tax Tax more than the low_____ income group. The income gap between the high-income group and the low-income group The rich The poor narrower will be ________. Public Finance (2) 5 Economic effects of indirect taxes Sales tax The price of taxed goods will _______. increase Effect on consumption pattern Consumers will buy less / more of taxed goods and less / more of non-taxed goods. Red wine $1,200 tax included Public Finance (2) 6 Economic effects of indirect taxes Sales tax Effect on resource allocation The price of taxed goods will _______. increase Consumers will buy less / more of taxed goods. I will produce I will produce Producers will produce less / more of taxed less Good X! more Good Y! goods. Resource will be diverted from ______ taxed goods non-taxed goods. to _________ Company X Public Finance (2) Company Y 7 Economic effects of indirect taxes Sales tax Effect on price levels tax burden to Since producers will try to pass the _________ increase consumers, the price of taxed goods will _______. As the prices of taxed goods are included in the consumer price index the general price level __________________, will _______. increase General price level Time Public Finance (2) 8 Economic effects of indirect taxes Sales tax Sales tax is a progressive / regressive tax. Effect on income distribution The low-income group have to pay relatively more sales tax than the high_____________ income group. The income gap between the high-income group and low-income group will be widened ________. Public Finance (2) 9 Quiz Suppose the government imposes a sales tax on a per unit basis and increases the proportional income tax rate. What are the overall effects on the price level? An increase in income tax will reduce ___________ disposable income. People will then decrease _____________ consumption and the __________________ general price level will fall. A sales tax will reduce / increase general price level. The overall effect on price level is __________, uncertain depending on the ______________ relative strengths of the above two forces. Public Finance (2) 10 Quiz Suppose the government imposes a sales tax on a per unit basis and increases proportional income tax rate. What are the overall effects on the income distribution? After the increase in proportional income tax, the highincome group will pay a higher / a lower / the same percentage of their income as tax compared with the lowincome group. Since sales tax is __________, regressive the low-income group pays ______________ relatively more income as tax than the high-income group. The income gap will be _______. widened Public Finance (2) 11 End Public Finance (2) 12