Consolid – Other. Issues

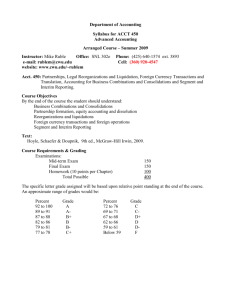

advertisement

Consolid – Other. Issues - 1 CONSOLIDATED STATEMENTS General Concepts Same GAAP as separate statements Only external transactions Specific consolidation mechanics depend on Parent’s accounting for investment in subsidiary Consolid – Other. Issues - 2 CONSOLIDATION MECHANICS Consolidation workpapers – No “set of books” for consolidated entity – Each party maintains their own books Eliminating entries – Necessary to eliminate “intercompany items” – Appear only on consolidation workpapers Consolid – Other. Issues - 3 INVESTMENT ELIMINATION Investment account (Parent’s books) vs. Stockholders’ equity (Subsidiary’s books) Treatment of the differential – Cost of the investment – FMV of subsidiary’s net assets (% acquired) – Book value of subsidiary’s net assets (% acquired) Consolid – Other. Issues - 4 INVESTMENT ELIMINATION Continued Positive differential (Cost vs. Book value) – Errors or omissions on subsidiary’s books – Excess of FMV over book value of subsidiary’s net assets – Existence of goodwill Negative differential (Cost vs. Book value) – Errors or omissions on subsidiary’s books – Excess of book value over FMV of subsidiary’s net assets – Bargain purchase or “negative goodwill” Consolid – Other. Issues - 5 INVESTMENT ELIMINATION Continued Treatment of noncontrolling interest Cost vs. Equity methods on Parent’s books Intercompany receivables and payables Valuation accounts at acquisition – Accumulated depreciation – Allowance for change in FMV of investment securities – Allowance for uncollectible accounts – Discount or premium on bonds payable Negative Retained earnings of subsidiary at acquisition Other stockholders’ equity accounts – Accounts accruing to common stock Consolidation Workpaper Account Titles Trial Balance Data Parent Subsidiary Consolid – Other. Issues - 6 Elimination Entries Debits Credits Work flow Consolidated 100% Purchase at Book Value Account Titles Consolid – Other. Issues - 7 Trial Balance Data Elimination Entries Peerless Spec. Foods Debits Credits Consolidated Cash 50,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 300,000 Total Debits 1,500,000 50,000 50,000 60,000 40,000 600,000 100,000 125,000 160,000 215,000 1,400,000 800,000 2,000,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Total Credits 1,500,000 300,000 100,000 100,000 200,000 (2)200,000 100,000 (2)100,000 800,000 300,000 700,000 200,000 300,000 500,000 300,000 2,000,000 (2) 300,000 300,000 100% Purchase at Book Value Account Titles Consolid – Other. Issues - 8 Trial Balance Data Elimination Entries Peerless Spec. Foods Debits Credits Consolidated Cash 50,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 300,000 Total Debits 1,500,000 50,000 50,000 60,000 40,000 600,000 100,000 125,000 160,000 215,000 1,400,000 800,000 2,000,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Total Credits 1,500,000 300,000 100,000 100,000 200,000 100,000 800,000 700,000 200,000 300,000 500,000 300,000 2,000,000 300,000 200,000 100,000 300,000 300,000 Purchase – Above Book Value Account Titles Consolid – Other. Issues - 9 Trial Balance Data Elimination Entries Peerless Spec. Foods Debits Credits Cash 10,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 340,000 Differential Total Debits 1,500,000 50,000 50,000 60,000 40,000 600,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Total Credits 1,500,000 300,000 100,000 100,000 200,000 (4)200,000 100,000 (4)100,000 800,000 (4) 340,000 (4) 40,000 800,000 Consolidated Purchase – Above Book Value Account Titles Consolid – Other. Issues - 10 Trial Balance Data Elimination Entries Peerless Spec. Foods Debits Credits Cash 10,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 340,000 Differential Total Debits 1,500,000 50,000 50,000 60,000 40,000 600,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Total Credits 1,500,000 300,000 100,000 100,000 200,000 (4)200,000 100,000 (4)100,000 800,000 380,000 (5) 40,000 (4) 340,000 (4) 40,000 (5) 40,000 800,000 380,000 Consolidated Purchase – Above Book Value Account Titles Consolid – Other. Issues - 11 Trial Balance Data Elimination Entries Peerless Spec. Foods Debits Credits Consolidated 60,000 125,000 160,000 255,000 1,400,000 Cash 10,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 340,000 Differential Total Debits 1,500,000 50,000 50,000 60,000 40,000 600,000 800,000 2,000,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Total Credits 1,500,000 300,000 100,000 100,000 200,000 (4)200,000 100,000 (4)100,000 800,000 380,000 700,000 200,000 300,000 500,000 300,000 2,000,000 (5) 40,000 (4) 340,000 (4) 40,000 (5) 40,000 380,000 Comprehensive Three-Part Workpaper Item Trial Balance Data Parent Subsidiary Consolid – Other. Issues - 12 Elimination Entries Debits Credits Credit Accounts: Revenues Gains Debit Accounts: INCOME STATEMENT SECTION Contra Revenues Expenses Losses Net Income Beginning Retained Earnings Add: Net Income RETAINED EARNINGS SECTION Deduct: Dividends Ending Retained Earnings to Balance Sheet section Consolidated Comprehensive Three-Part Workpaper Item Debit Accounts: Assets Contra Liabilities Credit Accounts: Contra Assets Liabilities Stockholders’ Equity: Capital Stock Paid-in Capital Retained Earnings Trial Balance Data Parent Subsidiary Consolid – Other. Issues - 13 Elimination Entries Debits Credits BALANCE SHEET SECTION From Retained Earnings Statement section Consolidated Consolid – Other. Issues - 14 ELIMINATING ENTRIES First Subsequent Period (Equity Method) Impact of current equity method entries – Ignore any impairment of goodwill Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – – – – – Including identification of noncontrolling interest Identification of differential Allocation of differential Depreciation/amortization of appropriate differentials Impairment of goodwill Consolid – Other. Issues - 15 ELIMINATING ENTRIES Further Subsequent Period (Equity Method) Impact of current equity method entries – Ignore impairment of goodwill Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – Retained earnings of subsidiary at BEGINNING of current year – Including identification of noncontrolling interest – Identification of REMAINING differential – Allocation of REMAINING differential • Including appropriate valuation accounts – Depreciation/amortization of appropriate differentials – Impairment of goodwill Consolid – Other. Issues - 16 20X1 Consolidation--100 Percent Ownership P 100% S Investment cost $300,000 Book value: Common stock--Special Foods $200,000 Retained earnings--Special Foods 100,000 $300,000 Peerless’s share x 1.00 -300,000 Differential $ -0- January 1, 20X1 (1) Investment in Special Foods Stock 300,000 Cash Record purchase of Special Foods stock. 300,000 20X1 Consolidation--100 Percent Ownership Common Stock, January 1, 20X1 Retained Earnings, January 1, 20X1 20X1: Separate Operating Income, Peerless Net Income, Special Foods Dividends 20X2: Separate Operating Income, Peerless Net Income, Special Foods Dividends Consolid – Other. Issues - 17 Peerless Products Special Foods $500,000 300,000 $200,000 100,000 140,000 60,000 50,000 30,000 160,000 60,000 75,000 40,000 20X1 Consolidation--100 Percent Ownership Consolid – Other. Issues - 18 Peerless records its 20X1 income and dividends from Special Foods under the equity method with the following entries: (2) Investment in Special Foods Stock Income from Subsidiary Record equity-method income. 50,000 50,000 (3) Cash 30,000 Investment in Special Foods Stock $50,000 x 1.00 30,000 Record dividends from Special Foods. $30,000 x 1.00 20X1 Consolidation--100 Percent Ownership Trial Balance Data Parent Subsidiary Item Income from Subsidiary 50,000 Dividends Declared (60,000) Investment in Special Foods Stock 320,000 Elimination Entries Debits Credits (4) (30,000) Consolid – Other. Issues - 19 Consolidated 50,000 (4) 30,000 (4) 20,000 Remove both the investment income reflected in the parent’s income statement and the parent’s portion of any dividends declared by the subsidiary. (60,000) Consolid – Other. Issues - 20 20X1 Consolidation--100 Percent Ownership Item Income from Subsidiary Trial Balance Data Parent Subsidiary 50,000 Retained Earnings, January 1 Dividends Declared 300,000 (60,000) Investment in Special Foods Stock 320,000 Common Stock 500,000 Elimination Entries Debits Credits (4) 100,000 (30,000) Consolidated 50,000 (5) 100,000 (4) 30,000 300,000 (60,000) (4) 20,000 (5) 300,000 200,000 (5) 200,000 500,000 Remove the intercorporate ownership claim and stockholders’ accounts of the subsidiary as of the beginning of the period. 20X2 Consolidation--100 Percent Ownership Consolid – Other. Issues - 21 Peerless records its 20X2 income and dividends from Special Foods under the equity method with the following entries: (6) Investment in Special Foods Stock Income from Subsidiary Record equity-method income. 75,000 75,000 (7) Cash 40,000 $75,000 x 1.00 40,000 Investment in Special Foods Stock Record dividends from Special Foods. $40,000 x 1.00 Consolid – Other. Issues - 22 20X2 Consolidation--100 Percent Ownership Item Income from Subsidiary Trial Balance Data Parent Subsidiary 75,000 Retained Earnings, January 1 Dividends Declared 430,000 (60,000) Investment in Special Foods Stock 355,000 Elimination Entries Debits Credits (8) 120,000 (40,000) Consolidated 75,000 (8) 40,000 (8) 35,000 (60,000) Remove the intercorporate ownership claim and stockholders’ accounts of the subsidiary recorded during the period. Consolid – Other. Issues - 23 20X2 Consolidation--100 Percent Ownership Trial Balance Data Parent Subsidiary Item Income from Subsidiary 75,000 Retained Earnings, January 1 Dividends Declared 430,000 (60,000) Investment in Special Foods Stock 355,000 Common Stock 500,000 Elimination Entries Debits Credits (8) 120,000 (40,000) Consolidated 75,000 (9) 120,000 (8) 40,000 430,000 (60,000 ) 35,000 (9) 320,000 (8) 200,000 (9) 200,000 500,000 Eliminate the beginning balance in the investment account and the stockholders’ equity accounts of the subsidiary at the beginning of 20X2. Consolid – Other. Issues - 24 ELIMINATING ENTRIES First Subsequent Period (Cost Method) Impact of current cost method entries Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – – – – – Including identification of noncontrolling interest Identification of differential Allocation of differential Depreciation/amortization of appropriate differentials Impairment of goodwill Consolid – Other. Issues - 25 ELIMINATING ENTRIES Further Subsequent Period (Cost Method) Impact of current cost method entries Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – – – – Retained earnings of subsidiary at ACQUISITION Including identification of noncontrolling interest Identification of REMAINING differential Allocation of REMAINING differential • Including appropriate valuation accounts – Depreciation/amortization of appropriate differentials – Impairment of goodwill Assign undistributed PRIOR earnings of subsidiary to noncontrolling interest 20X1 Consolidation--80 Percent Ownership P 80% S Consolid – Other. Issues - 26 Investment cost $240,000 Book value: Common stock--Special Foods $200,000 Retained earnings--Special Foods 100,000 $300,000 Peerless’s share x .80 -240,000 Differential $ -0- 20% NCI January 1, 20X1 entry: (10) Investment in Special Foods Stock 240,000 Cash Record purchase of Special Foods stock. 240,000 Consolid – Other. Issues - 27 80 80Percent PercentPurchase PurchaseatatBook BookValue Value Account Titles Trial Balance Data Peerless Spec. Fd. Cash 110,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 240,000 Total Debits 1,500,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Nonctrl. Interest Total Credits 1,500,000 Elimination Entries Debits Credits 50,000 50,000 60,000 40,000 600,000 240,000 800,000 300,000 100,000 100,000 200,000 100,000 200,000 100,000 60,000 800,000 Consolidated Consolid – Other. Issues - 28 80 Percent Purchase at Book Value Account Titles Trial Balance Data Peerless Spec. Fd. Cash 110,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 240,000 Total Debits 1,500,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Nonctrl. Interest Total Credits 1,500,000 Elimination Entries Debits Credits 50,000 50,000 60,000 40,000 600,000 240,000 800,000 300,000 100,000 100,000 200,000 100,000 800,000 200,000 100,000 300,000 60,000 300,000 Consolidated Consolid – Other. Issues - 29 80 Percent Purchase at Book Value Account Titles Trial Balance Data Peerless Spec. Fd. Cash 110,000 Accounts Rec. 75,000 Inventory 100,000 Land 175,000 Bldg. and Equip. 800,000 Inv. in Sp. Foods 240,000 Total Debits 1,500,000 Accum. Depr. 400,000 Accounts Payable 100,000 Bonds Payable 200,000 Common Stock 500,000 Retained Earn. 300,000 Nonctrl. Interest Total Credits 1,500,000 Elimination Entries Debits Credits Consolidated 160,000 125,000 160,000 215,000 1,400,000 50,000 50,000 60,000 40,000 600,000 240,000 800,000 300,000 100,000 100,000 200,000 100,000 800,000 200,000 100,000 300,000 60,000 300,000 2,060,000 700,000 200,000 300,000 500,000 300,000 60,000 2,060,000 Consolid – Other. Issues - 30 20X1 Consolidation--80 Percent Ownership Item Income from Subsidiary Peerless Products Special Foods 40,000 Dividends Declared (60,000) Investment in Special Foods 256,000 Eliminations Debits Credits Consolidated (13) 40,000 (30,000 ) (13) 24,000 (13) 16,000 Peerless’s 80 percent share of Special Foods’ income and dividends is eliminated. Consolid – Other. Issues - 31 20X1 Consolidation--80 Percent Ownership Item Peerless Products Special Foods Income to Non. controlling Int. Dividends Declared Noncontrolling interest Eliminations Debits Credits (14) (60,000) (30,000) 10,000 Consolidated (10,000) (13) 24,000 (14) 6,000 (14) 4,000 (60,000) A separate entry establishes the amount of income allocated to noncontrolling shareholders and enters the increase in their claim on net assets of the subsidiary. Consolid – Other. Issues - 32 20X1 Consolidation--80 Percent Ownership Item Peerless Products Retained Earnings, January 1 300,000 Investment in Special Foods 256,000 Common Stock 500,000 Noncontrolling interest Special Foods 100,000 Eliminations Debits Credits (15) 100,000 Consolidated 300000 16,000 (15) 240,000 (14) 200,000 (15) 200,000 500,000 (14) (15) 4,000 60,000 64,000 An entry is required to eliminate the stockholders’ equity accounts of the subsidiary and the investment account balance shown at the beginning of the period. Second Year of Ownership--20X2 Consolid – Other. Issues - 33 Peerless earns separate operating income of $160,000 and pays dividends of $60,000. In 20X2, Special Foods reports net income of $75,000 and pays dividends of $40,000. 20X2 Consolidation--80 Percent Ownership (16) Investment in Special Foods Stock Income from Subsidiary Record equity-method income. Consolid – Other. Issues - 34 60,000 60,000 $75,000 x .80 (17) Cash Investment in Special Foods Stock Record dividends from Special Foods. 32,000 32,000 $40,000 x .80 Consolid – Other. Issues - 35 20X2 Consolidation--80 Percent Ownership Item Income from Subsidiary Peerless Products Special Foods 60,000 Dividends Declared (60,000 ) Investment in Special Foods 284,000 Eliminations Debits Credits (18) (40,000) Consolidated 60,000 (18) 32,000 (18) 28,000 An entry is required to remove the income that Peerless has recognized from Special Foods, Peerless’s share (80 percent) of Special Foods’ dividends, and the change in the investment account that occurred in 20X2. 20X2 Consolidation--80 Percent Ownership Item Peerless Products Special Foods Consolid – Other. Issues - 36 Eliminations Debits Credits Consolidated Income to Noncontrolling Int. Dividends Declared (60,000) (40,000) (18) 32,000 Noncontrolling Interest An entry is needed to assign $15,000 of subsidiary income to the noncontrolling shareholders, based on subsidiary income of $75,000 and a 20 percent noncontrolling interest. Consolid – Other. Issues - 37 20X2 Consolidation--80 Percent Ownership Item Peerless Products Special Foods Income to Noncontrolling Int. Dividends Declared Noncontrolling Interest Eliminations Debits Credits (19) 15,000 (60,000) (40,000) Consolidated (15,000) (18) 32,000 (19) 8,000 (19) 7,000 (60,000) An entry is needed to assign $15,000 of subsidiary income to the noncontrolling shareholders, based on subsidiary income of $75,000 and a 20 percent noncontrolling interest. Consolid – Other. Issues - 38 20X2 Consolidation--80 Percent Ownership Item Peerless Products Retained Earnings, January 1 420,000 Investment in Special Foods 284,000 Common Stock Noncontrolling Interest 500,000 Special Foods Eliminations Debits Credits Consolidated 120,000 (18) 28,000 (19) 7,000 200,000 An entry is required to eliminate the stockholders’ equity accounts of the subsidiary and the investment account balance reported by the parent at the beginning of the year and to establish the amount of the noncontrolling interest’s claim on the net assets of the subsidiary at the beginning of the year. Consolid – Other. Issues - 39 20X2 Consolidation--80 Percent Ownership Item Peerless Products Retained Earnings, January 1 420,000 Investment in Special Foods 284,000 Common Stock Noncontrolling Interest 500,000 Special Foods 120,000 Eliminations Debits Credits (20) 120,000 Consolidated 420,000 28,000 (20) 256,000 (18) 200,000 (20) 200,000 500,000 (19) (20) 7,000 64,000 71,000 An entry is required to eliminate the stockholders’ equity accounts of the subsidiary and the investment account balance reported by the parent at the beginning of the year and to establish the amount of the noncontrolling interest’s claim on the net assets of the subsidiary at the beginning of the year. Purchase at More Than Book Value P 80% S 20% NCI Consolid – Other. Issues - 40 Investment cost $310,000 Book value: Common stock--Special Foods $200,000 Retained earnings--Special Foods 100,000 $300,000 Peerless’s share x .80 -240,000 Differential $ 70,000 Peerless Products purchases 80 percent of the common stock of Special Foods on January 1, 20X1, for $310,000. Purchase at More Than Book Value Cost of investment $310,000 Fair value of net identifiable assets $300,000 Total differential $70,000 Book value of net identifiable assets (80%) $240,000 Consolid – Other. Issues - 41 Excess of cost over fair value of net identifiable assets (80%) $10,000 Excess of fair value over book value of net identifiable assets (80%) $60,000 Consolid – Other. Issues - 42 Purchase at More Than Book Value The entry to record Peerless Products purchasing Special Foods stock on January 1, 20X1 is: (21) Investment in Special Foods Stock Cash Record purchase of Special Foods stock. 310,000 310,000 Purchase at More Than Book Value Consolid – Other. Issues - 43 In 20X1, Peerless Products earns income of $140,000 and pays dividends of $60,000. Special Foods reports net income of $50,000 and pays dividends of $30,000. (22) Investment in Special Foods Stock Income from Subsidiary Record equity method income: $50,000 x .80 40,000 (23) Cash 24,000 Investment in Special Foods Stock Record dividends from Special Foods: $30,000 x .80 40,000 24,000 Purchase at More Than Book Value Consolid – Other. Issues - 44 Entries are needed on Peerless’s books to recognize the writeoff of the differential: (24) Income from Subsidiary Investment in Special Foods Stock Adjust income for differential related to inventory sold: $5,000 x .80 4,000 (25) Income from Subsidiary Investment in Special Foods Stock Amortize differential related to buildings and equipment. 4,800 4,000 4,800 Consolid – Other. Issues - 45 20X1 Consolidation--80 Percent Ownership Peerless Products Item Income from . Subsidiary Special Foods 31,200 Dividends Declared (60,000) Investment in Special Foods Stock 317,200 Eliminations Debits Credits (26) (30,000) Consolidated 31,200 (26) 24,000 (26) 7,200 An entry is required to eliminate the subsidiary income. Consolid – Other. Issues - 46 20X1 Consolidation--80 Percent Ownership Item Peerless Products Special Foods Income from Noncontrolling Interest Dividends Declared Noncontrolling Interest Eliminations Debits Credits (27) (60,000) (30,000) Consolidated 10,000 (27) 24,000 6,000 (27) 4,000 (26) (60,000) An entry is required to eliminate the subsidiary dividends. Consolid – Other. Issues - 47 20X1 Consolidation--80 Percent Ownership Item Peerless Products Retained Earnings, January 1 300,000 Investment in Special Foods Stock Special Foods 100,000 (28) 100,000 317,200 300,000 7,200 (28) 310,000 (28) 500,000 Consolidated (26) Differential Common Stock Noncontrolling Interest Eliminations Debits Credits 200,000 70,000 (28) 200,000 500,000 (27) (28) 4,000 60,000 64,000 An entry is required to eliminate the subsidiary dividends. 