NEPTUNE GLOBAL EQUITY FUND ASSET ALLOCATION Research

advertisement

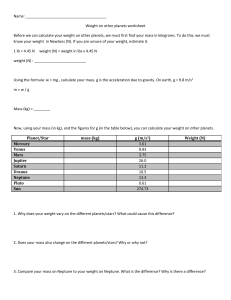

Unconstrained Investment and Portfolio Construction Douglas McDowell Head of Client Investment Strategies THIS PRESENTATION IS NOT FOR RETAIL CLIENTS GLOBAL STOCKMARKET RETURNS SINCE THE START OF THE DECADE 300 250 MSCI EM Index 200 MSCI World Index MSCI AC World Index % 150 MSCI EAFE Index MSCI Europe Index FTSE 100 100 S&P 500 50 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Bloomberg as at 31.01.2012. Past performance is not a guide to future performance. Neptune funds do not replicate a benchmark and holdings may therefore vary from those in the index quoted. For the reason the above comparison index should be used for reference only. TAKE A GLOBAL UNCONSTRAINED* APPROACH • • • Global sector research and understanding of the macro environment is essential to identify future sector and stock opportunities Exposure to both non-OECD and OECD economies allows better risk management Industry developments over the last 30 years and, in particular, the craving for ‘measuring’ a manager’s output has led to them, and all those offering, chasing short-term relative return by constructing sub-optimal portfolios based on indices or benchmarks and thereby putting an unnecessary cap on the generation of long-term absolute return These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. *Subject to prescribed regulatory limits. UNCONSTRAINED* INVESTMENT BASED ON CONVICTION • Investing in best ideas, holding the stocks you want, in the quantities you want, based on your conviction • The resulting increase in active risk may increase expected return • Strategic risk is the permanent loss of capital • • Active risk is the short-term volatility around an index or benchmark Accepting greater active risk (higher volatility) can lead to higher return (and a lowering of strategic risk) • Allows you to take a pragmatic view of absolute diversification • It allows you to take a long-term view *Subject to prescribed regulatory limits. These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. A DIFFERENT APPROACH TO INVESTING • • • • • Global equities are arguably best viewed on a sectoral basis Fundamental research focused on identifying the ‘winners’ in each industry Investors must understand the outlook for global sectors/industries, their key influences and likely development before assessing an individual company’s likely operational performance vs. other potential investments, both inside and outside that sector It is unlikely that any company, however well managed, can perform well vs. all other potential investments in an industry whose background is poor Without a clear understanding of the industry in which it operates, it is impossible to fully understand the prospects of a company operating within it These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. A SECTOR BASED APPROACH • • • • Sector allocation is the key determinant of portfolio construction and, as a by-product, regional allocation Sectoral reviews identify their current structure, prevailing 3-5 year trends and global opportunities Within the most promising sectors, it is the global companies that tend to dominate and investors should seek to add value by detailed analysis at the stock level to identify the most suitable investments. The aim of individual company research is to find those companies most likely to benefit from the sector/industry trends identified in sector research These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. PORTFOLIO CONSTRUCTION AND THE REAL WORLD • Beware of country-based benchmarking • • • • • Too much attention to benchmarks can constrain idea generation and performance National or regional silos can give you a narrow, historically-based focus Sector-based research is essential with increasingly ‘globalised’, interrelated economies A thorough understanding of global growth drivers alongside industry dynamics leads to real understanding Real understanding leads to real conviction • Meaningful positions based on knowledge of the company, its peers and its industry These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. IT’S NOT A BI-POLAR WORLD • Emerging markets (EM) vs. developed markets (DM) dichotomy is the received wisdom • • • In reality EM/DM remain interconnected in complex ways Emerging markets are a collection of vastly different economies Developed economies’ growth is patchy, but there are some areas of strength and they are still the home of many fast-growing global industry leaders Investing in emerging markets can involve a higher degree of risk. Less developed markets are generally less well regulated than the UK and do not have the strict standards of accounting and transparency present in developed markets. Some emerging markets may have relatively unstable governments, economies based on only a few industries and markets that trade only a limited number of securities. As a consequence, both the value of investments made and the ease of which the underlying securities can be bought and sold may be adversely effected. ECONOMIES ARE NOT MARKETS • • OECD economies are predominantly • Domestic • Consumer-orientated • Net borrowers OECD markets are predominantly • Global • Business-orientated • Net savers Source: Google Images, July 2011. INVESTMENT IN COMPANIES, NOT IN COUNTRIES • Japan’s business community ranked 1st overall (World Economic Forum Report 9.10.10) • • • • 1st in 4/9 categories Top 4 in three more 9th and 13th in the other two