CPP Chapter 7 - Unemployment Insurance

Federal Unemployment Tax

Who pays FUTA

Exempt wages

Exempt Employment

FUTA Tax Rate & Wage Base

Depositing & Reporting FUTA tax

Calculating the State Credits

Form 940

Penalties for noncompliance

AGENDA

• State Unemployment Insurance

– Employment Relationship

– SUI Taxable wages

– Contribution rates & Experience rates

– Voluntary Contributions

– Joint or combined accounts

– Unemployment Benefits Process

– Reporting Requirements

• State Disability Insurance

• Multiple Worksite Reporting

WHO MUST PAY FUTA?

• Nonfarm employers paying $1,500 or more in covered wages in any calendar quarter (current or preceding year)

• Nonfarm employers employing at least one employee for at least one day in

20 different weeks(not consecutive) (current or preceding year)

• Farm employers paying $20,000 or more in covered wages in any calendar quarter (current or preceding year)

• Farm employers employing at least 10 employees for at least part of one day in 20 different weeks(not consecutive) (current or preceding year)

• Employers paying domestic employees $1,000 or more in any calendar quarter (current or preceding year) for work in private home, college club, fraternity or sorority

WHO DOES NOT PAY FUTA

Easier to say who does not pay. . .

• Federal, State and Local government employers including Indian Tribes

• Nonprofit, religious, charitable or educational organizations that are tax exempt

EXEMPT WAGES

Sick or disability benefits paid more than six calendar months

Sickness or injury payments made under a state workers comp law

Deferred comp payments, not elective deferrals

Payments made under a 125 flex plan-other than adoption or deferred compensation

Noncash payments for work outside the employers business

Qualified moving expense

Death or disability retirement benefits

Noncash payments to agricultural workers

Reimbursement or provision for educational or dependent care assistance

The value of GTL(entire amount )

Value of deductible meals & lodging provided by employer

Wages paid to a beneficiary after the year of an employee’s death

Tips not reported by an employee

EXEMPT EMPLOYMENT TYPES

Federal, state, local government employers including political subdivisions

Work on a foreign ship outside U.S.

Work by full time students at the school they are attending

Work for a foreign government or international organization

Student nurses or hospital interns

Insurance agents, commission only

Newspaper deliverers under 18

Nonimmigrant aliens under F, J, M or

Q visas

Work for a spouse or child

Work performed by a child under 21 for their parents

Work by inmates of a penal institution

Work by election worker paid < $1600 in 2014

Alien agricultural workers under an H-

2A visa

Statutory nonemployees

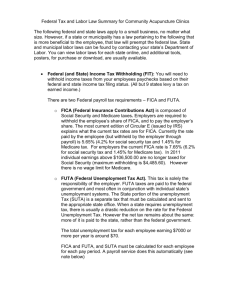

FUTA TAX RATE / WAGE BASE

FUTA Tax rate is 6.0%

Credit of up to 5.4% available for effective rate of .6%

Tax is employer paid

Rate is applied to the first $7,000 of an employee’s covered wages

A .2 % surcharge, in effect since 1976, was due to expire at the end of 2009. However, the Worker, Homeownership and Business

Assistance Act of 2009 extended the surcharge through June 30,

2011.

The .2% surcharge was allowed to lapse effective July 1, 2011.

Constructive payment rules apply – doesn’t matter WHEN wages were earned. DOES matter when they are PAID.

FUTA TAX RATE / WAGE BASE

If employers pay their state unemployment taxes in full and on time a credit up to 5.4% can be taken

Full credit allows for tax calculation to be .6 %

Maximum to be paid $7,000 x .6% = $42.00 per employee

Payment by successor companies based on the company application of the Social Security tax payment – however both predecessor and successor must be covered under FUTA.

Common paymaster companies follow the same practice as the withholding and payments for Social Security and Medicare

DEPOSITING & PAYING FUTA TAX

Employers can assume the credit for the first three quarters of a calendar year thus multiplying taxable wages by .6% --up to $7,000 wage base limit for a maximum of $42.00 per employee

If amount for all employees is $500 or greater then the deposit is due:

1 st quarter--- April 30

2 nd quarter-- July 31

3 rd quarter – October 31

If under $500 then the amount need not be deposited but carried over to the next quarter until the threshold of $500 is met .

The final quarter when filing the 940 and annual liability is reviewed:

Employer verifies the actual credit percentage

Adjusts if necessary

Verifies 4 th quarter liability if < $500 then can be paid with the 940 by January 31 if > $500 must be deposited separately by January 31

CALCULATING THE CREDIT

Two types of credit scenarios are available:

90% or normal credit- 5.4 %

Additional credit – equal to the difference between the state tax rate and 5.4%

Regardless of which option used:

State must have “certified unemployment insurance program”

The credit utilized cannot exceed 5.4%

90% OR NORMAL CREDIT

To claim the full 5.4% credit all deposits due must be made as required by law with the final payment being no later than the 940 due date.

All State unemployment payments must be made timely… if sent to wrong state, proof of timely submission will allow the credit.

If payment is late to the state, employer must calculate the liability as:

Annual Liability amount $1600 – Paid $1000 timely = Paid $600 late

Timely state payment $1000 x 100% = $1000.

Late state payment $600.00 x 90% = $540.00

Total credit on the liability = $1540.00

ADDITIONAL CREDIT ALLOWANCE

If an employer has a state unemployment rate that is less than 5.4 %, the employer receives a credit for the difference between the FUTA credit of 5.4% and the state unemployment rate.

Example: state unemployment rate is 3.6%

The additional credit is 5.4 % - 3.6% = 1.8%

The additional credit allow employers with a stable employment history to receive the same credit as other employers.

CREDIT REDUCTIONS

STATE LOANS FOR UI

States that have high unemployment may borrow funds from the federal agency to assist in benefit payments

The loans must be repaid by the end of the following year to avoid a credit reduction

If the loan is not paid in full by Nov 10 th then a .3 % reduction is imposed, making the new FUTA rate .9%

Each year a loan remains unpaid the credit reduction increases by an additional .3%

After Nov 10 th the IRS announces the credit reductions for that year and they are included on Form 940 Schedule A

13 states plus the Virgin Islands were credit reduction states for 2013

FORM 940

Annual filing showing the company's FUTA liability

Due date is January 31 st following the year of the liability

All forms must be signed by an owner, president, vice president, principal corporate officer, authorized partner or fiduciary.

Delivery must be made by mail, delivery service or hand delivered to the company’s appropriate IRS office, assigned based on where the business Is located, or if payment is accompanying the form.

Employers have an automatic 10 day extension for filing their Form 940 as long as their liability each quarter was paid in full and on time.

AMENDED 940

• Send the corrected form, checking the box labeled “Amended ” (Box ‘a’)

• Attach a statement explaining why the amended return is necessary

• Certification from state for credit allowance or credit reduction o If overpayment is claimed:

Attach file 843—Claim for Refund and Request for Abatement o If underpayment:

Include check for underpaid amount along with appropriate late filing percentage

• Amended 940 cannot be electronically filed – must be a paper form sent to IRS

Additional notes :

Successor company – needs to file and check the box labeled “Successor Employer”

Out of Business – need to file, pay and check the box labeled “Final: Business closed or not paying wages”

940 - LINE BY LINE

General filing information:

Business name and EIN must be on the top of EACH page

If paper form must use a 12 point Courier font

Dollars posted to the left and cents to the right of the decimal

Do not use dollar signs or decimals—commas are optional

Amounts on the form may be rounded

If rounded – must be consistent

Do not enter 0 (zero) -- leave blank

940 - LINE BY LINE

Part 1, Line 1a – State abbreviation

Part 1, Line 1b – Multi-State employer check box

Must complete Schedule A

Part 1, Line 2 – Credit reduction status check box

Must complete Schedule A

Part 2, Line 3 – Total payments to all employees (all wages)

Part 2, Line 4– Payments exempt from FUTA

If there is an amount on line 4, check the applicable boxes 4a- 4e

4a--Fringe benefits – this includes qualified moving expenses (talk to AP)

4b-- Group Term Life

4c – Retirement / Pension

4d – Dependent care

4e – Other – agriculture, visa workers, workers’ comp, etc.