20X1 Consolidation--80 Percent Ownership Peerless Products Item Cost of Goods Sold Land Buildings and Equipment Goodwill Differential Special Foods Consolid – Other. Issues - 48 Eliminations Debits Credits Consolidated 170,000 115,000 (29) 4,000 289,000 175,000 40,000 (29) 8,000 223,000 800,000 600,000 (29) 48,000 1,448,000 (29) 10,000 (28) 70,000 (29) 70,000 An entry is needed to assign beginning differential. Consolid – Other. Issues - 49 20X1 Consolidation--80 Percent Ownership Peerless Products Item Depreciation 50,000 Special Foods 20,000 Goodwill Impairment Loss Goodwill Eliminations Debits Credits (30) 4,800 74,800 (31) 2,500 2,500 (29) Accumulated Depreciation 450,000 320,000 Consolidated 10,000 (31) 2,500 7,500 (30) 4,800 774,800 Entries are necessary to amortize the differential related to buildings and equipment and to write down the differential related to goodwill. Consolidated Net Income, 20X1 Consolid – Other. Issues - 50 Consolidated net income, 20X1: Peerless’s separate operating income Peerless’s share of Special Foods net income: $50,000 x .80 Write-off of differential related to inventory sold during 20X1 Amortization of differential related to buildings and equipment Goodwill impairment loss Consolidated net income, 20X1 $140,000 40,000 - 4,000 - 4,800 -2,500 $168,700 Consolid – Other. Issues - 51 Consolidated Retained Earnings, 20X1 Consolidated retained earnings, December 31, 20X1: Peerless’s retained earnings on date of combination, January 1, 20X1 Peerless’s separate operating income, 20X1 Peerless’ share of Special Foods’ 20X1 net income: $50,000 x .80 Write-off of differential related to inventory sold Amortization of differential related to buildings and equipment Goodwill impairment loss Dividends declared by Peerless, 20X1 Consolidated retained earnings, December 31, 20X1 $300,000 140,000 40,000 - 4,000 -4,800 - 2,500 - 60,000 $408,700 Second Year of Ownership, 20X2 Consolid – Other. Issues - 52 Entries are needed on Peerless’s books during 20X2: (32) Investment in Special Foods Stock 60,000 Income from Subsidiary Record equity-method income: $75,000 x .80 (33) Cash 32,000 Investment in Special Foods Stock Record dividends from Special Foods: $40,000 x .80 (34) Income from Subsidiary 4,800 Investment in Special Foods Stock Amortize differential related to buildings and equipment. 60,000 32,000 4,800 Consolid – Other. Issues - 53 20X2 Consolidation--80 Percent Ownership Peerless Products Item Income from Subsidiary Special Foods 55,200 Dividends Declared (60,000) Investment in Special Foods Stock 340,400 Eliminations Debits Credits (35) (40,000) Consolidated 55,200 (35) 32,000 (35) 23,200 An entry is required to eliminate the subsidiary income. Consolid – Other. Issues - 54 20X2 Consolidation--80 Percent Ownership Item Peerless Products Special Foods Income to Noncontrolling Int. Dividends Declared Noncontrolling Interest Eliminations Debits Credits (36) 15,000 (60,000) (40,000) Consolidated (15,000) (35) 32,000 (36) 8,000 (36) 7,000 (60,000) An entry is needed to assign $15,000 of subsidiary income to the noncontrolling shareholders, based on subsidiary income of $75,000 and a 20 percent noncontrolling interest. Consolid – Other. Issues - 55 20X2 Consolidation--80 Percent Ownership Item Peerless Products Retained Earnings, January 1 411,200 Investment in Special Foods Special Foods 120,000 23,200 (37) 317,200 (35) (37) 500,000 Consolidated (37) 120,000 340,400 Differential Common Stock Noncontrolling Interest Eliminations Debits Credits 200,000 61,200 (37) 200,000 500,000 (36) (37) 7,000 64,000 71,000 An entry is required to eliminate the beginning investment balance. Consolid – Other. Issues - 56 20X2 Consolidation--80 Percent Ownership Peerless Products Item Land Buildings and Equipment Special Foods 175,000 40,000 800,000 600,000 Eliminations Debits Credits Consolidated 8,000 223,000 (38) 48,000 1,448,000 (38) (38) 10,000 Goodwill Differential (37) 61,200 Accumulated Depreciation 500,000 340,000 (38) 61,200 (38) 4,800 An entry is required to assign beginning differential. Consolid – Other. Issues - 57 20X2 Consolidation--80 Percent Ownership Item Depreciation and Amortization Peerless Products Special Foods 50,000 20,000 Retained Earnings, January 1 411,200 120,000 Goodwill Accumulated Depreciation 500,000 340,000 Eliminations Debits Credits (39) 4,800 Consolidated 74,800 (37)120,000 (40) 2,500 (38) 10,000 408,700 (40) 2,500 7,500 (38) 4,800 4,800 849,600 (39) Entries are necessary to show the amortization of the differential. Consolidated Net Income, 20X2 Consolidated net income, 20X2: Peerless’s separate operating income Peerless’s share of Special Foods net income: $75,000 x .80 Amortization of buildings and equipment Consolidated net income, 20X2 Consolid – Other. Issues - 58 $160,000 60,000 - 4,800 $215,200 Consolidated Retained Earnings, 20X2 Consolid – Other. Issues - 59 Consolidated retained earnings, December 31, 20X2: Consolidated retained earnings, December 31, 20X1 Peerless’s separate operating income, 20X2 Peerless’ share of Special Foods’ 20X2 net income: $75,000 x .80 Amortization of differential in 20X2 Dividends declared by Peerless, 20X2 Consolidated retained earnings, December 31, 20X2 $408,700 160,000 60,000 - 4,800 - 60,000 $563,900 Consolid – Other. Issues - 60 Computation of Consolidated Net Income Push Corporation owns 80 percent of the stock of Shove Company, which was purchased at book value. During 20X1, Shove reports net income of $25,000, while Push reports earnings of $100,000, plus equity-method investment income of $20,000. Computation of Consolidated Net Income Additive Computation Separate operating income of Push Net income of Shove Push’s proportionate share Consolidated net income Residual Computation Net income of Push Less: Income from subsidiary Net income of Shove Less: Income to noncontrolling interest Consolidated net income Consolid – Other. Issues - 61 $100,000 $25,000 x .80 $120,000 - 20,000 $25,000 x .20 20,000 $120,000 $100,000 25,000 $125,000 - 5,000 $120,000 Consolidated Retained Earnings Consolid – Other. Issues - 62 On January 1, 20X1, Push has a retained earnings balance of $400,000, and Shove has a retained earnings balance of $250,000. During 20X1, Push reports net income of $100,000 and equity-method income from Shove of $20,000; Push declares dividends of $30,000. Shove reports net income of $25,000 and declares dividends of $10,000. Consolid – Other. Issues - 63 Consolidated Retained Earnings Push Balance, January 1, 20X1 Shove $400,000 $250,000 Net income, 20X1 120,000 25,000 Dividends declared in 20X1 - 30,000 - 10,000 Balance, December 31, 20X1 $490,000 $265,000 Consolidated retained earnings equals the parent’s retained earnings when the parent uses the equity method Consolidated Retained Earnings Consolid – Other. Issues - 64 When the parent does not account for its subsidiary investment using the equity method, consolidated retained earnings is determined by adding the parent’s retained earnings from its own operations and the parent’s share of the subsidiary’s net income from the date of acquisition. Consolid – Other. Issues - 65 PUSH-DOWN ACCOUNTING Revaluing assets and liabilities of subsidiary directly on its books An SEC requirement Applied essentially to whollyowned subsidiaries Consolid – Other. Issues - 66 CONSOLIDATED NET INCOME Parent’s income from own separate operations + Net income from each subsidiary Adjusted for differential write-off Consolid – Other. Issues - 67 INCOME TO NCI Subsidiary’s net income Less adjustments for differential X NCI% Consolid – Other. Issues - 68 NONCONTROLLING INTEREST (Consolidated Balance Sheet) Subsidiary’s stockholders’ equity (date of combination) + Cumulative subsidiary net income +/ Differential (date of combination) net of cumulative adjustments Less Subsidiary’s cumulative dividends X NCI% Consolid – Other. Issues - 69 CONSOLIDATED RETAINED EARNINGS Parent’s retained earnings from separate operations (date of combination) + Parent’s share of subsidiary’s cumulative net income since acquisition (sub’s income less adjustment for differential) – Parent’s cumulative dividends since date of the combination