categories Many Japanese firms: • • • • Dominate their global sectors Higher exposure to non-OECD markets vs. their US/EU rivals Translational gains from yen weakness Sales and operating profits derived from overseas (41% & 44% respectively). Source: Neptune Research & Nikkei 225 Index as at 2010. ASSESSING POTENTIAL GROWTH OPPORTUNITIES • • • • Reflect the well-diversified and increasingly inter-dependant economic growth across both developed and emerging markets Understand both the drivers and distribution of future growth Equally important to understand the varying stages of economic growth of emerging markets… …and their idiosyncrasies • The BRICs are not all same and they are often very different from countries on the ‘frontier’ These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. STOCK SELECTION • • • • Company analysis assesses the growth outlook over 3-5 years, focusing on ROE and ROCE, margin history, balance sheet strength and free cash-flow and management’s record in capital allocation Those companies (potential investments) thus identified are then subject to a proprietary valuation tool which is the prime determinate of ultimate inclusion in a portfolio The ultimate determinate of a holding’s size is the strength of conviction Aiming to buy strong companies within preferred sectors at good valuations, coupled with the rigid sell discipline is the bottom-up contributor to performance These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. PORTFOLIO CONSTRUCTION AND CONTROLS • Truly unconstrained*, with a significant tracking error • Weightings not based on index weightings but on conviction • Entire process focused on portfolio risk • Sector constraints and guidelines • No geographic restrictions • Where a company is listed is largely an accident of history *Subject to prescribed regulatory limits. EMERGING MARKET OPPORTUNITIES • BRIC’s economic strength is dominating the outlook for global growth • • • We believe BRICs will account for two-thirds of global growth over the next 5 yrs Economic outlook remains robust, especially when compared to developed markets • • • Steep change in balance of economic power No constraints from deleveraging → new credit cycle beginning Rapidly reducing reliance on OECD for growth Divergent emerging vs. developed market performance a reflection of misunderstanding/distrust of Chinese economic policy Source: Neptune Research, August 2012. These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of our views. Past performance is no guide to future performance. Investing in emerging markets can involve a higher degree of risk. Less developed markets are generally less well regulated than the UK and do not have the strict standards of accounting and transparency present in developed markets. Some emerging markets may have relatively unstable governments, economies based on only a few industries and markets that trade only a limited number of securities. As a consequence, both the value of investments made and the ease of which the underlying securities can be bought and sold may be adversely effected. Please remember that forecasts are not a reliable indicator of future performance. THE WORLD OF EMERGING STOCKMARKETS 1991 Market capitalisation in US$ billions Source: Emerging Stock Markets Factbook 2011 16 . . . AND 20 YEARS LATER Emerging markets total market capitalisation in 2011 Poland, $212 bn Czech Republic, $53 bn Turkey, $282 bn China, $3,768 bn Russia, $1,048 bn Hungary, $33 bn South Korea, $1,140 bn Mexico, $458 bn Morocco, $66 bn Taiwan, $875 bn Peru, $91 bn Malaysia, $435 bn India, $1,506 bn Colombia, $212 bn Chile, $337 bn South Africa, $515 bn Brazil, $1,532 bn Source: Bloomberg, June 2011 Egypt, $70 bn Indonesia, $407 bn Thailand, $276 bn NEPTUNE GLOBAL EQUITY FUND ASSET ALLOCATION Materials 10.8% Industrials 14.7% Cash 0.6% Energy 14.5% Consumer Staples 22.5% Consumer Disc 16.2% Telecoms 1.5% Financials 4.9% IT 14.3% US 50.5% UK 9.1% China 10.9% Russia 12.7% Hong Kong 5.0% Japan 3.3% Norway 2.5% France 2.3% Switzerland 1.6% Mexico 1.5% Cash 0.6% Research process leads to conviction in leading companies Source: Neptune as at 30.09.12. This Fund may invest more than 35% in government and public securities in a number of jurisdictions. For further details please see the Prospectus. TOP DECILE IN 8/10 CALENDAR YEARS ENABLING A RETURN OF 165% SINCE LAUNCH (4/91) Period To 30.09.12 Neptune Global Equity Fund IMA Sector Average MSCI World % return Quartile ranking % return % return YTD 2.99 4 7.64 9.29 2011 -17.77 4 -9.58 -4.31 2010 22.43 1 16.41 15.87 2009 33.91 1 23.44 16.45 2008 -38.83 4 -24.24 -17.39 2007 29.85 1 10.42 7.72 2006 18.06 1 8.26 5.83 2005 56.66 1 26.61 23.04 2004 16.86 1 8.97 7.46 2003 31.44 1 21.78 20.29 2002 -15.45 1 -25.08 -27.26 Source: Lipper as at 30.09.12, A Accumulation share class performance, IMA Global sector, in sterling with net income reinvested and no initial charges. Calendar year performance as at the end of each year. The performance of other share classes may differ. Launch date: 31.12.2002. This Fund may have a high historic volatility rating and past performance is not a guide to future performance. Investments in emerging markets are higher risk and potentially more volatile than those in established markets. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations and your clients may not get back the original amount invested. IMA sector averages and rankings may change at any time as a result of closure, movement between sectors or price amendments by competitor funds. The discrete calendar year’s performance provided represents the Fund’s ranking at the close of that particular year. Neptune funds are not tied to replicating a benchmark and holdings can therefore vary from those in the index quoted. For this reason the comparison index should be used for reference only. NEPTUNE GLOBAL EQUITY FUND LONG-TERM PERFORMANCE ATTRIBUTION 900 Global Equity EM carve out 800 Global Equity DM carve out 700 MSCI EM TR Index 600 MSCI World TR Index 500 % 400 300 200 100 0 Q4 01 Q4 02 Q4 03 Q4 04 Q4 05 Q4 06 Q4 07 Q4 08 Q4 09 Q4 10 Q4 11 Source: Neptune and Bloomberg as at 30.09.12 in local currency. This Fund may have a high historic volatility rating and past performance is not a guide to future performance. Investments in emerging markets are higher risk and potentially more volatile than those in established markets. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations and your clients may not get back the original amount invested. Neptune funds are not tied to replicating a benchmark and holdings can therefore vary from those in the index quoted. For this reason the comparison index should be used for reference only. Appendix 21 NEPTUNE INVESTMENT TEAM Rob Burnett Chris Taylor Felix Wintle Head of European Equities Financials Sector Head of Research Head of US Equities Healthcare Sector Douglas Turnbull George Boyd-Bowman Ian Sealey James Dowey Chief Economist Mark Martin Thomas Barber Paul Caruana-Galizia Economist Healthcare Sector Financials Sector Thomas Sinclair William Rice Ben Pennington James Hackman Leonard Cripps Kate Trowbridge David Nelson Oil & Gas Sector Ted Alexander Kunal Desai William Balfour Technology & Telecoms Sector Emma Stanford Thomas Smith Chemicals & Utilities Sector Douglas McDowell Head of Client Investment Strategies Consumer Sectors Robin Geffen CEO Fund Manager, Global Equities Rebecca Young Scott MacLennan Industrials Sector Ewan Thompson Head of EM Equities Shelley McKeaveney Ben Myers Mining & Metals Sector Alex Breese Head of UK Equities Industrials Sector INVESTMENT PROCESS OVERVIEW INVESTMENT UNIVERSE 3 PARALLEL STREAMS OF RESEARCH PORTFOLIO CONSTRUCTION PORTFOLIO MONITORING AND RISK CONTROL • • • • • Country Reviews Global Sector Matrix Global Sector Reports Company Valuations WEEKLY MEETING CYCLE Common sense approach Efficient Diversification Concentrated portfolios Investment restrictions Pre-trade checks GLOBAL PORTFOLIO Highest Conviction Stocks • • • • • Ongoing monitoring Target prices Sell discipline Performance and risk analysis Post-trade checks and review CONTACT DETAILS Neptune Investment Management Limited 3 Shortlands, London, W6 8DA Tel: +44 (0)20 3249 0100 Fax: +44 (0)20 3249 0123 sales.enquiries@neptune-im.co.uk www.neptunefunds.com Phil Horton, Sales Manager, Nationals & Networks +44 (0)20 3249 0171 Catherine Ferguson, Sales Support +44 (0)20 3249 0213 Calls may be recorded for monitoring and training purposes and for your protection IMPORTANT INFORMATION This document is issued by Neptune Investment Management Limited (“Neptune”), 3 Shortlands, London, W6 8DA which is authorised and regulated by the Financial Services Authority, FSA number 416015. Details of Neptune's regulatory status and authorisation by regulators in other countries are available from us on request. The Neptune web address is www.neptunefunds.com Some information and statistical data herein has been obtained from sources we believe to be reliable but in no way are warranted by us as to their accuracy or completeness. These are Neptune’s views and as such this document is deemed to be impartial research. We do not undertake to advise you as to any change of Neptune's views. Neptune Investment Management Limited has not produced this report for Retail Clients. It is for private circulation to Investment Professionals only and is not for onward distribution. All information is given in good faith but without any warranty. Neptune Funds are available to any persons that may be marketed to under the Financial Services and Markets Act (Promotion of Collective Investment Schemes) (Exemptions) Order 2001. Retail Clients should contact their Independent Financial Adviser or other authorised intermediary. This communication is only intended for persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations. The provision of investment services may be restricted in certain jurisdictions. You are required to acquaint yourself with any local laws and restrictions on the availability of any services described. Please check whether such products are available in the country in which your clients are resident. None of the Neptune products are available to residents in the United States. Some Neptune funds may have a high historic volatility rating and past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations and your clients may not get back the original amount invested. These funds may invest more than 35% in government and public securities in a number of jurisdictions. Forecasts are not a reliable indicator of future performance. Investments in emerging markets are potentially higher risk than those in developed markets. The current Prospectus, Key Investor Information and Supplementary Information Documents and most recent annual and semi-annual reports can be obtained by calling 0800 587 5051 or downloaded from www.neptunefunds.com. Any past performance data that has not been shown is due to the information not being available. Neptune does not give investment advice and only provides information on Neptune products. 25