Chapter4Overheads

advertisement

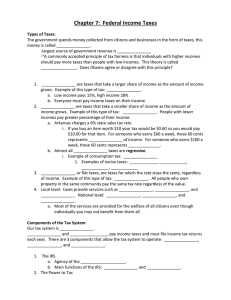

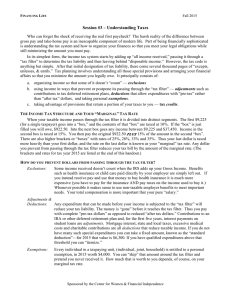

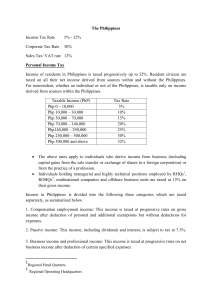

Chapter 3: Managing Taxes Objectives • Explain how taxes are administered and classified. • Describe the concept of the marginal tax rate. • Determine who should file an income tax return. Objectives • Describe the two ways of paying taxes: payroll withholding and estimated taxes. • Identify the eight planning steps involved in calculating federal income taxes. • Understand planning strategies to legally avoid overpayment of income taxes. • Explain the basics of IRS audits. What is Tax Management? ATTENTION! A PLANNING PROCESS FOR TAX: • Reduction • Deferment • Elimination Administration/Classification of Income Taxes • Federal tax laws • Marginal tax rate • Progressive nature of income tax • Effective marginal tax rate • Regressive • Average tax rate 2004 Filing Requirements for Most Taxpayers IF your filing status is. . . AND at the end of 2004 you were. . . Single Under 65 65 or older $7,950 $9,150 Married filing jointly Under 65 (both spouses 65 or older (one spouse) 65 or older (both spouses) $15,900 $16,850 $17,800 Married filing separately Any age $3,100 Head of household Under 65 65 or older $10,250 $11,450 Qualifying widow(er) with dependent child Under 65 65 or older $12,800 $13,750 Information taken from 2004 Publication 17. THEN file a return if your gross income was at least. . . The Progressive Nature of the Federal Income Tax If your filing status is Single If your taxable income is: Over: But not over -- The tax is: Of the amount over-- $0 $7,150 ------------ 10% $0 7,150 29,050 $715.00 + 15% 7,150 29,050 70,350 4,000.00 + 25% 29,050 70,350 146,750 14,325.00 + 28% 70,350 146,750 319,100 35,717.00 + 33% 146,750 319,100 ---------- 92,592.50 + 35% 319,100 The Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. It is not used to figure ones’ taxes. How Your Income is Really Taxed Assumes a single individual with gross income of $57,700 $3,100 personal exemption is not taxed. $4,850 standard deduction is not taxed. First $7,150 of income is taxed at 10%. Income Tax owed $21,900 taxed at 15%. $0 + $0 + $715 + This individual’s marginal tax rate is 25% This individual’s average tax rate is 15.9% (9,175/57,700) $3,285 $20,700 taxed at 25%. + $5,175 = $57,700 = $9,175 Who Should File a Tax Return? STUDENTS WITH: • Earned income • Unearned income • Transfer payments