Part 2, Line 5—Total of payments made to each employee in excess of $7,000

Part 2, Line 6– Subtotal – Total of exempt payments (lines 4+ 5)

Part 2, Line 7 – Total taxable FUTA wages (line 3 minus line 6)

Part 2, Line 8 – FUTA tax before adjustments (line 7 x .006)

940 - LINE BY LINE

Part 3, Line 9 – If all FUTA wages paid were excluded from SUTA, must pay those wages at 6.0% ( line 7 x 5.4%)

Part 3, Line 10 – If some FUTA wages paid were excluded from SUTA or paid late, complete the worksheet in Form 940 instructions and enter from line 7 of the worksheet to line 10 on 940

Part 3, Line 11– If credit reduction applies complete Schedule A and enter amount from Schedule A on Line 11 on 940

Part 4, Line 12 – Total FUTA taxes after adjustments– (add lines 8-11)

Part 4, Line 13 – FUTA tax deposited for the year

Part 4, Line 14 – Balance due (line 12-13)

Part 4, Line 15 – Overpayment (line 13-12)

940 - LINE BY LINE

Part 5, – Report your FUTA tax liability by quarter only if line 12 is >$500

Part 5, Line 16 – Report the FUTA tax liability for each quarter

This is the actual liability - not deposit amounts

Part 5, Line 17 - Total tax liability for the year (from Line 12)

Part 6 – May we speak with your third party designee?

Designee may:

Give the IRS any information that is missing from the form

Ask the IRS for any additional information about processing the form

Respond to certain IRS notices—math errors & processing form

Designee may not

Receive refunds

Bind employer to anything

Represent the employer before the IRS in any other matter

Part 7– Sign here--- Must be signed

Paid preparer use only– Vendor that has completed the form

SCHEDULE A

AND 940 -V

Schedule A -- Multi-State employer and Credit Reduction Information

Check box for every state in which you were required to pay SUI tax

Credit reduction for specific states – 13 credit reduction states in 2013 plus US

Virgin Islands

Total credit reduction

940-V– Form 940 Payment Voucher

Utilized only when mailing a check with the 940

Payment can be made via EFTPS

Credit card or Debit card payments can be made with one of three authorized service providers. Payments may be made via phone or internet. Provider charges a fee based on amount of payment

PENALTIES FOR FUTA

NONCOMPLIANCE

Late filing of Form 940 – addition to tax

5% of the amount of tax required to be shown on the return (reduced by timely deposits and credits) for each month or fraction of month return is late

Maximum of 25%

If fraudulent return – amounts increase to 15% up to a maximum of 75%

Failure to pay FUTA tax- addition to tax

.5% of the unpaid tax shown on the return( reduced by credits) for each month or fraction of month payment is late to a max of 25%

An additional .5% per month on the amount if notice or demand is issued and not paid within 21 calendar days (10 days if amount is at least $100,000) up to a max of 25%

Percentage increases to 1% -- if not paid within 10 days of a levy notice or within one day of a demand for immediate payment

PENALTIES FOR NONCOMPLIANCE

Failure to file and pay – the addition for failure to file is reduced by .5% of unpaid tax assessed if both late deposit and late filing occur

Reasonable cause—Affirmative statement under penalty of perjury that the employer

“exercised ordinary business care and prudence” and still could not pay or file

Accuracy related penalty – Understating the amount could result in a 20% penalty on the understated amount if due to negligence or disregard of rules

Failure to make timely deposits - Additional late penalty is assessed based on a four tier scale:

2% if the undeposited amount is paid within 5 days of due date

5% if the undeposited amount is paid within 6-15 days of the due date

10% if the undeposited amount is paid more than 15 days after the due date

15% if the undeposited amount is not paid within 10 days of delinquency notice

Beginning in 2011, all federal tax deposits must be made using EFTPS

10% penalty for not paying via EFTPS (not applicable to employers who owe less than $500)

STATE UNEMPLOYMENT INSURANCE

STATE UNEMPLOYMENT INSURANCE

Applicable for employees -- not independent contractors

Each state sets their own wage base and rate

Employers conducting business or services in multiple states need to allocate wages for unemployment purposes

Four factors when allocating:

1. Are services localized? – one primary location and other state activity is incidental, temporary

2. Does the employee have a base of operation? - office, reports to corporate office , keeps business records

3. Is there a place of direction or control? – no localization, no office, where their direction comes from

4. What is the employee’s state of residence? – In rare cases where none of the aforementioned apply, the employee’s residential state is to be utilized.

Reciprocal agreements allow for employers to choose one state for payment when the employee travels between the states.

SUTA TAXABLE WAGES

FUTA requires each state’s taxable wage base must at least equal to the FUTA taxable wage base of $7,000.

Types of payments included as taxable wages by the states generally follow the FUTA taxable wage base. BUT CAN DIFFER…

States can raise or lower their taxable wage base and will usually notify employers of changes prior to the beginning of the new tax year.

CONTRIBUTION RATES & EXPERIENCE RATING

Contribution rate is the rate an employer applies to its taxable payroll for each employee, up to the state’s wage base limit

Experience rating is the assessment of the contribution rate based on the employer’s average annual taxable wages and unemployment benefits charged

METHODS TO DETERMINE

EXPERIENCE RATE

Reserve Ratio – primarily used – account assigned for payments and reduced based on benefits charged

Reserve Ratio = Unemployment taxes paid – Benefits charged

Average Taxable Payroll

(the HIGHER the ratio, the lower the tax rate)

Benefit Ratio- 2 nd most popular formula –

Benefit Ratio = Benefits charged

Total taxable payroll

(the LOWER the ratio, the lower the tax rate)

METHODS TO DETERMINE

EXPERIENCE RATE

Benefit wage ratio method – Used in Delaware and Oklahoma

Benefit wage ratio = Benefit wages paid

Total taxable payroll

(the LOWER the ratio, the lower the tax rate)

Payroll Stabilization – Alaska only

Fluctuation in payroll from quarter to quarter either increases or decreases the rate

Surcharges may be assessed if the state is experiencing high unemployment, or has federal loan assistance. The surcharge may or may not play a factor when determining state credit against FUTA tax liability, depending on the reason it was established.

New Employer Rate - employer’s industry may be a factor

SUTA DUMPING PREVENTION ACT 2004

Law created to eliminate the manipulation of state unemployment rates to achieve a lower tax rate (“dumping” the higher rate)

Each state must enact laws providing for the four factors:

• Mandatory transfers– Unemployment experience must be transferred between common ownership companies

• Prohibited transfers—new company cannot utilize the lower rate of selling company-- a new company rate must be provided

• Penalties for SUTA Dumping– must have meaningful civil and criminal penalties for violating the transfer requirements

• Procedures for identifying SUTA Dumping must be established

NOTEWORTHY SUTA LAWS

Non- profit and public sector generally follow one of two options

• Direct reimbursement—Employer reimburses the state directly for any unemployment benefits charged to it

• Choose to become experience rated (usually more costly)

Employee contributions

Three states have plans that require employee contributions

Pennsylvania – Alaska - New Jersey

Voluntary Contributions - 27 states allow additional payments into the fund account to lower the employer’s tax rate. States have strict guidelines and timetables and not all employers are eligible.

JOINT OR COMBINED ACCOUNTS

When employers have more than one subsidiary in a state with separate

FEIN’s, they may want to look at joining the subsidiaries for unemployment insurance purposes. With the right mixture of good & bad unemployment experience, combining accounts may save the employer money.

Not all states offer the joint account option

The states that do allow the joint account option have very strict guidelines

UNEMPLOYMENT BENEFIT PROCESS

State Dept of Labor – places guidelines and conditions around granting

Unemployment Benefits

DOL issued final ruling in 2007 to limit state’s payment of unemployment stating individual must be “able and available to work”

In most states, the “base period” is the first 4 calendar quarters out of the 5 preceding the quarter during which the employee first filed the claim for benefits

Balanced Budget Act of 1997 included a provision that guarantees states the discretion to administer base periods as they see fit

Normal allowance is 26 weeks – Federal government may grant an emergency extension during periods of high unemployment

UNEMPLOYMENT BENEFIT PROCESS

American Recovery and Reinvestment Act of 2009 – states were offered federal incentive funding thru 2011 if they adopted ABP (Alternative Base Period) which looks at the immediately preceding four quarters of earnings

Incentive funding was also made available for states that enacted at least 2 of the following 4 provisions:

1) Coverage for part time workers

2) Coverage for workers who quit because of compelling family reasons

3) Coverage for workers in training programs

4) Dependent allowances

Part-time employees may qualify for benefits – employees whose hours are reduced are eligible as long as they are not earning more than the weekly benefit amount

Other payments may reduce benefits – holiday, vacation, dismissal or severance pay may delay a worker’s unemployment benefits in certain states

UNEMPLOYMENT BENEFIT PROCESS

If employee worked for more than one employer during the base period, states can choose between 4 different methods to allocate benefit charges

• Percentage of base period wages paid to claimant

• Claimant’s most recent employer receives full charge

• Employer who paid claimant the most wages during the base period receives full charge

• Most recent base period employer charged first (up to a maximum amount), then next most recent, etc

AUDITING AND CHALLENGING

BENEFIT CLAIMS

One way that companies can lower their expenditures for unemployment is to audit and challenge claims in an effort to alleviate some expenses.

Periodic Statements – provided by each state to the employer--should be audited regularly for errors and duplications

Challenging benefit claims – Employer should challenge claims for which they believe the former employee is ineligible and respond to all notices and requests for information from the state

REPORTING REQUIREMENTS

Each state requires employers to submit quarterly reports with some or all of the following information:

• Total wages paid

• Taxable wages paid

• Nontaxable wages paid

• Number of employees each month

• Gross wages for each employee

• Taxable/nontaxable wages breakdown for each employee

• Number of weeks worked by each employee

Many states require employers to file their quarterly wage information on some type of magnetic media – tape, cartridge, CD, or diskette – or electronically over the internet.

MULTIPLE WORKSITE REPORTING

Additional mandatory quarterly filing when an employer has multiple worksites

MWR (Multiple Worksite Reporting) breaks down the employment and wages by locality and industry

The information is used by the Federal Bureau of Labor Statistics (BLS)

Mandatory vs. Voluntary reporting – 29 states have mandatory Multiple Worksite

Reporting requirements. Standardization of the form has streamlined the process.

A mandatory MWR employer :

• Uses one unemployment insurance account number for all its employees

• Has more than one worksite, or conducts multiple activities

• Has a total of at least 10 employees at all its secondary locations

Magnetic and electronic filing options can be obtained at the Bureau of Labor

Statistics website and publications.

STATE DISABILITY INSURANCE

California, Hawaii, New Jersey, New York, Rhode Island and Puerto Rico have State

Disability Insurance programs to provide benefits to employees who are temporarily disabled by nonwork-related illness or injury

Paid family leave in California – began in 2004

Family leave insurance in New Jersey – benefits available as of July 1, 2009

Rhode Island Temporary Caregiver Insurance program – began in 2014

Contributions – SDI is funded by the employee and may include an amount to be funded by the employer