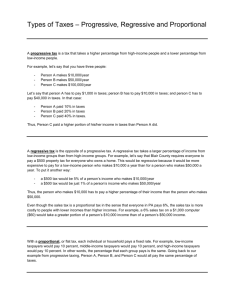

Tax Systems: Progressive, Regressive, Proportional Worksheet

advertisement

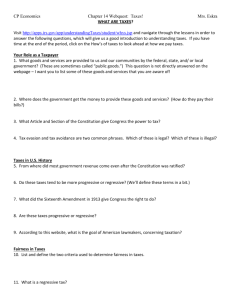

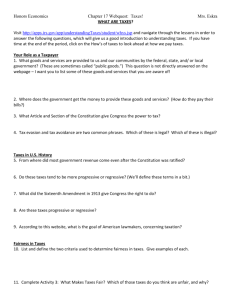

NAME: Worksheet Applying Progressive Taxes ACTIVITY 1 Complete the progressive tax chart below. To find the amount of tax, use this formula: Income X percent of income paid in tax = amount of tax. Example: $25,000 X .15 (15%) = 3,750 Income $5,000 $50,000 $100,000 $150,000 $350,000 Progressive Tax Percentage of Income Paid in Tax 10% 25% 28% 33% 35% Amount of Tax ACTIVITY 2 Answer the following questions: 1. What might happen if the wealthiest taxpayers were taxed at a rate as high as 60 percent? ANSWER: 2. What might happen to the nation’s economy if businesses were taxed at a very high rate? ANSWER: NAME: Worksheet Applying Regressive Taxes Key Terms Regressive tax—A tax that takes a larger percentage of income from low-income groups than from highincome groups. Summary A regressive tax is a fixed amount of money paid by each individual or household. In a regressive tax, the percentage rate decreases as the amount being taxed increases. User fees are often considered regressive because they take a larger percentage of income from low-income groups than from high-income groups. Activity 1 1. If this regressive tax were used as an income tax, which group of people would pay the highest percentage rate of taxes and which would pay the lowest? ANSWER: 2. Cory works at a fast-food restaurant. He makes $10,000 a year. How much would he take home after paying this regressive income tax? How much would his boss, who makes $25,000, take home? ANSWER 3. Marta was making $45,000. She just got a $5,000 raise. Under the regressive tax shown in the chart, would the share of her income that she pays in taxes increase or decrease? What percent would she be paying after the raise? ANSWER NAME: Activity 2 Make a chart similar to the one shown in Activity 1for the tax amount of $3,000. Then answer the questions that follow. (To find the percent of income paid in tax, divide the amount of tax by the income; for example, $3,000 ÷ $50,000 = .06 or 6 percent.). INCOME Regressive Tax ($3,000 Per Person) Percent of Income Paid in Taxes Amount of Taxes $5,000 $10,000 $25,000 $50,000 $100,000 1. Which income level would suffer most under such a tax? ANSWER: 2. Which income level would hardly notice the loss of $3,000? ANSWER: 3. Would it be better if the United States used a Regressive Tax for collecting Income Tax? Explain your answer. ANSWER: Activity 3 Do fixed fees have a place in the larger tax system? For example, states require fees for driver’s licenses. Is such a fee regressive? Is it fair to all income levels? Write a short answer below explaining your opinion on this fee placed on drivers. NAME: Worksheet Applying Proportional Taxes Key Terms flat tax—Another term for a proportional tax. proportional tax—A tax that takes the same percentage of income from all income groups. regressive tax—A tax that takes a larger percentage of income from low-income groups than from highincome groups. sales tax—A tax on retail products based on a set percentage of retail cost. Summary With a proportional or flat tax, each individual or household pays the same fixed rate. For example, lowincome taxpayers would pay 10 percent, middle-income taxpayers would pay 10 percent, and high-income taxpayers would pay 10 percent. The sales tax is an example of a proportional tax because all consumers, regardless of income, pay the same fixed rate. Although individuals are taxed at the same rate, flat taxes can be considered regressive because a larger portion of income is taken from those with lower incomes. For example, a 6% sales tax on a $1000 computer ($60) would take a greater portion of a $10,000 income than of a $50,000 income. Activity 1 Complete the proportional tax chart below. To find the amount of tax, use this formula: Income × percentage of income paid in tax = amount of tax. Example: $15,000 × .10 (10%) = $1,500. INCOME $5,000 $10,000 $25,000 $50,000 $100,000 PROPORTIONAL TAX Percent of Income Paid in Taxes 10% 10% 10% 10% 10% Amount of Taxes Activity 2 The Armey-Shelby flat tax proposal is also based on a 17 percent rate. The Armey-Shelby tax, however, applies that rate only on income over $35,400 for a family of four. In other words, if the family made $50,000, they would be taxed on $14,600 ($50,000−$35,400). 1. How is the attempt to exempt a certain amount from the tax a way to make the tax less regressive? ANSWER: 2. Using the Armey-Shelby tax exemption of $35,400, how much tax would a family of four earning $25,000 pay in taxes? ANSWER: